SoFi's Not Chasing Robinhood: It's a Billion-Dollar Genius Move

I think a lot of the narrative surrounding SoFi is slightly misguided. Most of the people reading this and most of the people who hang out on FinX or watch investing videos on YouTube are not normal people. Normal people would never spend a Friday night watching a livestream about a fintech company or a AI enterprise software company, much less recording one as I’m prone to do. The vast majority of people have never seen more than 5 minutes of CNBC, don’t know what a “10-Q” or a “10-K” is, and have no interest in understanding a discounted cash flow model or PEG ratio. I'm willing to bet that less than 2% of the US population have ever listened to a full earnings call from any company in their entire life.

We interact in a bubble of people who are highly focused on investing. That bias colors our perceptions and opinions. Because of the circles we interact in, there is significant emphasis on the brokerage platform of SoFi compared with its competitors, specifically Robinhood. When you view everything through the lens of investing, it means that the fact that SoFi’s Invest product is not as good for active investors as Robinhood’s gets an exceptional amount of attention.

And it is true that SoFi is not as good of a platform for active investors as Robinhood. That also doesn’t matter as much as you think.

SoFi doesn't care much about adding level 1 options, great charts, or any of the other stuff we care about because we are avid investors. We are not their target market. Their brokerage product is catered to passive investors. That's why they have an award-winning robo-advisor and are prioritizing alternative investment funds like their enhanced-yield ETF THTA, the Ark Venture Fund, Templum partnerships to invest in, SpaceX, Anthropic, Databricks, and xAI. They recently launched additional private market funds. If options were a priority, they'd have focused on that first.

Now, I don't like it because I love selling options, but they aren't catering to you and me. They want people who will turn into wealth management customers. That's their focus. They are not focused on day traders or people actively looking into options strategies. You can say that's the wrong strategy, and you may be right, but you can't fault them for not delivering on something that they aren't trying to deliver. So many people give the company grief for its brokerage offering and say they miss the mark.

The truth is, they aren’t even aiming at that target, so you cannot criticize them for missing something they aren’t aiming for. In our hyper-focus on the target of the best brokerage for us, we completely miss the bullseye they hit on the target they are actually aiming at. It seems to me that very few people consider that the mark isn't being hit because they aren't even shooting at it.

Yes, eventually if they want to be a one stop shop they have to have a brokerage that competes on all fronts, but they have bigger and more important fish to fry. If you are an active investor who uses options strategies, SoFi is a terrible brokerage for you. But that's also not what they're trying to build right now. It's like complaining about Robinhood because they took until 2025 to roll out their robo-advisor (Robinhood Strategies). A roboadvisor was not their focus, they want to cater to active traders first. SoFi will get there eventually, but it just isn't a priority right now. It actually sounds like they are starting to pivot and beginning to put resources into Invest again, but I think it will continue to be catered to passive investors rather than active ones.

It may be the wrong strategy, but it also may be the right strategy. This is data-driven investing, so let's just look at raw numbers. 58% of US households own stocks directly or indirectly. About 20% of them own single stocks. Of that subset, well under 10% actively trade. SoFi is trying to get the TAM of the 90% of passive investors and building a wealth management system for them rather than focusing on the 10% or less of active traders. They are intentionally ceding the active trader market to others for now. This is by design.

None of this is to take anything away from Robinhood, who have been relentless in their execution and have capitalized magnificently on the opportunity they’ve been presented with the equity and crypto bull run. Honestly, my hat is off to them for the rapid product velocity and relentless pursuit of innovation. I turned constructive on them as it became clear the credit card risk I was concerned about would not materialize and I initiated a position earlier this year via LEAPS.

What is SoFi aiming for?

So, if they aren’t focused on brokerage, where is their focus? It’s exactly where it should be, standing up a new business line that is already delivering $300M+ annualized revenue at 50%+ contribution margins. I’m talking about the Loan Platform Business.

SoFi is uniquely placed to build this business. Nobody else has the ecosystem, the underwriting chops, or the excess demand that SoFi has. LendingClub, Upstart, Pagaya, and Affirm don’t have the consumer ecosystem. Robinhood, Chime, Dave, and MoneyLion don’t have the underwriting experience. Nobody can marry the two like SoFi can. And SoFi hasn’t (yet) even included student loan and home loans in the LPB. They will eventually, and if they can simultaneously expand the credit box, this business can easily be a billion dollar business in the next year or two and continue to grow from there.

It also comes at the exact right time. Banking regulations are set to relax, meaning that banks will be able to increase the assets they hold. That gives liquidity to the market and drives demand for the type of loans that the LPB offers. Combine that with the fact that rates will be falling in the next year or two, and there is very fertile soil for the LPB to rapidly grow.

LPB is Crushing Competitors

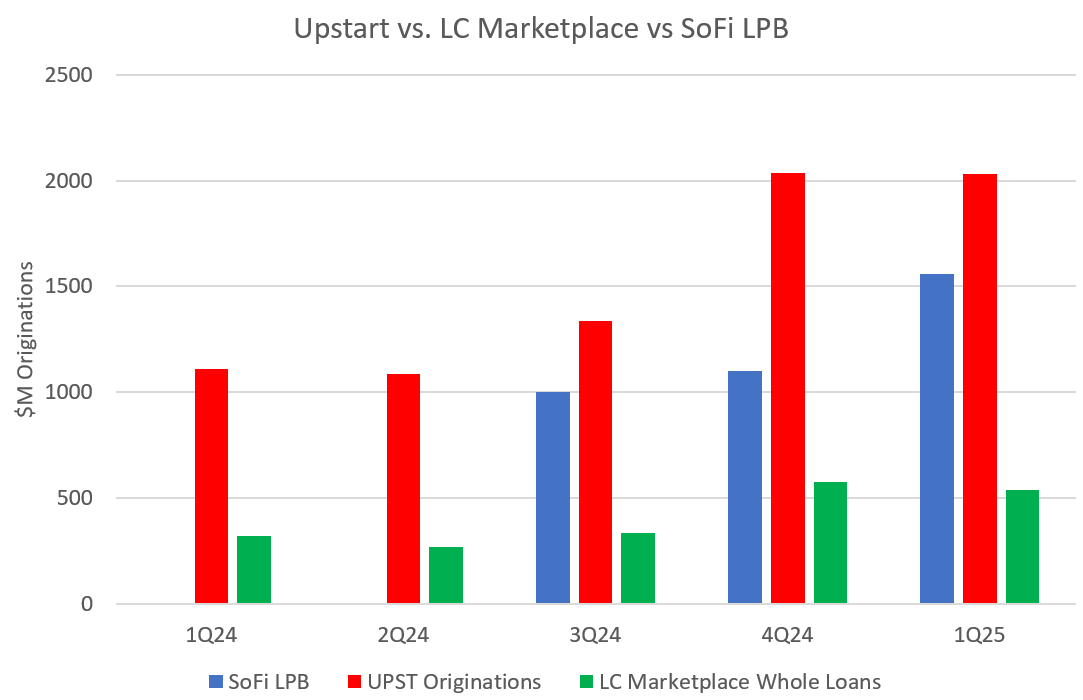

The LPB shares a lot of similarities with LendingClub’s marketplace business, and Upstart’s entire business. All those businesses do the marketing and underwriting and transfer the loans and risk almost immediately to a third party. Upstart has significant loss share agreements with their partners. SoFi has none at all. And look at how quickly SoFi’s LPB is growing relative to their competitors.

SoFi’s LPB didn’t exist until Q3 of 2024. In it’s debut quarter, it already had over 3x the originations as LC’s marketplace. By Q1 2025, in only its third quarter of existence, it already crossed $1.5B in originations. SoFi’s LPB is only originating loans in its existing credit box, but is looking to expand to other FICO ranges and to other loan types (student and home loans). SoFi built an entire Upstart inside its own business in less than a year.

This highlights something important to consider. When I initially was looking at SoFi and LC and Upstart, I thought a key differentiator was going to be the underwriting. It turns out that all three of these companies do a great job underwriting loans and get above-average returns for their credit boxes. However, it also turns out that underwriting is not the most important factor. The way it has played out is that building a sticky and trusted ecosystem, where you can cross-sell customers on other products and you get customers coming back for repeat business, is a much more important factor than underwriting. The hardest part about underwriting loans for these companies isn't the underwriting, it's finding potential customers at a reasonable cost. Lower customer acquisition cost (CAC) juices returns and volume much more than underwriting.

Think of it this way. On the margins, better underwriting in a normal environment can probably yield defaults that are lower than competitors by maybe 1%-2% in the prime plus category. Let’s look at the unit economics on each loan and see if lower defaults or lower CAC results in better returns. Here is what Anthony Noto said in Q1 2023 earnings about their profit per loan:

Let’s just say, over the course of the time, our average variable profit on a personal loan, and so that would be the revenue of that personal loan less the life‑of‑loan losses—the funding costs and variable operating costs and the customer acquisition cost—results in $800 of variable profit. That could have a customer acquisition cost of anywhere between $600 to $1,000.

If someone comes in through Relay, and they do credit score monitoring or they connect accounts or they're in checking or savings, and we see that they have a bunch of credit card debt and can benefit from consolidation, we would make a term‑loan offer to them or personal‑loan offer. If that person adopts that personal loan, the variable profit goes from $800 up by the savings on customer acquisition costs, so anywhere to $1,400 to $1,800.

SoFi’s average life of loan losses is 7%-8%. Lowering this down by 1%-2% would mean decreasing defaults to 5%-7%. That would increase total returns by around 10%-20%, from a variable profit of $800 to around $900-$960 per loan. Meanwhile, having a lower CAC increases the variable profit per loan to $1,400-$1,800. These aren’t mutually exclusive, and obviously the best option is to have both low CAC and better underwriting, but if you had to choose just one, you’d choose lower CAC every time.

This is why SoFi’s LPB will continue to win. It benefits from the financial services productivity loop, an advantage unique to SoFi among their competitors. They can drive volumes that the others cannot because they have an entire ecosystem of borrowers that they are constantly turning down for loans. They are beginning to monetize that group and their ability to monetize them will only increase as time goes on.

SoFi is Hitting the Bullseye on their Target

Let’s put this in perspective. SoFi has been a publicly traded company since Q2 2021. In that entire time, 15 full quarters, their cumulative brokerage revenue stands at $83.2M. The LPB has been in existence for a grand total of three quarters. The cumulative LPB revenue in those three quarters, not including servicing revenue, is $162.4M. Here is a graph of cumulative brokerage revenue compared with cumulative LPB revenue since SoFi has been a public company.

This isn’t a comparison. Level 1 options, fancy charts, and even crypto may add up to an extra $10M-$20M of revenue combined per quarter in the near future. Moreover, it would be competing head to head in a product category where SoFi has no leverageable competitive advantage. By way of contrast, there is no other company that is positioned to build and scale a lending platform business like SoFi. They have a unique and defensible competitive advantage here that they are using to build a billion-dollar business. There is no doubt; the return for investors from building the LPB is significantly higher than anything they could have achieved with SoFi Invest. SoFi is disrupting where THEY choose, not where we think they should, and the results speak for themselves. Judge them where they are focused and you’ll end up with a more accurate picture of the business than trying to prescribe to them what they should be doing.

Subscriber update

The DDI YouTube Channel is live. A sincere and heart-felt thank you to those who support my work. If you do want to support my work, there are several ways to do so. You can subscribe here on substack, or on X, or, now, on YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up for SoFi, or discounts on Tesla or finchat.io:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get up to $2500 off a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi and Robinhood.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Good write up but the company has just started churning profit and its business model is high risk and very susceptible to economic changes.

Their balance sheet has increased its exposure to consumer credit risk.

It’s an interesting company and something to keep in mind but I would much rather prefer reoccurring high revenue and high margin companies.