SoFi Q3 Earnings Review - Onward and Upward

Quick announcement to start. The DDI YouTube Channel has started! Please subscribe if you want to see my video content. I did a live Q&A on the day of earnings. I plan to make a mixture of live and prepared content and put out a video at least once every other week. A massive thank you to all my paid subscribers who made this happen. I’m sincerely grateful for your support!

SoFi pulled a much bigger beat out of its hat than I was expecting, or quite frankly, anyone was expecting. They crushed analyst expectations with their biggest revenue beat ever. I’ll use my predictions as a framework to discuss the results.

Members

SoFi added more members in Q3 than ever before with 756k new members, eclipsing the previous record of 717k new members from Q3 of 2023. That was more than I expected and it is a testament to their ongoing marketing efficiencies. I also think it justifies what CEO Anthony Noto has been saying all along. He has said that the biggest thing standing between them and being one of the largest banks and financial institutions in the USA is brand awareness. People need to trust them before they give them their money. What is more, their quarterly customer acquisition cost is now consistently and meaningfully lower than it was in 2022. They are getting more members for less dollars.

I think there were several things that I underestimated when I made my prediction of 675k new members. The first is that I underestimated their marketing efficiency. I predicted that originations would be higher, which means greater marketing than usual. Last year in September, Noto said only 25%-30% of new originations come from existing members. While cross but has hopefully increased as total members has grown, it’s probably reasonable to assume that at most 30%-40% of new originations are from existing members.. That means large origination numbers will often correspond to higher new members as well. I mentioned that in the preview in relation to student loans, but underestimated the company, a mistake I'm ok making.

One last quick note on members is that they removed 157k members from their total member numbers this quarter. These churned members were inactive or maybe residual crypto-only accounts that were removed. Just something to be aware of, although I consider it inconsequential. It’s a good thing to remove inactive accounts in my opinion.

Originations

I'm feeling pretty vindicated when it comes to originations. One of the best theses in the stock is that the growth was completely down to having extra room on the balance sheet from becoming a bank. Last year I wrote that the core driver of growth was member growth, and that balance sheet growth was how they were choosing to grow, but not why they were able to grow. My contention was that originations track with membership, and when they filled up the balance sheet, they'd find other ways to monetize the origination demand. Since then, they created their structured certificate program, and more recently, the loan platform business. I predicted $4.75B in originations and they came in with $4.89B, so I was very close, but was not bullish enough. As expected, personal loans originations still track mostly with total membership.

Multiple ways to monetize

As LendingClub is fond of pointing out, holding loans to maturity is actually the best way to monetize them, and results in the biggest returns per loan (see their slide below on lifetime value). So if you have room on the balance sheet, you should use it to maximize returns. Is that capital intensive? Yes. Is it the best decision to maximize revenue and profits? Also yes.

Does it mean that growth will grind to a screeching halt when the balance sheet is full? Absolutely not. Many said that was the case. I said it was bullcrap. I still think I’m right. These are high yielding assets and people are willing to pay healthy premium to buy them. Now that SoFi’s balance sheet is close to full, they’ve pivoted to the capital-light business of selling more of those loans. This includes whole loan sales of their existing portfolio ($375M sold in Q3), senior secured loans ($312M sold and $594 refinanced and paid off in Q3), or the new loan platform business ($1.0B originations sold in Q3). Bears would have had you believe they are balance sheet constrained. I said when the balance sheet was full, they’d sell loans. They sold ~$2.3B of loans in the quarter. And they matched their highest gain on sale margin ever for the whole loans, sold the senior secured loans at par, and got a very healthy 5.6% in fees from the $1B in loans sold through the loan platform business, with an additional $5.5M servicing strip included as well, making the total gain on sale around 6.1%.

Now, obviously, some of this is macro dependent and has to do with how much liquidity there is in capital markets and the banking system. However, these loans are assets that perform great with high returns, so there is always going to be some level of demand. The recent crisis has also highlighted how valuable shorter duration assets can be for banks who want to diversify their portfolio away from assets with duration risk (like long-term bonds and mortgage-backed securities) or commercial real estate. Short-duration, high-yielding assets like personal loans are seeing a demand tailwind as liquidity returns from falling rates. The loan selling is also still accelerating. They also said in the earnings call that “Quarter-to-date in Q4, we've already done close to $1 billion in sales across our products as well.” And remember that they don’t count the loan platform business in that sales number.

They are killing it in personal loan originations. They originated more personal loans in Q3 than Upstart did in the absolute peak of the stimulus-fueled zero interest rate policy days of 2022. They are selling a ton of these loans into capital markets at high margins to bolster their noninterest income. They are gobbling up market share while still maintaining high FICOs. Their personal loan market share EXPANDED relative to LC and Upstart in Q3 to 60.1%, its highest figure ever. They are expanding into lower FICO areas with absolutely no balance sheet risk and no loss share agreements. They are manufacturing capital-light, fee-based revenue to supplement their net interest income from holding the loans on the balance sheet. They are winning.

It’s still going to grow

There was one fascinating tidbit from the earnings call that I think is really worth highlighting. Here was an awesome question from Morgan Stanley’s Jeff Adelson:

Could you just talk a little bit more about the expectations for the Loan Platform Business, how you expect that can grow from here? I know you said expect that to continue growing, but how meaningful can this become? It seems like, if we look at the numbers today, it's already at a $4 billion run rate. You've got the Fortress relationship, which, correct me if I'm wrong, is additive to that. So that's already $6 billion.

And should we be thinking about the economics as close to a 5.5% take rate based on the revenues you reported this quarter? And then I'm just curious, are you going to maybe deemphasize the loan sales a little bit more from here? I mean, it came in a little bit lower at the $375 million versus the $1 billion for the last 3 quarters as you maybe prioritize the Loan Platform Business from here?

I won’t quote the entire responses from CFO Chris Lapointe and CEO Anthony Noto, but here were the important parts:

Chris Lapointe

Part of that $1 billion of originations that we did, Jeff, in the period, a portion of that did come from the Fortress transaction that we announced earlier in the quarter. So it's not additive to your $4 billion run rate. It's inclusive of that, but we do expect to see continued strong growth in the segment. […] In terms of the take rate, what I would say is, we're looking at apples and oranges when you're trying to compare this take rate to what you see in the general originate to sell business. […] What we're receiving is a platform fee for our underwriting capabilities, our marketing capabilities, and our overall operational capabilities, and that platform fee will vary depending on the partner.

Anthony Noto (my emphasis added)

A couple of points just to emphasize. One is, the partners in the Loan Platform business, many of which are new incremental partners on loans as opposed to the wholesale loan buyers or ABS buyers that we've typically had, they're not all incremental, but a large percentage of them are, including in the most recent quarter. In addition to that, Chris has mentioned a couple of times, these are loans we wouldn't have otherwise originated, and we only originate when we actually have a contract. So it's not a zero-sum game. It's incremental. And the outlook for it is pretty significant as we go into 2025 in excess of what you articulated.

Four key takeaways. First, don’t count on 5.6% returns, it’s going to be partner dependent. Second, a portion of the Q3 originations did come from the Fortress deal. Third, most of these are new partners, so it should not cannibalize existing securitizations and sales, it allows them to expand their credit box. Fourth, they expect greater than $4B-$6B going into 2025.

As a reminder, this is Upstart’s entire business, and SoFi just confirmed that they will do more originations in 2025 than Upstart has done in the trailing twelve months. This is MASSIVE.

Student Loan Originations

I nailed this one. I predicted $950M in student loan originations and SoFi ended up with $944M. Slow rate cuts will be a consistent tailwind for this part of the company. Trump winning the presidency and dispelling the constant stories about student loan forgiveness will be a tailwind for this product. People won’t be waiting on the possibility of forgiveness to refinance. This business will be a nice consistent grower over the next several years.

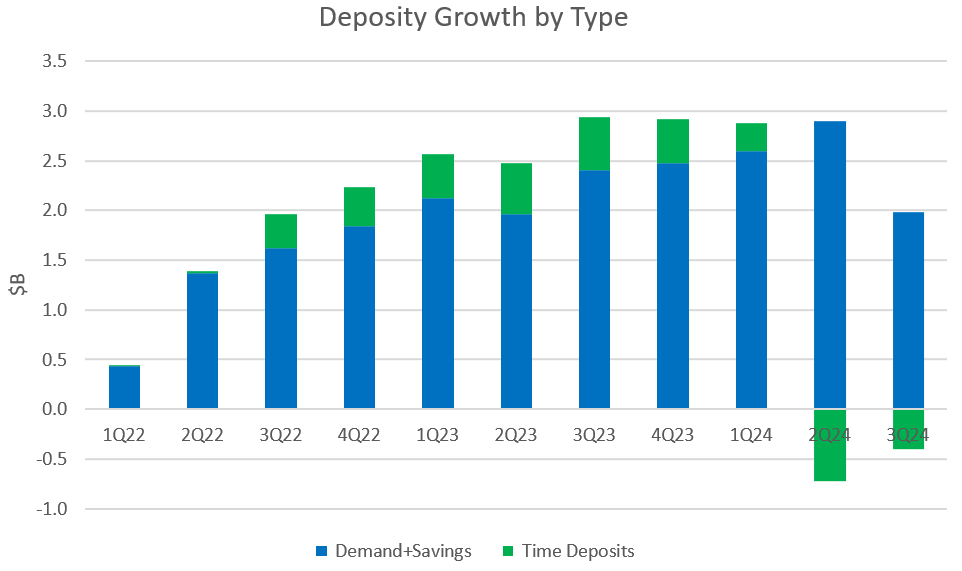

Deposits

I was too bullish here (the first time I can say that). It looks like the drop in APY did slow the deposit growth. They do need to continue to build these over time, but the fact that their warehouse lines are so low and they are intentionally letting certificates of deposits expire without renewing them (time deposits in the below graph) makes it seem like they aren’t particularly worried about pushing deposit growth. I predicted $3B+ in demand and savings deposit growth this quarter and they only got $1.98B.

Revenue

Lending

I talked a lot about lending above, so I won’t rehash the discussion again here, but the pivot to capital-light business is huge. Even though the revenue from the loan platform business goes to the financial services segment (except the servicing strip), lending revenue still came in at $391.9M, well above my expectations of $352M. Lending growth is well and truly back, to the tune of 14% YoY. They also revised their guidance to lending revenue of at least 100% of what they did last year. It will not be that low, it’ll be much higher.

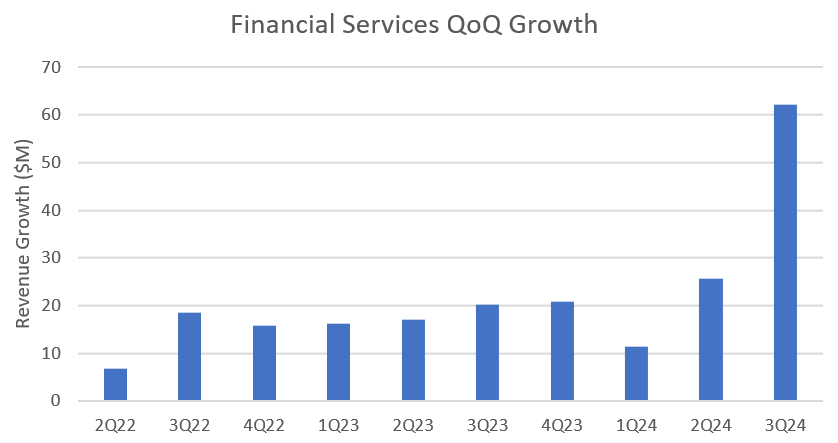

Financial Services

I thought meeting their revenue guidance here was a bit of a stretch. 80% growth from 2023 levels seemed like a tall task. That was before the lending platform business surprise. I modeled out that they needed around $210M in revenue in the segment in the quarter and that was my prediction. They came in at a whopping $238.3M, crushing my estimates and everyone else’s as well. For those who whine about lack of products and innovation, the rapid scaling of this business is proof positive that there is still innovation to be had, including from sources that nobody saw coming. I was concerned that SoFi would need to get above $22/member in FS revenue to meet their guidance.

SoFi made my concerns look laughable. They came in north of $25/member. That is a massive jump. It’s a 27% QoQ jump. This was a metric that appeared to be topping and then they pulled this out of nowhere. Huge props to SoFi for finding and leveraging this new business. And especially being able to do so in a way that does not cannibalize their existing business. Look at what happened to their QoQ overall growth in the segment. It’s mind boggling:

Tech Platform

Even a blind squirrel sometimes finds a nut. I’ve predicted $103M in tech platform revenue for three straight quarters. It came in at $102.5M. Nothing to write home about, but it is a step in the right direction. They really need 3-4 straight quarters of consistently increasing revenue to really get me excited again about the tech platform. The commentary about the pipeline was pretty similar and they also lowered the bottom range of growth guidance, which is not a particularly positive signal. We also didn’t get any new Tech Platform metrics, so this segment will remain in the penalty box for me until it shows better execution.

Corporate Revenue

This one is a head scratcher. Corporate revenue was way down this quarter, and I really have no good explanation why. The biggest portion of corporate revenue is the interest they are paying on the revolving debt facility they have and the senior convertible notes. However, that number was mostly flat from Q2 (-12.7M) to Q3 (-12.9M). Corporate revenue, however, tanked from -$13.7M to -40M.

That is almost double the worst previous quarter. The only hint we have here is that the change is due to “net interest income (expense)”. Unfortunately, this line item is not well explained even in the 10-Q. The corporate revenue line also makes up for differences in their Funds Transfer Pricing (model). FTP allocates their net interest income (NII) to the different business segments. Sometimes there is a bit of a mismatch between how much NII goes to the lending segment and financial services segment. If the amount of NII being given to financial services is larger than the amount being charged to the lending business for consuming it, then corporate revenue will be more negative. The corporate revenue line fluctuates depending on how much of a discrepancy there is between the two. I will reach out to Investor Relations and hopefully get more information here.

Total Adjusted Net Revenue

The midpoint of SoFi’s guidance was $635, analysts expected $633.8M, and I predicted $654M. SoFi came in at a whopping $689.4M. That is the biggest beat relative to their guidance that they’ve ever had. Top line growth has reaccelerated in a very meaningful way.

Not only that, but YoY growth reaccelerated back to 30%, which is extremely encouraging.

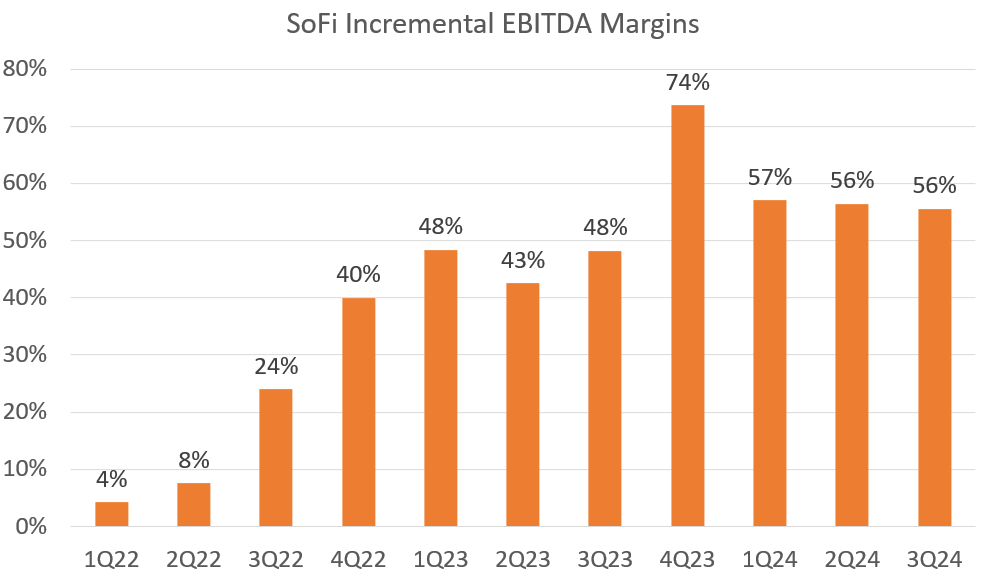

Adjusted EBITDA

SoFi guided for $162.5M, analysts expected $167.28M, and I predicted $169M. The massive revenue beat also trickled down to the bottom line. Actual adjusted EBITDA set a new record at $186.2M.

I thought they’d have incremental margins of 55% and it came in at 56%. That means they are still driving really high efficiencies even with accelerating lending. This is seriously great performance on both the top and bottom lines this quarter.

Net Income and EPS

Analysts estimated $0.04 EPS. I called for $49.3M in net income, which rounds up to $0.05 in net income. SoFi delivered $60.7M in net income, which rounded down to $0.05 on a fully diluted basis.

Guidance

I thought SoFi’s guidance would be $665M at the midpoint for revenue and $170M at the midpoint for adjusted EBITDA. SoFi’s FY2024 guidance implies $675M at the midpoint and $174M. Analyst estimates were $640.3M and $167.8M, respectively, so the guidance, especially the revenue guidance, was also a pretty big beat.

Conclusion

The call itself did not have the same energy as the Q2 call, but it was still extremely positive. Analysts asked a lot of questions about the new loan platform business, which I think took everyone completely off guard. Management was positive, they have a really good trajectory, and I think they have a clear path to meet or beat their 2026 guidance. At this point, honestly, I don’t think management has to be bombastic or over the top. They just need to deliver, and there is nothing that this management team does better than execute. This quarter was an inflection point to accelerating growth across every fundamental metric and justified the run up in the stock over the past several months. Moreover, I still think the stock is undervalued and has plenty of upside from here.

Subscriber update

The DDI YouTube Channel has started! My first video was a live Q&A on the day of earnings. I plan on making a video at least once every two weeks. A sincere and heart-felt thank you to those who support my work.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in SoFi and LC.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Great read from the SOFI 🐐

You are potentially changing people's lives with this research.

Thank you. Might have a new subscriber incoming.

Greetings from the UK.