SoFi: The AWS of Fintech

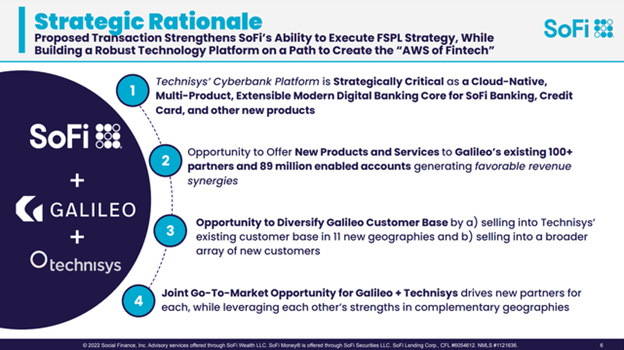

Galileo, Technisys, and the bank charter give SoFi an unmatched, unique product offering.

Hey everyone, I’ve been writing for a while for Seeking Alpha. Despite the fact that over half of my articles there on SoFi have been nominated as an “Editors’ Pick” (less than 1% of articles receive that distinction), they think that I write too much about SoFi. Their loss is your gain today because they rejected this article, so now it is being published as my first Substack article. If I get enough traction here, I’d love to be able to publish everything here instead. Please subscribe if you enjoy what you read.

Almost exactly one year ago, I set out to answer the main bear cases against SoFi (SOFI). Today, I finish that endeavor. SoFi's detractors claim they are:

A student loan company who will end up bankrupt because of the student loan payment moratorium,

Diluting their shareholders and giving out absurdly high amounts of stock-based compensation,

Unprofitable on a GAAP basis and therefore not worth investing in, and

Lack a moat, and everything they do can be easily replicated by others.

I have written about how SoFi handled the collapse of its student loan business and how it will benefit once they come back. I wrote twice about stock-based compensation. I consider one of those articles among the best pieces I've ever written, giving nuance and context to the discussion after having interviewed SoFi's CFO Chris Lapointe on the subject. I've also written significantly about SoFi's profitability, discussing their stable financial foundation and how to properly analyze their cash flow and answering why they use adjusted EBITDA. Finally, I also took a look at their consumer-facing business, and how their blend of best-in-class products and ability to cross sell gives them a unique digital offering in the consumer finance space. That was part one of addressing concerns about their moat. This article will delve into the most misunderstood part of SoFi’s business, which also happens to be the hardest to replicate: their technology segment.

Moats Are Built, Not Bestowed

I'll paraphrase my thoughts from my previous moat article to provide context for this discussion. Warren Buffett popularized the notion of moats when he said "The most important thing [is] trying to find a business with a wide and long-lasting moat around it … protecting a terrific economic castle." A medieval castle moat was built with hard manual labor, and a business moat is no different. It is built with superior technology like Google's (GOOGL) search algorithm, exceptional design, vision, branding, and execution like Apple (AAPL), a relentless devotion to customers like Amazon (AMZN), or something else that makes a business truly one of a kind. What set apart Google from Lycos, Apple from Blackberry, and Amazon from Pets.com was not their initial advantage, it was their ability to work smarter and execute better than the competition. A wide and enduring moat is the result of years of exceptional execution and hard work, not because some magical moat fairy came and waved a her wand over these businesses.

Why the comparison to AWS?

Jeff Bezos keeps a framed copy of this 2006 BusinessWeek magazine as a reminder that Wall Street doesn't always appreciate innovation. The article labels AWS as a risky bet and highlighted how Wall Street didn't like how the significant investment into tech R&D was dragging on the earnings of Amazon's core e-commerce business.

AWS is now Amazon's most lucrative business. What Bezos saw back then is that there was significant value in the processes and infrastructure that Amazon had built, and that there was money to be made selling those services. Amazon had to build significant physical and digital infrastructure for their e-commerce business to run. Bezos decided to sell access to that infrastructure to other businesses through AWS. AWS customers benefited from Amazon's economies of scale and didn't have to build the tech or buy the hardware themselves. Amazon, in turn, got an extra return on the time, money, and capex they invested in their systems, code, warehouse space, and hardware. It ended up being a huge win-win for both Amazon and AWS customers.

What does that have to do with SoFi?

SoFi exists in the highly-regulated financial space where the vast majority of the existing infrastructure is archaic. Most of the legacy banking tech stack is built in COBOL, a programming language that debuted in 1959, a full 10 years before man set foot on the moon. Maintaining this deprecated technology is costly and keeps banks from being able to innovate and build new processes and systems. It also keeps financial institutions inflexible and makes banking slow and ponderous.

SoFi recognized early that if they want to be an agile and low cost provider of financial services, they'd need a modern, vertically-integrated, API-driven, and cloud-based technology stack. That takes significant investment to build or acquire, but results in compelling unit economics for their core business. If they own the technology from the bottom to the top, they don't have to pay third parties for those services, resulting in better margins. Taking a page from the book of Bezos, SoFi is improving their return on that investment by selling what they build. Any financial institution who needs card issuing, payment processing, a multiproduct single core platform, AI-based customer service, and many other services can buy those services from SoFi.

Three pillars of SoFi's Technology Segment

SoFi has a trifecta of offerings that bring down their own costs and represent a completely unique product offering for potential partners. The three pillars of their technology are Galileo, Technisys, and their bank charter.

Galileo

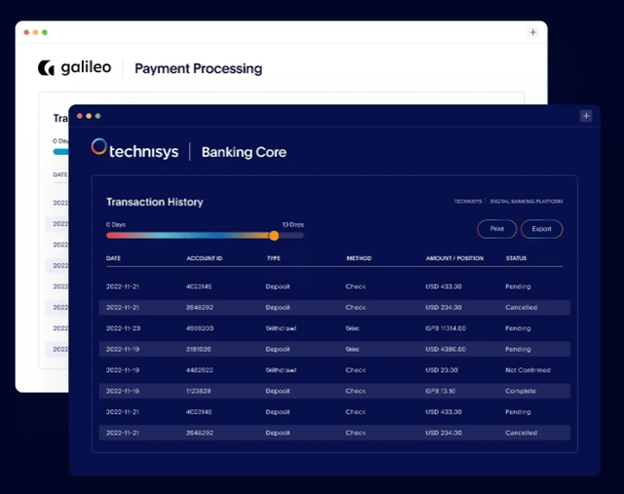

Galileo was purchased by SoFi in April of 2020 for $1.2B in combined cash and stock. It was, and is, an API-driven backend to support many account and payment functions including "account set-up, funding, direct deposit, ACH transfer, IVR, early paycheck direct deposit, bill pay, transaction notifications, check balance, and point of sale authorization as well as dozens of other capabilities" (citation). Included in those dozens of other capabilities are debit card issuing, payment processing, and fraud detection. These are core functionalities that are needed by most financial institutions and Galileo clientele includes neobanks such as Chime, Dave (DAVE), MoneyLion (ML), Revolut, Robinhood (HOOD), Toast (TOST), and Varo, among many others.

Technisys

Technisys was acquired by SoFi in March of 2022 in an all stock deal that was at the time valued at $1.1B. It's main product offering is a cloud-native single core multi-product banking platform. Banks require a core and ledger for each of their products (checking, savings, credit cards, brokerage, etc.). Most utilize siloed cores that are inefficient and technologically incapable of sharing data. This increases cost for a number of reasons. The isolated cores mean that a single user with multiple accounts will have their data replicated across each core. Getting the cores to speak to each other is a tedious process, with multiple layers built on top of the archaic cores to allow them to interface with modern processes and websites.

All that data storage and server space requires legacy hardware that is owned and operated by the financial institutions, making it hard to scale, as it requires ever more servers. Additionally, banks are unable to truly utilize the vast amount of data they have since it is all segregated and siloed. This is why you have to reenter your personal information every time you apply for a loan or fill out a credit card application even if you've been a customer at the bank for a decade.

Technisys' offering is completely modern. It's a cloud-based platform that shares data across the products. It is cloud agnostic and can run on AWS, Microsoft (MSFT) Azure, or Google (GOOG, GOOGL) Cloud, and scales easily to any size user. The data is also more accessible than legacy systems. Financial institution can utilize that data to better understand their customers and cater products, offerings, and services to meet their needs. Technisys' clients have better visibility into their clients' behavior, needs, and habits than those who run off older core systems. They also only pay for what they need and can expand quickly and easily using the nearly infinite scalability of the cloud.

Bank Charter

SoFi received their bank charter in early 2022. This allows them to operate in all 50 states as a licensed bank and to use deposits as collateral for lending. It also makes it so that they can act as a sponsor bank for other non-chartered banks. Any unchartered neobanks or fintechs (e.g. Chime, Dave, MoneyLion, Acorns, Cash App, Paypal, etc.) need a sponsor bank who houses their deposits, since they are not a chartered bank themselves. SoFi can fill this role and then benefit by using those deposits fund their lending products.

What is the moat?

There are a large number of companies that offer payment processing and are competitors to Galileo. Likewise, Technisys is not the only digitally-native cloud multiproduct single core product. There are also literally thousands of chartered banks in the USA. However, SoFi is the only company in the market that offers a payment processing solution combined with multiproduct single core banking solution. That alone is a unique offering, and adding the ability to act as sponsor bank only further differentiates SoFi from the competition.

The combination of these three offerings is completely unique from what any other fintech on the market has to offer. They can offer differentiated turn-key solutions to potential clients, and deliver those products in very short timeframes. This has opened new doors that were previously closed to SoFi. CEO Anthony Noto went into great depth about this at Bank of America's 2023 Electronic Payments Symposium Conference:

We’re in conversations with large financial institutions we just weren't in conversations with before. We didn’t have the complete stack. Banks are really challenged to innovate. The cost of their technology stacks is just growing exponentially and their businesses are not growing exponentially.

So many of them face the issue of having old cores, old technology stacks. Competition from new entrants and innovative products is increasing, not decreasing, while their costs to actually compete are exponential.

So we have ongoing conversations with a significant number of financial institutions that we didn’t have a complete solution for before. Having Technisys and having a multiproduct single core, having SoFi in the cloud and the other investments that we’ve made has been really differentiated.

This adds to comments both he and CFO Chris Lapointe made about how it is now only a matter of time before they sign a large institution onto the platform. In November, Chris Lapointe said at the Credit Suisse 26th Annual Technology Conference, "It's not a question of whether our technology is superior or we're able to deliver this technology or service at the lowest cost, it's more of a question of when it happens, not if."

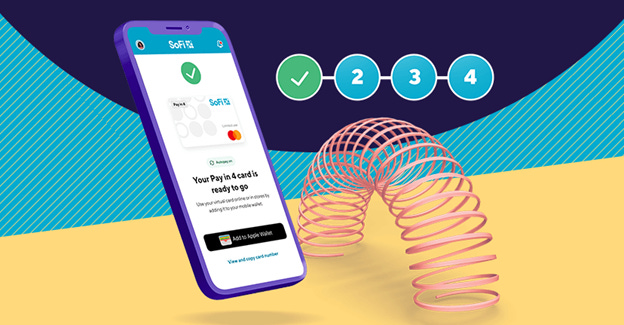

Pay In 4 as a case study

SoFi's "Pay in 4" product is a case study in how the AWS of fintech will work. Pay in 4 is the first product offering built on both Galileo's API framework and Technysis' banking core. It is a buy now pay later (BNPL) offering that SoFi began rolling out in December 2022, allowing SoFi members who qualify access to a digital card that can be easily added to Apple Wallet or Google Pay. That card authorizes the holder for any purchase up to $500 (for now), which they then pay back in four equal installments, one at the time of the purchase and three more every two weeks thereafter.

The entire process is incredibly easy for the consumer. Signing up, receiving approval, and adding the card to my Google Pay wallet took less than 2 minutes on my phone. SoFi's UX was seamless and it actually took more time, effort, and clicks to go through Google Pay's interface to add the card than I spent in SoFi's app applying for the service. Owning their own tech from top to bottom makes it that easy, and utilizing Technisys' multiproduct single core tech allows them to use the personal information they already have on me to fill out the tedious portions of application in the background.

Opening up the BNPL ecosystem to banks and fintechs

The Pay In 4 product allows SoFi to compete with other BNPL providers like Affirm and Afterpay. However, that isn't what is so exciting to me about this product launch. SoFi has paid for the R&D cost to build this offering from the ground up for their own customers. Now they are leveraging that R&D expense to offer BNPL to the entire existing Galileo and Technisys clientele. Banks and fintechs can tailor the product to meet their needs. Galileo clients can can modify interest rates, number of installments, flexible payment schedules, late payment penalties, and other terms to match the risk profiles and needs of their user base.

SoFi caters to an affluent and high-earning user base, but their neobank clients have a much more varied clientele. Many of those who use Chime and Dave, for example, are the underbanked who struggle to access credit via traditional lending channels like credit cards and personal loans. This gives those neobanks a tool to address that need. On the other side of the spectrum, Galileo's regional banking and credit union partners simply do not have the technological chops to be able to build this kind of product. Galileo gives them access to a modern turn-key product that helps them keep pace with the industry. The entire BNPL product can be launched in only six weeks because Galileo owns the entire technology stack from end to end, per CEO Anthony Noto. That is an incredibly fast turnaround for a brand new financial product.

Pay in 4 is the most visible example of how SoFi will build the AWS of fintech. SoFi's 5M+ members and Galileo clients give them insight into the demands and needs of today's banking customers and the companies that serve them. The technology platform gives them the agility to build unique products and allows them to be a first mover in the industry. Building those products in a highly regulated space can be a high-cost endeavor. However, once the product is built, SoFi can turn around and sell it to their hundreds of tech partners. As the technology platform's products become stronger and more varied, it makes working relationships stickier, leads to increased revenue from cross selling new offerings to existing partners, and makes the value proposition more compelling for potential clients.

It is true that giving others access to their differentiated product offerings will make their consumer-facing products less unique. If everyone has a BNPL offering, SoFi's Pay in 4 is not as compelling for signing up new members on the banking side. I'm not worried about this for two reasons. First, expanding the return on investment on their R&D expenses is well worth losing the exclusivity of the technology. Second, SoFi will always remain the low cost provider. They own the tech and will be able to use it at cost, where others will be paying SoFi a fee for the service. SoFi will maintain their best-in-class unit economics over their competitors.

Execution is the biggest risk

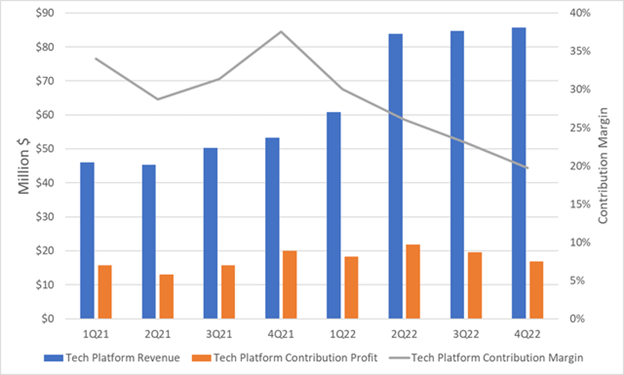

SoFi's consumer-facing lending and financial services sectors thrived in 2022. Lending saw hugely expanding margins in addition to origination growth. Financial services, meanwhile, has seen rampant revenue growth and is turning the corner on profitability. The technology platform, by contrast, saw less compelling results. Revenue has been flat for three straight quarters while margins are actually decreasing with time. That is not what I want to see.

Revenue, contribution profit and contribution margin of Galileo (note that contribution margin is plotted on the right y-axis) (Author)

There are two mitigating circumstances that provide some justification for this weakness. First, the majority of Galileo's clients are neobanks that cater to underbanked consumers. Those are exactly the segments of the economy that have been hit hardest by the macroenvironment. One need only look at the stock performance of Dave and MoneyLion (down 98.8% and 96.6%, respectively from their highs) to see that Galileo's neobank partners have been struggling mightily.

Second, 2022 was a big year of investment for the technology segment. First, SoFi spent years transitioning from on-premises facilities to the cloud. This added extra cost to maintain operational redundancy of existing hardware while the cloud-based system was thoroughly vetted. They are now in a position to decommission those legacy systems and reap the benefits of their investment. CFO Chris Lapointe discussed this last month:

So over the course of the last few years, specifically with Galileo, we've invested quite heavily in migrating from on-prem to the cloud. We are now essentially done with that migration. We have over 99% of all authorizations on the platform going through the cloud. So we're going to be able to start realizing cost savings by not having to operate both on-prem and the cloud, which we've had to do over the course of the last few years.

The other investment was onboarding Technisys and folding them into the Galileo portfolio. This was a large undertaking as Technisys had a larger headcount than the existing Galileo business. Unifying all the processes, projects, workflows, and systems to under one roof took time, money, and the better part of a year to work out. However, things are now accelerating. The recent confirmation that the two businesses are being consolidated into a unified Galileo brand indicates that these growing pains should be behind them. Between the launch of Pay in 4, significantly increased presence on social media, and other product launches (like an expanded fraud offering), the combined Galileo entity seems ready to scale and go to market.

The pathway forward

The trailing year's results for the technology platform have yet to match the bold AWS of fintech vision. Galileos strong results in 2020 and 2021 were built on the growth in the neobank sector. As neobanks have struggled, Galileo is pivoting their approach and shifting focus into business-to-business (B2B) transactions, large financial institutions, and platforms like existing client Toast, a restaurant technology and point-of-sale provider. These types of clients have longer sales cycles, but should result in higher revenue growth once the clients sign. I am willing to give them a pass for 2022 because of the mitigating circumstances mentioned above, but there needs to be significant revenue growth and margins need to expand in 2023.

AI Offering

Because AI is all the rage, it is worth mentioning that Galileo has a commercial AI customer service chatbot product called Konecta. This was a part of Technisys product offerings that came with the acquisition. Their website boasts clients such as Santander (SAN), BBVA (BBVA), Coca-Cola (KO), and Ricoh (RICOY).

Risk of perceived conflicts of interest

One other risk to the expansion of the technology platform is that a lot of Galileo clients are SoFi competitors. While SoFi allows Galileo to run autonomously, there might be some residual distrust of a brand that is owned by a direct competitor. Chime was a Galileo client before the acquisition, and a former Chime employee put it this way in a recent interview:

What was very interesting was that, at a certain point, SoFi bought Galileo and then everyone was like, "Uh-oh, this is bad. Our competitor now owns the underlying technology that empowers all these companies." Chime, certainly, and lots of other companies started to build their own backend systems, which is a very complicated task, but I think they're trying to prevent the risk of favorable terms with this separate-but-owned-by-a-competitor company.

Neobanks, fintechs, and financial institutions may be reticent to partner with Galileo. This is due to the fear of strengthening a competitor as well as the fear of SoFi pulling the rug on them with unfavorable contracts due to the perceived conflict of interest. As long as Galileo continues to provide excellent service and provide more value to clients than the cost of their offerings, this risk should decrease over time. Many Amazon competitors have very little qualms using AWS because they have built a relationship of trust and fairness over decades. Galileo will have to do the same.

I'm bullish on the AWS of Fintech vision, but the jury is still out

Galileo gives SoFi obvious cost advantages over their competitors. It has positive contribution margins, so it is pulling its own weight and does add value. However, the last year has raised questions about the long-term viability of the business across the entire business cycle and exposed their reliance on neobanks. SoFi's other segments have flexed their muscles and shown strength in a tough environment, but the same cannot yet be said for their "AWS of Fintech" offering.

Execution in lending and financial services has been exemplary, and SoFi's management team has, thus far, gained my trust. Just last month, CFO Chris Lapointe said this about the technology segment:

In the near to medium term, margins will expand back to those levels that we've talked about historically. On the revenue side, one of the things that we talked about focusing on was larger, more durable customers that are diversified and have larger installed bases, which naturally have longer sales cycles. Once they're fully integrated, that will help reaccelerate revenue.

For context on margins, in November he said "Our tech platform business operates [historically] at a 30% contribution margin. We expect that business longer term to operate north of 40%." To maintain my trust that they can execute of their vision for their technology platform, I need to see margin expansion and reacceleration of revenue growth in 2023.

The technology platform has huge upside. If Galileo becomes the backend infrastructure that powers a substantial part of the financial industry, buying the stock at these prices would result in huge returns, easily eclipsing a 10x in my opinion. Not only that, but it would firmly entrench SoFi as one of the low-cost providers for loans and financial services across the entire sector, helping to enable CEO Anthony Noto's goal to become a top 10 financial institution. That is the grand vision of the AWS of Fintech.

At this point the tech platform only provides SoFi a moat, but it is one that is relatively shallow and narrow. It is now down to the company to execute and put in the work to dig a wide and long-lasting moat of which even Mr. Buffett would approve.

Keek doing this! Very helpful

Great to know more about SoFi as investor. Besides that, it is just fun to read your articles. The way you structure your writings make it very easy to follow. Jealous as a fellow engineer.