What Does It Mean When SoFi Hedges Their Loans?

This is mostly an educational piece to help people understand what exactly SoFi is referring to when they talk about hedging their loans. First let’s give an example that everyone should understand of what hedging means. Let’s say you placed a $100 bet at 9-1 odds during the NBA Season that the Denver Nuggets would win the championship (for anyone who doesn’t follow basketball or the NBA, the Denver Nuggets are playing the Mami Heat in the NBA finals right now). If the Nuggets go on to lose, you’ll get nothing, but if they win, you win $1000.

Let’s assume that right now the betting odds are 1-1 for the Nuggets winning and 1-1 for the Nuggets losing. At this point, the hypothetical you is losing sleep over your bet and so you just want to guarantee you can make money no matter the outcome. To accomplish this, you can go and place a $500 bet at 1-1 odds that the Nuggets will lose. You have placed two bets and spent $600. If the Nuggets win, you get the $1000 payout from your first bet. If they lose, you get a $1000 payout from the second bet. No matter what happens, you make $400. You were in a favorable position, so you made a hedge that guaranteed that you make money no matter what.

SoFi wants to do the same thing with their loans. Their loans are an asset that they can sell them for more than the remaining principal on the loan when originated. SoFi wants to guarantee that they get a positive return when they sell, so they hedge their loans. They do this mostly by buying credit swaps. For anyone who doesn’t know what credit swaps are (a group that included me until I started investing in SoFi), here is an explanation.

Let’s use a fictitious example between SoFi Bank and Fake Bank. SoFi owns a personal loan and is charging a fixed rate on it, let’s call it 14%. They are worried that rates are going to move up, so they sign a contract to swap rates with another financial institution. That institution says they will pay SoFi a variable rate that is expected to net the exact same amount over the term of the contract as the fixed rate they are collecting.

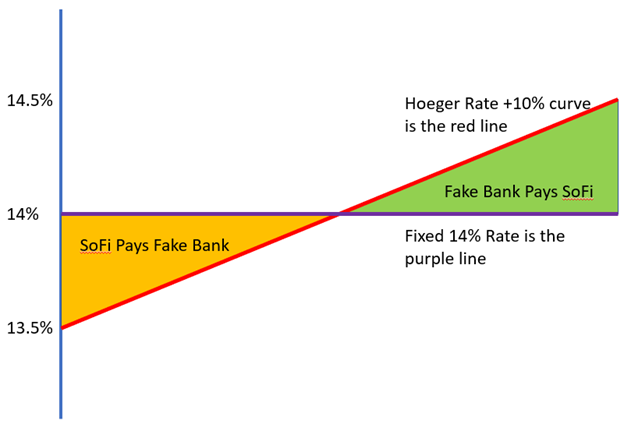

There are standard benchmark variable rates that are used for these type of deals, like SOFR and LIBOR rates. Let’s make up a fictitious rate called the Hoeger rate and we’ll assume a really simple “curve” for this example which is just a straight line. Today, when SoFi Bank and Fake Bank agree to the contract, the Hoeger rate is 3.5% and it is expected to increase linearly to 4.5% in 6 months, when SoFi expects to sell the loan. The two banks agree to a rate swap at the Hoeger Rate + 10%. Let’s assume that the Hoeger Rate prediction was accurate and the curve stays exactly as predicted at the beginning of the contract. In this scenario, on day 1 SoFi is paying Fake Bank 14% and Fake Bank is paying SoFi 13.5% (in reality, SoFi just pays Fake Bank the net difference of 0.5%). So Fake Bank is making money at the beginning of the contract. At 3 months, the rates are equal, and at 6 months, Fake Bank is paying SoFi 0.5%. After 6 months, SoFi Sells the loan and the credit swap expires. Both institutions made nothing because rates stayed exactly where everyone thought they would. This is illustrated in the graph above. The yellow portion represents the profit that Fake Bank makes, and the green portion represents the profit that SoFi makes. The yellow and green portions are the same size, so neither company nets any gains, it was all just a wash.

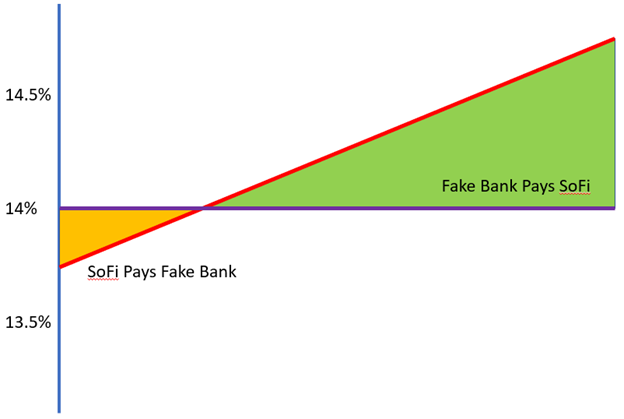

Now let’s say the day after the contract was signed, inflation came in hot and the Fed surprised everyone and moved rates 25 bps higher than expected and that the Hoeger rate moves exactly with the Fed Funds rate. The variable Hoeger rate moves with this surprise and goes up immediately to 3.75% and then proceeds to increase at the same linear rate as before. How does this affect the deal?

At the beginning of the contract, SoFi is paying Fake Bank 0.25%, but at 1.5 months into the contract, the rates are equal. The remaining 4.5 months of the contract, Fake Bank is paying SoFi interest. By the time 6 months rolls around and the loan is sold, they are paying SoFi 0.75%. In this example, the green area is 9x bigger than the yellow area, so SoFi makes 9x the amount they paid to Fake Bank.

Why Does SoFi Employ Hedges?

SoFi holds all of their loans as Held-For-Sale. That means they give them a fair value that they could sell them for on the open market. That also means that SoFi has interest rate risk. If interest rates are higher, the value of their loans decreases.

This is best understood with a hypothetical scenario. Let's assume that three months ago in March, SoFi originated a $10,000 personal loan with a 15% interest rate. The Fed Funds rate was at 4.5%. I am a bank who buys loans. As a bank, I can choose to either lend my money out at the fed funds rate or purchase that SoFi loan. When the loan was originated, I would be making 10.5% on the spread between the Fed Funds rate and the interest rate of the loan, so on the day the loan is originated, I am willing to buy that loan for $10500 knowing I'll make that $500 back and more on the spread. Today, the Fed Funds rate is 5%, and the spread is only 10%, so I'm only willing to pay $10,300 so I can still get a good return on that investment. So the "fair value" of that loan that SoFi has on their balance sheet decreased by $200 between last quarter and this quarter.

This is a simplified example that assumes the principal remained the same during those three months, but you get the picture. SoFi wants to guarantee that they can make money selling their loans no matter what happens to interest rates. To do this, they hedge the loans with credit rate swaps as described above. The purpose is that the fair values and the hedges would balance each other out. For every $1 that the loan loses in fair value because rates go up, SoFi will gain $1 from their hedge, so the losses offset the gains.

How has this worked out for SoFi?

Last year we saw the most aggressive rate hiking cycle that has ever occurred. SoFi’s hedges proved to be an extremely prudent decision. SoFi’s total revenue grew by more than 50% from $1.01B to $1.54B from FY2021 to FY2022. What would have happened if they had not had these hedges in place? Here is how much SoFi’s hedges netted them in 2022 from the 10-K.

With the crazy movement in rates, SoFi’s hedges ended up netting them $358M last year. That’s 23.2% of their total FY22 revenue! That means that if the assets were unhedged (like LC, UPST, Silicon Valley Bank, Signature Bank, First Republic Bank, and others), SoFi’s total revenue would have only gone from $1.01B to $1.18B. Imagine where the stock would be if they only grew revenue by 18% in 2022 and missed analyst estimates every quarter as they would have without their hedging program.

The downside to hedging

We are now in an economic environment where inflation is falling and the bond market is signaling that rates are much more likely to move down than up. I’ve used the Fed Funds rate as the baseline for all the examples in this article because most people understand what the Fed Funds rate is and have been aware of its movements. However, the actual credit rate swaps that SoFi uses follow the price of treasuries rather than the Fed Funds rate. In the example I gave above, we say that when when rates go up, then fair values go down. The opposite is also true that when rates drop, the fair value of their loans actually goes up. That means that having hedges in place in an environment where rates are going down is actually a drag on earnings and revenues. This actually happened in 1Q23 as we can see from the 10-Q. Treasuries went down in 1Q23, so SoFi ended up losing $30M on revenue because of hedges in that quarter.

What I think SoFi should do moving forward

When rates were at or near 0%, there was very little downside to hedging. It was extremely difficult for rates to go much lower. The downside is now much greater because there is now a lot of room for rates to fall. SoFi has publicly said they want to keep their noninterest income “rate agnostic”, meaning that no matter what happens to rates, they will employ hedges to make sure that any movement in fair value is offset by movement in the hedges. I think they should actually be less aggressive in their hedging because it seems to me that at this point the hedges carry more downside than upside. However, I’m not SoFi management so my opinion does not matter and I expect them to continue their hedging program.

Remember to Subscribe

Please make sure to become a free subscriber by entering your email. I do this analysis because I want to make sure that I am doing due diligence on my own holdings and because I enjoy writing. Taking that and turning it into in-depth articles and making visuals and graphs adds a lot of time and effort to that endeavor. I plan on always publishing everything I do for free. If you feel like my analysis has helped you, I ask that you consider becoming a paid subscriber. It isn’t too expensive, it’s only $5/month or $50/year. Always 100% voluntary. Thanks for reading everyone.

Had this on the to-do for a while. Thank you Chris for writing it, really enjoy your work.

Great article using understandable examples so the reader can follow along and actually understand instead of 25-50% comprehension. :)