Q1 2025 Earnings Review: Up and to the Right

SoFi delivered another excellent earnings and the company continues to perform. Let’s review those results and I’ll share some extra observations as we go. One thing you’ll notice is that almost every chart is up and to the right, the stock price will eventually follow.

Members

The 11M members turned out to be a red herring. They are certainly above that number now, but that made my prediction inaccurate. Even so, this was the highest number of new members in the history of the company with 802k new members. There were also 13k churned members during the quarter, which led to a net quarterly member increase of 789k members up to 10,916k total members.

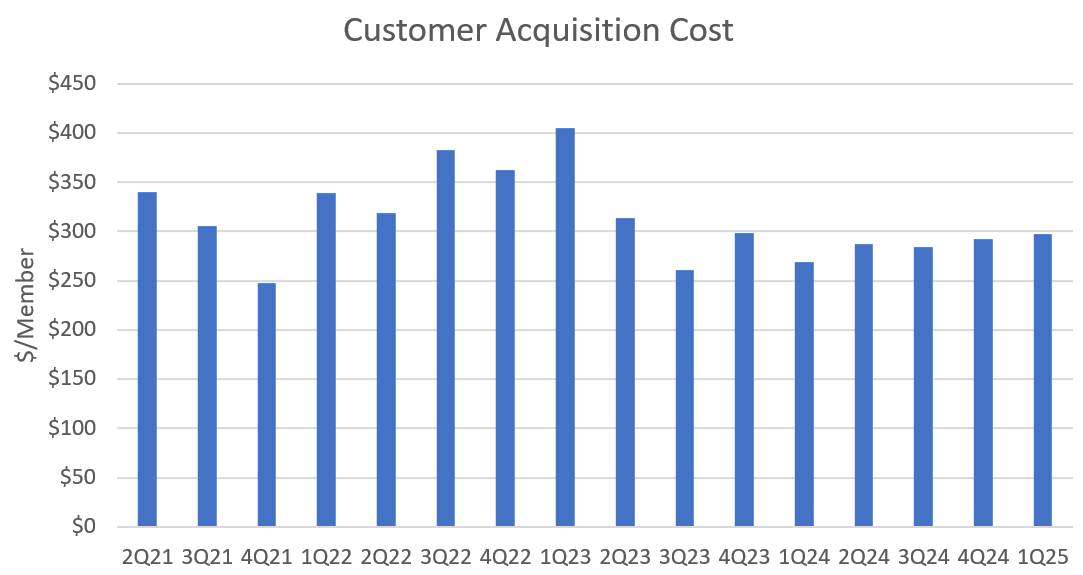

They also achieved this without significant increases in customer acquisition costs, even as the TGL deal went live. CAC has remained very consistent at just under $300 per new member for quite a while now. I think SoFi is probably comfortable with that number. It is very encouraging that they've managed to quickly scale member additions per quarter while maintaining the same CAC. SoFi’s marketing team is doing an excellent job.

Originations

Personal Loans

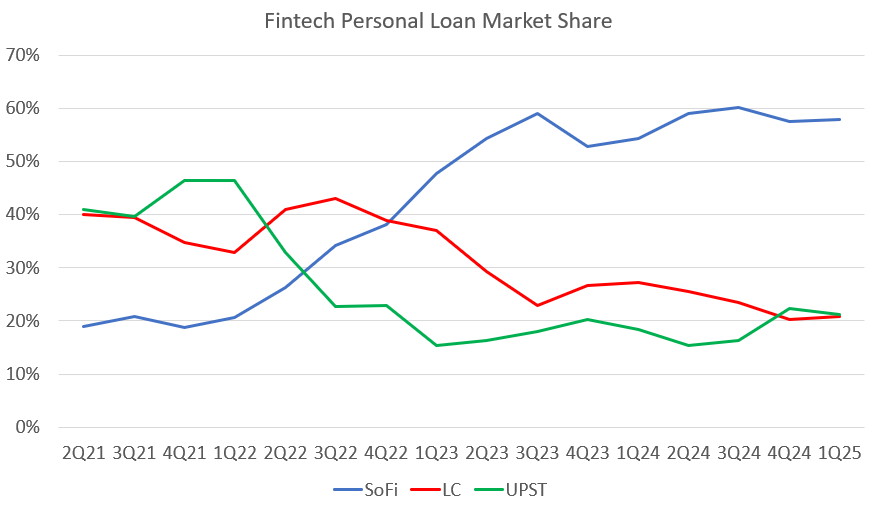

I guessed $5.7B for personal loans, with a range of $5.4B-$6.0B. They came in at $5.53B, inclusive of $1.56B in the LPB. Unfortunately we did not get commentary on when they began originating loans for the Blue Owl Capital deal, so it’s difficult to really know how much is from announced LPB deals versus unannounced deals. Even so, SoFi grew originations by 5.4% QoQ and have proven they can and will continue to gobble up market share in the personal loans business. Just look at their personal loan origination numbers compared to competitors LendingClub and Upstart. This is what winning looks like.

I wrote a SoFi earnings preview for Seeking Alpha prior to Q2 2022. In that article, which is now almost 3 years old, I said there would be three things that differentiated SOFI from LC and UPST. In order of importance:

Member Growth: SoFi's ecosystem ensures that member growth would fuel origination growth, but also that those members stick around and become repeat customers. SoFi now has 11M members compared to less than 4M members when I wrote that article.

Quality of Borrowers: SoFi primarily lends to prime, prime plus, and super prime borrowers. Loans to higher-quality borrowers perform better across the cycle and asset managers trust SoFi's loans more than competitors’. They also have access to the vast pool of members referenced in point 1 above. In Q1 2025, SoFi sold over $2.5B in personal loans, that's more loans sold than LC or UPST even originated in the quarter.

Access to Funding: SoFi’s continually growing capital allows them to hold more loans on their books each quarter. The combination of durable member growth and high-quality borrowers has led to greater commitments from asset managers than their competitors. Receiving the bank charter also means that in future times where asset managers and banks might be backing off, they have a resilient source of capital in the form of their own balance sheet to continue to drive revenue.

In 2022, none of those things were certain, but this has played out exactly as I said it would. When I wrote about these three strategic advantages that would lead to outperformance of SoFi over their competitors, SoFi's market share of originations between these three companies was 21%. It's now 58%. SoFi went from being the new kid on the block to the dominant player in the fintech personal loan space, and their advantage should continue to compound for years to come.

Neither LC nor UPST has the ecosystem that SoFi does, and that gives SoFi a competitive advantage. The ecosystem means that SoFi pays to acquire a customer once and is able to keep them as a sticky customer. SoFi members are much more likely to return at no incremental cost the next time they need a lending product or any other product. This also means that asset managers are confident that SoFi can hit higher origination amounts because they have a deep pool of high-quality members to originate from.

Consider this stat. SoFi's total origination growth from Q1 2024 to Q1 2025 was $2.26B. That is greater than the total originations of either LC ($1.99B) or UPST ($2.03B) in Q1. Their yearly growth is higher than LC or UPST’s entire business. That’s nuts. They have differentiated products and a differentiated business model, and that is leading to differentiated results.

Student and Home Loans

I predicted $1.3B in student loans and $450M in home loans. SoFi originated $1.19B and $518M, respectively. Those are very respectable numbers. It’s nice that SoFi is replacing previously low APR student loans with higher ones in the current environment. Rate cuts and a decrease in treasury yields are what is really needed for this business to accelerate. The question now is when those rate cuts happen, not if. I do wish they were selling some of their student loans rather than holding all of them, but it does give them a very large base of her interest income with extremely low default rates.

Deposits

I’m not sure how much I’m going to cover deposits in the future because they’ve reached their target long-term ratio. SoFi wants to cover about 90% of their loans with deposit funding. They are at that mark. This will probably hold steady going forward. As expected, time deposits came down and demand and savings deposits went up. I expected around $1.8B in added demand and savings deposits, and it came it at $1.88B. There are only $502M time deposits left total, so that portion of their funding is getting extremely low, which is good because they are higher coupon than demand or savings.

The important takeaway is probably that they aren’t going to push too hard on deposits now that they’ve reached their funding goal. Also, the people who thought that deposits would drop precipitously because they’ve lowered their APY were mistaken. The ecosystem benefits are strong enough that they don’t need to have the highest tier APY to grow their deposits. That’s very good news. That’s a sign of a developing moat.

Revenue

Lending

Lending actually came in well under my own estimate of $440M at a mere $412M. Am I worried about that underperformance? No, and here is why:

Net interest income continues to grow and that is cash flow into the company. Noninterest income decreased quite a bit this quarter, but a lot of the noninterest income is non-cash revenue, meaning things like movements in the fair values of their loans, the gains or losses on their hedges, and how much they gained or lost selling their loans. Things like fair values and hedges can be lumpy from quarter to quarter and will always be noisy. There are two things that are important that can come through that noninterest line. They are:

Is there a deterioration in credit quality that is negatively affecting fair values?

Is the gain-on-sale margin on their loans decreasing, meaning there is less demand for their loans from asset managers and banks?

Those would be trends to watch and maybe be concerned about. Neither of those things are happening. Here are their defaults and delinquency rates (this is excluding the effects of the late-stage delinquent loans they sell):

They are going down. Moreover, total defaults against their maximum life of loan losses target of 8% looks increasingly constructive. The gap between their current losses and the 7.85% losses they saw in 2017 keeps expanding.

Last quarter the gap between the lines was 1.28%. The gap is now 1.44%. It looks to me like they are on track to have net cumulative losses around 6% on these vintages. This is a far cry from the doom and gloom scenarios painted by Wall Street analysts as recently as Q2 2024, when KBW said you should short the stock ahead of earnings because they expected losses to skyrocket.

How about loan sales? Are they still profitable, or are the gains they get from selling loans decreasing over time?

Gain on sale margin is up and to the right. Lending revenue may have missed my estimates and may be down quarter over quarter, but there is absolutely nothing here to worry about. All the signals are extremely positive.

Financial Services

I thought they’d have more members, but even still they crushed my estimates. I thought they’d get $277.2M and they came in with $303.1M. Average revenue per member hit a new all-time high of $27.77. Financial services is absolutely killing it.

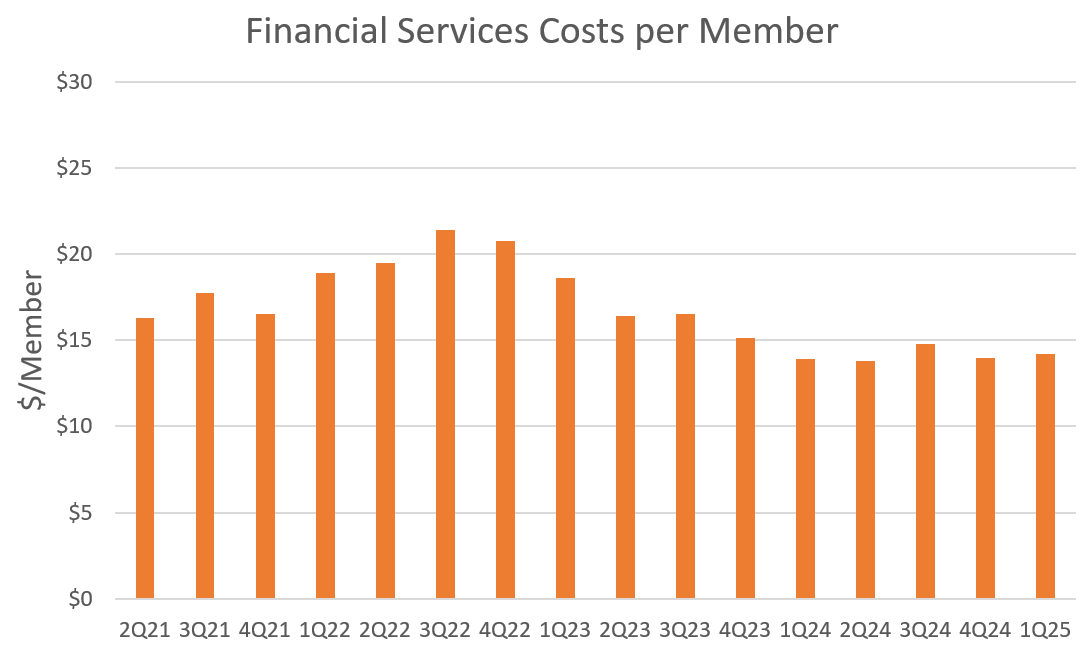

And here is a new chart to demonstrate their operating leverage in this business. Here are financial services directly attributable costs per member over that same time period.

I’m not completely sure what the floor is here as it seems to be flat recently, but the combination of decreasing costs per member and increasing revenue per member is leading to very significant operating leverage for the overall business. That is why the contribution margin in this business is skyrocketing.

Technology Platform

I projected $105M in revenue, and it came in at $103.4M. They also lost Chime, their largest client in absolute account numbers, as Chime switched to doing their own processing in house. The Tech Platform remains a disappointment. We have had some good commentary at fireside chats since the quarterly report, but the Tech Platform remains in the penalty box for me until revenue growth meaningfully reaccelerates for several consecutive quarters. It seems like that is possible in 2026, but I’ll wait and see. We know that there are plenty of new contracts that will be generating revenue, but we still don’t know how many might end up like Chime and move off Galileo and we don’t know how fast those new contracts will be ramping revenue. I really like the story here, but we need some steak along with the sizzle.

It also isn’t good that contribution profit has been flat for almost two years and contribution margin is on a downtrend. There should be some seasonality here with payroll taxes, but last year we didn’t get a margin boost in the second half so I'm not sure if that’ll happen this year either. They are adding headcount, and therefore expenses, at about the same rate as they are adding revenue right now, and that's not good. Revenue absolutely needs to accelerate in 2026 in the tech platform. I’ll be excited when I see multiple quarters of growth here, not before.

Corporate

I said -$40M, we got -$48M. I might in the future start thinking differently about how to split up revenue to remove the effects of corporate revenue weirdness, but for now it is what it is.

Total Adjusted Net Revenue

I predicted ANR at $782M and SoFi came in at $771M. SoFi’s guidance was for $735M at the midpoint and analyst estimates are at $739M so this was still a beat. The difference in lending revenue was the bulk of the difference between my estimate and the actual result. As covered above, I do not find what happened in lending to be concerning in the least.

Adjusted EBITDA

SoFi said that they outright expected to lower incremental EBITDA margins to the 30% range in their Q4 earnings call. I thought they’d get better operating leverage than expected and end up with 34% YoY incremental adj. EBITDA at $213M. Actual adjusted EBITDA was $210M. Analyst expectations are $173M and their guidance was for $180M, so this was a very big beat. Incremental margins came in at 35% YoY and 39% QoQ, so even with heavier reinvestment, they are still driving significant incremental margin growth.

Net Income and EPS

I estimated GAAP net income at $54.6M and $0.047 EPS. They came in at $71M and $0.06. Their own guidance and analyst estimates were for $0.03. The tax rate was lower than I expected, leading to outperformance. A great double beat here on the bottom line.

Other Stuff

I’ll cover two other things here briefly before I close. Credit Cards and LPB.

Credit Cards

SoFi is fixing their biggest operational mistake of the past few years. Credit cards were supposed to be a growth driver in 2023. They scaled the product in 2022, doubling it from just under $100M in credit card balances at the end of 2021 to just over $200M borrowed at the end of 2022.

However, SoFi got the underwriting wrong. Defaults spiked all the way up to 19.3% in Q1 2023 and the credit card business has cost them hundreds of millions of dollars of cumulative losses over the past several years. 2024 was a year where credit card balances stayed basically flat and charge-offs began to trend downward. Q1 2025 was the first quarter in over a year where credit card balances saw a meaningful increase, and it was accompanied by even lower defaults.

Credit cards can be a very lucrative business if you get it right. It looks like SoFi has turned a corner here, and if they can continue to decrease the losses while increasing balances, this looks to be an underappreciated growth driver for 2025 and 2026. Here is how CEO Anthony Noto talked about it recently at the JP Morgan Conference: "We've restructured our [credit card] business and relaunched products and our new product and go to market is performing very well. Our back book is still a hindrance and, you know, we're living with that back book and we'll optimize it over time." Hopefully this is part of a new S-curve for growth. I'll be keeping an eye on this moving forward.

LPB

The crown jewel of SoFi’s recent past and it just keeps getting better. The old-school loan referral business exploded this quarter. It had been chugging along at $12M-$13M per quarter for a year, but had a 58% QoQ increase to $19.7M. The new LPB also saw a really big QoQ increase across the board. We still don’t know exactly when the Blue Owl Capital deal started, but originations jumped from $1.0B in Q3 and $1.1B in Q4 to $1.56B in Q1. That led to a jump in LPB revenue from $47.0M in Q4 to $73.1M, a 55% QoQ increase.

But none of that is the most exciting part to me. The most exciting part is that their take rate is expanding. Take rate is the percentage they make from each dollar they originate. It was right around 4.25% for the first two quarters. It expanded to 4.69% in Q1. That’s a big jump and raises the ceiling on this business by quite a bit.

Take rate may still fluctuate from here, especially as they expand the credit box and possibly add student loans and home loans to the mix. Those will have a lot take rate. I truly hope that in the future they will give us originations and take rate by loan type, because otherwise this will be much more difficult to track and understand. Nevertheless, this is a business that did not exist last year and is already above a $300M annualized run rate, with huge contribution margins (probably around 60%+), and is still in its infancy. It cannot be stressed enough how game changing this is for the business as a whole. The LPB changed everything.

Conclusion

I said there was smooth sailing ahead and we’re seeing it. SoFi continues to be a compounding machine. There are some criticisms, but they are mostly around perception and narrative…not the business itself. This is the best macro that SoFi has seen in its history since Noto joined as CEO, crypto is coming back, they will finish the transition onto their own core this year, and *crosses fingers* the product release cadence should rapidly accelerate once that transition is complete. This is such an easy company for me to hold right now, and its still only really getting started.

Subscriber update

The DDI YouTube Channel is live. A sincere and heart-felt thank you to those who support my work. If you do want to support my work, there are several ways to do so. You can subscribe here on substack, or on X, or, now, on YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up for SoFi, or discounts on Tesla or finchat.io:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get up to $2500 off a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

The q1 earnings review a month before q2. All jokes aside, looking forward to reading it

Excellent work