A Deep Dive into SoFi's Loan Platform Business

The more I dig into Q3 earnings, the more enthused I am about the loan platform business. I think it’s a game changer in a bunch of ways. Although I did cover it somewhat in my earnings review, I think it is a big enough deal that it deserves its own in-depth article. I’ll start by describing why I think it’s so important conceptually, then go through the details of how much this affects revenue and profits, and then describe some of what I think the biggest implications of this new business are.

The advent of the loan platform business is not just a shot across the bow of the bear thesis, it’s a direct hit to the hull. Bears have maintained their position that SoFi’s growth will meaningfully slow as they become capital constrained. My contention has always been that the numbers don’t really support that argument.

I have argued, and continue to maintain the opinion, that member growth is the crux of their long-term growth. If you can grow the number of members entering the ecosystem by about 40% every year, then your revenue will continue to grow at very healthy rate above 20% each year. If you get people into the ecosystem at reasonable customer acquisition cost (CAC) for whatever product they are adopting, they will generate a healthy return. Not only that, some of them will cross sell into other products. This leads to greater lifetime vale (LTV) of each member at very low additional cost. Ergo, grow the member base and as long as the product is sticky enough to keep them around, SoFi will find ways to monetize them.

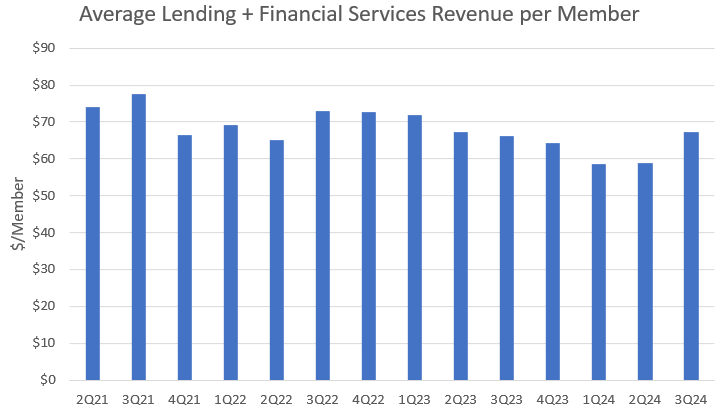

Has this played out? Yes. The average revenue per user (ARPU) has stayed relatively flat. The overall trend is slightly downward, which is to be expected as they pivot from a lending focus to financial services focus and as users go dormant on the platform. However, in three years, their ARPU moved from its peak of $77.66 in 3Q21 to $67.24 last quarter. That’s a decrease of 13.4% over 3 years, which is only 4.3% per year. Meanwhile, their total number of members grew by 219% in that same time period, an annualized growth rate of 47%.

The counterargument is that that is all well and good, but the only reason that SoFi has been able to pull it off is because they’ve had room on their balance sheet to grow their loan originations. Once that balance sheet space fills up, monetization would go down. I thought that was a poor argument because they’d pivot from using the balance sheet to monetize in different ways.

Enter the Loan Platform Business

What are other ways they could monetize those members? Maybe by, I don’t know, debuting a brand new capital-light business model to extract fee-based revenue with absolutely no balance sheet risk that is massively scalable? They did exactly that, and it is called the loan platform business (LPB).

At the Mizuho Conference on June 12, 2024, Dan Dolev asked a question and CFO Chris Lapointe’s response left me frustrated. I want’t frustrated by the response, but rather the fact that Mr. Dolev didn’t ask what I considered an obvious follow-up question. Here was that exchange:

Dolev: And maybe kind of talking about the other side of it, like maybe a little bit of an update on the capital market activity, like how do you feel vis-a-vis the loan buyers?

Lapointe: Yes. Demand is as strong as it's been since I've been in this seat. We ended up doing $1,900,000,000 of sales in Q1 of this year. That was the most sales that we've done over the course of the last 2 years. We have more demand than we are willing to fulfill right now at execution levels that are really favorable to us.

The obvious question to me was this: if you have more demand from loan buyers than you are willing to fulfill right now, why not originate more to fill that demand? Why not create a marketplace for loans that matches your borrowers with those investors? This isn’t a novel concept, LendingClub does something very similar with their own marketplace. However, it seemed at the time that SoFi’s business model did not incorporate this type of offering. SoFi would only fund loans that they felt comfortable holding on their own balance sheet, and perhaps they would sell them later.

I’d thought about them maybe doing something like the LPB, but to be honest, I did not see this coming and neither did anyone else. The LPB blindsided me, other investors, and analysts alike, and as a result, Q3 numbers blew away everyone’s expectations. SoFi usually likes to do a slow rollout to test new products before leaning into them. They often debuts new products like their new recent credit cards, Pay in Four (their BNPL), custom ETFs, etc., but they’ve never had a new product that immediately hit the top and bottom line as fast or as significantly as the LPB.

What kind of results are we talking about here?

To be completely fair, this wasn’t an entirely new line of business. SoFi has long touted that they turn down about 80% of the people who ask them for a loan. They refer those people to other companies through their Lantern business and partnerships with companies like Pagaya, taking a small referral fee for lead generation to other lenders. This showed up in their financial services segment as referral revenue, and its growth can be tracked below. This is total referral revenue, which also includes fees they get for other referrals like insurance, estate planning, business accounts, etc. The data we do have indicates that lending referrals make up the vast majority of this revenue, about 85% of the total.

So what changed in Q3? The new wrinkle is that rather than farming out these leads to others for a small fee, SoFi took a portion of the people they would have otherwise rejected and used their own underwriting expertise to originate the loans on behalf of others, such as Fortress. They originate the loan and immediately transfer it within days or weeks to the balance sheet of their partners. Those partners pay them handsomely for providing the marketing, underwriting, and other services associated with originating the loans. SoFi also gets to sign up any new customers acquired this way as new members and keeps a small ongoing revenue stream from servicing the loans. The result was an explosion of a brand new business line, with the LPB bringing in a total of $61.2M in revenue in Q3.

SoFi, conveniently, did us the favor of separating the revenue from this new business from the previous referral revenue in the 10-Q. Total revenue from the loan platform business in Q3 was $55.6M in fees, with an additional $5.5M in servicing revenue. Of that $55.6M in fee revenue, $13.3M was from the same type of lead generation referrals I explained above. However, a whopping $42.4M was fees from the new product they started in Q3. That’s right, they scaled the product from $0 to $42M in a single quarter.

On the servicing side, there was $5.5M in Q3 and a total of $12.2M recognized cumulatively in the year to date. So the jump in servicing revenue was probably somewhere around $2M from Q2 to Q3. That means all told, the new product they added to the LPB resulted in around $44M of extra revenue in its very first quarter of operation. For context, all other noninterest revenue from the financial services segment, which includes interchange revenue, brokerage revenue, and the referral business I described above was only $40.2 combined. In its very first quarter, the new LFB contributed more to the top line than all other noninterest income put together from all their other financial services products. That’s nuts.

Capital light revenue

But wait, there’s more! This revenue is truly and completely capital light. It is a fee that they collect in cash immediately. There are absolutely no loss share agreements or financing agreements. They are taking absolutely no risk on that $44M of revenue they just brought in.

With this product, SoFi may throw a bit of a kink in the works of Upstart and LendingClub’s marketplace business. While the credit boxes don't overlap completely, they are now directly competing for those borrowers. SoFi, however, has the built-in advantage of their sticky ecosystem that leads to greater customer retention, cross sell, and repeat sales. The one-stop shop they’ve built means that market share will probably continue to shift to SoFi. In 2021, SoFi was the laggard of these lenders in personal loan originations, with their market share between these three companies hovering in a range around 20%. They have dominated since then, with their market share coming in at an all-time high of 60% in Q3. The vast majority of LendingClub and Upstart’s clientele is there just for a loan. Most of SoFi’s members are not there for a loan, but will go to SoFi as one of their first options if they are looking for a loan. Leveraging the existing user base is a powerful advantage of SoFi’s model.

Furthermore, it gives them a more diverse portfolio of assets to offer to asset managers and banks. Some investors may prefer seasoned loans, others might want the benefits of buying structured certificates, and others, like Fortress, want new loans. SoFi now has a plethora of options that allow them to serve all those different needs.

Expand the TAM without expanding risk

One of the questions I’ve had in the past is where does SoFi draw the line on member growth. Their target demographic is HENRYs (High earners, not rich yet). These are people between the ages of 20 and 45 who make $100k+, but still haven’t become high net worth individuals. But how many of those are there out there? SoFi will end the year with around 10M members. The image below, from Visual Capitalist, shows that the 90th percentile income for individuals doesn’t cross $100k until sometime between the ages 30 and 35. Around 36% of the US population is between 18 and 45, and let’s generously say that 15% of these people make more than $100k. That means only about 18M people in the US possibly qualify as HENRYs.

SoFi, at some point, needs to broaden their offerings to more than just HENRYs in order to continue to grow. The reason that they target these individuals is because they have the highest LTV. It is also because the higher the income, typically the less likely a borrower is to default on a loan. SoFi is entering a stage where they are going to have to start expanding their concept of their target audience, but do not necessarily want to take the risk of holding loans from lower quality borrowers.

The LPB solves this issue. SoFi can expand their credit box and originate those loans, but immediately transfer the risk to someone else. They still make money off those people by getting the fee. But they also service the loan, which means borrowers become members and are introduced into the SoFi ecosystem. As far as the borrower is aware, SoFi looks like their lender. They still use SoFi’s interface to pay their loans, they can still be cross sold on other products, but the risk of default is on someone else’s balance sheet. The LPB gives SoFi the flexibility to expand their credit box, and expand the customer base, without the risk that typically accompanies doing so.

This may be cannibalistic to loan sales

There is one potential downside to the LPB. This was a question that was brought up on the earnings call, and one that needs to be looked at closely going forward. It is possible that loan buyers who purchase their loans through the the LPB will decrease the amount of loans SoFi otherwise sells. For example, if the LPB didn’t exist, would Fortress perhaps have signed a $2B forward flow agreement for whole loan sales that are already on SoFi's balance sheet instead of new originations? Nobody knows, but it seems reasonable to think that might be the case.

However, that didn’t really manifest in the quarter. Yes, whole loan sales were only $375M, which is the lowest they’ve been in a while, but they sold an additional $312M in structured certificates, and $594M were prepaid and refinanced, also getting them off the balance sheet. All told, that’s $1.28B in loans that were moved off the balance sheet in the quarter, which is right in line with the prior two quarters, and is not inclusive of the $1.0B in “sold loans” from the LPB. Furthermore, we know they already closed a securitization in Q4 and management said that “quarter-to-date in Q4, we've already done close to $1 billion in sales, across our products as well.” That is probably inclusive of the securitization I mentioned, but still it is a sizable number. This is something to keep an eye on moving forward, but also something that has not manifested as a problem yet.

Way too early LPB projections

Take all of this with a grain of salt. Also, I’ll try to explain my assumptions here and why they might be dead wrong. To make a projection about how much money this new business will make, we need to decide what to expect for LPB originations and for SoFi’s take rate, or gain on sale margin (GOSM). Here is the info we have from the call in those two areas.

For LPB originations, they did $1.0B in Q3. During the Q3 earnings, Jeff Adelson from Morgan Stanley asked about what to expect for LPB origination volumes and gave a range between $4B and $6B. CFO Chris Lapointe said, “We have that $2 billion agreement with Fortress, as well as commitments for Q4 and 2025 with several other partners.” Anthony Noto added, “The outlook is pretty significant as we go into 2025, in excess of what you articulated.”

Those $1.0B in originations resulted in 42.4M (let’s ignore the servicing revenue to make it easy), which means about a 4.2% GOSM. This is going to fluctuate. Here is what Chris Lapointe said about that on the call:

In terms of the take rate, what I would say is. We're looking at apples-and-oranges when you're trying to compare this take rate, to what you see in the general originate to sell business. These are loans that are originated on behalf of others, and they would not have been originated unless contracted to given the credit - and overall asset characteristics of the loans, as well as our own risk appetite and capital allocation strategy. What we're receiving is a platform fee for our underwriting capabilities, our marketing capabilities, and our overall operational capabilities. And that platform fee will vary depending on the partner.

Let’s give a range then of what we could expect from this business in the next 12 months. Let’s assume the bottom of the range for 2025 LPB originations is $6B, since Noto said “in excess of what you articulated,” and what was articulated was $4B-$6B. It doesn’t seem crazy to think that they could get to $8B of LPB originations in 2025 when they did $1B in their first quarter. So let’s give it a range of $6B-$8B of originations. On GOSM, let’s say there is a range of 3.5%-4.5%.

That gives us a range of $210M-$360M of incremental 2025 revenue from the LPB. Analyst estimates for 2025 did go up after SoFi reported earnings, but they went from $2,862M to $2,994M. That’s a decent jump, but that’s only an increase of $132M. Remember, this is a business that DID NOT EXIST prior to Q3, that nobody saw coming, and that generated $42.4M in incremental income in its very first quarter. At a bare minimum, analyst estimates should have jumped by $169.6M even if the LPB stays absolutely flat from Q3 levels for an entire year.

Analysts are assuming that it stays flat AND it cannibalizes around $40M in revenue from other businesses, and it is not incremental to servicing revenue (we already know it is). If you needed any indication on how clueless most analysts are about SoFi’s future, this is an excellent example. Analyst estimates should probably have jumped around double what they did just with this one piece of data alone. I don’t know how they missed it since more than half the questions on the call were about the LPB, but the math just doesn’t make sense to me.

Lack of innovation argument takes a blow

One last point. I often hear complaining about SoFi’s lack of innovation. Some of it is absolutely warranted, and I wish we saw more products rolled out faster. However, to go from a product that didn’t exist to one that’s around $200M annualized in a single quarter is pretty incredible. It shows agility, it shows innovation, it shows that they can roll things out in the background with no fanfare, and it hints that there are probably additional of innovative products that we don’t see that are in the works.

Conclusion

The Loan Platform Business is a game changer. It proves innovation at SoFi is not dead. It’s a brand new business that already has around a $200M annualized revenue run rate. It allows them to expand their credit box and target demographic without increasing their risk profile. It gives them another completely capital light revenue source with high incremental margins. Analysts didn’t even price the business in properly even though they asked a ton of questions about it. It’s a paradigm-shifting product and I’m excited to see how it continues to develop and grow.

Affiliate Partner

I’ve started using finchat.io and I really like their product. You’ll probably start to see more graphs from them going forward in my articles. If anyone is interested in trying their services feel free to use my link.

Subscriber update

The DDI YouTube Channel has started! My first video was a live Q&A on the day of earnings. I plan on making a video at least once every two weeks. A sincere and heart-felt thank you to those who support my work.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in SoFi and LC.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Did the 1B of qtrly LPB Originations come from personal loans exclusively ?

If yes, can they expand the LPB to home and student loans ?

Excellent analysis of this new offering from SOFI! It can be confusing keeping track of all their irons in the fire. Especially since some are based on different business models. I do wonder how they will manage all these emerging business lines as each scales up to meet demand. I see the advantages, as you point out, on the pull through effect across offerings.