Q4 2024 Earnings Review: By The Numbers

SoFi’s Q4 was a bit of a mixed bag, with some parts of the business wildly outperforming expectations while others were less stellar (looking at you, Galileo). I'll discuss all of this through the frame of reference of my earnings predictions. I’m splitting this earnings review into two parts. This first part is a breakdown of the results by the numbers. The second part will deal more with the narrative and vibes surrounding the company and hopefully will come in the next week. My recent vacation really threw a wrench into the works both at my actual job, where I’m now terribly behind and hustling to catch up, and with putting out timely content. I’ll do my best and hope you all can be patient with me.

Members

While we didn't quite get the 800k new members I'd hoped for, Q4 still set a new all-time high with 785k new members added to the platform. There were also 31k members who were churned off the platform, leaving 754k net new members for the quarter.

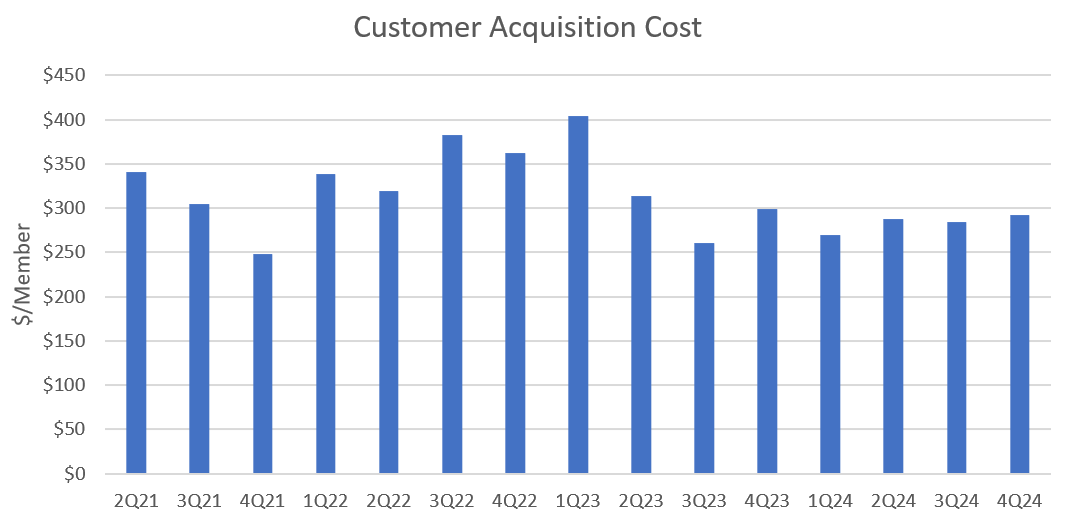

I'm very pleased with that number. Member growth is the key to achieving consistent, sustainable, and durable growth. Their marketing strategies are paying off by bringing more people unto the ecosystem. Moreover, they continue to do so at relatively low customer acquisition costs below $300.

Many are calling for SoFi to have a quarter with 1 million new members in 2025. I do think there is an outside chance they get it in Q3 or Q4 of 2025. As we’ll cover a bit more in depth below, it looks like 2025 is supposed to be a year of reinvestment in growth initiatives in the business, with a lot of that going into brand awareness. If Noto is right, and brand awareness is what stands between SoFi and their ultimate goals, then reinvesting heavily into that brand awareness ought to result in outsized member gains this year.

Originations

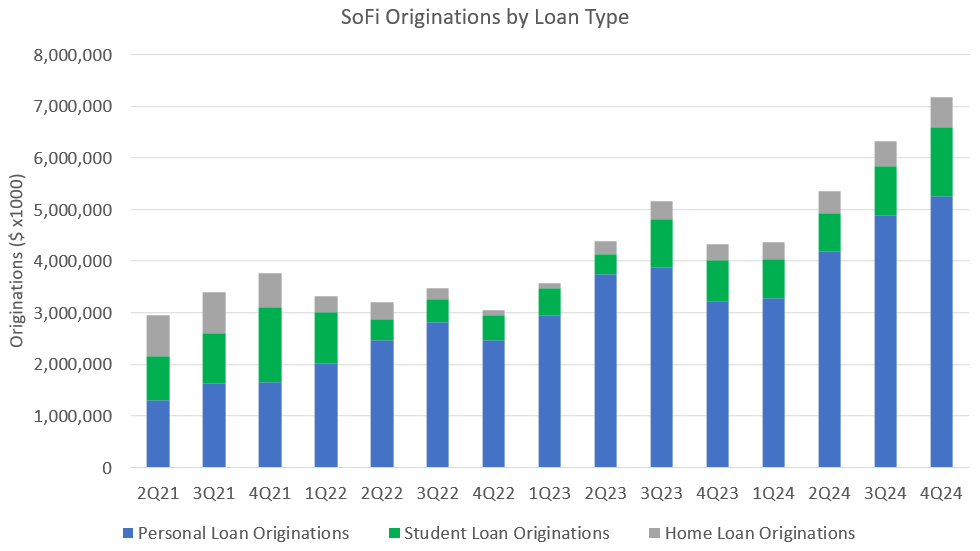

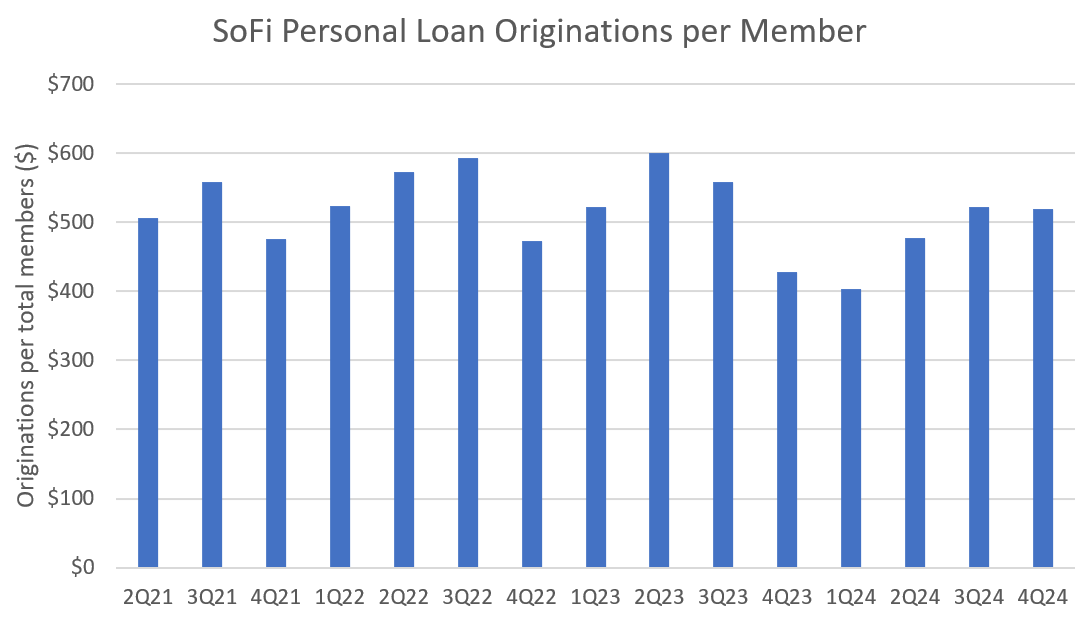

SoFi absolutely crushed my origination predictions across all three loan types. They set a new all-time high in personal loans, and this quarter saw their highest student loan originations and home loan originations since Q4 2021, when the Fed Funds rate was 0%.

I predicted $4.55B in personal loans, $790M in student loans, and $400M in home loans. They originated $5.25B, 1.35B, and $577M, respectively. The normal Q4 headwinds to student loans were overcome by, it seems, the resumption of student loan payments. Similarly, the home loan numbers came in strong in spite of Q4 usually being a weaker quarter as well. It might have been helped by some refinancing or closing of loans that were locked in during September when rates were lower, but not closed until October or November. Even so, these origination numbers were simply spectacular. This is far and away the strongest Q4 we’ve ever seen for personal loans and bodes very well for the coming year.

Deposits

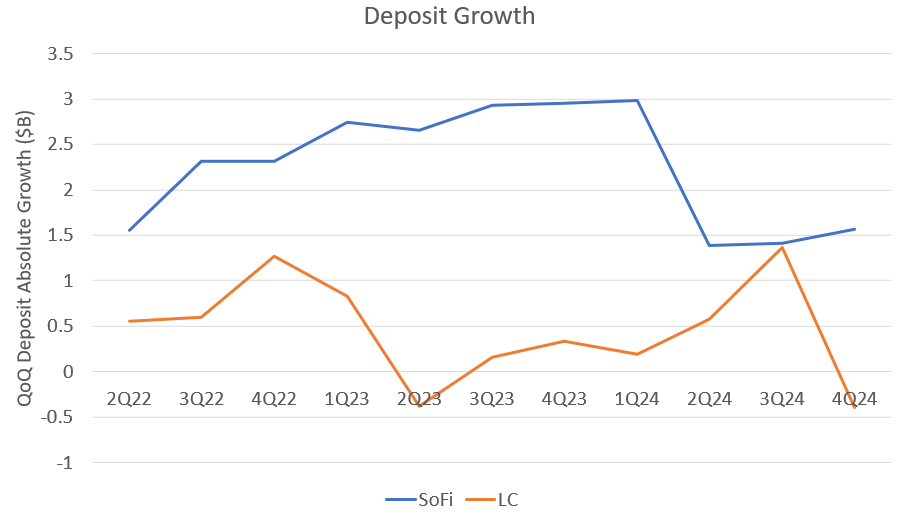

I predicted $2.1B in demand and savings deposit growth and a decrease in time deposits. That’s almost exactly what happened with $2.09B in demand and savings deposit growth and a decrease of $662M in time deposits. In Q4, APY decreased from 4.6% to 4.0% and yet they still had record member growth and consistent deposit growth.

I think it is worthwhile to point out that many people say that deposit growth is simply a function of the APY that is offered. The data have definitively proven this is not true. In November, after SoFi’s APY had already been cut several times, LendingClub was still offering 5.15% APY, which is higher than SoFi ever offered. Right now they offer 4.5% when SoFi offers 3.8%. LendingClub has had a higher APY for several years at this point. Yet here are their quarterly deposit growth numbers (this includes demand, savings, and time deposits).

Deposits are not just a function of APY. The fact that SoFi has added more deposits every quarter than LC while having a lower APY is proof. The rest of the value proposition and the ecosystem benefits are just as important. Noto spoke to this on the earnings call:

What we've seen is that the value prop of SoFi Money is much more than the APY. Having Zelle is really critical. People want a safe, secure way to be able to send money person-to- person. We also provide person-to-person payments via just a phone number email in addition to bill pay, free overdraft, the two-day early paycheck. And we'll continue to add other features and functionalities, to make that really valuable.

The data back it up. SoFi’s full value proposition is much more than just their APY.

Revenue

Lending

Originations outperformed my expectations so it is absolutely no surprise that lending did too. I thought they’d end up with $365M in revenue, but they blew that out of the water with $423M, driven by an ever-increasing net interest income line and robust continued noninterest income. As a reminder, net interest income is cash and not tied to fair values. The fair values fall in the noninterest income bucket that each and every quarter becomes less and less important.

SoFi initially guided to lending revenues in 2024 declining to between 92%-95% of 2023 levels. They ended up growing the segment by 11% instead. Their original guidance was for a GDP decline in 2024 and 5% unemployment. Neither of those happened, so they outperformed. We’ll revisit this thought later…

Financial Services

The first ever quarterly decline in revenue per member since the bank charter finally happened in Q4, going from $25.42/member to $25.33/member. That combined with the slightly lower member adds than I predicted meant that Financial Services revenue missed my own prediction of $259M and came in at $256.5M. It’s still showing incredible growth, and with the Blue Owl Capital deal that was announced and almost finalized for the loan platform business, the growth will continue in 2025. Financial Services has really become the star of the show for SoFi, and that trend looks set to continue for the next couple years with their increase in the three-year growth guidance.

While we are on the subject of the LPB, I’ll have a more thorough analysis after they release the 10-K and I’ll probably do a quick article just on that. However, it’s great to note that they grew originations from $1.0B to $1.1B this quarter (I do wish we had one more significant digit on that number). 10% QoQ growth is impressive, but more importantly, that Blue Owl Capital deal would end up being an additional $625M of originations per quarter. That would put LPB volume at around $1.7B-1.8B per quarter as soon as the deal goes live. As a reminder, LendingClub did $1.84B in total originations in Q4 and Upstart did $1.33B in Q3 (they haven’t released Q4 numbers yet). SoFi’s LPB business on its own in less than a year will be matching or beating the entire origination volume of their two biggest US fintech lending competitors. That’s a very big deal.

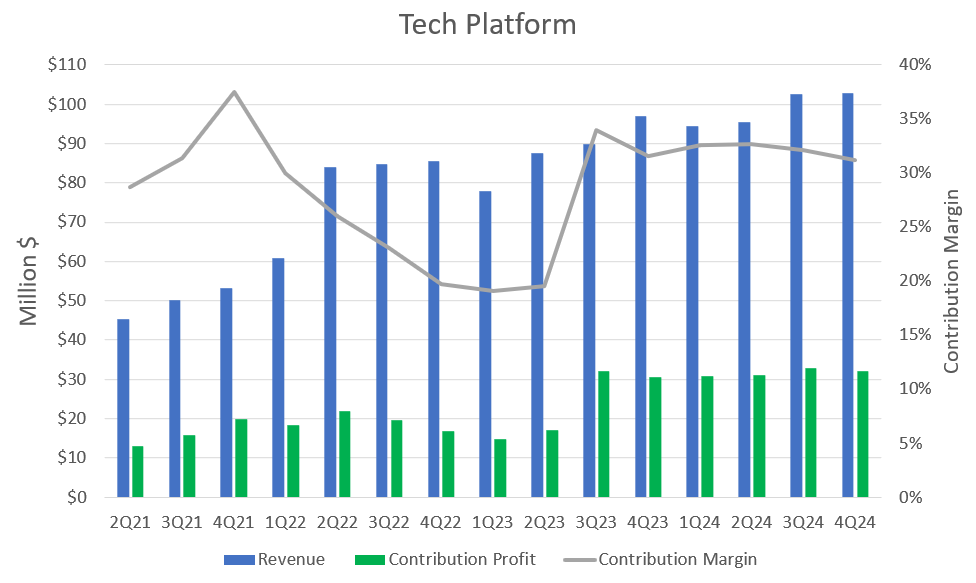

Tech Platform

Not good enough. The tech platform growth stalled further this year when it was supposed to be accelerating. This has become a big point of contention in the SoFi community and deserves a full discussion of its own, which will come in part two. I will briefly say here that this should not be too big of a surprise to those who have been paying attention. Earlier this year, after Q2 earnings, I said, “the execution at Galileo has not matched the excellent execution everywhere else in the business. The Tech Platform is in the penalty box for me after this quarter.” At the time, I said that it will remain in the penalty box until I see four straight quarters with 15%+ YoY revenue growth. Based on guidance, I predicted $112.5M in revenue, but they only posted $102.8M.

I also said in the earnings preview that “Any Galileo contract announcements would be more important than the actual results here.” We got three of those. The government deal with Direct Express we already knew about, but the hotel deal and the other financial services provider deal were new to investors. However, the fact that none of these deals will really make a mark until 2026 bring up more questions than answers for me. I want more clarity and I think investors deserve it. Why does it take so long for these deals to become monetized? What does that ramp look like? What type of bespoke integration and investment are needed to get these things online? As I said, full article forthcoming here.

Corporate

Corporate revenue continues to be a riddle wrapped in a mystery inside an enigma (such a good Winston Churchill turn of phrase). I know why it happens (FTP), but it’s virtually impossible to predict, so it is what it is. This quarter it came in at -$43.0M.

Total Adjusted Net Revenue

All told, SoFi managed to handily beat my expectations of $697.5M in ANR with a whopping $739.1M. They beat their own guidance by $67M, their highest ever quarterly beat, and beat analyst estimates by $63.5M. It was honestly a massive quarter. It’s pretty crazy that at this point that seems almost expected, but here we are.

Adjusted EBITDA

SoFi also recorded a new record adjusted EBITDA of $198.0M, which was $8.1M above my estimate. EBITDA was slightly lower margin than I expected it to be, but they still managed to beat analyst expectations by $26M. Again, this seems to have been swept under the rug a bit because it’s so expected at this point, but that is a 15% beat on EBITDA, which is actually a very impressive feat.

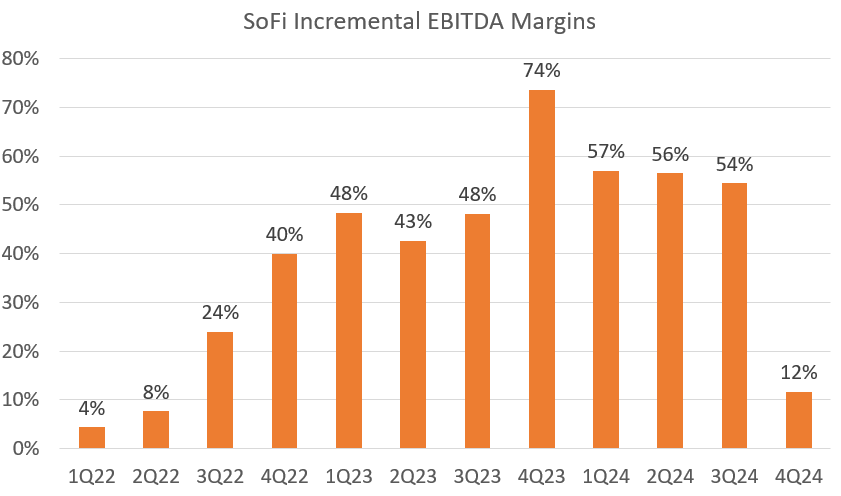

While we are on EBITDA, I want to speak to something that management said. This will come up again in the guidance section below, but I do want to discuss something that Noto said during the call about incremental margins. If that’s a new concept for anyone out there, an incremental margin is how much you drop to the bottom line for each new dollar of revenue you get. So if you have a 30% incremental EBITDA margin and you go from $600M to $700M in revenue, a $100M increase, it would mean your EBITDA would increase by $30M. Here is what Noto said:

In 2023, we had set guidance with a 30% incremental EBITDA margin. We said our margins long-term would be 30%. So in that time period, we wanted to show evidence of that, and manage the balance of growth and profitability, by delivering a 30% incremental margin. […]

In 2024, we took a very conservative stance at the same point last year, relative to others based on interest rates, the economy, inflation, geopolitical, et cetera. And because we took that very conservative stance, we drove margin expansion at the expense of revenue growth, and we delivered well more than 30% incremental EBITDA margins, which is evidence that we can do that and maintain growth, having just grown 25%, which is well above the revenue expectations that, we established last year in January. So we couldn't be more confident that our long-term margins, are 30% for EBITDA and 20% for net income.

And in 2025, we're just tilting the balance back, to where we were in 2023, which is a 30% incremental EBITDA margin. Because that allows us to ensure we're investing today, to drive durable growth beyond today into the future in revenue, in products and in members. The thing that's most important about our guidance, which we just provided, is our revenue expectations are higher in '25, than the street had and what we had previously had. And our revenue expectations for growth into '26, are now higher as well.

Noto’s point was that they had 30% incremental margins in 2023, boosted them in 2024 to drive profitability, and will be adjusting them back down by reinvesting more this year. Noto repeated this line on his earnings-day appearances on Bloomberg and CNBC. It’s a lie…but it’s a good lie. Incremental EBITDA margins in 2023 were never close to 30%. They were much higher, with the lowest quarter coming in at 43%. So it remains to be seen whether this time they are sandbagging (which would surprise absolutely nobody), or if they really will drive only 30% incremental margins.

The just completed quarter’s incremental margins were very low at only 12%, but that’s because it was coming off such a difficult comp from Q4 2023. One year ago, they were driving hard for profitability and really limited expenses and had 74% incremental margins. I think 30% will be the minimum for incremental margins and would certainly not be surprised if they once again come in higher.

Net Income and EPS

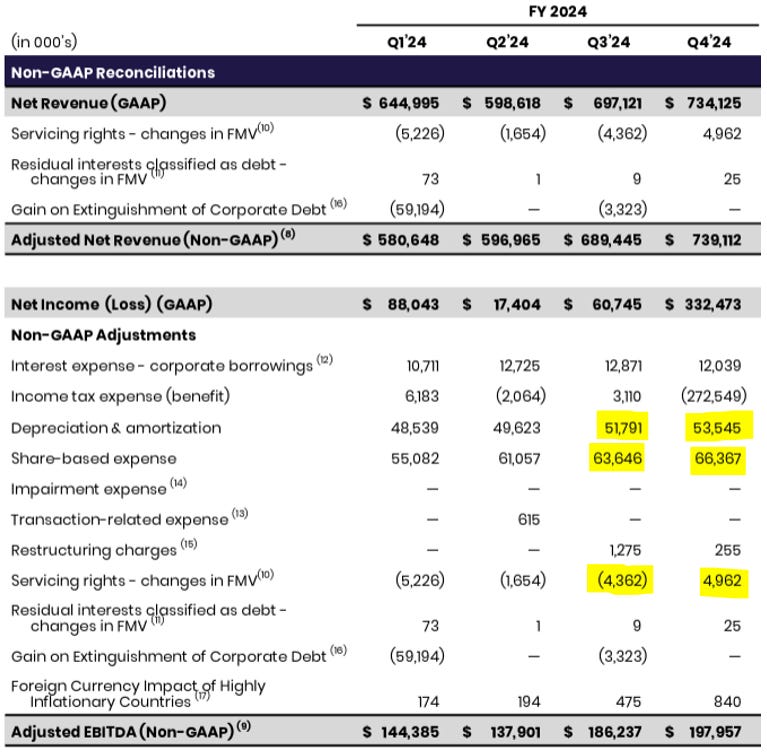

Despite the fact that adjusted EBITDA came in almost $12M higher than in Q3, net income only increased by about $300k from $60.7M to $61.0M (excluding the benefit of the tax credit). The main culprits for the differences between Q3 and Q4 reconciliations were:

An increase in SBC of $2.7M

An increase in depreciation and amortization of $1.8M

A $9.4M change in the fair values of servicing rights from a $4.4M credit last quarter to about a $5M loss this quarter.

None of these are particularly troublesome to me. SBC is going to increase as they continue to hire more staff and D&A will increase as they invest more into capital expenditures for the business. The fair values of the servicing rights only matter in the event that they eventually choose to sell those servicing rights. It’s a noncash accounting treatment based on fluctuations in loan prepayment, interest rates, default rates, and everything else we understand so well from the last two years of fighting fair value battles. However, to my knowledge, SoFi has never sold servicing rights to any of their loans, which makes this purely academic, and it’s why they adjust it out for both their total adjusted net revenue and adjusted EBITDA.

That swing in fair values of servicing rights moved this from a 6 cent EPS quarter to a 5 cent EPS quarter. It still beat analyst expectations of $0.04. Q4 results were excellent across the board with the exception of the tech platform.

Guidance

I thought that SoFi would guide for $3.15B-$3.25B in revenue for 2025. They actually guided higher than that at $3.2B-$3.275B, which absolutely crushed analyst estimates of $3.02B. I projected an EPS guidance of $0.30-$0.35. They guided for $0.25-$0.27, which actually missed analyst expectations of $0.28. There are three mitigating factors here that should be discussed. They are taxes, reinvestment, and bearish macro assumptions. I’ll cover each independently.

Taxes

My own projections for their taxes for 2025 were only for around 8% because they still had plenty of losses that they could write off. Only they took all of them this quarter and from here moving forward, they are assuming a 26% tax rate. So, taking the higher tax rate into account, a $0.27 guide actually translates to $0.33 if the tax rate were only 8%. In other words, SoFi is actually guiding to almost exactly where I thought they’d end up if they would not have taken the entire tax write-off this quarter.

I also assumed the same tax rate for 2026 (I honestly just hadn’t thought that far ahead), which means that they are going to have to drive even more profitability to the bottom line to hit their 2026 guidance than I had built into my models. I will adjust accordingly.

There is one massive benefit to taking the taxes now that I haven’t seen extensively covered anywhere else. That ~$270M credit goes straight to their total capital for the business. That is the equivalent of around $1.8B more assets they can hold on their balance sheet in 2025 without increasing their capital ratios. At their current net interest margin of 5.9%, that is enough room to grow net interest income by around $26M/qtr. That tax credit is essentially a new $100M business that just dropped into their lap. That’s easy growth to capture over the next several quarters in the lending segment and financial services segment.

Reinvestment

I mentioned this above, but Noto talked in the earnings call about reinvesting back into the business at a higher rate this year than in 2024 to supplement growth. I’m a growth investor. I love this move. Starting this year, for every $100 the company drops to the bottom line, they have to pay $26 in taxes. When there are still so many ways to grow the business, the long term ROI in reinvesting that money into growth is so much greater than giving it away to Uncle Sam.

I’d much rather see 30%+ revenue growth in 2025 with $0.30 in EPS than 25% revenue growth and $0.35 in EPS. In fact, even if we only get $0.40 of EPS in 2026 but you told me it would lead to 40% revenue growth in 2025 and 2026, I’d take it. The greater revenue growth would be the result of more members being monetized at a higher rate.

When you have a sticky relationship with your members like a bank does, marketing dollars and new product initiatives are an investment that will repay itself in spades in the years to come. Market share gains are way more important to the goals of the company than a few cents of EPS in the short or medium term. I’m glad they are using the money to build better tech, push brand awareness, and hopefully launch some new products that will result in extra expenses in the short term. I’m all for it if it means that they are fulfilling the vision of becoming the one-stop shop for all your financial needs.

Macro Assumptions

True to form, SoFi has a lot of room for outperformance built into their macro assumptions. Here is what they said on the call about the assumptions behind their guidance:

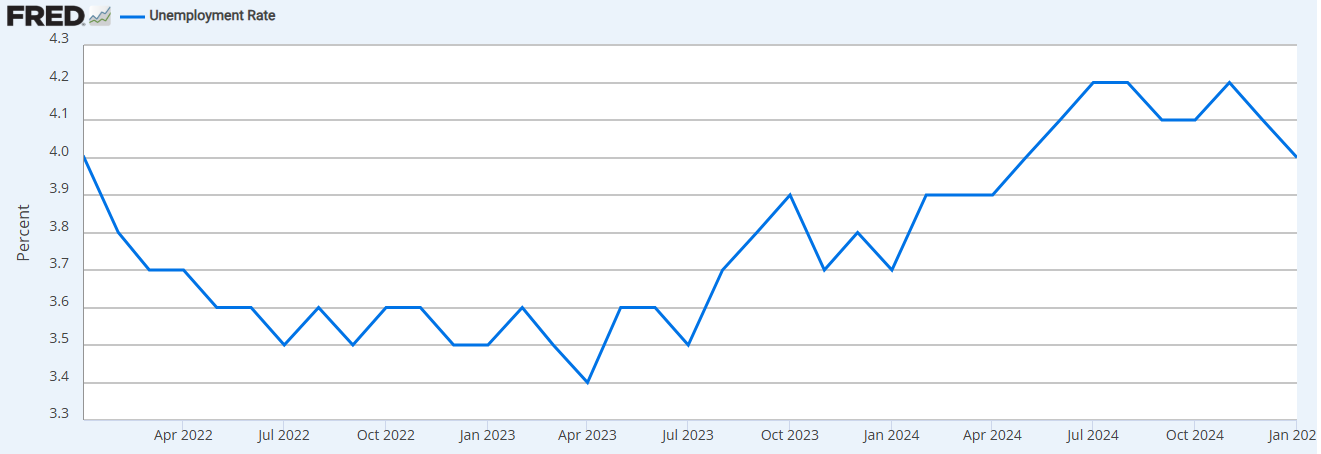

In line with market expectations, our assumptions are as follows: an interest rate outlook consistent with the forward curve and just north of 1.5 rate cuts; GDP expansion of 1% to 2%; normalization of unemployment in the 5% range; and continuation of normalized credit spread across capital markets and stabilization of consumer credit.

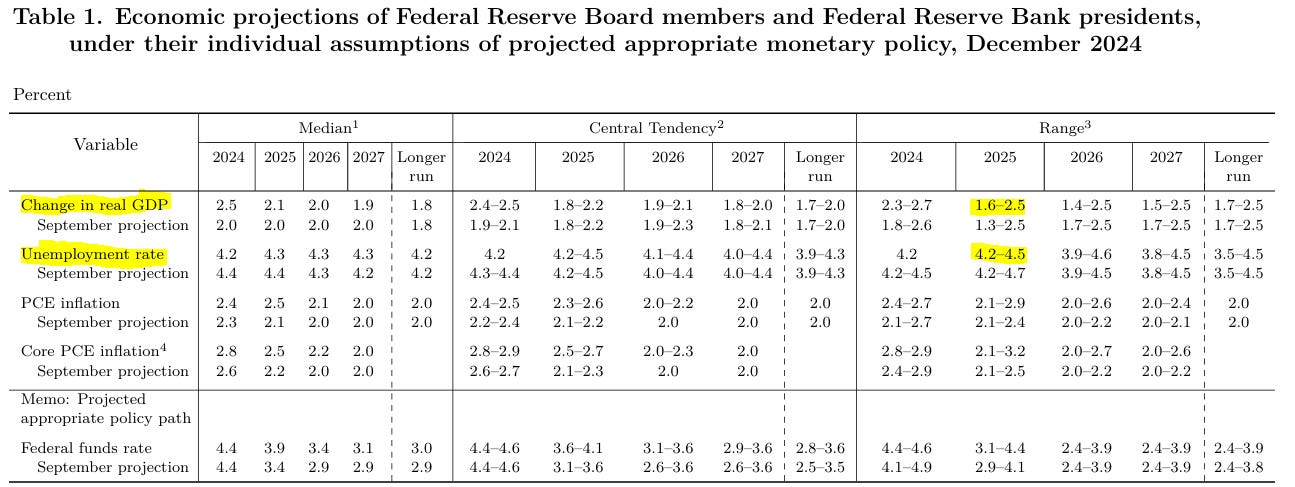

I love the “in line with market expectations” bit, because only one of those numbers is actually in line. The market is only pricing in about 1.5 rate cuts. However, the other two numbers are increasingly bearish. The GDP numbers are only slightly bearish, as the Fed Reserve Board expects a range of 1.6%-2.5% (see graphic below). However, the very most important number from SoFi’s perspective is the unemployment number. People who are employed pay back their loans. 5% unemployment by the end of this year is incredibly bearish. In fact, if there were close to 5% unemployment by the end of the year, there would certainly be more than 1.5 rate cuts. Here is the unemployment data from the past three years.

Unemployment peaked at 4.2% last summer, touched that number again in November, and is at 4.0% as of the January reading. Unemployment to 5% by the end of this year would mean that something breaks in the economy this year. To put it in perspective, in December, the Federal Reserve Board updated their projections. The range of anticipated unemployment exiting 2025 from all Fed Board members is 4.2%-4.5%. The most bearish member of the Fed only sees 4.5% unemployment by the end of the year and SoFi is guiding for 5%.

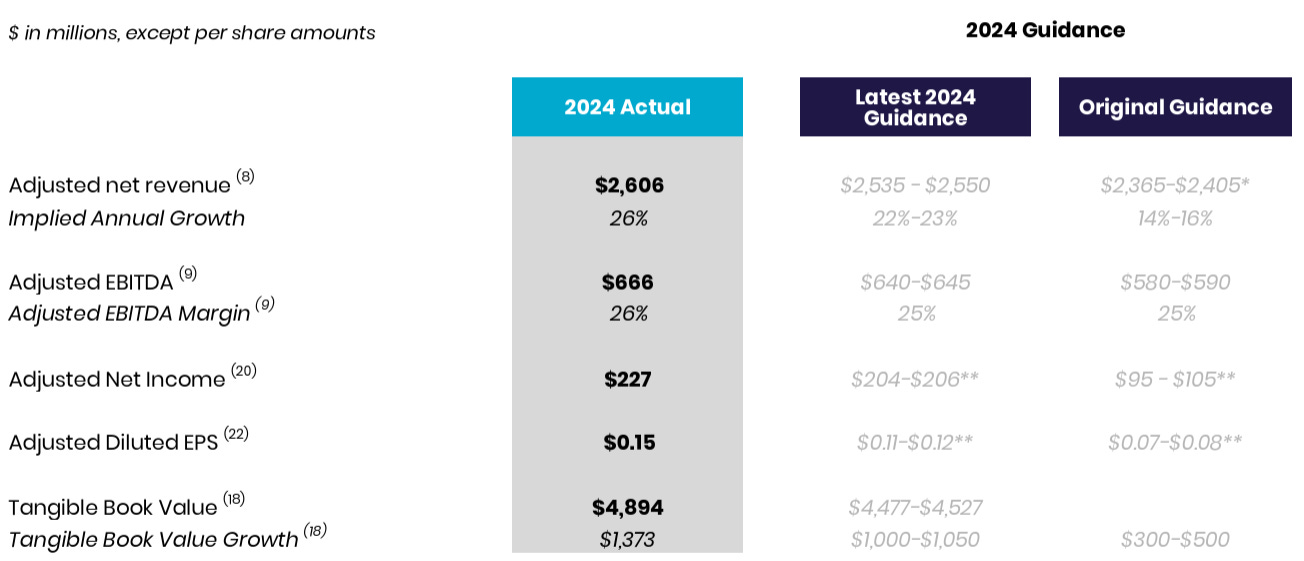

SoFi, as usual, has left themselves room to outperform based on extremely conservative macro assumptions, especially in unemployment. This is one of the key reasons they continually beat their guidance and that I expect them to continue to do so this year. Last year they did the same thing, guiding to 5% unemployment. The real number ended up being 4.1%, and SoFi outperformed their initial revenue guide by $221M, their EBITDA guide by $81M, their net income guide by $127M, and doubled their EPS by getting $0.15 when they guided for $0.075 (see below). I don’t know what the magnitude of the beats will be in 2025, but unless the economy breaks, I feel safe saying the beats will come and they will be substantial.

Management does not care about their PSUs

One thing that I took away from this earnings is that this management team has the utmost integrity. Anthony Noto, Chris Lapointe, and team are consummate professionals whom I already trusted, but with whom I'm now even more impressed.

In my earnings preview, I wrote about their PSUs and how it might lead them to push extra hard or perhaps be slightly more aggressive this year. To their credit, they stuck 100% by their standard guidance methodology. They do not seem to care about the stock or how they can personally benefit nearly as much as they care about building a durable, long-lasting business that will grow and compound for more than a decade regardless of the near-term consequences. If I, as an investor, were to get mad or be frustrated at the type of long-term mindset, integrity, and devotion to core values that I claim to espouse myself, I'd be a hypocrite. That doesn’t make them infallible or absolve them from criticism, some of which will come in my next article. However, it does make them, in my opinion, very trustworthy. I'm proud to be a shareholder of this company and look forward to many years of compounding returns.

Conclusion

Q4 was in most ways an excellent quarter. For anyone who was watching live as we reacted to the earnings release on YouTube, I had some initial concerns with the guidance, but it is actually better than I originally thought when I saw it at first glance and was reacting in real time. The Tech Platform is legitimately disappointing… a black mark on otherwise great results. The long term trajectory of the company is still stellar. They are still not being fully rewarded for their consistent and secular growth. They are winning and look primed to continue winning over the coming years.

Subscriber update

The DDI YouTube Channel is live. I’m still figuring out how to do everything there, but expect to see more as we go. A sincere and heart-felt thank you to those who support my work. If you do want to support my work, there are several ways to do so. You can subscribe here on substack, or on X, or, now, on YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up, or Tesla, or finchat.io for a discount on those products:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get up to $2500 off a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi. I recently sold my long position on LC and no longer hold any position.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Integrity. There's no way Noto walks away from $300M and White and Lapointe just accept they won't be getting 7X annual salary, bonuses. I'd say the board accepts in common sense, that growth now, over ST SP juicing, is the better option at this point and Noto et al. already know those RSU's will be reset to a later date. Thanks as always for the analysis, you're the best out there!

Great analysis. Can you review share count and dilution with capped call transaction in mind. TIA.