Lessons from SoFi Bank Call Report (Deposits, Interest Income, Non-Interest Income, GAAP earnings, CECL, and Mortgages)

If you follow me on Twitter, you’ll have already read a lot of this, but I’m going to put it all in one centralized location as well. If you don’t follow me there or didn’t see my full analysis, well then, here it is.

SoFi’s FFIEC Call Report came out today. It’s important to understand what this is and what this isn’t. This is the quarterly report for SoFi Bank, which is a part of SoFi’s business, the largest part, but still just a part. That means there is a lot of things that are in the business that are not included at all in these reports (like the entire tech platform, brokerage, and even a decent chunk of the lending segment, among other things). There are also some things included in the bank that are attributed to other segments on the quarterly report (like credit card revenue and profits). This report gives lots of information, but not all of it translates one-to-one with the business as a whole.

The best way I think for me to present this is as signal-to-noise and importance. Signal-to-noise ratio describes how much the call report data translates the what we will see on Monday’s earnings. High signal means that you can pretty much guarantee that what we see on Monday is going to look just like what we saw on the call report. High noise means that there might be a correlation, but there are lots of other factors to consider that could change what we end up seeing on Monday. There are some data from the call report that are both important and where the information from the report is mostly signal and with some noise (like deposits), others that are important, but have high noise (noninterest income), and yet others that have perfect signal to noise but are of lower importance (CECL provisions). We’ll cover them each independently:

Deposits

Signal-to-noise: Mostly Signal

Importance: High

The SoFi call report deposits so far have always been higher than what they report in their quarterly numbers (see chart above). Until last quarter, the change in deposits from quarter to quarter had always been pretty similar (see chart below) where the call report showed $3B in deposits, but the quarterly report only showed an increase in $2.75B.

On the SoFi Weekly last night, they were talking about $3.2B increase. I do NOT think we have that many deposits. That is comparing this quarter's call numbers to last quarters earnings reported numbers, which will overestimate the increase. If you just look at how many deposits were added from the last call report to this call report (an apples to apples comparison), the increase was $2.87B, which is still a fantastic number. As far as I know, nobody understands why there is a discrepancy between the call report deposits and the quarterly report deposits since they are ostensibly reported on the same day.

Bottom line: Deposit growth is most likely somewhere in the range from $2.5-$3B. Total deposits will likely come in somewhere between $12.5B and $13B for this quarter. In a quarter where every other neobank that has reported (LC, Ally, Discover, etc) has seen a significant slowdown in deposit growth, the fact that SoFi is still bringing in substantial deposits indicates they truly have a differentiated product.

Net Interest Income

Signal to noise: Fairly high

Importance: Very high

This is where things get complicated. SoFi is a conglomerate of many interwoven businesses including SoFi Bank, SoFi Lending, SoFi Securities, Galileo, etc. Some of the things that are in the call report are broken up differently. I'll give a quick example. SoFi credit cards are held inside the bank and will be included in the call report. But when SoFi reports quarterly numbers, credit card revenue gets reported in the Financial Services segment, not the Lending segment. So the call report is going to include interest from credit cards, but that interest will not be in the SoFi Lending segment when they report on Monday.

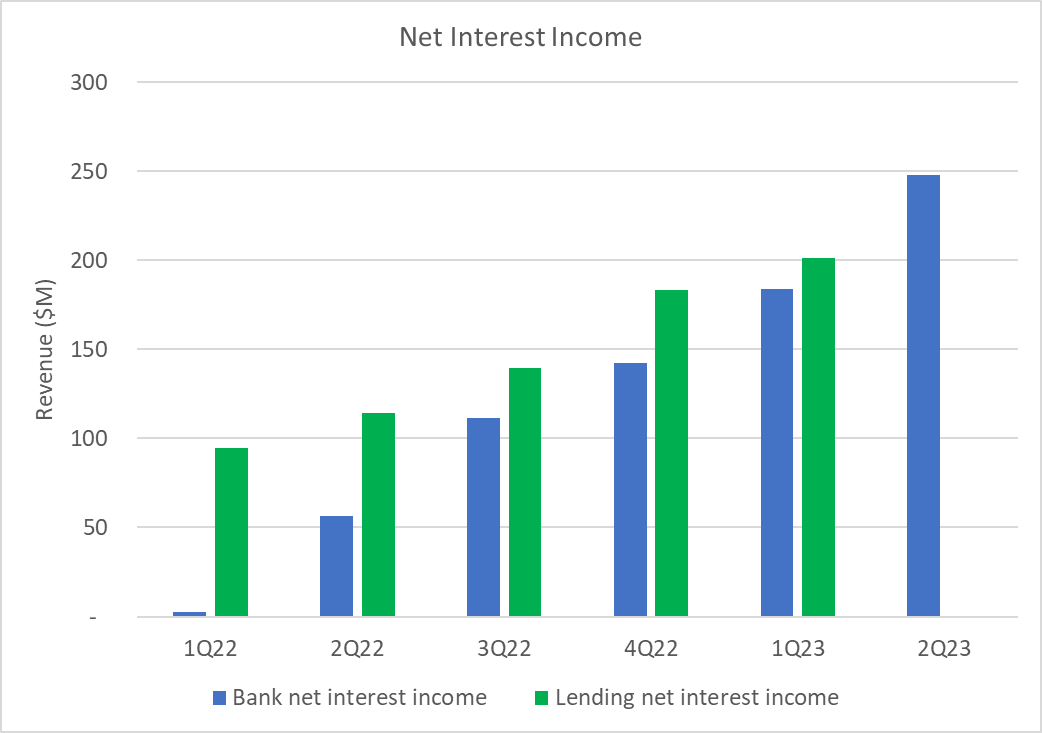

The second, extremely important thing to understand is that the call report is YTD. So when it says that 2Q23 net interest income (NII) is $431.7M, that is the sum of 1Q and 2Q numbers. To get the numbers for just 2Q23, you have to subtract the numbers from 1Q23. So NII in the bank increased from $184M in 1Q to $247.7M in 2Q. That's a huge increase and is very bullish. You can see the quarterly totals in the first graph above.

However, you must also take into account that SoFi is, to some extent, cannibalizing their warehouse lines of credit with deposit growth. That means NII is moving slowly from SoFi Lending to SoFi Bank. This is why bank NII is growing more every quarter than SoFi Lending NII (see graph above) So interest in SoFi Lending is decreasing as a percentage each quarter. The graph below makes this very clear, as the gap between the bank NII and the Lending segment NII is narrowing every quarter. Thus far, Lending segment NII has always been higher than bank NII, but that doesn't have to continue to be true because of what I mentioned before how the interest from credit cards will be assigned to financial services. Nevertheless, this is the biggest jump in NII we've ever seen, and that's awesome because NII is cash in the door during the quarter.

Noninterest Income

Signal to noise: Medium

Importance: High

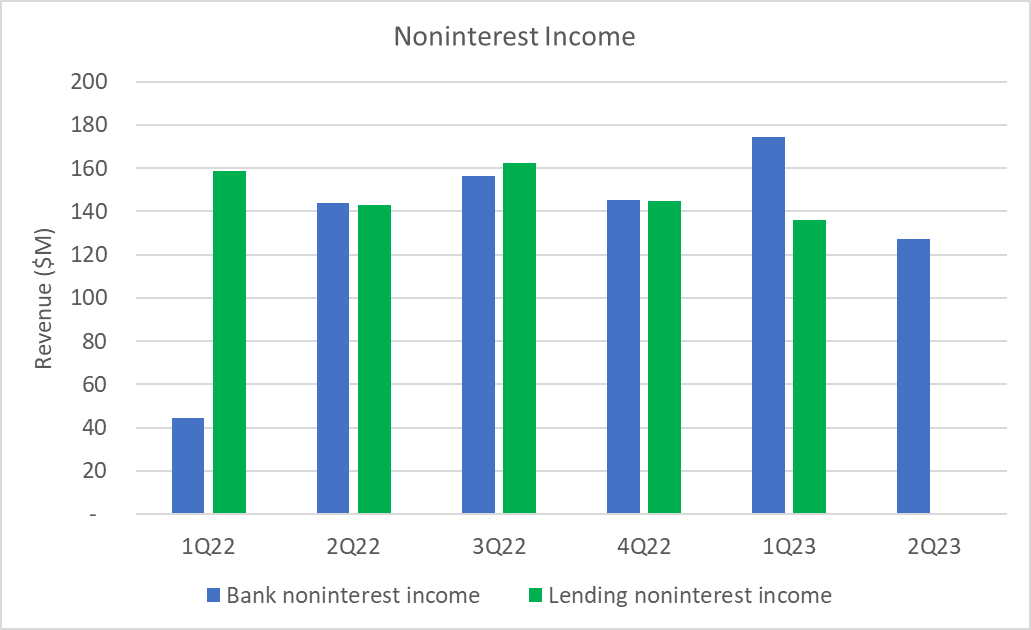

Non-interest income is by far the most convoluted metric in SoFi’s earnings and I do not have time to go into all the details that I do understand and I don't even understand all the details myself. This is stuff like loans sold, gain on those loans, increases and decreases in fair values, increases or decreases in the value of hedges, interchange fees from people using their debit card and credit cards, etc. Noninterest income in the call report decreased QoQ from 1Q to 2Q, from $174M to $127M.

However, the correlation between bank call report noninterest income and the Lending Segment noninterest income is spurious. They were fairly close last year, but in 1Q23, the bank had a big increase while the lending segment reported a decrease. This discrepancy made all my 1Q23 predictions from the call report wrong. The $38M swing in revenue from call report to quarterly report made actual numbers come in way off from what I predicted. I have done my best to try to track down the discrepancies and haven't found a way to reproduce these results.

It's extremely complicated because we have no way of knowing which loans are in the bank vs in SoFi lending, where the hedges get recorded and reported, the fair value movement of loans inside the bank vs outside the bank, etc. It's like an analog clock. You can tell the time by looking at it, but there are cogs and gears and calculations they had to make to build the clock that you can't see from the outside. Imagine trying to reverse engineer that clock just from the outside. That's noninterest income, there's a hundred moving parts inside the machine and we only get to see the finished number that gets spit out at the end. So take this metric with a grain of salt.

GAAP Net Income

Signal to noise: Medium

Importance: Very High

Many don't know this, but SoFi Bank is actually GAAP profitable and has been since 2Q22. SoFi the overall company has negative GAAP net income but is pushing toward GAAP profitability. Bank earnings actually decreased between 1Q23 and 2Q23 from $73M to $63M. On the surface this is bad.

However, like everything else, it needs the proper context. Generally speaking, both the bank earnings and SoFi earnings are trending up and to the right, but they really aren't that well coordinated. You'd think that when bank earnings increase a lot that SoFi earnings increase a lot. That just isn't the case. SoFi saw massive leaps forward in their own earnings between 2Q22 and 4Q22 when they went from -96M/qtr to -40M/atr, a $56M improvement. Bank earnings meanwhile, only increased from $25M/qtr to $30M/qtr over that timeframe, a modest $5M/qtr improvement. Bank earnings then saw a huge jump $43M increase in 1Q23 only for SoFi to only show an increase of $6M.

The biggest reason for the difference in 1Q23 between the two was the $38M swing in noninterest income that I covered in my last tweet. The graph below shows that the difference between the two net incomes is pretty different from quarter to quarter, so bank earnings are not very predictive of SoFi earnings, hence the reason I gave this a medium signal-to-noise ratio.

Based on these numbers, I do not think SoFi will achieve profitability in 2Q23. It’s possible if noninterest income surprised to the upside, but unlikely. I’d give it a 5% chance or less.

CECL Provisions

Signal to noise: 100% Signal

Importance: Low to Medium

Provisions for credit losses are also known as current expected credit losses or CECL. CECL has always been identical between the call report and quarterly report. SoFi only takes provisions for credit losses on their credit cards because those are the only loans they hold for investment. All other loans are held for sale and reported at fair value and SoFi does not take provisioning for them. This quarter's provisions are $12.6M. These will be directly deducted from SoFi's GAAP net income. This is up from 1Q23, but lower than 3Q22 and 4Q22. It's basically in line with expectations.

Home Loan Originations and Sales

Signal to noise: Very High

Importance: Medium to Low

Mortgage originations and home loans sales are another number that track almost dead on. They started originating home loans in the bank in 3Q22 and basically all their loans in 4Q22 were in the bank. Originations in 1Q23 in the bank matched SoFi home loan originations exactly. 2Q23 originations were $243M and loan sales were $245M in the call report. 1Q23 originations were 90M and loans sales were $78M. The Wyndham purchase is already paying dividends in the first quarter they’ve owned it, increasing originations by 150% compared to last quarter. The fact that they’ve been able to integrate them so quickly is surprising and a testament to good execution.

Other Call Report Analysis

If you haven’t done so, please go check out Vadim Kotlarov’s article about the call report and subscribe to his substack. Vadim is a wealth of knowledge about SoFi and often provides insights that I miss. He knows the data and info as well as I do and in some respects better than I do. His article goes into great detail about the expenses from the call report and is very insightful and worth reading.

The Bottom Line

The biggest takeaways for me is that the core thesis that SoFi has a unique offering that is differentiated and resilient. The continued increase in deposits even though they don’t have the highest APY is a testament to this fact. The growth in NII also shows that the cost of the bank charter, the foresight to work towards obtaining one, and the decision to lean into the flexibility it grants were solid decisions. This is another quarter where the long-term thesis looks like it will be confirmed again.

Please make sure to become a free subscriber by entering your email, or a paid subscriber if you feel so inclined. Always 100% voluntary. Thanks for reading everyone.

Disclosures: I have a long position in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Thanks for the post. Between your and Vadym’s analysis, it looks like we might have to temper out expectations a little as these figures aren’t as blowout as some are pitching, albeit the caveat being there is only so much we can read into them

Thanks for your take, Chris. There have been some wild changes in expectations since the FFIWC report came out. Euphoria changed to concern; it's tough to sort out the numbers. Thanks for working a path through it.