DDI Earnings Prediction: SoFi Q4 2023 Earnings and FY 2024 Guidance

Earnings is next Monday, so it’s prediction time. I’ll try to highlight the data I used to make my predictions.

New Members:

The fourth quarter is historically SoFi’s strongest quarter for membership growth in the year. This was true in 2020, 2021, and 2022. That makes sense to me because it corresponds with football season, which is when their stadium deal pays the most dividends. However, I believe this year may be different for two reasons. First, I think the Taylor Swift concerts provided a big tailwind in the third quarter. Second, I suspect that SoFi might have frontloaded a lot of sales and marketing spend into Q3 to make sure they were going to hit profitability in Q4. I think its likely that S&M will be flat or slightly down in Q4, which would lead to less new memebers. In my estimation, membership growth in Q4 will be higher than in Q2 but lower than in Q3. One Q4 tailwind will be the return of student loan payments. That was their main go-to-market strategy before 2020, so they should also receive a little bump from people who are looking around to refi their student loans.

DDI Prediction: 630k new members to end the year at ~7.6M total members

Originations

Unlike membership numbers, Q4 is actually their worst quarter historically for personal loan originations. In 2021, Q4 originations were just barely higher than Q3. In 2022, they were actually less than in Q3. Based on the historical evidence, the fact that SoFi is getting close to their capital ratios, and the fact that through December they were preparing for a higher-for-longer scenario, I think we see a meaningful pullback from Q3 numbers.

Originations per member is, in my opinion, the most accurate way to predict personal loans. If you look at the past two Q4s, originations per member were almost the same. Using this average and my total member number above results in $3.57B in PL originations.

Student loans are a whole different beast. In Q3, I was surprised that originations jumped from $395M to $919M even though payments hadn’t even restarted yet and they got that jump. Since then, yields have come down and payments actually restarted, so I think we see another considerable increase here. Because we’ve never ended a moratorium before, using historical data is pretty worthless here, so I’m just shooting from the hip with this projection.

DDI Prediction:

Personal Loans Originations: $3.57B

Student Loan Originations: $1.6B

Deposits

There is a consistent trend in deposits that I find somewhat strange. Deposits jump, then stay flat for a quarter, and then jump again. I have no explanation as to why this would be the case. It seems to me that it should be consistent quarterly growth rather than a step function every two quarters, but this is a very small data set and might not tell the whole story.

That being said, rates stabilized in Q4 unlike the past two years, and as I mentioned previously, I think Q4 will have less revenue growth than Q3. That makes me think that Q4 deposit growth will be similar to Q3.

DDI Prediction: $2.92B in new deposits

Revenue

SoFi’s is guiding is for $565-$585M this quarter. Let’s see how I think they perform.

Lending Revenue

This is a hard one. Lending revenue has been relatively flat over the past year. It’s still growing but its growth rate over the past 4 quarters was 6.0%, 3.2%, -0.9%, 6.3%. For Q4 2023, I see growth accelerating slightly for two reasons. First, the acceleration in student loan originations will lead to noninterest revenue growth because the new loans will be marked up to their fair value. We should also see net interest income expand since deposits are growing and they are still growing the loan book.

Noninterest revenue has been declining but I’m constructive that the decline will slow for two reasons. First, they sold at least $475M of loans in the quarter at what I believe is a higher value than their fair values. That means the realized noninterest income should be slightly higher than the fair value they carried it at in Q3. Second, the interest rate hikes are finally done. While they do hedge out interest rate risk, rising rates were still putting a lot of pressure on the fair values of their existing portfolio (especially their old student loan book that has been weighing them down). That really hurt the last few quarters. Lower Q4 originations and a seasoning loan book will still weigh on noninterest income, but I’m estimating 7% lending growth next quarter to arrive at my prediction. That is in line but slightly higher than the Q3 growth rate.

DDI Prediction: Lending segment ANR of $366.5M

Financial Services

Growth here has been rock steady since receiving the bank charter. I think they are figuring out their credit card offering and that deposit growth keeps this trend going.

Management said half of their revenue in 2024 should come from the financial services and tech platform segments. Therefore, I expect the revenue ramp to continue to increase in absolute terms. I think growth comes in a shade under $22M for this segment in Q4 2023.

DDI Prediction: Financial services segment ANR of $140M

Technology Platform

If you read my last article, you are aware that SoFi really needs to start ramping the tech platform. Management has stated multiple times that this quarter is when we should see a return to growth. Data from the tech platform is very minimal, making projections more difficult, but I’m hoping they grow at approximately a 40% annualized run rate, which is what I have baked in here as my projection. This is one of the predictions I am least confident about.

I am confident that their contribution margin will remain elevated in Q4 2023. I think they intentionally front-loaded taxes here to ensure higher profitability in the back half of the year. Here is the quote from the Q3 earnings call.

It seems to me that maxing out payroll taxes for the year means they also won’t be paying those payroll taxes in Q4. Expect contribution margin to come back down after this quarter, but I think it stays in the mid-to-high 30s for this quarter.

DDI Prediction: Technology Platform segment ANR of $98M

Corporate ANR

This is interest they get charged that is not connected to any particular segment. It’s floating rate and they restructured it to slightly more favorable terms and rates have been coming down, so it should decrease QoQ.

DDI Prediction: Corparate ANR of -18.5M

Total Adjusted Net Revenue

DDI Prediction: Sum the four above and you get my prediction of $586M, which is $11M above the midpoint of their guidance, and slightly above the high end of the guidance.

Adjusted EBITDA

Alright, here is where I think it gets pretty obvious that SoFi is ready to pull a rabbit out of their hat and has been planning for this quarter all year. Their guidance is for $391M in adjusted EBITDA at the midpoint. Year-to-date through Q3 2023, they have made $250.5M in adjusted EBITDA. That leaves $140.5M for Q4 2023, which would be a $42.4M improvement from the $98M they earned in Q3. For context, the midpoint of their revenue guidance assumes that they increase their revenue by $44.5M in from Q3 to Q4. Their guided EBITDA growth ($42.4M) is basically their entire guided revenue growth ($44.5M). That’s an incremental EBITDA margin of 95%. In other words, if you believe their guidance, it means that they are planning on dropping 95 cents of every dollar of revenue growth in Q4 to the bottom line.

That’s unsustainable in the long term, but it is completely reasonable in a single quarter if they already knew exactly how they were going to handle their expenses (e.g. cut sales and marketing). I’m certain they have done everything in their power to front load as many expenses as possible to be absolutely sure to hit their GAAP profitability goal this quarter.

In fact, this wouldn’t be the first time SoFi had that high of an incremental margin. Between Q2 2022 and Q4 2022, their revenues went from $419M to $443M from while their adjusted EBITDA went from $44M to $70M. Revenues increased by $24.2M while EBITDA increased by $25.8M, so they actually dropped more to the bottom line than they added to the top line in that quarter. Their incremental margin for that quarter was above 100%.

Expenses are much harder to dig into and project than revenues, but directionally, this high incremental margin helps investors understand how they are thinking about this quarter. Therefore, I assume an 85% incremental EBITDA margin to calculate my EBITDA prediction. This is conservative compared to what SoFi itself thinks it has in store for Q4 2023.

DDI Prediction: Adjusted EBITDA of $145M

GAAP Net Income and EPS

I am 99% sure SoFi is going to be GAAP positive this quarter. They’ve guided for it at least 25 separate times and their credibility hangs in the balance. Once you have a prediction from EBITDA, calculating net income is pretty easy. Here is the chart of the difference between the two since SoFi came public.

The biggest pieces of the reconciliations between the two are depreciation and amortization and stock-based compensation. I assume the reconciliations are roughly flat QoQ at $118M, although there might be ways they could have front-loaded some of these costs as well.

DDI Prediction:

GAAP Net Income: $27.1M

Shares Outstanding: 960M

GAAP EPS: $0.028

Bonus Prediction - Next Year’s Guidance

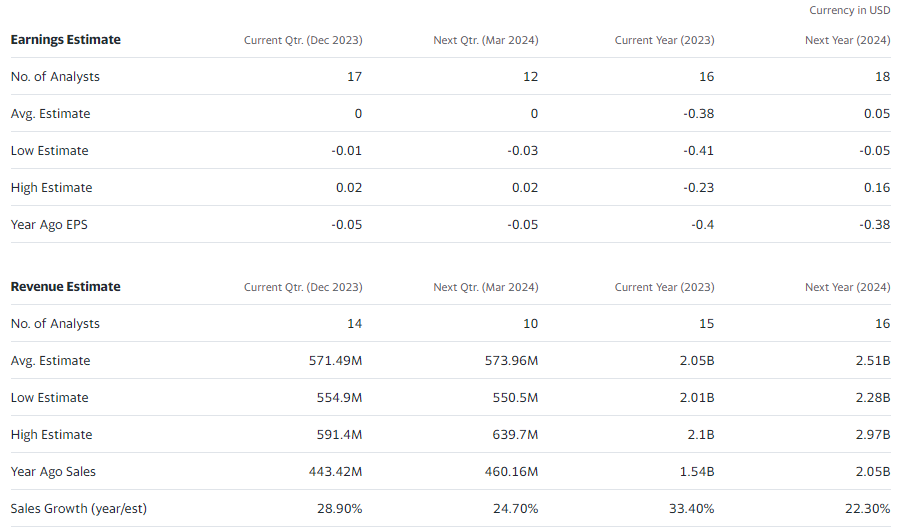

This might be a stretch, but I am going to attempt to predict SoFi’s 2024 guidance. Please note, this is not what I actually think SoFi will do for revenue and EBITDA in 2024. This is my prediction for what SoFi will guide for in 2024. These numbers are both less than what I think they’ll do in 2024 and what I suspect SoFi internally believes they are capable of in 2024. Analyst projections provide the context for this analysis. SoFi will likely guide above what analysts project, but below what they think they will deliver. Here are next year’s analyst predictions per Yahoo! Finance:

Given that the difference between net income and EBITDA is about $120M per quarter, the $0.05 EPS average estimate represents $120M*4 + 0.05*1B = 530M in EBITDA (assuming about 1B shares outstanding by the end of next year, which is probably an overestimate). SoFi has, thus far, never had a quarter with less EBITDA than the one prior. If they are projecting $140M in EBITDA for Q4, it seems reasonable to me that the lower end of their range will end up being around that level on an annualized basis. That would be $560M, which above the consensus analyst estimate of $530M.

Revenue projections are for $2.51B. My last article covered in detail why I think this is a very low estimate. I think SoFi comfortably guides for slightly higher than analyst estimates here, but a number they think are almost certain they will surpass. That way on both the revenue and EBITDA they will be confident that they’ll beat and raise throughout the year.

DDI Prediction: SoFi guides for $2.60B-$2.70B in revenue and $560M-610M in EBITDA for 2024. This corresponds to a GAAP EPS of $0.08-$0.13 for the year.

One thing to keep in mind is that it is possible that they will not guide for profitability in Q1 2024. They have said several times that they expect to be profitable for the full year 2024, but have not specifically said they’d be GAAP profitable in every quarter moving forward. They have pulled some expenses forward on purpose in 2023, but those expenses would return as normal in Q1 2024, so it is possible their guidance would make them barely breakeven or have slightly negative GAAP net income in Q1 2024. I do not think this will be the case, but wanted to highlight it as a potential risk.

Final Quick Thought

As I said above, SoFi has never missed the midpoint of their revenue or EBITDA guidance. On average, they beat revenue and EBITDA by $22M and $15M, respectively. If they were to do that again, they’d end up with $597M in revenue and $155M in adj. EBITDA, which would be around $37M in GAAP net income, or about $0.04 EPS. Those would both be higher than my predictions here. Just one more data point for people to consider.

Predictions in one place for easy reference:

Members: 630k New Members, 7.6M total members

Personal loan originations: $3.57B

Student loan originations: $1.6B

New deposits: $2.92B

Lending revenue: $366.5M

Financial Services Revenue: $140M

Technology Platform Revenue: $98M

Corporate Revenue: -$18.5M

Total adjusted net revenue: $586M

Adjusted EBITDA: $145M

GAAP Net Income: 27.1M

GAAP EPS: $0.028

Predictions for SoFi’s FY 2024 Revenue Guidance: $2.6B-$2.8B

FY 2024 EBITDA Guidance: $560M-$610M

Subscriber update

I got quite a few subscribers after my last article, so I’m closer to starting the YouTube channel. Thank you to everyone who has become a paid subscriber.

Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X). I’m at 75 right now.

Paid subscribers also get access to a private X chat.

Disclosures: I have a long positions in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

I paid money to subscribe but have not been able to access chat in X. I wanted to ask you some questions. How can I fix this

Love your work Chris. Care to throw in an estimate on Loans sold in Q4? When they reported Q3 2Yr loan yields were as high as 5.26% In Q4 2Yr yields were as low as 4.24% that's 20% more appealing price for them.