How much money can SoFi lend out?

The purpose of this post is to answer the simple question in the title of the article: how much money can SoFi lend out?

The answer is not quite as simple and this is one of the more misunderstood aspects of SoFi’s business. I'll very briefly discuss how much liquidity SoFi has, touch on how fractional reserve banking works, discuss what a capital ratio is and why its important, and then we'll go to SoFi's financials to see how they've been operating since receiving the bank charter. Finally, I'll do my best to approximate when SoFi is going to become balance sheet constrained.

When SoFi wants to lend out money, they need two things.

Capital to lend from.

To stay within required banking regulations.

Before becoming a bank, SoFi had two buckets of capital they could lend from: warehouse credit lines and their own capital. Warehouse lines, or warehouse facilities, are just a fancy term for money they are borrowing from other banks to lend out. Once they became a bank in 1Q22 they added a third bucket: deposits.

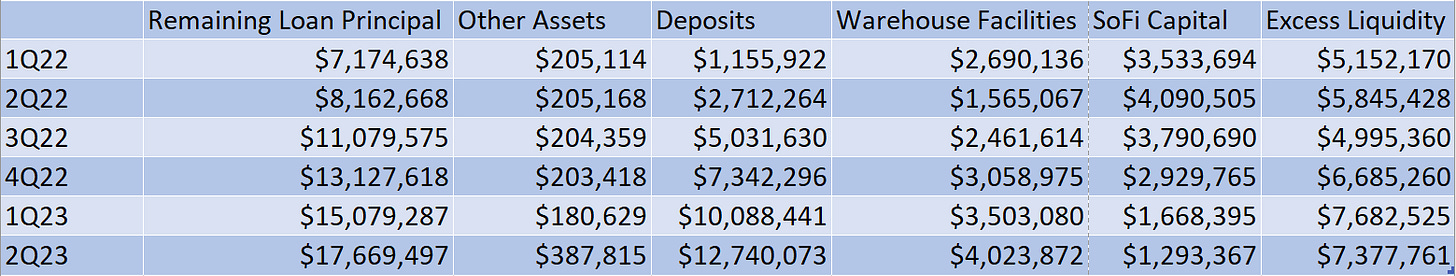

SoFi has a ton of liquidity

The table below summarizes, to the best of my ability, where the money has come from that they are lending out or investing in assets for each quarter since they became a bank. Note that they do not explicitly say exactly how much of their own capital SoFi has available or how much they are loaning out. They often say they have “about $3 billion”, but I’ve also heard “3.5 billion” mentioned several times, and in the 4Q22 earnings call CFO Chris Lapointe said “We're coming off of a year in 2021 of raising over $3.5 billion of capital.” Since they are net cash flow positive since that capital raise, the total capital available is actually somewhere north of $3.5B. I’ll call it $4.2B total available for reasons that will become clear in a moment. The amount of warehouse facilities they have available fluctuates from quarter to quarter, but is right around $8.5B right now (info about the warehouse facilities you can find in the 10-Q).

Although they do not explicitly state how much of their own capital is being lent out, it’s pretty easy to back calculate. I just took the remaining principal of all their assets, and subtracted out how much they have drawn on the warehouse lines and the total deposits. Their total assets include the remaining principal on their loans at the end of the quarter as well as “other assets” which include treasuries and other bonds and securities. “Excess Liquidity” is just how much extra capital they have between their own capital that isn’t being lent out and the undrawn warehouse facilities. For the excess liquidity calculation, I assumed SoFi has $4.2B in their own capital available since this is slightly more than the almost $4.1B they had lent out in 2Q22.

Two interesting things stand out. First, they have been freeing up their own capital at a rapid pace. This corresponds well with the fact that their Cash and Cash Equivalents have grown rapidly during this time (see below). As they fund more of the loans from deposits and warehouse facilities, they are freeing up cash. Second, you can see that even as they have grown their loan book by over $10B, they have actually increased the amount of excess liquidity they have by around $2.2B.

So if capital to lend out were the only requirement, SoFi would be good to go. They are growing deposits so quickly that they could keep up the current pace of originations forever. Liquidity is not a concern for SoFi. In fact, their liquidity is actually improving with time.

Regulations

Fractional reserve banking can result in deposit constraints

Fractional reserve banking is the system the USA uses for its banks. The idea is that a bank only has to hold a fraction of the deposits they take in as liquid, and the rest they can loan out. If the requirement is 10% reserve, then if I deposit $100 into my checking account, SoFi would be required to hold $10 as liquid and could lend out $90. In March 2020, as a response to the pandemic, the Federal Reserve reduced the required reserve amount to 0%, meaning banks don't have to hold any of their deposits in reserve. Holding deposits in reserve, therefore, are not the limiting factor for SoFi or any other bank.

On the surface this sounds terrifying. If this were the only requirement banks had to follow, then it would be terrifying. However, the truth is that banks have other standards and minimums they have to hit that made the deposit reserve redundant. It turns out that having 10% reserves was almost never the limiting factor for what banks lend out. The limiting factor for most banks, including SoFi, are their capital ratios.

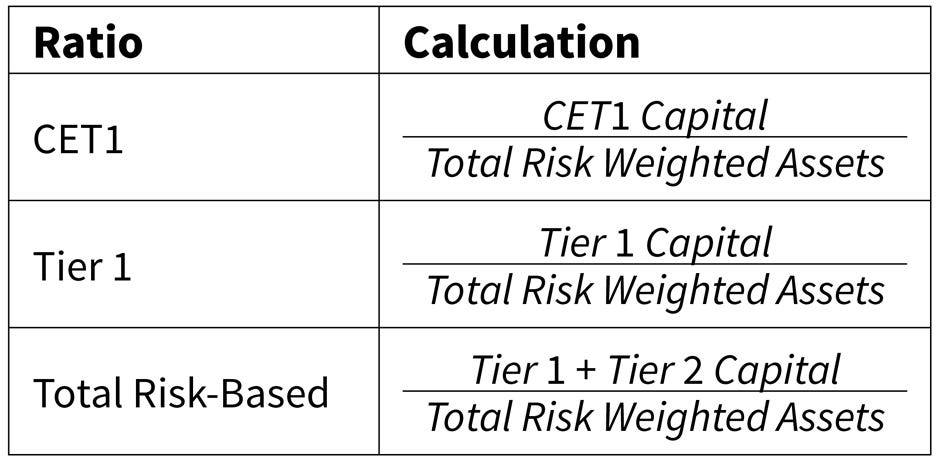

What's a capital ratio?

This stuff is pretty boring, so I'm not going to go into too much depth here. The point is that banks are required to maintain a minimum amount of capital for each dollar they lend. There are requirements for common equity tier 1 (CET1), tier 1 capital, tier 1 leverage, and total risk-based capital. If you want to read about the differences between these, there are lots of resources available to do so.

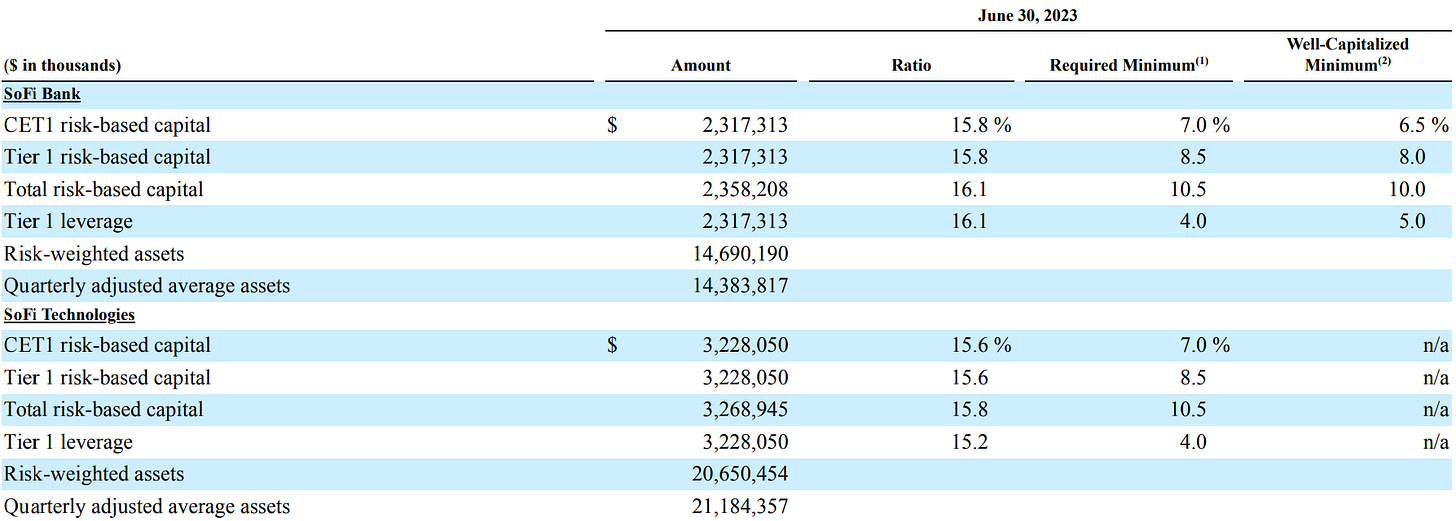

The important part for this discussion is that if you divide the capital the bank or company has in these different buckets has by the corresponding amount of assets they have, you get the capital ratio. Assets, in this context, are interest-paying loans, treasuries, securities, etc. that the bank holds. If a bank goes below the minimum ratio, regulators will require them to sell assets until they meet the minimum. The table below shows the capital ratios for just SoFi Bank and also for the whole SoFi Technologies business at the end of 2Q23, as well as minimum required ratios.

What's this got to do with SoFi?

Ok, boring background stuff is over. What does this have to do with SoFi? Let's think through a hypothetical scenario. Let's say Elon Musk decided to liquidate $100B of his net worth and put it into a SoFi savings account tomorrow. They'd have $112B+ in deposits and tons of liquidity. However, even with all that liquidity and assuming they they had sufficient demand to originate $100B of loans, they wouldn’t be able to originate even close to that number of loans. If they originated an additional $100B of loans, their total risk-weighted assets for SoFi Technologies would go to $120B. Their total risk-based capital is only $3.27B, so their ratio would be 2.73%, which is very much under the required minimum of 10.5%.

How many assets can SoFi have?

SoFi’s CET1 risk-based capital, Tier 1 risk-based capital, and total risk-based capital are almost identical, and total risk-based capital has most stringent requirement, so that is the limiting factor for how many assets they can hold. The absolute minimum ratio is 10.5%, but SoFi does not want to get too close to that because if defaults and delinquencies rise suddenly, they don’t want to be forced to liquidate assets or get into trouble with regulators.

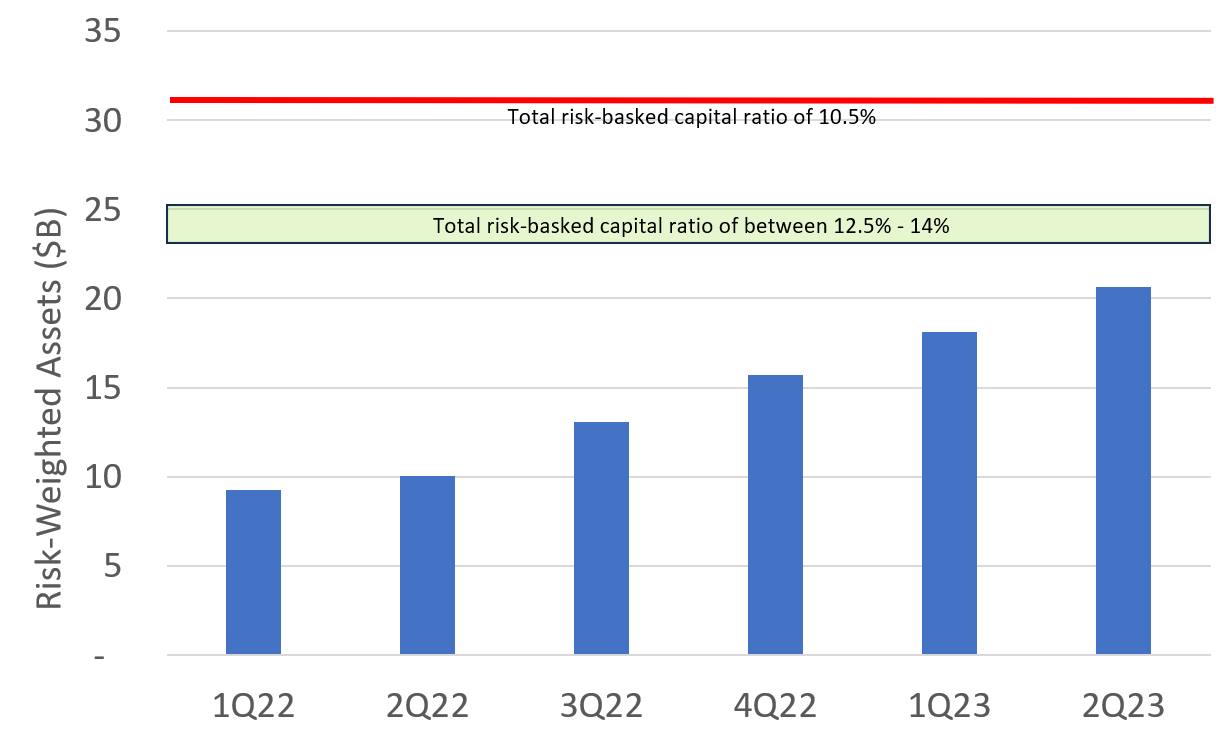

The graph above illustrates total risk-weighted assets (RWA) for the entire company since becoming a bank. It also has a green box around the area I consider a reasonable capital ratio (between 12.5% - 14%) as well as a red line that shows the absolute maximum assets they could hold when they hit the minimum ratio of 10.5%. The green box extends from $23.3B to $25.1B, and the red line is at $31.1B. Keep in mind that the green box is completely my interpretation of where I think they’ll settle. To my knowledge SoFi has never publicly guided for where they want this long term ratio to settle, so it might be higher and it might be lower than that box.

You’ll notice I’m only paying attention to the SoFi Technologies ratios and ignoring the SoFi Bank ones. That’s because SoFi Technologies can move additional capital into SoFi Bank as necessary, which they did in both 1Q22 and 2Q22, so I’m focused on the full company.

When does SoFi become capital constrained?

SoFi has been growing their total risk-weighted assets at a very steady pace since becoming a bank.

As you can see, they are growing assets at about $2.5B per quarter. There is a slight downtrend here, which can be explained by the fact that as you hold more loans, the existing loan book prepayments and defaults make up a larger absolute number of loans that come off the books each month. I do expect this slow downward trend to continue, but $2.5B per quarter growth seems like a reasonable estimate going forward.

I could do a bunch of fancy math with default rates, prepayment rates, and originations to project how much they’ll grow the RWA per quarter. However, odds are it wouldn’t be much better than just assuming that moving forward they’ll keep growing the balance sheet at the same rate they have been until they hit their capital ratio requirements. RWA was at $20.7B last quarter, so assuming they keep up the same pace, they’d end up just under the green box for Q3 at a 14.1% ratio and near the top of the box in Q4 at a 12.7% ratio.

What happens when they can’t grow their balance sheet anymore?

A lot of the revenue growth in the lending segment since the beginning of 2022 was due to the increase in net interest income. Once they hit their capital ratios, they will not be able to continue to grow their assets to generate more interest at the same rate as they have been able to for the past year and a half. They will be able to continue to grow the interest income by offsetting warehouse lines with deposits, lowering their weighted average cost of capital, but the growth rate of interest income will slow.

The only way they would be able to increase their total risked-based capital at that point would be to raise more cash via dilution or debt (a terrible option if you ask me), or to have GAAP net earnings (a much more palatable option). This is one of the key reasons that GAAP profitability in Q4 is so important for SoFi. It isn’t just what the market wants, it’s what the company needs to be able to continue to grow. GAAP net income gets added as “retained earnings” to the total capital available, and then they can grow their balance sheet as that total capital increases. If, for example, they make $100M in GAAP earnings in a quarter, and you assume a 12.5% capital ratio, that means the next quarter they could grow their risk-weighted assets by $800M ($100M / 12.5%). To be clear, I’m not projecting $100M in GAAP earnings any time soon, I’m just using it as an example because it’s a nice round number. I do not think it is a coincidence that they plan on achieving GAAP profitability the same quarter they are becoming constrained by their capital ratio.

What if they get more deposits than they can loan out?

One last thing to talk about while we are on the subject is what does SoFi do once they get enough deposits to offset all their warehouse lines. Right now they have about $4B drawn on warehouse lines. They expect to grow deposits by $2B+ each quarter. Once they become capital constrained, it would only take about two quarters to offset all the remaining warehouse lines with lower cost deposits.

A concern I’ve heard expressed is if they can’t originate more loans, then they’ll have to pay 4.5% on new deposits and won’t be able to make any interest on them. This is not true. You’ll notice that I’ve mostly been talking about “risk-weighted” assets. Different assets have a different risk weighting depending on whether they are secured loans, unsecured loans, in good standing or in delinquency, treasuries, etc. If SoFi has excess deposits, they can use them to buy assets that have 0 risk-weighting like short-term treasuries or deposit them in the Federal Reserve’s “Interest on Reserve Balances” (IORB) program. For example, today the IORB is paying 5.4% for any banks’ excess deposits, which means SoFi would be making some interest on the spread between these no-risk assets and what they pay in APY to their members. Now, 1-2% net interest margin is not nearly as good as the 5%+ they get from their loans, but it does mean they’ll never lose money by having too many deposits.

There is a maximum that they can do here too, it’s the “tier 1 leverage” you see above, but the ratio is 4%. With their current capital, they could have up to $80B in total assets before worrying about hitting that ratio, so until SoFi gets close to $80B in deposits, this is not something anyone has to worry about.

Conclusion

When you hear about SoFi becoming capital constrained, this is what people are talking about. At some in the next two or three quarters they’ll have enough loans that it would be risky to take on any more. Not because the loans are risky per se, but because having too many loans would get them in trouble with banking regulations. That means they’ll have to start selling loans at a similar pace as originations if they want to keep their originations up. It also means a slowing in the rate of the revenue growth coming from interest income. I hope to have another article on where growth will come from moving forward. Hopefully this was informative and helps people understand the underlying business.

Subscriber update

Thank you to everyone who has become a paid subscriber. I am now at 68% of my Tier 2 goal. I’ve been talking to my subscribers and almost all of them would rather that I start a YouTube channel next rather than write more, so I’m changing the tiers around. As a reminder, I plan on ramping my content output as paid subscribers increase. Here are the content tiers:

Tier 1 – About 2 articles/month on the Substack. This is the level I’m comfortable at for now with what I’m making.

Tier 2 – I’ll start a Youtube channel and do at least one video every other week. Some ideas I have for the channel would be to present my articles as videos, discuss the basics of options, how I approach portfolio building, finances, my overall investment philosophy, a “Fundamentals of SoFi” series, how I approach options, etc.

Tier 3 – A minimum of 4 articles/month on the Substack

Tier 4 – Add a weekly Twitter Spaces where I can engage better with followers and answer questions people may have.

Disclosures: I have a long position in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

"First, they have been freeing up their own capital at a rapid pace."

Aside from this statement not being literally true, the way you are modeling it (subtracting warehouse lines and deposits from total loan principal) is not very useful or reflective of real world rational financial decision making. In the real world, all else being equal, the lowest cost sources of capital are utilized first. Modeled this way 100% of SoFi's own capital is being utilized and the cash on their balance sheet is being borrowed from warehouse facilities at 5.26%-7.24% while it earns interest at 4.48%.

Given the expense, why are they accumulating cash in great excess of their operating needs? Are deposits simply coming in faster than they can deploy them? Are they expecting to rapidly deploy this cash as student loans return? Is it cushion to guard against banking instability? No way to get an exact figure, but it could be costing them between 10-15mil per quarter to maintain the optionality this extra 2.5B in cash is providing.

Really enjoyed this read! Thank you Chris. I need to get the Cap Rate formulas into the head but Banking world is becoming a whole lot more clearer with you sharing your knowledge. Deeply Grateful!