SoFi Q3 Preview: Why Wall Street's $888M Estimate is Wildly Low

SoFi will report their Q3 2025 earnings on October 28. I am very confident they will, once again, post a triple beat by reporting more revenue and EPS than Wall Street expects and raising guidance. Last quarter they posted massive revenue growth of 43.8% Y/Y. They had the benefit of Q2 from last year being a relatively easy comparison. That is no longer the case in Q3, as last year’s Q3 was one of the biggest surprise quarters SoFi has ever had. In the quarter, they beat analyst expectations by $59M, which is still their biggest beat ever.

The main reason for that outperformance? Last year at this time is when they debuted the Loan Platform Business. It took everyone off guard and has turned into a huge part of their business. In Q2 of this year, just the fee-based revenue was $105M. When you include referrals and servicing, the LPB is already a business with an annualized run rate over $500M. I don’t think they’ll get above 40% revenue growth again, but they also don’t need to. They need steady, consistent, sustainable growth. Noto and company aren’t interested in building a cyclical business, they want to create a secular compounder.

Members

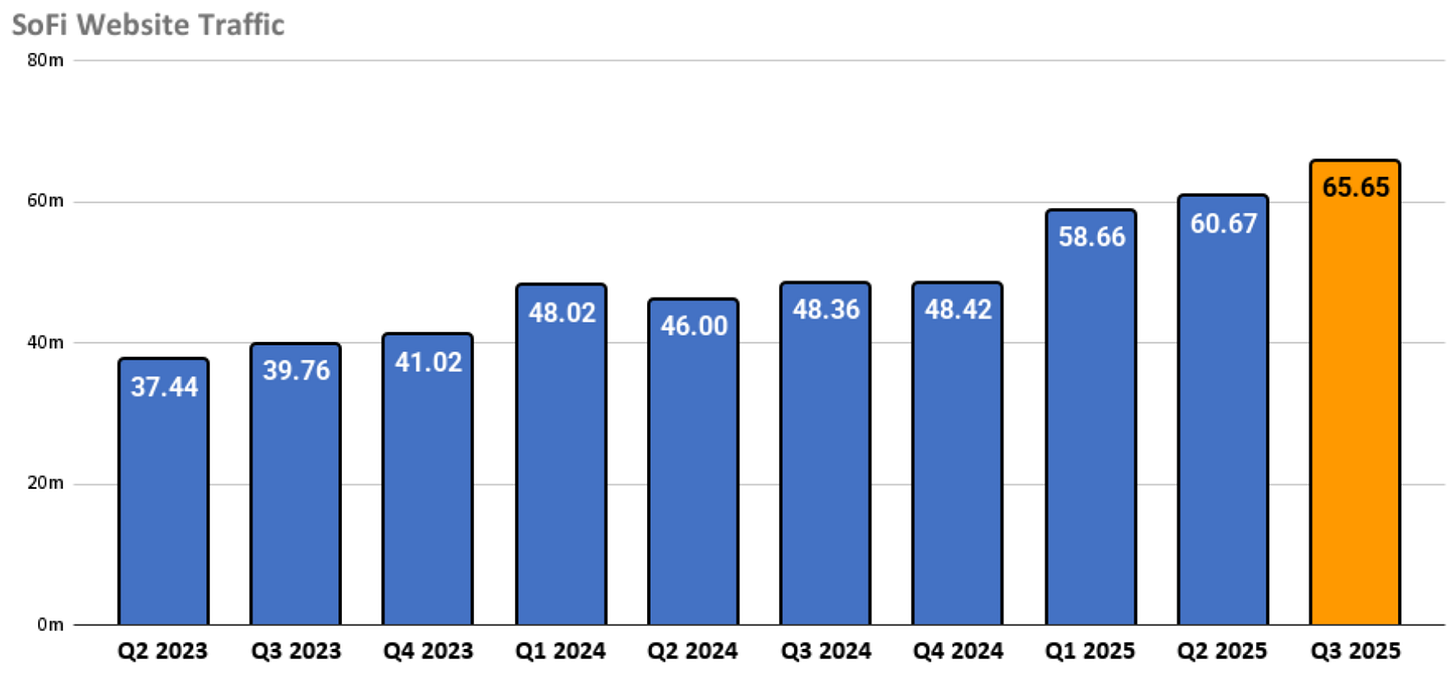

It’s been an excellent quarter for website traffic. I took this image from Future Investing.

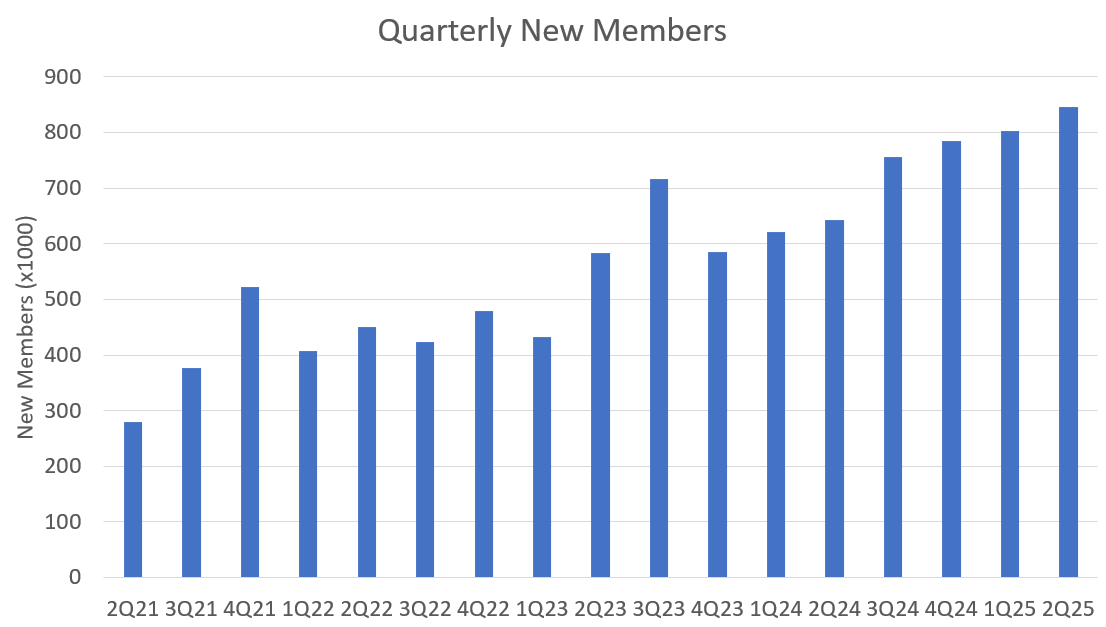

Moreover, Q3 has shown a sequential increase of more than 100k new members in each of the last two years. In 2023, there were 584k new members in Q2 followed by 717k new members in Q3. In 2024, they followed up a 643k new member Q2 with a 756k new member Q3.

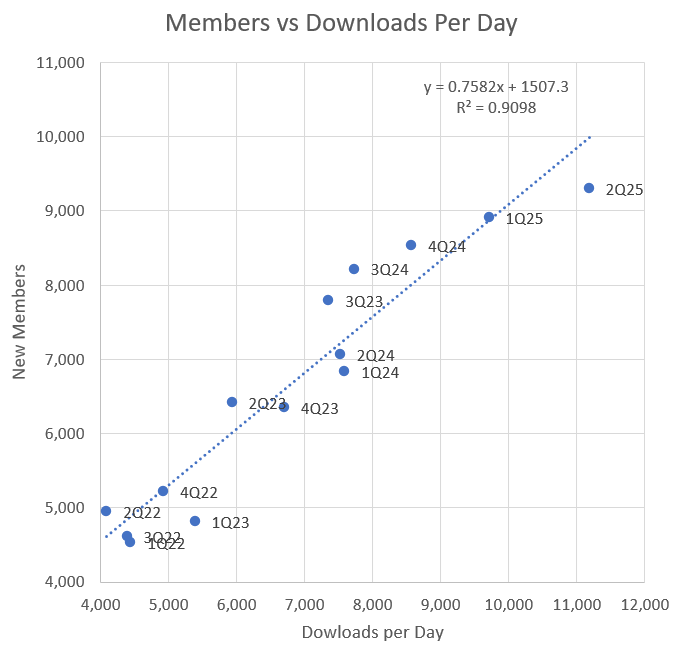

The last piece of data we have is the recent SensorTower data that also came from Tannor at Future Investing. This is the total app downloads across both Android and iOS, and it actually maps pretty well to new members. Here is new members per day compared to downloads per day for all the data that Tannor showed in his video. I don’t have access to the raw data, so I just transcribed what he had on screen. The trendline is also shown below. The R-squared value is 0.91, which essentially means that 91% of the change in the value of new members can be predicted by the change in new downloads. That’s an exceptional correlation.

If you use the trendline equation, you come up with a value of 1,054k new members in the quarter. You can also see how Q3 in each of the last two years has outperformed the correlation. As I said, Q3 is actually a seasonally strong quarter usually for new member adds.

Based on that recent data from Tannor, I increased my initial estimate of 940k new members to 1,010k new members. I would not have predicted a 1M member quarter prior to seeing the SensorTower data, but it really seems plausible now. That might be slightly high, but in my opinion, the download data is definitive that new members will almost certainly be above 960k in my opinion. Members are the lifeblood of everything that SoFi does. This is, in my opinion, the most important growth metric to track in the long term. SoFi will find ways to monetize members over time. Getting them in the door gives the company the opportunity to do so. I also expect about 20k churned members, putting the net member increase at 990k.

Originations

Personal Loans

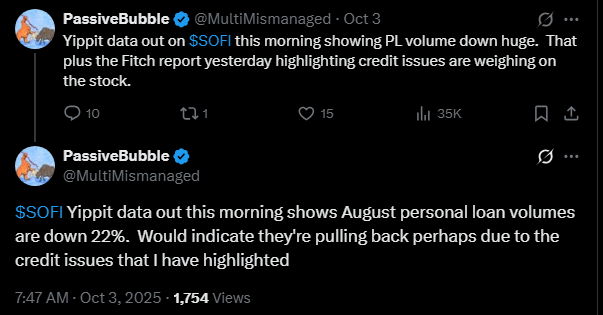

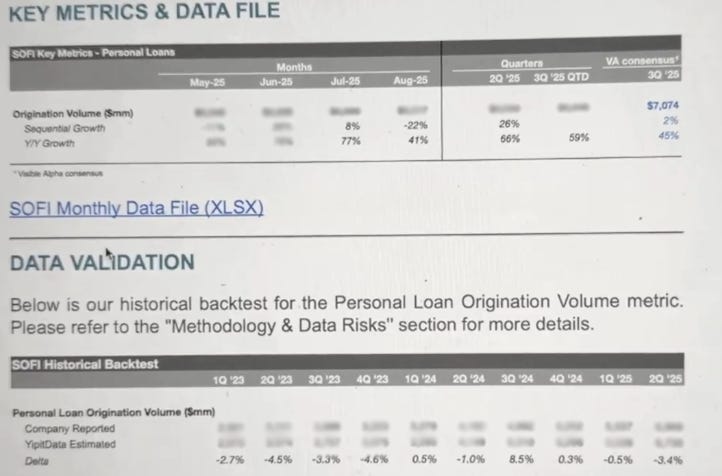

We also had some fun personal loan data during the quarter courtesy of a SoFi bear. Here was a tweet that surfaced at the beginning of October about SoFi’s personal loan data.

Unsurprisingly, this bear cherry-picked the only bearish part of very bullish data. The data do show that August M/M numbers were down 22% from July. However, what they failed to mention is that that was still 41% Y/Y growth and in July and August combined, there was 59% Y/Y growth compared to July and August of 2024. If that 59% Y/Y trend continued for all of Q3, it would imply $7.78B in PL originations and 11.6% Q/Q growth.

The point of highlighting a one-month drop of 22% was to stoke fears of a slowdown in business. The overall data show quite the opposite. The data does not show September so I’m just extrapolating to get the $7.78B number, so take that with a grain of salt. As an aside, YipitData’s historical back test accuracy actually looks quite good. Their data seem very credible. That’s great since it’s so bullish. However, the overall signal is looking very nice. Because August was a bit of a down month for originations, it seems probable that September also may not be as high as July’s numbers. I think SoFi will originate around $7.6B in PL originations.

Student Loans

The third quarter is historically very strong for student loans, and I expect that to be no different this quarter. Many students go back to school, so the in-school loans usually get a boost. I think we see the highest student loan origination numbers that SoFi has had since before the pandemic at $1.55B.

Home Loans

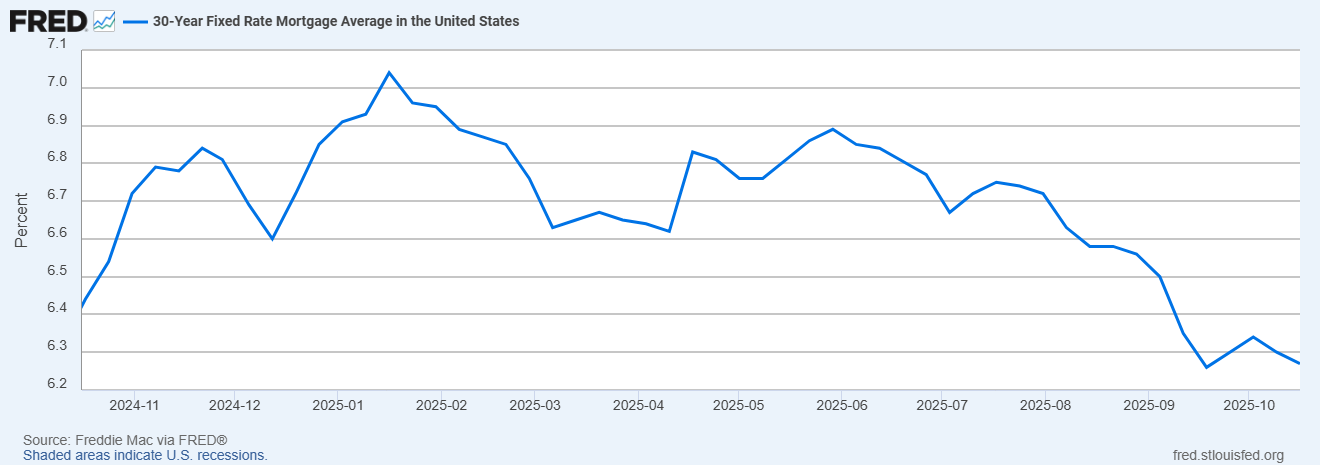

Rates came down meaningfully in Q3 and SoFi is obviously putting an emphasis on home loans. There has been a lot of marketing, they’ve added HELOCS, and just this week they announced the $3M expansion of their Charlotte offices and stated they plan on hiring several hundred new employees. Their Charlotte office is the office they acquired when they purchased Wyndham Capital a few years ago. I’m guessing business is going well, and this is a key growth area they’ve identified for the next few years. I think Home Loans sets a new ATH in Q3 with $950M

Potential LPB Upside?

Last quarter I highlighted that there was potential upside if they expand the credit box or if they add student loans or home loans. They ended up expanding the credit box and we saw a meaningful uplift in originations. I think that credit box expansion will continue to be gradual as they gain trust in the underwriting. But that leaves both student loans and home loans as potential expansions for the LPB. I think it’s likely that it happened in Q3 or will happen in Q4 as management has talked about it several times in the last 3-6 months as a possibility. If that expansion happened, it’s very possible that my student loan or home loan numbers could be low.

Revenue

Lending

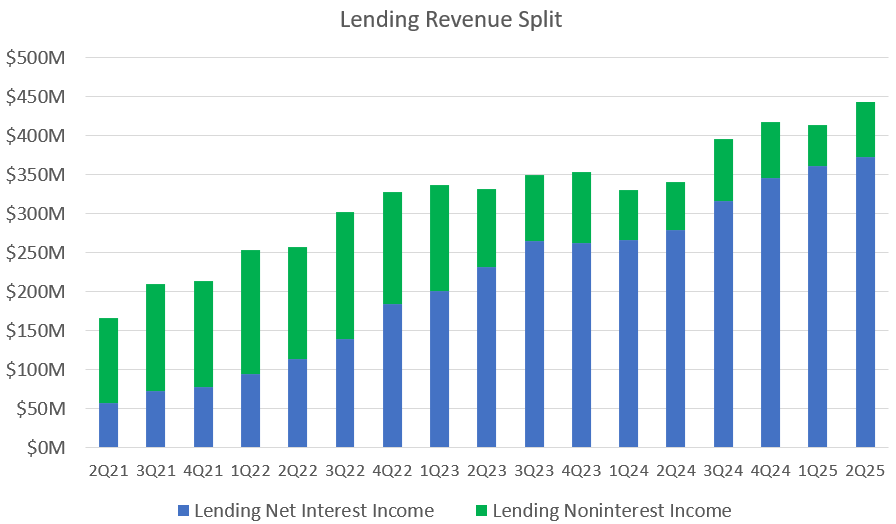

Net Interest Income only goes one way for SoFi. Noninterest Income is fairly lumpy, but with a good origination quarter and rates coming down, it should be strong. I have lending revenue increasing to $485M in Q3 on the continued expansion of the balance sheet and strong origination growth. Noninterest income should be bolstered by the strong home loan and student loan quarter as well.

Financial Services

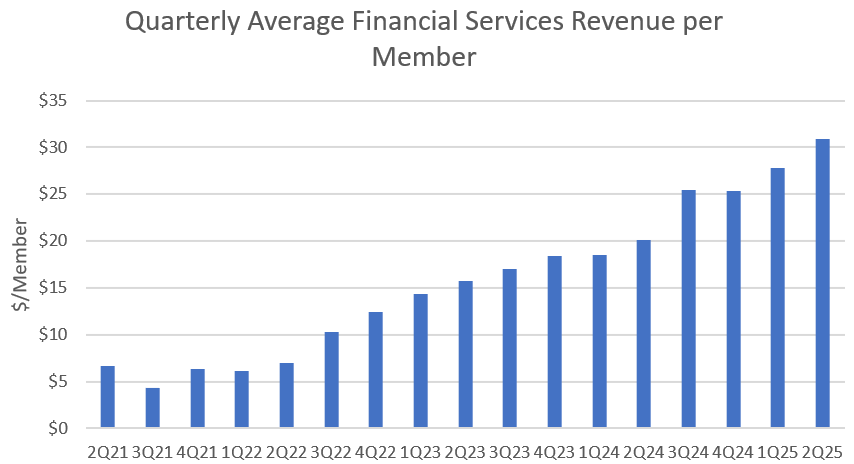

I never get tired of looking at this graph of Financial Services quarterly average revenue per member.

Combine this growth with the exponential member growth and the results have been wild. Last quarter they made $30.86/member in financial services revenue. They are ramping Invest and credit cards, and obviously the LPB continues to expand every quarter. I’m assuming $32.50/member this quarter, which I think is a reasonable ramp. It will definitely be low if the LPB scales into new loans, but I think it’s a good estimate. That leaves us with $414M in FS revenue for this quarter

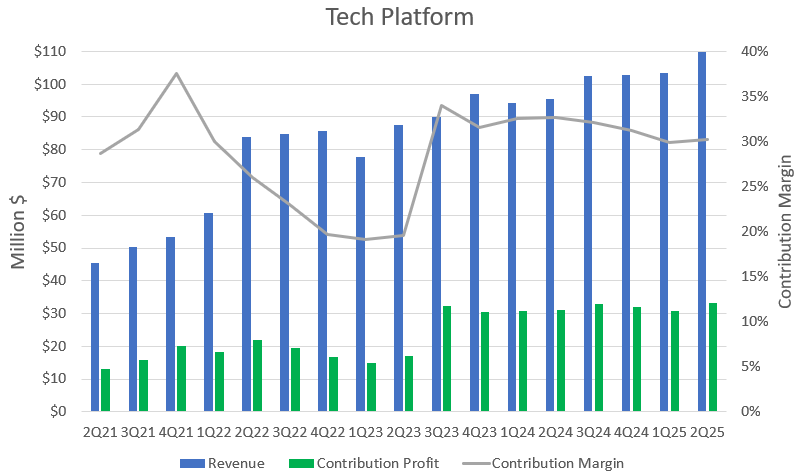

Tech Platform

We’ve seen some real green shoots here. Last quarter was their first quarter of real growth in a full year. They’ve been rolling out the Wyndham deal, their internal revenue should continue to increase, fintech is coming out of its winter and into its spring, and I’m actually slightly encouraged and think continued growth is a real possibility. I have $116M in revenue projected for this quarter. They’ve invested a lot into this business and I really want it to start paying off.

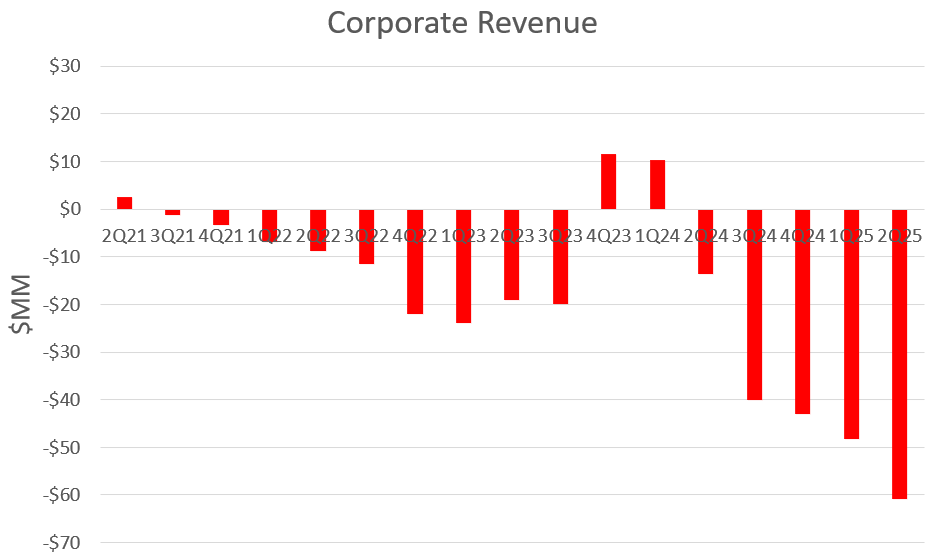

Corporate

I think if there is a disconnect between myself and others it will probably be here in corporate revenue. Technically, this should come down for the last two months if they used the capital raise to pay off their corporate revolver, because the interest they pay on that is a portion of the corporate revenue line item. The corporate line item is lumpy, but it just keeps getting worse and worse, and it isn’t a rounding error anymore. It’s become a big enough line item to worry about. I’m projecting -$65M in corporate revenue, which more negative than last quarter’s -$61M number despite the interest savings that should be coming in. I would love to be wrong here, but the trend seems pretty consistent.

Total Adjusted Net Revenue

That leads to my total projected ANR of $950M. That is 37% Y/Y growth on an extremely solid Q3 from last year. SoFi did not give specific quarterly revenue guidance for this quarter for the first time as a public company. They did give a 2H revenue projection of $1,746M. Even if you split that evenly between Q3 and Q4, that’s only $873M a quarter, which is wildly low. Analysts, as of the time of writing, have them pegged at $888M for Q3, with a high estimate on Wall Street of $935M. A month ago the estimate was $880M, so several analysts have raised their numbers in the last few weeks.

It’s worth pointing out that every quarter for the last 5 quarters, they haven’t just beaten the mean or median estimates, they’ve beaten the highest estimate on Wall Street every single quarter. They are averaging $30M more revenue than the highest Wall Street estimate over the last 5 quarters.

Adjusted EBITDA

To get the type of member growth I’m projecting, it means that they will have spent significantly on new member acquisition. Additionally, they are expanding their credit card, which comes with new provisions for credit losses. In spite of this reinvestment, I still think they maintain incremental EBITDA margins of around 42%, which puts my adj. EBITDA estimate at $294.2M, an increase of around $55M from last quarter’s all-time high of $249.1M. Again, SoFi only gave 2H guidance and not quarterly guidance, but splitting it into two quarters and dividing by two yields an adjusted EBITDA per quarter for Q3 and Q4 of only $250M. Seems sandbagged to me. Analysts are expecting $249.6M with a high estimate of $261.6M. I think they beat both of those marks

Net Income and EPS

The difference between adj. EBITDA and Net Income will continue to increase moving forward simply because as they make more money, they have to pay more taxes. I think the gap between adj. EBITDA and net income will come in around $158.5M this quarter (it was $151.5M last quarter). In theory, if they did use the cash they raised to pay off the corporate revolver, that number would come down by by around $7M as that is one of the line items in their reconciliations. That means I might be slightly bearish here, which would be great. I end up with net income of $135.8M, which corresponds to an EPS of 11.2 cents for the quarter with my estimated updated share count.

SoFi’s guidance implies only 8 cents of EPS for each of the next two quarters and analyst estimates for Q3 are 9 cents, with a high of 12 cents.

Guidance

Their guidance was so sandbagged last quarter that I expect we see big upward revisions this quarter. Even though they’ll still guide conservatively for Q4, I expect the revenue guide of $3,375 for FY25 will be revised upward to a minimum of $3,500M. Analyst estimates are $3,448M. I think for EBITDA the upward revision will be from $960M to above a billion at $1,020M in EBITDA (analyst estimates are $982M). I estimate that their EPS guidance raise will be from $0.31 to $0.37 (analyst estimates are currently $0.32). I’m very confident we see another triple beat.

Price Action

Last quarter I said that I thought that $25 this year was still possible and I really believed that a new ATH above $28.26 would happen this year. At the time the stock had only recently broken $20 for the first time in years. Crazy to think about that now as only a quarter has gone by and the low-$20s seems bearish. This category is just for fun, but I do think that this quarter will definitely justify the current prices in the high 20s, and a guidance raise that large, relative to analyst projections, could easily shoot it past $30 again. If they deliver the quarter I outlined here, I think low-$30s becomes the new floor assuming good macro.

Of course, I’m notoriously terrible at predicting the price action, so it could easily sell off on excellent earnings. I think the macro is more accommodative now, and there will likely be a rate cut the day after earnings. I don’t think a sell off will happen this quarter if they post the results I expect.

DDI Predictions in One Place:

New Members: 1,010k (990k net new members with 20k churning off the platform)

Personal Loan Originations: $7.6B

Student Loan Originations: $1.55B

Home Loan Originations: $950M

Lending Revenue: $485M

Financial Services Revenue: $414M

Tech Platform Revenue: $116M

Corporate Revenue: -$65M

Adjusted Net Revenue: $950M

Adjusted EBITDA: $294.2M

Net Income: $135.8M

EPS: $0.112

Subscriber update

The DDI YouTube Channel is live. If you want to support my work, you can subscribe here on substack, or on X, or, YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up for SoFi, or discounts on Tesla or finchat.io:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get a discount on a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

People are going ham on SoFi lately. Much potential here.

This breakdown is extrmely helpful, especially the segment by segment revenue estimates. I think your $900M+ revenue call was pretty bold at the time but looks spot on now that we've seen the actual results. The lending segment analysis is particuarly interesting, I didn't realize how much the personal loan originations would drive fee income vs just NII. One thing I'm wondering about though is the tech platform revenue. You estimated $107M but that seems optimistic given historicl growth rates in that segment. Do you think the 10 new Technisys clients Noto mentioned will actually materialize fast enough to move the needle in Q3, or are we looking at a Q4/2026 story there?