What Do Rate Cuts Do for SoFi?

The Fed just cut rates by 50 basis points and the median projection is another 25 bps in the next two meetings, for a full 1% cut before the end of the year. What will that do for SoFi’s business? The biggest changes to what rate cuts do for SoFi is in the lending segment, I’ll try to be brief, but the takeaway is that everything gets better and easier as rates come down as long as they come down relatively slowly. That will be the case as long as the economy doesn’t break or unemployment does not increase rapidly, which are kind of two sides to the same coin.

One of the reasons that SoFi investors want rates to taper off at a reasonable pace is because SoFi, for the most part, does not charge fees on their loans. That means there is very little friction to refinancing and if rates go down too quickly, a lot of people will refinance existing loans with new ones. That’s fine for the most part, but if it happens rapidly, it will increase prepayment rates, which hurts the fair values of their loans, and it will decrease the net interest margin they are getting on their loans. This is not a big problem as long as SoFi is the company they are choosing to refinance with, but nevertheless, the optimal path is still the goldilocks one where rates come down slowly over time. Rates coming down slowly also means we aren’t in a recession, which is also obviously positive for all equities, and that unemployment stays at a normal rate, which means people are paying back their loans.

Personal Loans

Some argue that decreasing rates is bad for the personal loan business. I disagree. A lot of personal loans are consolidation of worse debt with worse interest rates, like credit card debt. The logic is that because credit card rates fall with falling rates, people have less incentive to refinance. While that is true generally, the gap between personal loan APR and credit card APR is still so massive, and will continue to be massive even as rates decline, that demand should still persist. Average SoFi personal loan rates are currently at 13.26%. The average credit card interest rates according to FRED are at 22.76% right now. That is a big spread and I have a hard time believing that banks are in a big hurry to give up the extra margin they’ve gained over the past several years.

Just as important for SoFi, is that if they want to keep growing originations over time, they are going to have to find buyers for their loans. SoFi’s business model is still originate to sell, and even though they freed up some extra capital with the convertible note deal earlier this year, they still need to be prudent about how to best use their balance sheet going forward. That means selling loans will continue to be a key source of revenue and if they can’t sell loans, it will constrain how many personal loans they can originate. The most bullish thing about lower rates is that it takes pressure off banks, which should improve liquidity. Increased liquidity means there is more money available to buy up assets like personal loans. We’ve already seen this start to play out as SoFi has sold around $1.2B of personal loans in each of the last 3 quarters after a dearth of sales in late 2022 and most of 2023.

What’s more, they are realizing better and better margins on their sales as time goes on. They haven’t always disclosed their gain-on-sale margins (GOSM), which is why this graph only goes back to 1Q22, but you can see that the amount they are making by selling their loans has been steadily increasing since the rate hike cycle ended.

Increased liquidity and increased demand for high-yielding assets as rates come down should be a large tailwind for the business as a whole. Before SoFi took their foot off the gas near the end of 2023 to wait out the macro turbulence, their personal loan originations per member were very steady. It will take a few quarters to figure out if originations can get back around $500+ of originations per member where they were for 2021, 2022, and most of 2023. However, if they do, then revenue growth from personal loans will accelerate exponentially as member growth continues its exponential growth, and that growth will be driven by capital-light revenue from loan sales. Overall, the amount of loans that SoFi originates are miniscule compared to the total amount of capital needed across banks and asset managers, but it still remains to be seen if they can find enough buyers for those loans attractive sale prices. The odds of finding those buyers increased significantly today. This will be something to monitor over the next 6-9 months. If SoFi can get back into the range of $550-$600 in personal loan originations per member range, we’ll see explosive growth in the lending segment.

Huge Tailwind for Student Loans, Home Loans, and HELOCs

We're being cautious today. If rates come down, that will open up the gates for our student loan refinancing business and our home loans business, which is really small right now.

-Anthony Noto, June 12, 2024, Mizuho Technology Conference

Student loans and home loans both have a similar dynamic. In essence, demand for student loan refinancing and home loans (both refinancing, new purchases, and home equity lines of credit (HELOCs) will rise as rates fall. The housing market has taken a hit with affordability at all-time lows. Similarly, federal student loan interest rates are higher than they’ve been in 20 years. Origination volumes for student loans and all types of home loans will increase as rates move down. A slow and steady move down here will lead to a long and lasting tailwind as demand slowly increases and membership continues to grow.

Some of the biggest players in the student loan business, like Discover and CommonBond, have completely exited the space over the last several years. Recently, Navient was banned from servicing federal student loans recently as well. SoFi stands to benefit greatly from the decreased competition. They already are the largest player in the space, and I think their market share will only grow.

Student loans

Before SoFi received their bank charter in Q1 2022, they would sell all their student loans within about 3-6 months of origination. Here are originations compared with loan sales for that past 3 years or so. The combination of the bank charter and rising rates forced SoFi into a situation where they chose to hold loans for longer, which this graph makes very obvious.

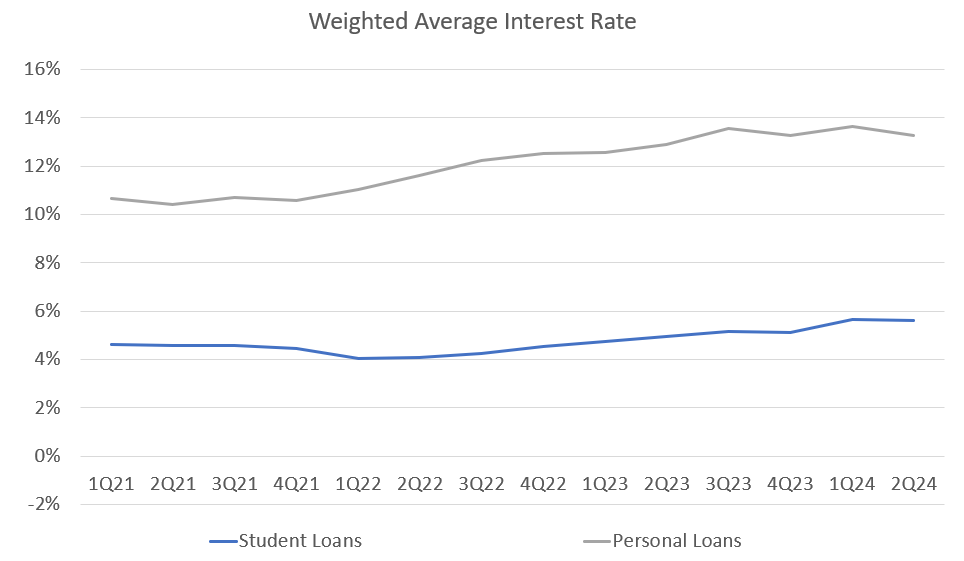

Here is the weighted average interest rate on student loans compared with personal loans.

The immediate question is why would SoFi choose to forego the massive difference in interest and put student loans on their balance sheet? Why even originate student loans at all if the rates are so low on them? Why not follow Discover and CommonBond out of the product? I get this question all the time from both bulls and bears so I’ll give my answer briefly.

I don’t think people understand the student loan business. Defaults are incredibly low and the debt is incredibly difficult to discharge. It will even follow borrowers through bankruptcy. As such, student loans represent extremely low-risk assets. Here is the annualized net charge-off rate of student loans compared to personal loans. And delinquencies, which are a leading indicator to defaults, went down last quarter, so 2Q24 might be the max annualized loan student loan default rate going forward.

Because student loans are so reliably paid back, they are very attractive to asset managers that require very stable, low-risk, higher-yielding-than-treasuries assets. They are often sold to pension funds, insurance companies, etc. Moreover, they provide an incredibly reliable base net interest income for SoFi that will not fluctuate as much with swings in the macro economy and provide a backstop for cash flow during downturns.

Historically, SoFi gets gain-on-sale margins (GOSM) of around 4% on their student loans, which is not much lower than their PL GOSM because those cash flows are so reliable that people are willing to pay for them. Here are GOSM for student loans since coming public. Notice that there are lots of gaps in between quarters as there are many quarters where they did not sell any student loans.

Why would asset managers pay $104 for $100 of loans with such low interest rates? SoFi student loans can vary from 5-15 year terms. In other words, those who buy the loans make their initial investment back in just over one year and then have very reliable profits thereafter for many years. Discover recently sold its entire $10.1B student loan book above principal. Reports stated that the maximum value could be $10.8B, even though right now the risk-free rate is above 5%, that'd be a 7% GOSM. Those loans have similar APRs as SoFi’s old loans as most of them were originated during extremely low-rate environments. As rate comes down and bond yields come down, student loans should only become more attractive. I think student loans will be a mostly capital-light business. I think its overlooked and will surprise people moving forward.

Home Loans and HELOCs

SoFi’s home loan business is capital light as they cycle their book almost always within 3 months of origination. SoFi focuses on agency loans like FHA loans and VA loans that are guaranteed to be purchased by government-sponsored enterprises like Fannie Mae and Freddie Mac. So as volumes go up with rates going down, this will only be a tailwind to noninterest income in the lending segment. They may pivot to originating more non-agency loans at some point and hold some on the balance sheet, but so far that has not been the case.

Home equity lines of credit, or HELOCs, are a new product that only recently started being offered by SoFi. I am excited to see how it grows. Anthony Noto spoke about it in the Goldman Sachs Conference last week:

We do have the capability now of doing home equity loans as a principle. It’s a secured product. We’d underwrite as much of that as we could given it’s secure, and we have very little secured lending on our balance sheet. In addition [there are] refinance home loans that would benefit meaningfully from a lower rate environment.

So it appears that SoFi wants to hold HELOCs on the balance sheet. This dovetails well with their core competencies as many people will want to tap the equity of their homes rather than taking, for example, a higher interest personal loan to do debt consolidation. Because it is secured, the risk weighting is only 50%, meaning if a customer has a $100k HELOC, the risk-weighted capital it takes is only $50k. That means that even though they may be lower interest rate loans, the leveraged returns can be comparable to or even surpass personal loans.

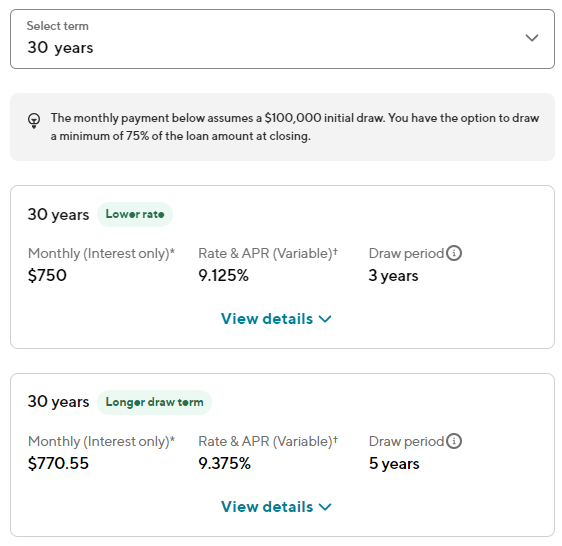

I went to my SoFi account to take a look at the HELOC rates they’d offer me. For a $100k HELOC, my 30-year rate would be 9.125%-9.375%. A 20-year rate would be 8.75%-8.875%. My current credit score is 815, so this gives you an example of what type of returns SoFi could get.

As an aside, getting rates for a HELOC was super easy. It took about 3 clicks, although I did have to fill out my personal info like name and address, which they should already have. They also followed up extremely quickly. I got an email, phone call, and a text from a loan officer within about 10 minutes of checking the rate to ask how we could move forward.

Cost of Capital

SoFi already decreased the APY on their savings account from 4.6% to 4.5%. A big part of the reason they did that was to test how elastic their customer’s deposit demand is. As rates come down, expect further decreases in the checking and savings APY, although they should still be very competitive. Moreover, the variable rates they pay on their warehouse facilities will also come down. SoFi’s weighted average cost of capital already peaked in Q4 of 2023. They now have the dual tailwinds of replacing higher cost capital like warehouse lines and time deposits with lower cost capital like checking & savings deposits AND rates on all of those types of capital are coming down. Cost of capital will come down faster than the interest rates on the loans they charge. This will juice their net interest margin and therefore boost their net interest income.

Conclusion

Rate cuts unlock liquidity for banks and asset managers to purchase SoFi’s assets. They spur demand for loans as the cost of those loans decrease. They especially increase demand for student loans and home loans. Much of the increases in the lending revenue will be generated in a capital-light way through loan sales. Moreover, existing loans on their books will generate greater net interest as their funding costs come down. I think the next 12-18 months are going to be transformative for SoFi the company and SOFI the stock.

Subscriber update

I am just under 90 subscribers right now.

Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I am long SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

The headwinds are becoming tailwinds. Bright future for SoFi.

I assume even if it wasn't profitable on its own, it would make sense to stay in the student loan business as a loss leader, getting a desirable demographic into their ecosystem for cross-selling and marketing at the start of their borrowing years.