What do LendingClub's earnings mean for SoFi

SoFi's current revenue and profits, for now, are most tied to their lending segment. LendingClub (LC) is the company that most closely resembles SoFi's lending business. They reported earnings today and while there are key differences between the companies, there is a lot we can learn from LC’s earnings that can be applied to SoFi.

First, we’ll discuss the key differences between the businesses to give context for interpreting the results. SoFi makes money on their loans in two ways. They hold the loans on their balance sheet for a while, collect interest, and then sell them. I like to think of SoFi's use of their balance sheet similar to a spring. As SoFi originate loans, it compresses the spring. Selling the loans releases some of that pressure and allows the spring to decompress. SoFi can only pack so many loans onto the balance sheet before the spring is fully compressed and has no more room to give.

LC targets near-prime, prime, and prime plus customers who are serial users of credit. Their model is slightly different. Their originations fall in two buckets. The first is their own balance sheet. LC, as a bank, takes a portion of their loans and put them in their "Loans Held for Investment" (HFI) portfolio. These are loans that LC intends to hold on their books through maturity. The remaining portion of the loans are sold on what they refer to as their Marketplace, which is comprised of other banks and capital markets (like hedge funds, pensions plans and other bond investors).

Important takeaways from LC earnings

Originations are continuing to come down for LC. More specifically, they are dropping in their market place (see table below). Originations that are held for investment in their own bank have averaged right around $1B consistently. This is the source of finding that is 100% under LC's control. Marketplace originations peaked in 2Q22 at $2.8B and have dropped by about $500M/we're ever since.

Their commentary on the call reinforced that the banking crisis had caused marketplace volume to remain low for the foreseeable future.

Read Across to SoFi

Remember that compressed spring? SoFi sells their loans into the same markets that LC does. If they cannot offload loans, the most likely course of action is to pull back on originations. Before becoming a bank, SoFi would only hold loans on their books for about 3 months before selling them because they had less access to capital, so they had to cycle their balance sheet more often. After becoming a bank, they guided for extending that holding period to 6-7 months. Enough time has passed that they should be selling significant amounts of loans. If they cannot do that, it means that to keep origination loans, they have to push harder on a spring that is already compressed. Doing that carries risk.

Mitigating circumstances in SoFi's favor

There are a few things that make SoFi's loans easier to sell:

Borrower Quality

LC keeps the high quality loans (think >720 FICO) for themselves and sells the lower quality loans to investors (<720 FICO) to the marketplace. SoFi's borrowers are, on average, more affluent and have higher FICO scores than LC's borrowers (average FICO of ) and the loans it's selling are that sale quality. In the current environment, where bank and non-bank buyers alike are tightening credit, this is an even bigger differentiator than usual.

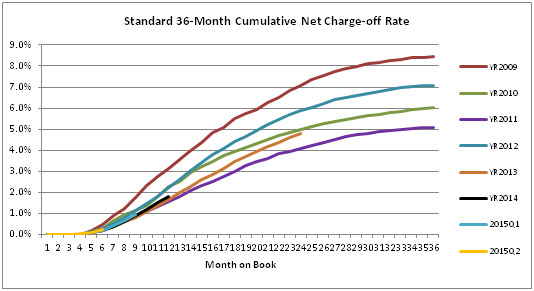

Seasoned loans

The loans that SoFi is selling are partially seasoned, meaning that some borrowers have already gone into default during the time period that SoFi has held them. While 6 months doesn't seem like much, charge off curves like the one you see above follow a well-established trajectory. Having 6 months of data is enough time for the loan vintage to begin to establish the shape of it's curve. That much data leads to significantly more accurate predictions about what loan buyers are purchasing, decreasing risk.

Hedging program

SoFi’s loans are hedged, meaning that they’ve been able to already collect non-interest revenue on them through credit rate swaps as rates have increased. I’ll write a better explanation about this sometime in a separate post, but this means that they can maintain their gain-on-sale margin even at lower market prices because they’ve already been able to collect non-interest income on the loan from the swap.

SoFi’s pricing leads the Fed, it doesn’t lag it like LC

From their call last night, LC reiterated that their pricing lags the Fed. That means the Fed moves their rates, then credit cards move their rates, and finally LC moves their rates. They gave a specific example previously in their 3Q22 earnings call when they said that “At this point, the Fed has moved 300. Credit cards have moved roughly 250, we've moved, as of today, roughly 200. So this is proceeding as we had indicated we thought it would.” That squeezes LC’s margins and makes their loans less valuable to sell because the net interest margin is being squeezed.

SoFi has actually been leading the Fed. They’ve raised their rates on their personal loans faster than the Fed has raised the Fed Funds rate. Frontrunning the Fed means that their loans will sell at a premium compared to LC loans.

SoFi Is Pulling Back on Originations

Here are Noto's comments on tightening lending standards from March 21 at the Bank of America Conference.

So within the confines of being able to deliver our plan, we’ve been able to tighten credit, not just this quarter but over the last year as we’ve seen different activity in different credit tiers and different pricing tiers. So we are in an environment where we’ve reduced things that we’re underwriting and finding opportunities in other areas where other people have walked away that are really attractive to us.

So, like I said, we feel good about our guidance, but we are in an environment where we’re looking at normalization of credit and we’re going to be vigilant and make sure we keep our life-of-loan losses at the 7% targeted level.

That is as close to saying out loud that they are pulling back on originations. Tightening credit is bank speak for moving to higher FICO scores and lower originations.

Conclusion

LC’s earning highlight a risk for SoFi, which is that the macro environment they are current in will make it hard for them to cycle their balance sheet because loan demand is weak. SoFi can still beat and raise with lower originations for other reasons that I hope I’ll be able to write about later today. I expect a double beat, and I think guidance will either be reiterated or raised slightly.

And actually, I’m ok with them pulling back on originations for now. Remember that pushing too hard on that spring comes with consequences. It makes it so that they have less flexibility in the future. They can originate more, but it would come with opportunity costs. Those include liquidity for M&A (which we know they took advantage of for the Wyndham merger), room to absorb student loans coming back, and expansion of other lending products like credit cards.