Additional Insights from SoFi Q1 Earnings

As I have continued to review the SoFi Q1 earnings, here are some of the more interesting things I’ve noticed that I thought it would be interesting to share.

Stock-Based Compensation

I’ve been in SoFi long enough that I was around when stock-based compensation (SBC) was one of the biggest bear cases against the company. In fact, the very first ever call I had with anyone inside of SoFi was with CFO Chris Lapointe about this very subject. Partially lost in all the other analysis and hand-wringing about how the stock is down since earnings is the fact that SBC has never been lower in both relative and absolute terms

SBC dropped from $69M last quarter to $55M this quarter. For the first time ever, it was less than 10% of revenue. This fulfills a promise made by CFO Chris Lapointe in November 2022, when he said "We expect to get that down to single digits over the course of the next several years". It was 9.5% of revenue in Q1 2024.

A quick aside here. The recent shareholder letter made clear that moving forward, management’s stock plan will skew more and more toward performance stock units (PSUs) and less toward restricted stock units (RSUs). PSUs are stock awards only granted if certain performance targets are met, where as RSUs are awarded as long as the employee remains employed at the company. The PSUs are contingent on growth in SoFi’s tangible book value and include a multiplier based on the performance of the stock compared to the Nasdaq composite index. This will result in even greater alignment between management and shareholders.

Personal Loan Net Charge-offs

This is a big one to keep an eye on. This is the annualized rate of of personal loans that have gone into default during Q1. At first glance the data look stupendous, as Q1 was much better than Q4. However, there is some very important context here that you need in order to interpret the data properly.

It appears that default rates peaked in Q4 and came back down in Q1. If that were true, it would be fantastic. However, the outperformance is certainly a result of a transaction that SoFi did in Q1 that is fairly out of the ordinary for them. They sold $62.5M late-stage delinquent personal loans in the quarter. Once they sell the loans, they are no longer on SoFi’s books, so if they get charged off, they do not count toward SoFi’s net charge-offs (NCO), which means this quarter’s NCOs are artificially low. If you assume all $62.5M loans would have gone into default in Q1, that would be a worst-case scenario for the loans. That would have resulted in an annualized default rate of 5.03%. This would be above the 4.85% NCO rate they assume in their fair value calculations.

Because of the way they have built the personal loan portfolio, defaults will be peaking in Q2 and Q3 of this year. That’s because unsecured personal loans reach their peak default rate between 6-12 months after origination. Q2 and Q3 of 2023 were the quarters with the highest originations of personal loans before SoFi pulled back on lending in Q4 2023 and Q1 2024. If SoFi can get through the next 6 months without NCOs getting above 5%, the picture ought to get brighter from there.

Credit Card Net Charge-offs

Credit card NCOs rose in Q1 2024 after having decreased for three consecutive quarters. If they want to ramp the credit card product and make it profitable, NCOs have to get below 10% in a hurry and eventually settle below 5%. For comparison, Chase’s NCO on credit cards was only 2.6% at the end of 2023.

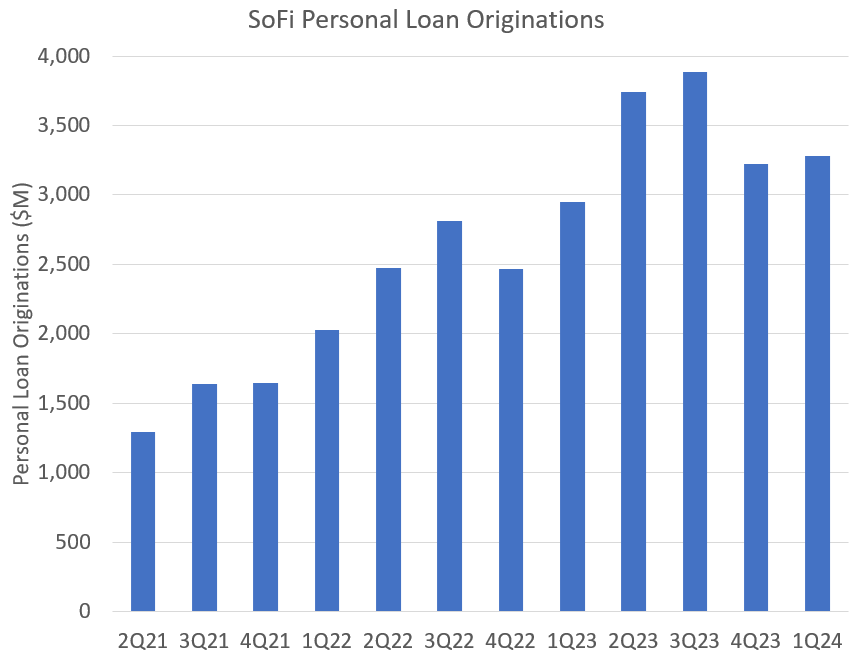

Personal Loan Originations

While we are on the lending side of things, let’s take a look at a chart that shows how SoFi is deliberately pulling back on lending. I often talk about how member growth is the key to revenue growth. One of the charts that led me to that opinion is the personal loan originations/member chart.

Many have argued that SoFi would be restricted by capital ratios. My contention has always been that as long as there is liquidity in the market for their loans, originations are not constrained by their capital, but rather by member growth. This proved true all the way through Q3 2023. If you look at the graph of personal loan originations per member, it was mostly flat as they grew from less than 2 million members to 6 million members. However, starting last quarter, it fell off sharply. Even though they raised capital in Q1, they did not use it. This graph makes it obvious to me they are intentionally pulling back on lending.

My personal thesis, which may be wrong, is that as the macro picture becomes more clear and liquidity returns through less aggressive quantitative tightening and eventually rate cuts, originations per member will climb again to back around the $500/member range. This may not happen until 2025, so it'll take a while to determine if I'm correct or if the recent dropoff is purely a function of capital constraints and will continue moving forward. Either way, I find this graph is important to highlight the fact that SoFi is absolutely and deliberately pulling back on lending in the current environment.

Technology platform growth

The following graphs are the Y/Y revenue growth rate of Palantir compared to the SoFi Technology Platform since Q1 2023. I'm not going to label the graphs. Can you tell which one is which?

Now, to be fair, SoFi received a shot in the arm in Q1 2022 through their acquisition of Technisys. That inorganic revenue growth did help them show strong growth during a time of weakness for their core Galileo payment processing product. That is why the graph above started in Q1 2023, so this data is only from the time after they completely lapped those comparisons. Palantir is one of the greatest success stories in Wall Street in 2023 and 2024. SoFi's technology platform, on the other hand, is seen as a low-growth failure. If you can't really tell which one is which from the data, one or both of those narratives is false.

Thoughts

As I’ve dug through the 10-Q and analyzed the earnings and the call, I find I’m just as enthusiastic about the long term prospects here as ever. While I want every quarter to be a blowout, that isn’t how these things work. SoFi is being prudent and managing the business well while setting up for years of compounding in the future.

Subscriber update

Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have a long position in SoFi.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.