Let's Talk About the Macro

This euphoria seems off.

In November 2021, I ignored blatant fundamentals that the market was obviously overbought and P/Es were overinflated. Given the significant increase in the risk-free rate of return, it isn't a stretch to say that current prices are stretched even further now than they were then. I don’t want to make the mistake I made in 2022 again.

Here are the basics. You can calculate the effective yield of your investment by taking the reciprocal of the price/earnings ratio (in other words, divide 1 by the P/E ratio). If you invest in a company with a P/E of 15, you would expect to make your money back in 15 years. That is a 6.67% yearly yield on your investment (which you can calculate by dividing 1 by 15).

Right now, the forward P/E of the S&P 500 is 19.4. That leads to an effective yield of 5.15%. Also right now, I can buy a 3-month T-bill that will pay me 5.34%. In other words, right now, I can invest in the S&P 500, which is a riskier investment than a T-Bill and receive a lower yield. That shouldn’t happen. Equities are inherently more risky than government treasuries, so there should be risk premium that you have to pay to buy stocks. In other words, when the yield on a risk-free alternative investment goes up, the P/E that investors are willing to pay for stocks should go down. You CERTAINLY should not be buying something that has higher risk and a lower yield.

This graphic from the Financial Times tells the story quite well:

Now, to be sure, we are much closer to the end of the rate hike cycle and so the discount rate isn't going to move higher like it did in 2022 to send things crashing down. That light blue line should be coming down in the future rather than continuing to increase, but there should always be a gap between the dark blue line and the light blue line that represents the risk premium for equities. That gap illustrates the spread that people are willing to pay to take on risk. Even at a compressed spread of around 2%, that would mean the S&P 500 P/E should be around 13.6 right now.

The earnings estimates might be off, and better earnings could justify this valuation, but every equity across the entire S&P 500 needs to beat estimates by about 30% to justify current prices. I also understand that the market looks forward, but the 1-year treasury yield is still 5.33% and the 2-year is at 4.76%. That means rates are not expected to come down very quickly, certainly not quick enough to justify this type of P/E ratio. The index is priced for perfection right now. It is overpriced right now. There should be a reversion to the mean for equity pricing. The tweet below describes the same thing in different terms.

I actually see the Fed cutting sooner rather than later with the rate of disinflation. I think that the economy will slow but that economic indicators are actually, all things considered, doing pretty well. However, it can be both true that the market is overheated and above fair value AND that conditions are improving at the same time. That means things could be getting better and there still needs to be a correction.

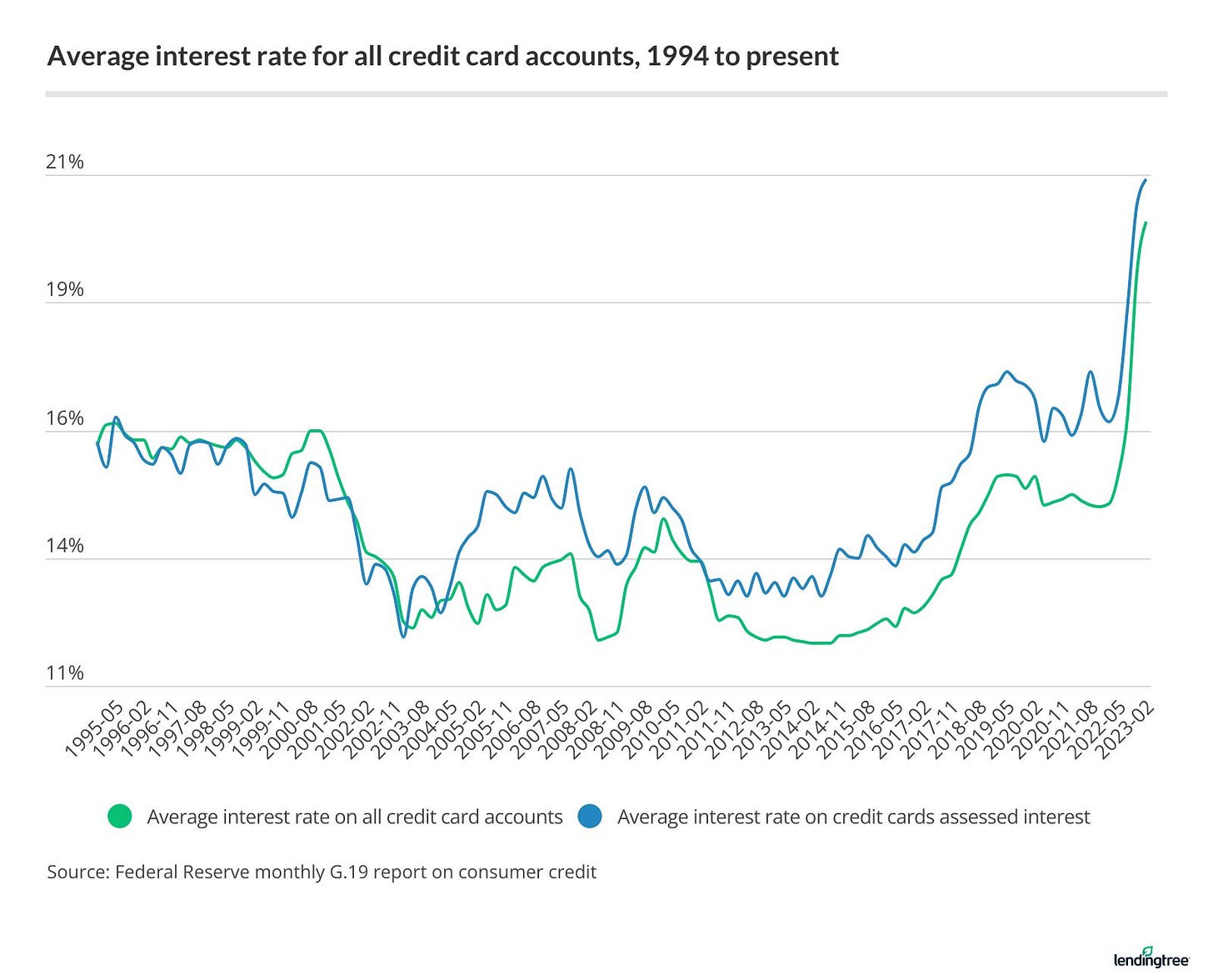

Credit card debt is now above $1T and credit card interest rates have never been higher. Average credit card interest rate is 20.8%. This fall, the student loan payment moratorium is ending and will siphon off about $18B every month from the economy according to Jeffries. The US consumer has stayed strong, but this is going to put extreme stress on them.

Between the weaker consumer and the overpriced S&P 500, I think we are going to get a large correction sometime, something like a 10-20% drop from peak to trough. I don't know when it's coming, but I personally think it will happen in the next 9 months as the rate hikes make their way through the economy, unemployment begins to rise, student loan payments take a large chunk out of monthly budgets, and credit card debt begins to really crush people. Greed will make way to fear at some point during that cycle, and equities will fall.

This is talking about the indexes at large. There are still individual names that are undervalued. I’m also not selling my positions or anything. Usually I DCA weekly, but I stopped that about a month ago because things feel overheated. I will continue to build my cash position and might sell some covered calls on portions of my positions as a hedge. I will be ready to buy if the correction comes. If I’m wrong then I’ll have that cash to DCA at even higher prices than today and I’ll miss some upside, and that will be ok. Just wanted to share my thoughts on what I’m seeing and thinking.

Please make sure to become a free subscriber by entering your email, or a paid subscriber if you feel so inclined. Always 100% voluntary. Thanks for reading everyone.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.