The Breakout Quarter: SoFi Cements Its Status in a Class of One

That was an absolutely incredible quarter. As CEO Anthony Noto said in 2023, SoFi is in a class of one. I’ll focus mainly on the fun charts and interesting tidbits, although we’ll cover key metrics like revenue, EBITDA, and EPS as well. In the earnings preview my big question was whether SoFi could achieve 40% YoY revenue growth. Let’s answer that question right off the bat, shall we?

Yes. And they didn’t just skate by; they delivered a whopping 43.8% YoY revenue growth. They haven’t had that kind of growth since Q4 2022. Back then their YoY absolute growth was $163.5M. This quarter that absolute revenue growth was $261.3M, which is by far their best absolute growth number (their previous best was Q1 at $190.1M). And it isn’t like this is just growth-at-all-costs type of performance either. EBITDA and net income margins hit new highs at 29.0% and 11.4%, respectively, and their incremental EBITDA margin, which they guided to 30% this year as they reinvest into the business, was actually 43%.

SoFi posted record growth and still managed to drop over 40 cents of every new dollar earned to the EBITDA line. I think the 30% long-term EBITDA margins they have guided for are actually a floor, and based on the actual results, long-term EBITDA margins will be much closer to 40%+ once they are fully optimized. That combination of growth and margins puts them in truly elite company, and the Rule of 40 proves it.

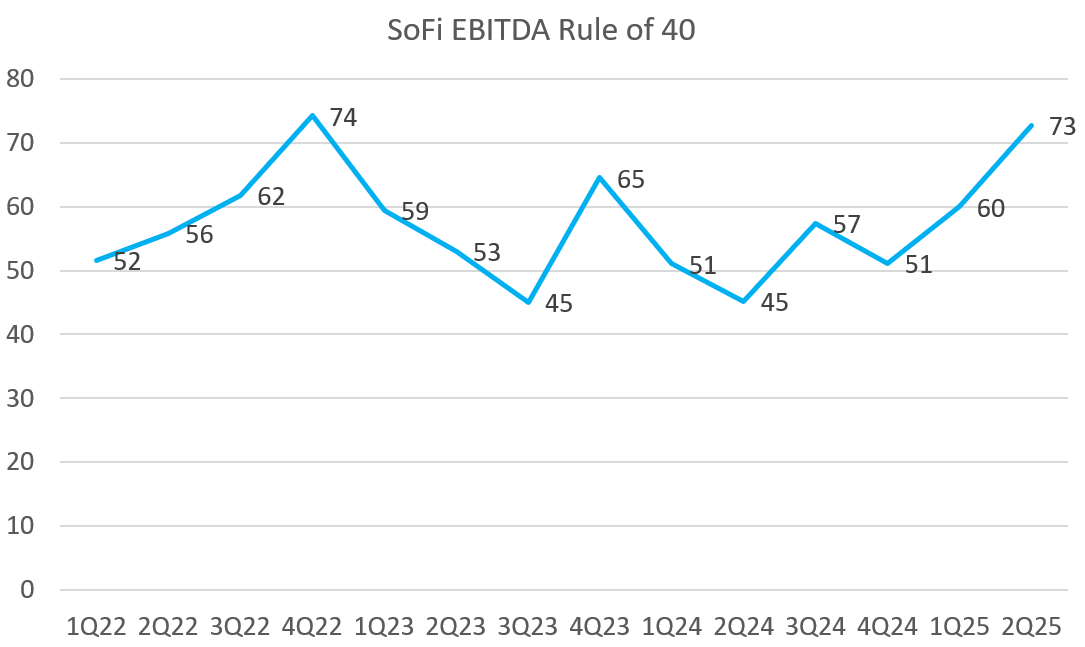

Rule of 40

For those who aren’t familiar, the Rule of 40 was popularized by Brad Feld, a venture capitalist. It’s a fairly simple rule of thumb that was used to evaluate worthwhile investments in the SaaS (software-as-a-service) industry. The concept is that if you add the company’s revenue growth rate to its profit margin, the sum of the two should be 40 or higher. This means that the company can be high growth and low profitability (e.g. 55% growth but -10% margins, for a rule of 40 score of 45), medium growth and medium profitability (30% growth and 15% margins for a rule of 40 score of 45), or low growth and high profitability (10% growth and 30% margins for a rule of 40 score of 40), and be considered a worthwhile investment in all cases.

The choice of profitability metric varies. Some use EBITDA, others operating income (or EBIT), and still others use free cash flow. EBITDA is probably most often used, but it’s certainly not universal. Since SoFi uses EBITDA and GAAP net income as their primary profitability metrics, we’ll use EBITDA. It also helps that virtually every tech company publishes their EBITDA, so it’s a good metric for comparing companies. SoFi’s Rule of 40 has been above 40 every quarter except one since going public. Here is their EBITDA Rule of 40 score for the last three-and-a-half years.

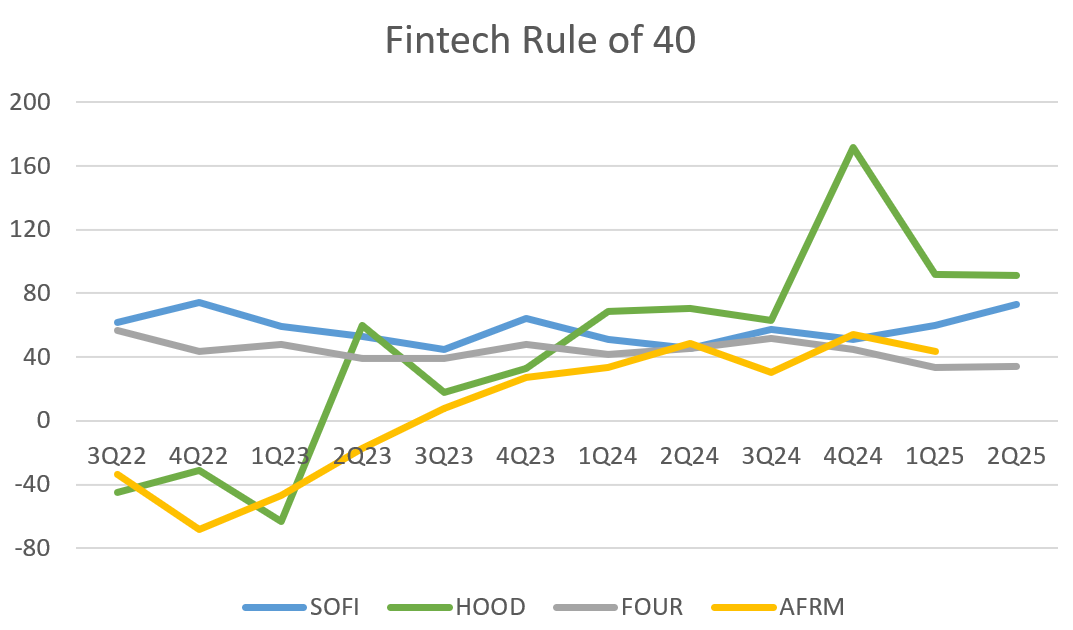

A Rule of 40 score of 45 or higher for the entire time period and of 73 in the recent quarter shows truly exceptional consistency and results. How exceptional? Let’s take a look at some of their best US fintech competition. These are companies that have, for the most part, been growing consistently throughout the last several years and are either profitable or very close to it. Here is SoFi’s rule of 40 (in blue) compared to Robinhood (green), Shift4 (gray), and Affirm (yellow). Affirm hasn't reported their earnings yet for this quarter.

Only Robinhood has managed to post a single quarter better than SoFi’s Q2 print. And Robinhood had an extremely rough 2022 and 2023, where they posted a rule of 40 score of -63 at the low in Q1 2023. It is easier to post growth after a period of contraction, which SoFi has never had. HOOD has had some monster quarters recently, but for sheer consistency, nothing beats SoFi’s performance. FOUR is the next closest, but has been under SoFi every quarter except Q2 2024, where they came in at 45.4 to SoFi’s 45.2. To my knowledge, no other US fintech that has had an IPO in the past 5 years has posted a Rule of 40 score above 40 every quarter since the beginning of 2022 except SoFi. That is incredible consistency and execution in any industry, but especially one that is supposedly rate-sensitive during a rate hike cycle. SoFi’s management still does not get enough credit for what they’ve accomplished.

Originations

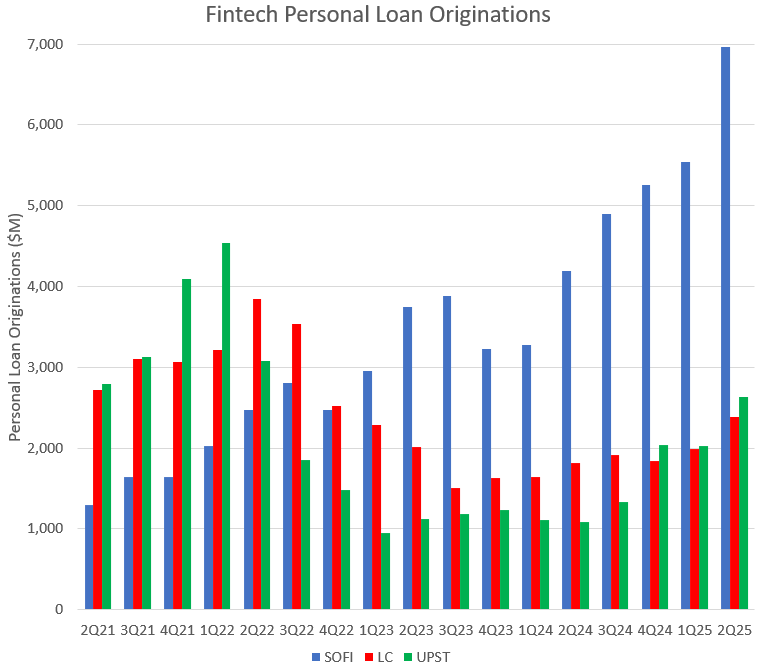

I thought that SoFi would have $5.8B in personal loan originations. They absolutely demolished my estimates and came in with a whopping $6.97B. They beat my estimate, which I considered fairly bullish, by almost $1.2B. Let’s look at their originations compared to other fintech lenders LendingClub and Upstart.

That graph is majestic. In four years, they went from less than half of Upstart’s and LendingClub’s origination levels to almost triple their competitors origination levels. SoFi now dominates the personal loan space, and they are expanding their credit box through the LPB. I’ll cover more about the LPB in a minute. They are maintaining about 60% market share between these three companies despite both LC and UPST putting up very good YoY growth numbers. It’s so impressive that SoFi not only became the dominant player as others weakened, but has maintained that dominance even as the macro has turned more favorable.

Revenue

Lending

Net interest income continued to grow and noninterest income reverted to a more typical number. While the $443.5M number was under the $457.5M I projected, it’s still great growth. We could see bigger jumps in future quarters as a result of the capital they just raised offsetting high-interest costs as they said, but I’ll save a deeper dive into that, and my full thoughts about the capital raise, for another article.

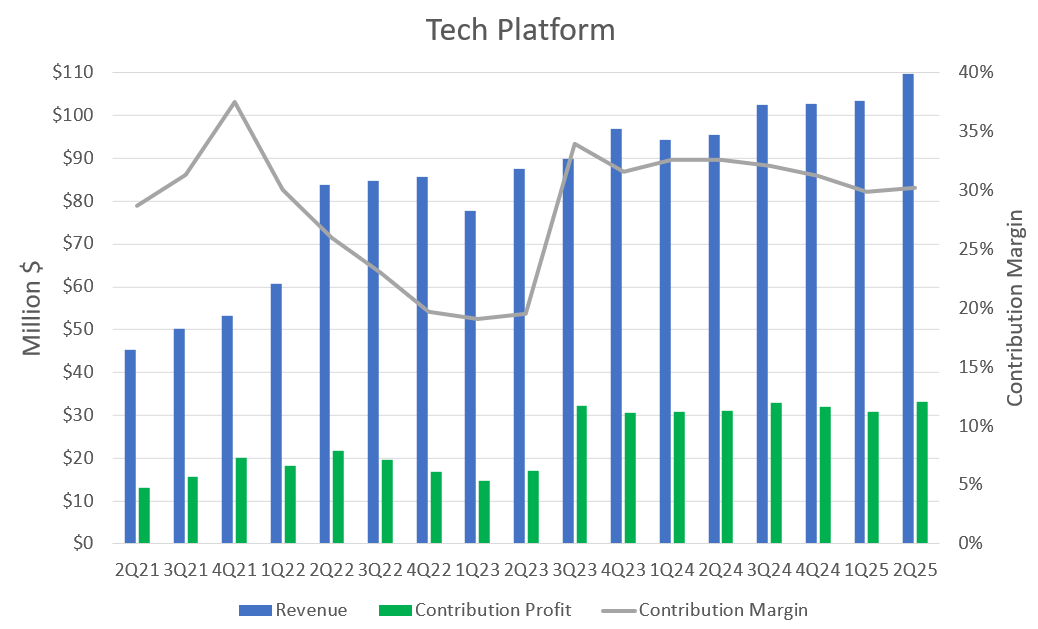

Tech Platform

Hey, a positive surprise here as Galileo actually grew this quarter and beat my expectations of $106M (which were more bullish than many others in the SoFi community) by putting up $109.8M in revenue. That’s 15.1% YoY growth, which is the second highest growth they have put up since lapping the Technisys acquisition bump in Q2 2023. It’s a respectable result. After Q2 of last year, I said that, “I will not be fully convinced [that Galileo is back to growth] until I see four straight quarters with 15%+ YoY growth.” They barely beat that threshold this quarter, and Q3 is a tougher comp for Galileo, so we’ll see if they get over that hurdle.

Encouragingly, the contribution margin, which had been under pressure and decreasing for a full year seems to have stabilized this quarter. I'll need to see that confirmed next quarter to know if has truly bottomed. In ancient history in March of 2023, at the KBW Fintech Payments conference, CFO Chris Lapointe said this about contribution margin for Galileo (emphasis added by me):

On the Tech Platform side of things, we've been operating in the low to mid-20s from a contribution margin perspective. Part of that is as a result of the Technisys acquisition. Pre-acquisition, we were operating in the low 30s. We've been investing pretty aggressively in the platform and the people to really build out a combined offering and scale that business. And as we start to get more and more scale in that business, we do expect to get that to a 40%+ long-term margin.

I don’t think they’ve spoken about long-term contribution margins since then, but it would be nice to see them move consistently toward that 40% target from here as growth appears to be returning. I do think they’ve invested heavily in engineering and product development, so that might be a margin headwind for a while, but it’s something to keep an eye on. I want to see the revenue growth outpace the directly attributable expense growth from here.

I also love the detail they provided on the benefits their new client, Banco Nacion of Argentina, is already seeing:

The implementation, which started with corporate banking, has already resulted in a 25% increase in organic client growth and reduced implementation time from months to just 4 business days. They've now positioned themselves to unify mobile and desktop banking systems for over 10 million consumer banking customers as well.

25% in organic client growth is a lot of growth, and reducing implementation times is an efficiency boost for any business.

Also, just something to point out. They started out with corporate banking and are now moving to consumer banking. One piece of low-hanging fruit that I think is ripe for SoFi to pluck is SMB banking accounts. Technisys obviously already has the infrastructure available if they are doing corporate banking on their core for Banco Nacion. Would love to see them roll out those corporate accounts sooner rather than later.

Financial Services

I’m not a fan of all caps, but there are certain times where they are acceptable…

ARE YOU KIDDING ME?!?!?

We all knew that financial services results were going to be good. Nobody thought they’d be this good. I said in my earnings preview that there could be fireworks in financial services if they expanded the credit box on the LPB or they added student loans and home loans to the mix. I didn’t build any of that into my predictions. We saw fireworks and my predictions were way off. I thought there’d be $322.6M in revenue and it came in at $362.5M. I have never been so far off on a revenue projection for any segment as I was for Financial Services this quarter. It blew my numbers completely out of the water. Let’s throw up some graphs. First, revenue by type:

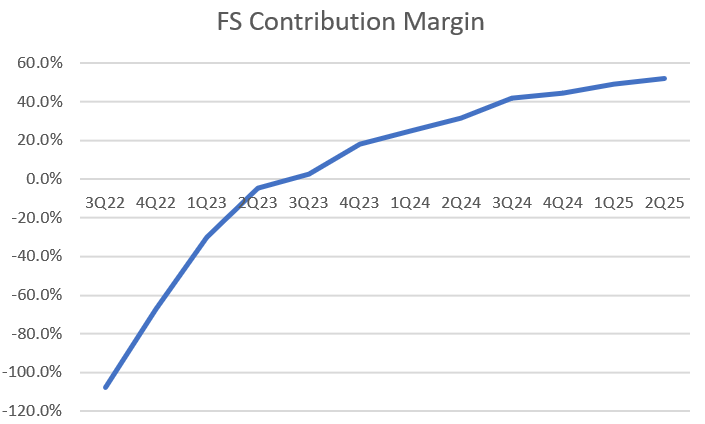

Noninterest income was up 358% YoY. 358%! And check out contribution margin:

It’s almost as high as lending and now comes in at 51.9%. Remember that KBW conference I mentioned above? Here is what Chris Lapointe said about Financial Services contribution margins in that conference:

Then on the Financial Services side of things, as I mentioned, we've been investing really aggressively. We were at a negative 100% contribution margin in that business. We've made progress every single quarter. We're on the precipice of getting to breakeven in that business, and we expect to get to a 20% to 30% contribution margin in the long-term.

From -107.5% contribution margin in Q3 2022 to 52% in Q2 of 2025 and way higher than the very top end of their long-term contribution margin guide from two years ago. Wow. Look at the return to growth in average Financial Services revenue per member. Where are the bears worrying about how SoFi is just pumping their member numbers with people who are checking their FICO scores and isn’t monetizing their members? In hibernation, that’s where.

Lending Platform Business

The driver, of course, is the lending platform business. The expansion of the credit box is super exciting for a number of reasons. Obviously it expands their revenue as they are able to offer their partners more loans. It also gives them data that they never had before in FICO bands that they’ve never lent to. They can also now convert people outside their own credit box (which, remember, has a hard cut off at a FICO of 660) into the SoFi ecosystem. They service all loans that come through the LPB, meaning that for all intents and purposes, it looks to the person who gets the loan like they are getting it from SoFi. They become a member, they login to SoFi to make their payments, and they enter the financial services productivity loop to be cross-sold into other products.

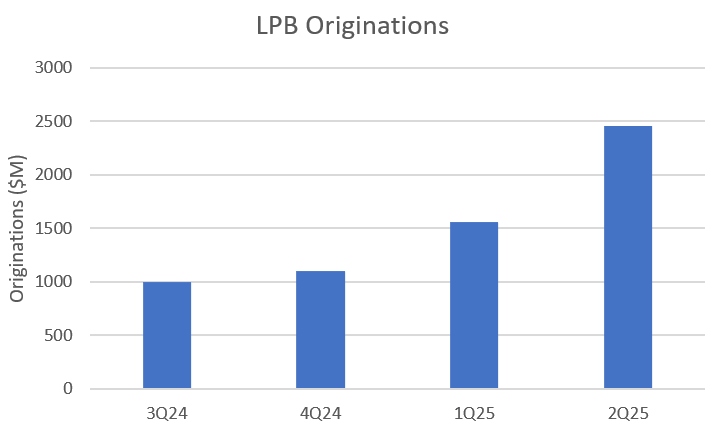

The QoQ growth in LPB volume is way higher than I anticipated, especially as there were no LPB agreements announced. SoFi had $1.56B in LPB volume in Q1 and then it rocketed to $2.45B in Q2. That is a 57% QoQ growth rate. We knew that this was going to be strong, but nobody expected it to be that strong.

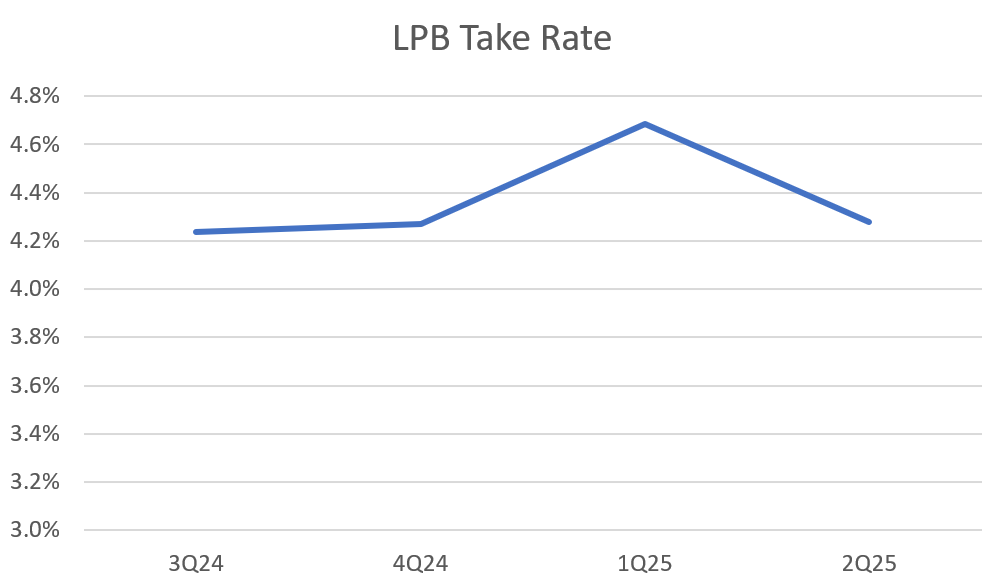

More on originations in a second. The LPB take rate normalized back down to 4.28%, which is very close to where it was in Q3 and Q4 of last year.

Now here is the craziest part of all. One year ago, this business did not exist. Now, just the LPB fees, not including the referrals (which are also growing because now they have more ad spend going towards finding people looking for loans) or servicing, is on an annualized run rate of $420M. If you include referrals and servicing, that number is $522M. They built a half-billion-dollar business from scratch in one year. This isn’t a product launch that could someday be a $100M business. It will be a billion-dollar business sooner rather than later.

One of the mic drop moments in the Q&A that I’m not sure many caught was Chris Lapointe saying, “What I would say is we aren't guiding specifically to LPB originations in the back half of this year, but we do expect continued growth in momentum in both Q3 and Q4.” More growth in Q3 and then more growth on top of that in Q4 is really exciting. And student loans and home loans are going to happen in the LPB. It’s a matter of when, not if.

Let’s put this into context for just a second. The vast majority of Upstart’s entire business does the exact same thing as SoFi’s LPB. Upstart was founded in 2012. They’ve been building this business for over a decade. SoFi has been at it one year. Here is SoFi’s LPB origination volume compared with Upstart’s total personal loan origination volume over the last five quarters (I’ve also included LendingClub’s Marketplace, which is a similar product for them, for reference).

SoFi has built an entire Upstart inside their own company in less than a year. They almost had more originations this quarter than Upstart did. SoFi’s loans have no loss share agreements nor co-funding agreements. Upstart’s have both. Upstart’s take rate also fell in Q2, a big reason for the drop in their stock price (though its take rate is still much higher than SoFi’s LPB). SoFi expanding their credit box is also slowly ratcheting up the competition with Upstart, who cater mostly to lower FICO borrowers. The overlap between their target audiences is still fairly minimal, but with SoFi going down the FICO chain and Upstart going up, the overlap is increasing each quarter. It will be very interesting to see how this develops over the next year. If SoFi’s LPB can overtake Upstart in volume, which looks very plausible from the graphs above, there might not be words to describe how bullish that would be.

Wallet Share and Spend

One of the bigger pieces of data that doesn’t affect revenue as much as some of the other things I’ve discussed, but is still hugely significant, is how much people are spending through SoFi. Debit cards are a huge source of interchange for SoFi and credit cards are a smaller contributor but growing more each quarter (more on this in a minute). In Q2 of last year, SoFi users spent $9B in annualized spend with SoFi debit cards, according to their earnings call. This year, including both debit and credit card, that number is up to $18B on an annualized basis. That is double the amount of spending.

This does lead to some extra revenue, as interchange revenue is up 83% YoY from $14.45M last year to $26.50M this year. The bigger deal to me though is that spend is up 100% while membership is up 34%. People complain about SoFi not publishing their monthly active users. This is as important a metric as you can imagine for how much people are using SoFi and engaging with it as their primary bank. Given that much growth, it’s reasonable to assume that new members are using SoFi as their primary bank more than existing members and SoFi Plus and other network effects are succeeding in getting existing members to also engage at a higher level. This is clear evidence of the flywheel they are building.

Credit Cards

SoFi’s credit card business has been a drag on their earnings as far as I can remember. The main problem is that they got their underwriting wrong and have been digging themselves out of that hole for several years. This has been their biggest operational mistake since I’ve been a shareholder, but they have really turned a corner.

Charge-offs peaked at a whopping 19.3% in Q1 of 2023 but have now come all the way down to 7.7%. Credit cards could easily be another billion dollar business, but they had to deal with these massive losses and get the underwriting correct first. It looks like they’ve done that and I expect that credit cards will be one of the sleeper best-growing portions of SoFi’s business in 2026. If you look at average credit card lending, you can see that it was basically flat for five straight quarters from Q4 2023 through Q4 2024 at around $270M. In Q1, it finally saw a little growth to $297M and then in Q2 it really accelerated to $342M. The ramp in growth is obvious, and the additional capital they just raised should allow them the flexibility they need to accelerate that ramp. I also think we’ll see some creative credit card products tied to secured credit and crypto in the next year or two from SoFi. This is one of their next growth S-curves in the making if they can keep defaults down as they lean back in.

Nitpicking

This was such an outstanding quarter that it was really difficult to find things not to like. However, there are two little things I want to mention to keep an eye on.

Student Loans

SoFi purchased another batch of older student loans at the end of Q1. They had a higher charge-off rate, so the student loan charge-off rate went up. They probably got a good deal on them, so I have no problem with that purchase. However, it has now been five straight quarters with no student loan sales at all. Student loans also have longer terms, so they don't pay down as quickly as personal loans. As a result, they are building up student loans on the balance sheet at almost the same rate as personal loans. Between Q3 2023 and Q2 2025, they added about $5B in student loans to the balance sheet and $5.4B in personal loans.

Student loan average weighted interest is only 5.93% compared to 13.09% for personal loans. My calculation for SoFi’s weighted average cost of capital is 3.49% in Q2. That means the net interest margin (NIM) for student loans is only 2.36%, compared to 9.52% for personal loans. So $1B of student loans on the balance sheet makes SoFi $23.6M in net interest income compared to $95.2M if they were using that space for personal loans instead. While student loan default rates are tiny, a 2.36% spread is quite small.

I don’t fully understand why they are carrying $10B of student loans on the balance sheet and not selling any. Home loans, which are secured by the home as collateral, had a NIM of 4.05% last quarter. SoFi sells all their home loans within 2-3 months of origination at a gain-on-sale margin (GOSM) of 1%-2%. Meanwhile, student loan fair values are 105.8% of principal, meaning they should be able to sell them for 5.8% GOSM. Why keep student loans, which generate lower NIM despite having a high GOSM, while selling home loans that have higher NIM and lower GOSM? I hope somebody asks them about this at some point, because it doesn’t make a lot of sense to me. I’m sure there is a strategy here, but I would like to know what it is.

During times of stress, it will be nice to have a ton of high-performing and very low-risk student loans on the balance sheet. They aren’t going to see the type of potential spikes in defaults that personal loans do. However, wouldn’t home loans accomplish the same goal, but with higher net interest income?

Cyclicality

This deserves a deeper dive but it is worth mentioning here. SoFi’s LPB is incredibly exciting. However, it introduces additional cyclicality into SoFi’s business. Demand for these types of credit products is cyclical and eventually we are going to hit a period where demand for loan assets dries up. At that point, SoFi is no longer completely the captain of its own ship. If Fortress, Blue Owl Capital, and other asset managers and banks all pull back at the same time, LPB volume, revenue, and profits will take a blow. This is what happened to Upstart starting in 2022 and continuing through 2023. They went from over $4.5B in originations to less than $1B in four quarters (you can scroll back up and see the origination graphs again for reference).

SoFi provides higher-quality borrowers to its partners that are more resilient throughout the cycle. That should shield them from the worst of the cyclicality, but make no mistake, when a risk-off period comes, SoFi will not be immune. The LPB is obviously worth it, but the downside is that SoFi becomes reliant on the decisions of companies outside their control. That’s the risk inherent in building the LPB and while it’s a small one for now, it’s worth pointing out during the rosy times so that investors aren't surprised down the road.

Profitability

Okay, enough with the cautionary tales and nitpicking. Let’s celebrate how SoFi blew my own projections and the projections of everyone else from Wall Street to YouTube and everywhere in between completely out of the water with their profitability for this quarter. I already covered how their incremental margins were way above expectations, but Noto explained why in the Q&A on the call and it was very insightful and crazy bullish.

So I think you're starting to recognize we clearly have a lot of operating leverage in the model and our margins could be well in excess of 30% on the EBITDA line. I've been a student of the evolution of direct-to-consumer technology companies starting back in 1999, and I think it's really critical that we invest for the future. We want to compound 25% revenue growth for decades, not just for a couple of years. So we don't want to underinvest in the business.

In the quarter, if we start to outperform relative to expectations on the revenue line, we're going to have a hard time spending that money back in the quarter. And so if you see us above the 30% incremental EBITDA margin in a quarter, it's because we outperformed relative to what we thought and we couldn't spend the money fast enough. But we are going to make sure that we keep putting $0.70 of every incremental revenue dollar back into the business. In terms of where we're spending it, the greatest increase in the spending in the back half of the year is in our engineering product and design areas.

There are a couple of important tidbits to pull from that quote. First, their margins were so high because they made so much money above their own expectations that they just can’t spend it fast enough. And keep in mind that this is a trend because incremental margins are consistently way above their 30% target. Every single quarter, they make more money than they know what to do with. Those are the kind of problems I love to see haunt the companies that I invest in.

Second, he said that they want to compound at 25% for decades. That is the very first time, to my memory, that he has put the number that high. He’s said 20% for decades before in another interview, but never 25% for decades. Just for reference, if you take today’s share price ($23.50), and you compound it at a 25% clip for the next 20 years, the share price would be $2038, a 480-bagger from its ATL of $4.24. I’d be ok with that.

Finally, engineering product and design teams is where they are spending the money. That's a welcome insight to those of us who are concerned that the product launch cadence has become too slow. Hopefully we see them ramp the speed of innovation and products back up to 2019-2021 levels.

EBITDA

The midpoint of SoFi’s adjusted EBITDA guidance was $205M (which matched analyst expectations of 205.7M). I expected to see $223.7M. SoFi posted a whopping $249M. They beat the midpoint of their guidance by $44M, which is their absolute highest beat ever. They have guided for their long-term EBITDA margins to be 30%. They aren’t even fully optimized for profitability, and yet their margins are already 29%.

Net Income and EPS

An EBITDA beat that large naturally led to a significant beat in net income and EPS. I thought they'd get $83.7M in net income, which translates to an EPS of $0.07. Analysts had them pegged at $0.06. They came in at $97.6M with an EPS of $0.084. The higher tax rate that they guided for did not materialize. Their tax rate was up to 13.3% this quarter from 10.9% last quarter, but still a far cry from the 26% they guided for. There was nothing of particular note in the GAAP reconciliations between adjusted EBITDA and GAAP net income.

What is surprising to me is that analyst estimates still seem very behind. They are still only expecting $0.31 for the full year, and we already have $0.14 in the first two quarters. That only leaves $0.17 for the rest of the year, which is very minimal growth. That just seems unrealistic.

Big picture thoughts

This was virtually a perfect quarter. The business is firing on all cylinders, management answered the questions well, the flywheel is really beginning to spin, there are new products and improvements on the horizon, and even the Technology Platform is showing signs of growth and improvement. The LPB has become a showpiece for the unique strengths that SoFi brings to the table, and the stock, which had been on an absolute tear going into earnings, has justified that move and is continuing its upward momentum. Continued growth and outsized returns for investors in the long run seem inevitable. I can't wait to see what they have in store for us next quarter.

DDI Predictions vs Reality

New Members: DDI Prediction - 835k (815k net new members with 20k churning off the platform)

Actual - 846k (830k net new members with 15k churn)

Personal Loan Originations: DDI Prediction - $5.8B

Actual - $7.0B

Student Loan Originations: DDI Prediction - $1.1B

Actual - $993k

Home Loan Originations: DDI Prediction - $550M

Actual - $799k

Lending Revenue: DDI Prediction - $457.5M

Actual - $446.8M

Financial Services Revenue: DDI Prediction - $322.6M

Actual - $362.5M

Tech Platform Revenue: DDI Prediction - $106M

Actual - $110M

Corporate Revenue: DDI Prediction - -$44M

Actual - -$61M

Adjusted Net Revenue: DDI Prediction - $842.1M

Actual - $858M

Adjusted EBITDA: DDI Prediction - $223.7M

Actual - $249.1M

Net Income: DDI Prediction - $83.7M

Actual - $97.6M

EPS: DDI Prediction - $0.072

Actual - $0.084

Subscriber update

The DDI YouTube Channel is live. Work has been extremely rough this year and demanded a lot more of my time. I’m going to get back to a more regular cadence of articles and YouTube videos as things should be settling down some in the coming months. If you want to support my work, you can subscribe here on substack, or on X, or, now, on YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up for SoFi, or discounts on Tesla or finchat.io:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get a discount on a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

That was just a helluva a good call on SOFI and the SOFI-AWS examination was invaluable to understanding the company. Again, great call.

Let’s Connect. I love your content.

The AI narrative is powerful, but I believe the real winners will be those who combine innovation with durable economics. I wrote about this in my recent review — showing how thesis-driven investing captured both AI and energy transitions. Happy to share here

https://open.substack.com/pub/thesisrationale/p/annual-investment-review-20242025?r=48cf8j&utm_medium=ios