The Crystal Ball Quarter: I Predicted (Almost) Everything Right in SoFi's Q3

I have never had a quarter where my predictions were so close to reality. With the exception of my prediction for new members, which we’ll discuss below, the difference between what I projected and what actually happened was extremely tight, especially when it comes to originations and revenue. I honestly doubt I’ll ever have another quarter as good as this one in the future again. I’ll use my predictions as a framework for the discussion and highlight any interesting things I see along the way.

Members

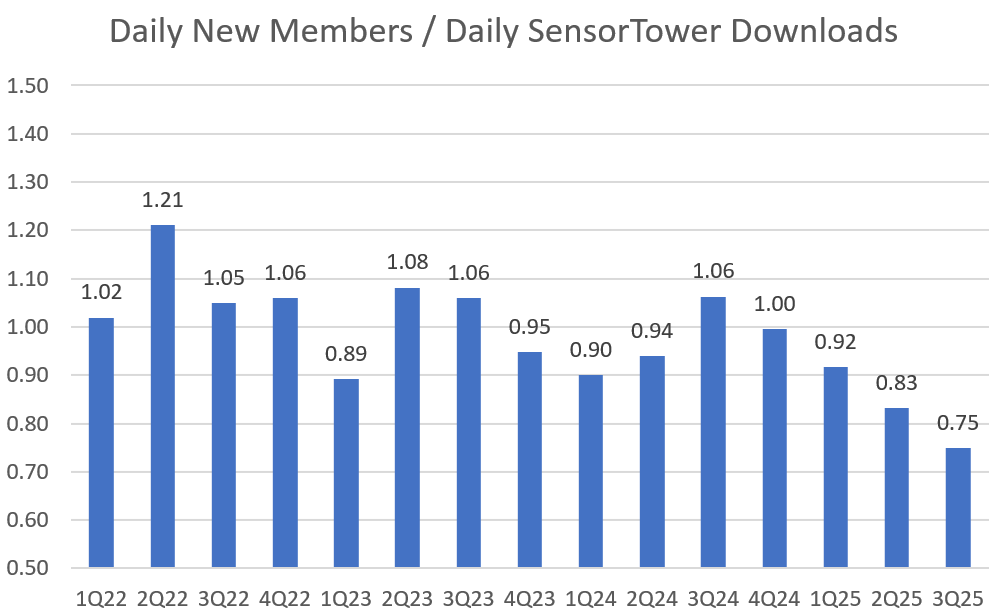

Alright, so my 1M new member prediction turned out to be way off. We’ll have to wait for Q4 for that one (hopefully). The SensorTower data led us astray this quarter. Previously, when you looked at the comparison of what SensorTower predicted for daily downloads and daily new members added, they tracked pretty well.

Before Q2 of this year, and with the exception of Q2 of 2022, which was very high, 0.9 was the lowest number of new members they got per downloads. Q2 of 2025 was also low, but based on the consistency of the data prior to that one data point, I felt it was likely that was an outlier. It now looks like something in SensorTower’s data has gone amiss, as this marks two quarters in a row that break the former trend. I thought the data was pretty definitive and we would get a 1M member quarter. I was wrong.

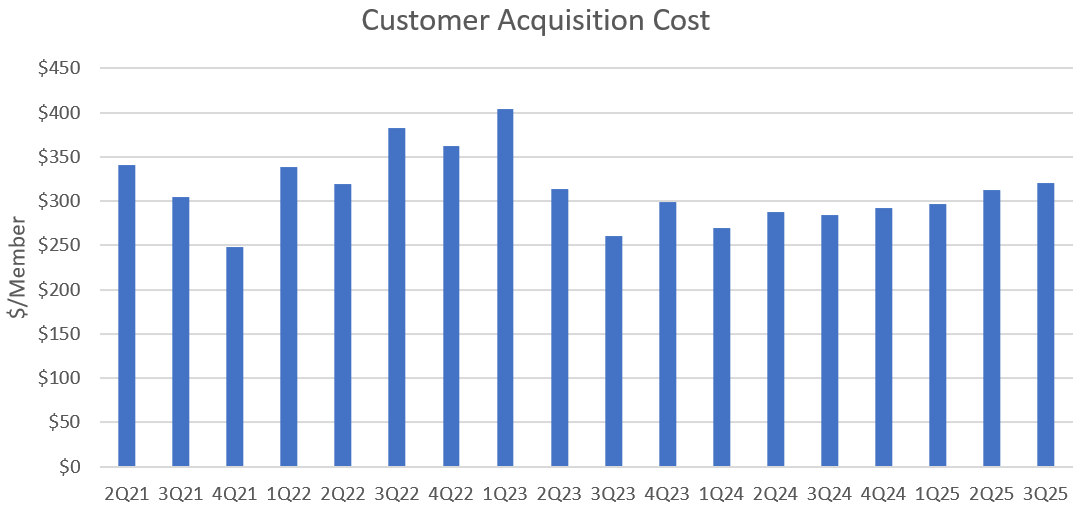

Regardless, 905k new members is still pretty incredible growth. They did spend slightly more per new member in sales and marketing than they have in the past, but each new member is also bringing in more revenue than they used to, so I’m ok with the extra customer acquisition cost. New members are the lifeblood of their growth. I’m ok with spending a little more to bring more growth.

The rest of my predictions were incredibly close

This is the part where I am going to gloat a little bit. I have never, ever, been so close in my predictions as I was this quarter. My new members prediction was the exception. For everything else, I was spot on. Here were the actuals compared with my predictions in parentheses:

Personal Loan Originations: $7.48B vs ($7.6B) ✅

Student Loan Originations: $1.49B vs ($1.55B) ✅

Home Loan Originations: $945M vs ($950M) ✅

Lending Revenue: $481M vs ($485M) ✅

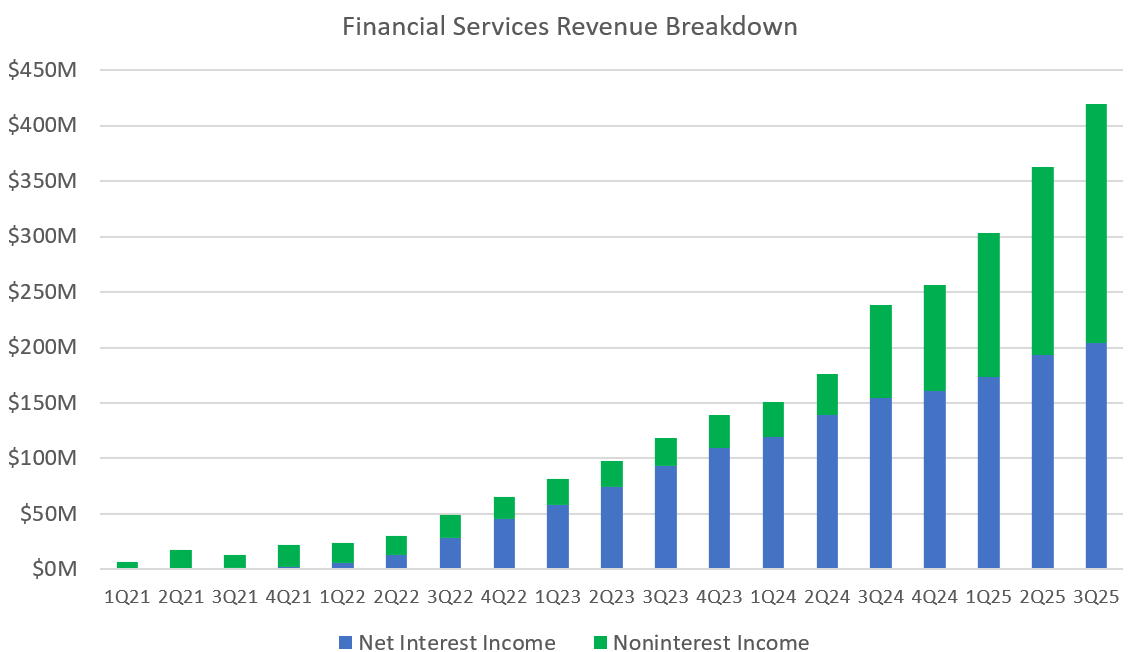

Financial Services Revenue: $419M vs ($414M) ✅

Tech Platform Revenue: $115M vs ($116M) ✅

Corporate Revenue: -$66M vs (-$65M) ✅

Adjusted Net Revenue: $950M vs ($950M) ✅

Adjusted EBITDA: $277M vs ($294.2M) ✅

Net Income: $139.4M vs ($135.8M) ✅

EPS: $0.11 vs ($0.11) ✅

Really proud of the accuracy here.

Originations

Personal Loans

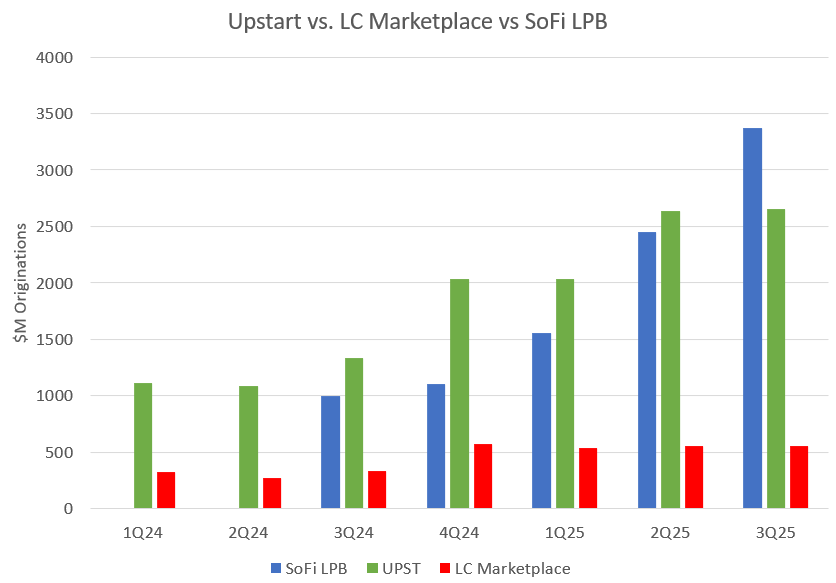

SoFi just continues to absolutely own the personal loan market. In the last year, originations have grown by $2.6B. To put that in perspective, LendingClub, one of their competitors, just did $2.6B total in all of Q3. The Loan Platform Business alone did $3.37B in originations. That’s more than either LendingClub or Upstart did in Q3. The business that SoFi just started in Q3 of last year is already doing more quarterly originations than either of their top fintech personal loan competitors. SoFi has become the lending demand aggregator by building an ecosystem that invites high-quality borrowers in and then gives them better services than competitors.

One other interesting thing to consider is that several years ago, when I was having lots of back and forth with bears, one of their key arguments was that personal loans are a commodity. In a commoditized market, they said, there will be no clear winner. My argument at the time was that SoFi would be the winner because their tech allows them to be the low-cost provider and therefore offer better rates. Moreover, the stickiness of their ecosystem drives more repeat business. I would love to know what the breakdown is on SoFi’s repeat customers in personal loans vs new customers. We know that LendingClub’s was about 50/50 this quarter, and we know that SoFi’s member base has been increasing exponentially. SoFi is absolutely destroying the competition in this commoditized market.

SoFi is absolutely dominating this vertical.

Student and Home Loans

Student loans got the Q3 boost we expected. Home loans are being helped by lowering rates. These will continue to be an undervalued source of growth until the moment that they start entering into LPB deals. At that point, everyone will start talking about them.

Revenue

Lending

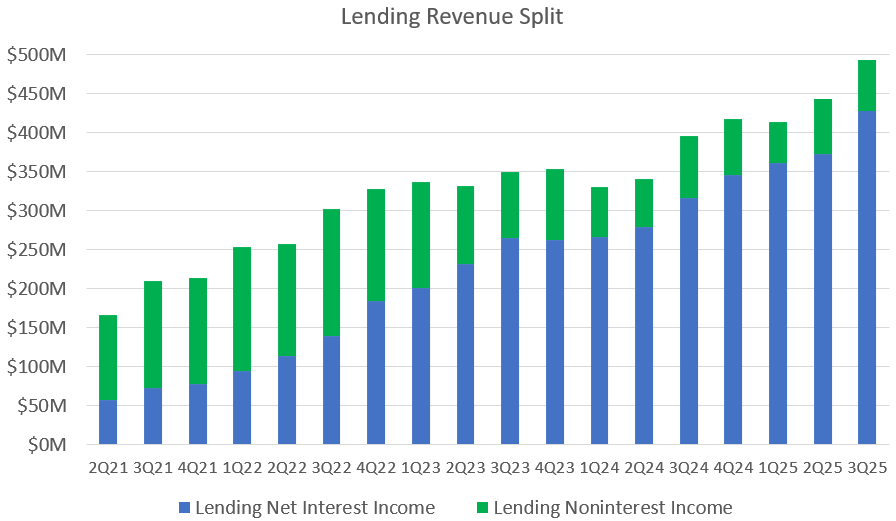

We already covered originations, which were really good, and so lending revenue was likewise very good. Net interest income made a big jump as expected due to lower cost of capital from the capital raise.

Rates coming down will continue to be a tailwind. The noninterest income will continue to fluctuate from quarter to quarter, but it is an ever-smaller percentage of the total segment revenue, so that volatility matters less each new quarter. Sustained consistent secular growth looks like it will continue unabated as they slowly deploy the extra capital they raised in the quarter over the next year or two.

Financial Services

This segment is just plain nuts. Everything about it is outstanding. Let’s talk overall revenue, then LPB, then credit cards, and then potential future continued growth. I could go on and on here, but I’ll try to make it succinct.

For the first time basically since they got the bank charter, noninterest income in financial services was greater than net interest income. Net interest income growth on its own is already excellent, increasing 32% Y/Y. The noninterest income is finally lapping the first quarter of LPB from last year. The growth rate was nevertheless 157% Y/Y. If anybody would have told me this was feasible in Q2 of last year, I would have had a very difficult time believing them. All that noninterest income is fee-based, high margin, and carries no default risk. That’s a beautiful thing.

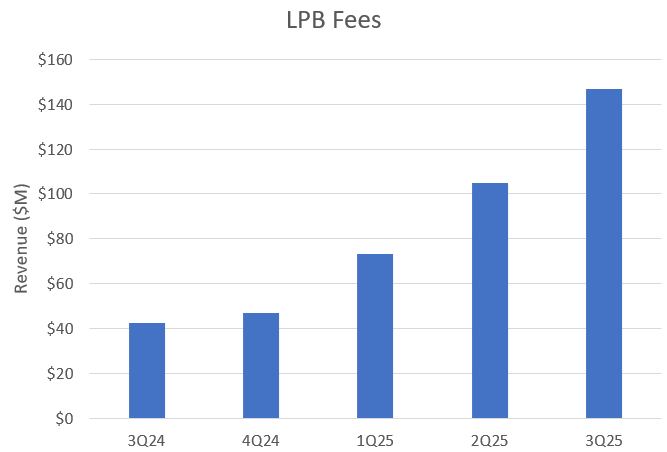

Loan Platform Business

As has been the case since the release of the LPB, it’s the star again this quarter. I already showed the graph of how it’s already ahead on origination volume compared to Upstart and LendingClub’s marketplace. The Q/Q increase on LPB originations was $920M. What’s more, we already know it is continuing to accelerate into Q4. How do we know? Management told us during the Q&A:

Kyle Peterson: “Was the strength this quarter broad-based in terms of you guys adding participants on the platform on the funding side, or was it fairly concentrated with existing partners?

Chris Lapointe: “Thanks, Kyle. We saw growth across both new partners as well as existing partners who have partnerships with us. What we actually saw is a bit of a flight to quality where a number of existing partners came to us and asked to upsize their commitments not only in Q3, but Q4. We expect continued momentum to occur in the last quarter of the year. We also saw some growth in new partners as well as expanding credit. Net-net, it was growth across the board.

Just how much growth we will see is anyone’s guess, but the flight to quality appears to be real based on how the LPB is growing faster than Upstart’s business.

LPB fees continue to follow originations. Capital-light risk-free revenue is something Wall Street loves to see. I think there is huge upside long term from expanding this to other loan types, and it’s only a matter of time until that comes to fruition.

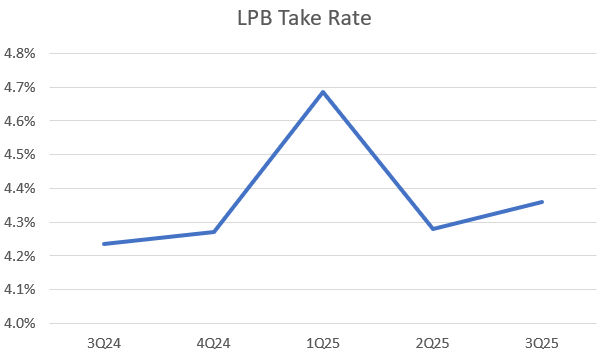

I don’t know exactly why the take rate expanded in Q1 only to contract again in Q2. Nevertheless, the trend here with that one outlier quarter is that the take rate is slowly ticking up over time. That means the new partners, the existing partners who are increasing their deal size, or both, are also buying them at higher prices, another indication of excellent demand for this product. This is also a product that SoFi is very uniquely positioned to offer. There is not another fintech on the market that could build this business. They have the member base to drive the volume, the underwriting capabilities, the marketing channels, and a uniquely growing cohort of high-FICO borrowers. This business is extremely difficult for anyone else to replicate.

Credit Cards

I want to discuss three quick points on credit cards. First, the new SoFi Smart Card sounds really unique as well, and should come with some excellent benefits as well as novel funding dynamics. I’ll withhold complete judgement until we see the release, but if they are targeting young high earners, a secured card like this sounds like it will be really differentiated for Gen Z, who hate traditional credit cards. I’m excited to see what it looks like.

Second, they are really starting to ramp their credit card offering. Here are average credit card loans outstanding.

The ramp is really beginning. The new smart card should see this further increase as well. Credit cards are very good business for most banks, so this is an area that should lead to another S-curve of growth in 2026 and beyond.

Third, and best of all, ridiculously high net charge-offs seem to be a thing of the past.

SoFi just had their second lowest net charge-off rate ever at 6.6%. The consistent downward trend is so encouraging after the massive problems they had in 2022 and 2023. If they continue to scale this and bring NCOs down, financial services has yet another growth vector ahead of it.

Tech Platform

The slow improvement continues as accounts continue to grow. A lot of this is certainly driven by intercompany revenue, but there are a lot of green shoots for external deals as well. Wyndham hotels, Southwest Airlines, United Airlines, and T-Mobile have decided on Galileo to run their debit card programs. Contribution margin shrank this quarter, and Y/Y growth sank down to 12%. I’ve said it before and I’ll say it again. I won’t start to get excited until they put up at least two straight quarters of 15% Y/Y revenue growth.

Galileo is still the engine that allows them to iterate and improve SoFi. The pace of new product acceleration is a direct result of SoFi moving over to the Galileo core, which is either complete now or very close to it. That juices the margins in the other two segments and gives them the speed to implement their strategy to iterate, learn, and innovate. Without owning the underlying tech, they wouldn’t be able to accomplish what they do. I want to see this grow as much as anyone, but I’m also comfortable knowing that as long as it is allowing the business as a whole to achieve elevated growth rates, that’s good enough.

Corporate

Corporate revenue continues to be an enigma. I wish they would provide guidance so that I could know what to put into my projections. I was dead on in my estimate, but that estimate was mostly a guess derived from looking at the trend in the data. A little clarity here would help a lot.

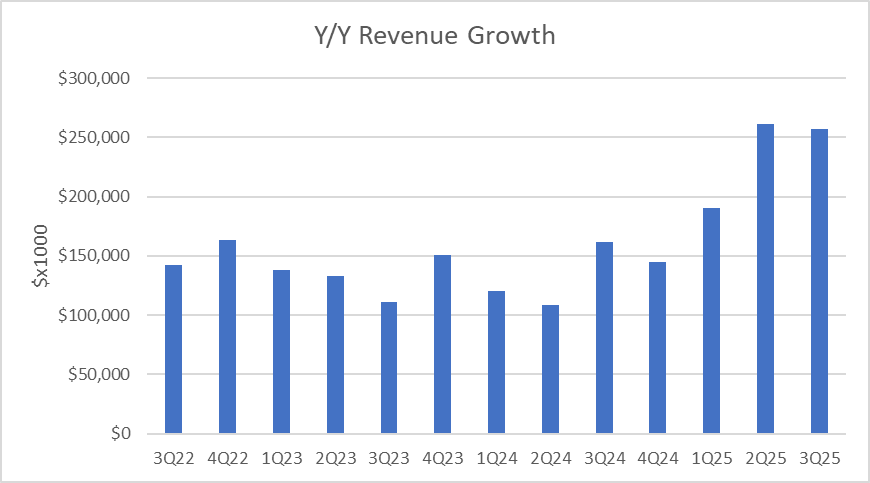

Total Adjusted Net Revenue

I projected $950M and SoFi came in at $949.63M. It doesn’t get much closer than that. I should probably just retire and never make projections again because I doubt I’ll ever do better than this quarter. 37.1% Y/Y growth on what was an excellent Q3 last year is stellar. They once again beat even the high estimate on Wall Street, which was $935M.

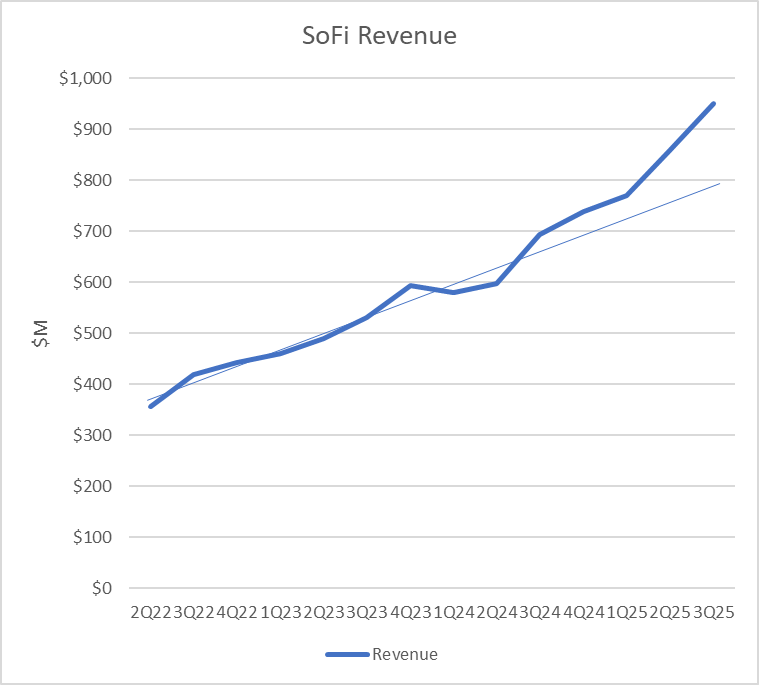

In July, before SoFi reported Q2 earnings, I said it was time for revenue and profits to go from linear growth to exponential growth. In Q2 and Q3, it’s gone exponential. The easiest way to visualize this is by looking at Y/Y growth . If the quarterly growth numbers are flat, that’s linear growth; if the numbers are increasing, that is exponential growth. Y/Y revenue growth was basically between $100M and $150M every quarter for several years. In the last two quarters, it was above $250M. This looks like exponential growth is beginning.

You can also see it by drawing a straight line through the quarterly revenue trend through 2024. You’ll notice that the recent revenue trend is now significantly above the straight line.

Adjusted EBITDA

I didn’t hit this exactly on the head, but I was still very close. They put up $277M and I projected $294M. They reinvested more into the business than I thought they would, which I am also completely fine with. It still beat the highest estimate again on Wall Street, which was $261.6M. You can also see that this is trending toward exponential growth as well.

The data is noisier, but Y/Y EBITDA averaged around $50-$60M per quarter (the spike in Q4 2023, which was helped by one-time line items, was offset by small growth in Q4 2024). The last two quarters were the first two in a row above $90M in growth. And this Q3 was actually against a very hard comp from last year.

Net Income and EPS

Net income of $139.4M with an EPS of $0.11. This did not quite beat the high estimate on Wall Street of $0.12, but it was still a great beat. Nothing too out of the ordinary to report on here, just continued compounding.

Guidance

I thought they’d raise revenue guidance to a minimum of $3,500M, adjusted EBITDA to $1,020M and EPS to $0.37. Actual updated guidance was $3,540, adjusted EBITDA was raised to $1.035M, and EPS was raised to $0.37. Not only did I get the quarter right, I even got the guidance extremely close as well.

Other Thoughts

Focus shifting to cross sell

I think one of the key shifts in SoFi’s progression that is taking place is the focus on building out the ecosystem to be even more comprehensive. They’ve always said that they want each product to be best in class and also for all the products to be better together. I think that “better together” is the piece that is finally starting to get some attention.

The emphasis on SoFi Plus is the first step. SoFi Plus is meant to give you extra benefits across most of their financial and lending products, which should encourage each member to cross sell into more products. They highlighted the partnership with Josh Allen on the call, and they explicitly stated that they will be increasing their investment into SoFi Plus. They also highlighted the Smart Card as another thing they are going to be adding into SoFi Plus as well.

The next step is their foray into consumer-facing AI integrations in the app. This includes the already-existing Cash Coach and what I think will be a much more upgraded version of it that they are just calling “Coach” that is to be released in 2026. They mentioned it on the earnings call, but he went more in depth in the KBW fintech conference this week. This quote is a bit long, but it’s totally worth the read to catch the vision.

Cash Coach is giving you options to optimize your cash. There is something that we have not launched that we are working on right now called Coach.[…] Coach is really meant to be like the equivalent of a ChatGPT for you at SoFi. For example, my credit card was run up to $6,000. I had just paid it off about eight days ago. I am like, I did not spend $6,000 on anything. I went in and clicked on Coach. I said, please give me a list of every transaction that has happened on my SoFi Credit Card since I paid the bill off X days ago. Ten seconds, it has every transaction. Please aggregate them by merchant. All of a sudden, I’m like, holy cow, my family’s spending a lot of money at DoorDash and on Uber and a lot of money on Apple. We have four Netflix accounts. We’re the only family in the country that’s actually paying for multiple Netflix accounts.

You can ask it other things. How do I improve my credit score? How do I lower my cost of debt? Can I refinance my mortgage? Am I diversified enough? How may I change my risk profile? That is something that will come out later. It will be something that’s unique to SoFi because we have all this data on you, but we also have all this data on other people. We can train models based on that data.

Being a one-stop shop all of a sudden becomes a differentiator on usable data to help you get your money right. In the end, we want that product to proactively answer for you the three questions every day.

If they get this right, it will be an extremely powerful tool for cross sell. It will also be a very differentiated tool that I do not believe exists at any other financial institution or bank, that will speak to their digitally native clientele, and that is very likely to drive amazing word-of-mouth advertising. Cross sell is a huge opportunity for them to increase their average revenue per member. Anthony Noto in the past has said, “My hope is that our products per member at that point are on average at three, which means our most heavy loyal people are at five or six and our least loyal are at one or two.” Right now they are very far away from that goal, and the average number of products per member only just recently bottomed and started to go up. I think Coach is the key to really build this metric.

Products per member went up initially after IPO and then dropped precipitously when crypto rolled off the platform in Q4 2023 and Q1 2024. It’s been basically flat since then but ticked up slightly in Q3. The recent improvements to Invest, crypto launch, SoFi Pay, rollout of Cash Coach and Coach, and especially the perks from SoFi Plus should hopefully help drive this key metric up. This is something I’ll be tracking closely into the future.

Flight to Quality

I’m going to zoom out for a minute. When Anthony Noto came on as CEO in 2018, he told the board that not only would they not meet their student loan origination growth expectations, but that there would be an intentional decrease in originations. He set out, instead, to rebuild the business from the ground up with a relentless focus on building durable revenue and profit streams that would be consistent throughout the economic cycle. The focus shifted from quick profits and high immediate growth to high-earners and borrowers with consistent cash flow. The ecosystem was built out to be able to support those people through their long-term journey to wealth creation and meeting them where they were and helping them to achieve their financial goals.

We’ve all heard the 3-5 minute Noto pitch so often that most long-term investors can quote it. “One-stop shop for all our members’ financial needs,” “be there for every big financial decision and all the days in between,” “help them spend less than they earn and invest the rest,” “get your money right,” etc. At times these just seem like platitudes. I hear them at the beginning of a CNBC interview or investor conference and think “c’mon, we’ve heard this before, let’s get to the other stuff.” But I don’t think those are just words to Noto. They represent the vision that he created when he took over. That is his north star.

The results they are seeing right now are the fruits of those long years of labor. They could have increased originations in 2021 when rates were low, liquidity was high, and money was essentially free like LC and Upstart only for those numbers to crash afterward. They could have circumvented the years-long arduous process of becoming a chartered bank. There were many times they could have sacrificed durability to pull growth forward.

Instead, Noto and team built a product, team, and business that was focused on creating long-term value, building a trusted relationship with their members, and results that would be durable, consistent, and resilient. The unrelenting demand they are seeing through the LPB from asset managers, hedge funds, banks, sovereign wealth funds, and insurance agencies is a direct result of that long-term focus on quality. The phrase “flight to quality” was used five different times. The origination numbers I put above are significant data to back up that claim. SoFi’s years of building things the right way is now yielding differentiated results.

Conclusion

Another fantastic quarter for SoFi is in the books. The beat-and-raise nature of this business continues to show itself time and time again. There are a lot of catalysts coming. A slow drop of rates is ideal for their business, QT is coming to an end, S&P 500 inclusion appears inevitable and seems very likely to materialize in the next 12 months, and they have the cash flow to reinvest into the business. This is becoming such an easy company to hold for me now. Can’t wait to continue to see what the future holds.

I have been following your blog from quite some time since stock was around 6, but i was too worried that it would be always be looked at as a bank. Finally I gave in at 14$ and bought a bunch of stock. Very happy with the results. 2 questions for you.

1. What is your eta for stock price in 1 year, 2 years, 5 years ?

2. What are some of the other stocks that you have analyzed deeply as this and have a good conviction about.

I apologize i am trying to ride your coattails, I am not as smart as you.

You are a very smart fellow and you do your homework. No crystal ball just damn good research! I invested in Sofi around $6.70, and you had a lot to do with that. You showed major conviction, and had the research to back it up, so I bought 10,000 shares. Glad I did!