DDI Earnings Prediction: SoFi Q1 2024 Earnings

Earnings is a week away. It’s prediction time, let’s get to it.

Members

Last quarter saw 585k new members added, the second highest total ever. It appears that there was a step change in 2Q last year where 500k+ new members has become the new normal. The trend for the past two years has been that Q1 numbers are lower than Q4 numbers. Website traffic data is up, and the NBA partnership kicked off during Q1, which should add some unaided brand awareness. I thought that there would be a bump in Q4 from the return of student loan payments, but I was wrong. Additionally, they have to walk the same tightrope this quarter as they did last quarter. They want to maintain profitability, and this quarter they won’t have a corporate revenue tailwind to help like they did last quarter (more on this below).

I think sales & marketing is the easiest expense to dial in exactly where they need it to maintain profitability. Since they are only marginally profitable right now, and because they are not going hard into lending, I think they will still be hesitant on spending heavily to acquire users for Q1 and possibly Q2 as well. I expect a quarter very similar to Q4 in terms of marketing efficiency and member adds.

DDI Prediction: 595k new members. S&M of $175M. CAC of $294/member

Originations

I’ve said several times now that this quarter is the most difficult one to predict since SoFi became a public company. Lending is the reason why that’s the case. They have been extremely clear that they are intentionally being cautious because of the macro. Last quarter was the first time ever that their capital ratios increased since becoming a bank (from 14.5% in Q3 to 15.3% in Q4). This means that relative to the capital they have, they are decreasing the amount of loans they are holding on the company’s balance sheet. This was due in part to the large amount of sales and securitizations they had in Q4 ($1.25B), but also to the fact that they really reigned in personal loan originations from $3.89B in Q3 to $3.22B in Q4.

Trying to predict what will happen in Q1 is even more complicated. We know that through the forward flow agreement they announced last year, that they will have at least $500M in whole loan sales in Q1. We also know that they had two personal loan securitizations in Q1. They’ve never had a securitization of less than $300M, so it appears that they will have sold or securitized at least $1.1B of loans. They actually surprised me in Q4 by selling $873M in whole loans. In the Q3 call in October, they said that they’d already sold $100M and securitized $375M in Q4. Going into the Q4 earnings, we knew they would shed at least $475M off the balance sheet. They actually sold an additional $775M on top of that, for a total of $1.25B sold in the quarter. Given that the market for loans picked up again in Q1, we could see something similar again. Between sales and securitizations, SoFi should have offloaded anywhere from $1.1B - $1.8B in personal loans in the quarter.

In the Q4 earnings call, they said that they’d be able to maintain an origination run rate of $18B-$20B in 2024. I expect student loan originations to be around where they were the past two quarters at least until rates come down, which is around $800M quarterly or $3.2B annually. Home loans, likewise, will probably remain in the $300M-$400M range for most of the year (I’ll call it $1.4B annually). That leaves $13.4B-$15.4B annually, or $3.35B-$3.85B left quarterly for personal loans. Here is the full quote of what was said during the Q4 earnings call about this year’s originations:

In terms of our lending capacity, we have the ability to originate $18 billion to $20 billion in loans in 2024 while keeping capital ratios well north of regulatory minimums, and that's based on growth in tangible book value, amortization of existing loans and previously announced loan sales. To be specific, we expect to generate $300 million to $500 million of tangible book value in 2024, which translates to approximately $2.4 billion to $4 billion of incremental capacity.

Second, loans are amortizing or paying down an annual rate of $8.4 billion. Third, we have our previously announced $2 billion forward flow agreement in addition to a number of on-the-run loan sale transactions we expect to execute similar to the sales achieved in Q4. And lastly, we have headroom in our capital ratio. Having said that, we intend to originate less than the $18 billion to $20 billion in capacity, and this is based on the factors I outlined previously.

What really could throw a wrench in the works is that they just raised around $500M of capital above and beyond what they had planned for when they gave that guidance as a result of the convertible note deals. As a reminder, an extra $500M in capital means they have the ability to originate an additional $3.5B this year and still be able to keep their capital ratios above 15%. That would mean an extra $1B/qtr above their $18B-$20B they talked about on the earnings call.

However, due to Chris Lapointe’s comments at the UBS conference, and my own discussions with him and Investor Relations (which I discussed in my last article about the senior convertible notes deals), I do not think they intend to use that extra capital in the near term. In fact, I expect them to operate for now as if they didn’t have that extra capital buffer available at all. I think they’ll keep it in their back pocket for now to use as a trump card in the future.

Ok, with all that being said, the fact that I think this was a strong quarter from a sales perspective and that they knew they’d have extra capital buffer, I do not expect them to be below what they did in Q4. I think they still will have the brakes on relative to where they would be originating if the macro environment were more stable, but that we’ll see a QoQ increase in personal loan originations and that they’ll come in a little above the midpoint of the $3.35B-$3.85B range I gave above.

DDI Prediction: $3.65B in Personal Loan Originations, $760M in Student Loan Originations, and $290M in Home Loan Originations

Deposits

The trend I highlighted in last quarter’s earnings preview continued. Deposits jump in Q1, stay flat for Q2, jump in Q3, and then stay flat again in Q4. The only plausible explanation I have heard for why deposits move like this rather than linearly increasing is that people often spend extra in Q4 for the holidays, which keeps them flat relative to Q3, and tax returns in Q1 boost those numbers relative to Q2. In any case, I’m going to assume this trend continues, regardless of the reason why, until proven wrong, which means I will predict that this is the first quarter where deposits increase by more than $3B in a quarter.

DDI Prediction: $3.1B in new deposits for $21.7B deposits total

Revenue

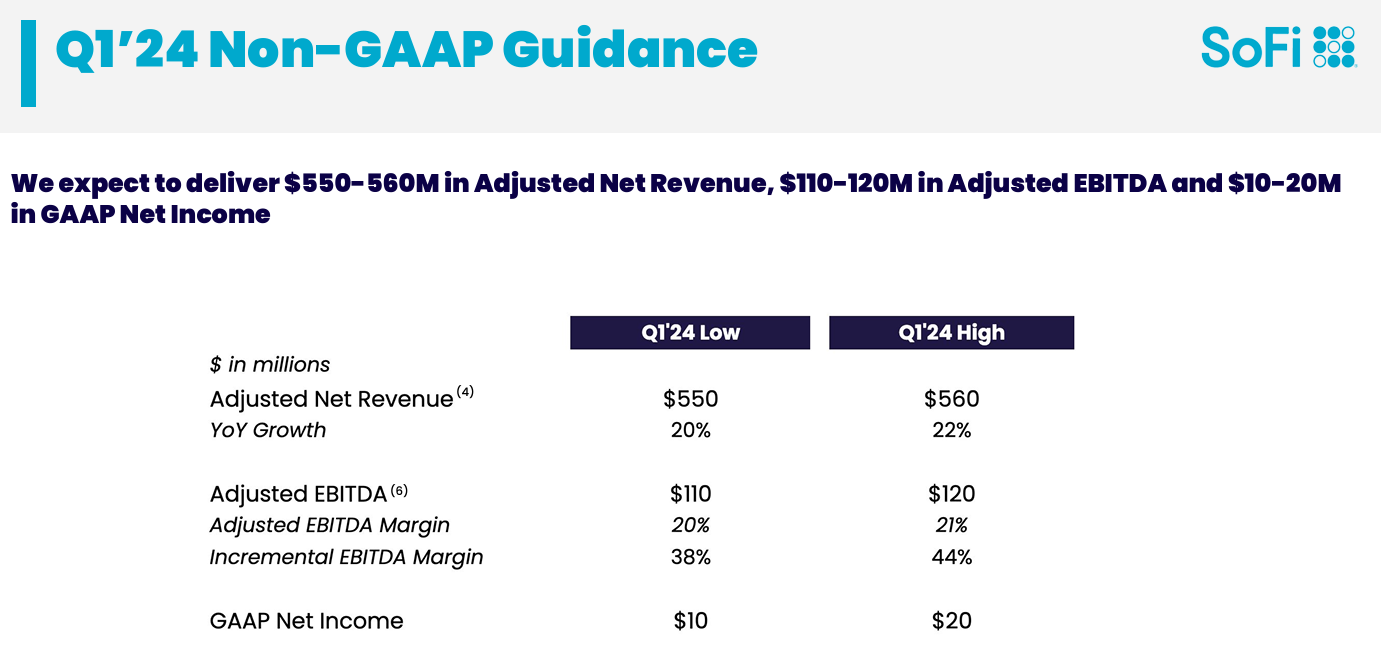

SoFi’s guidance for this quarter is $550-$560M in adjusted net revenue.

Lending Revenue

Again, this is really hard to predict. They’ve guided that full year 2024 lending revenue will be 92%-95% of 2023 revenue. Q1 2023 revenue was $325M and Q4 2024 revenue was $347M. Net interest margin should continue to expand as they continue to fund more loans with lower cost deposits rather than warehouse facilities. A lot of loans from 2022 that are at lower rates are also being paid down and are being replaced by ones with a higher interest rate, which should further increase net interest income. However, the slight shift in the new origination mix toward student loans, which are lower yield than personal loans, will drag slightly on net interest income.

That will be offset by some decrease in noninterest income from the continued amortization of the older loans in their portfolio. Additionally, while they try to hedge their portfolio against rate movements, treasury yields did move up in Q1, and that will also be a headwind to noninterest income. That all leads me to believe that lending revenue will be down relative to Q4, but still up compared to Q1 2023.

DDI Prediction: Lending Segment ARR of $335M

Financial Services

Finally something that is relatively easy to predict. FS revenue growth is mostly tied to deposit growth at this point.

SoFi guided for a 75% increase in revenue in FS in 2024. That corresponds to continued quarterly growth of around $21M throughout 2024. There might be some additional room for improvement here if they can continue to improve on their credit card charge-off rate. That’s certainly one of the things I’ll be looking at carefully from these earnings.

DDI Prediction: Financial Services ANR of $160M

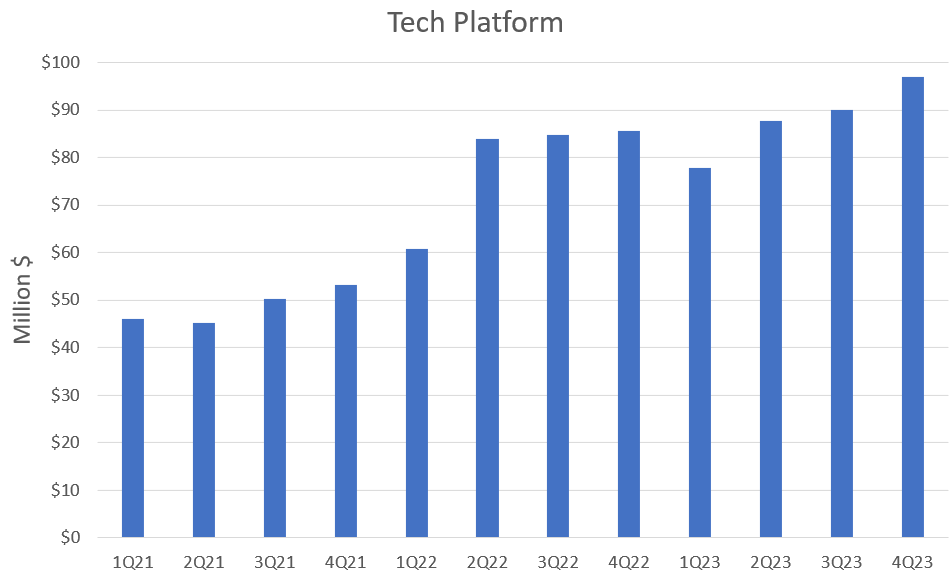

Tech Platform

After a very lackluster 2022 and start to 2023, SoFi’s technology platform, also known as Galileo, has had three straight quarters of growth. 2022 was a year of investment into migrating to the cloud and integrating Technisys into the Galileo business. That should be behind them now so they can turn their focus toward again toward growing the business.

On their Q4 call, they guided for the tech platform to grow 20% YoY in 2024 and have a multi-year CAGR of 25% through 2026. They actually saw very good growth of 7.8% QoQ in Q4, which is an annualized growth rate of 35%. Yearly growth rate next quarter is going to look great as Q1 of last year is a particularly easy comparison to beat as they had lost their second biggest client, Current, in Q4 2022, so revenue actually decreased. In fact, partially because of that down quarter last year, if they were to grow the TP revenue by 5% in each quarter of 2024, they’d end up with around 25% growth in TP rather than the 20% they guided for. Personally, I’d really like to see 30%+ CAGR in the tech platform over the next three years through 2026. SoFi often guides conservatively, and I think that’s the case here as well. I’m hoping and predicting that Galileo will outperform SoFi’s guidance for this quarter and this year.

DDI Prediction: Technology Platform ANR of $103M

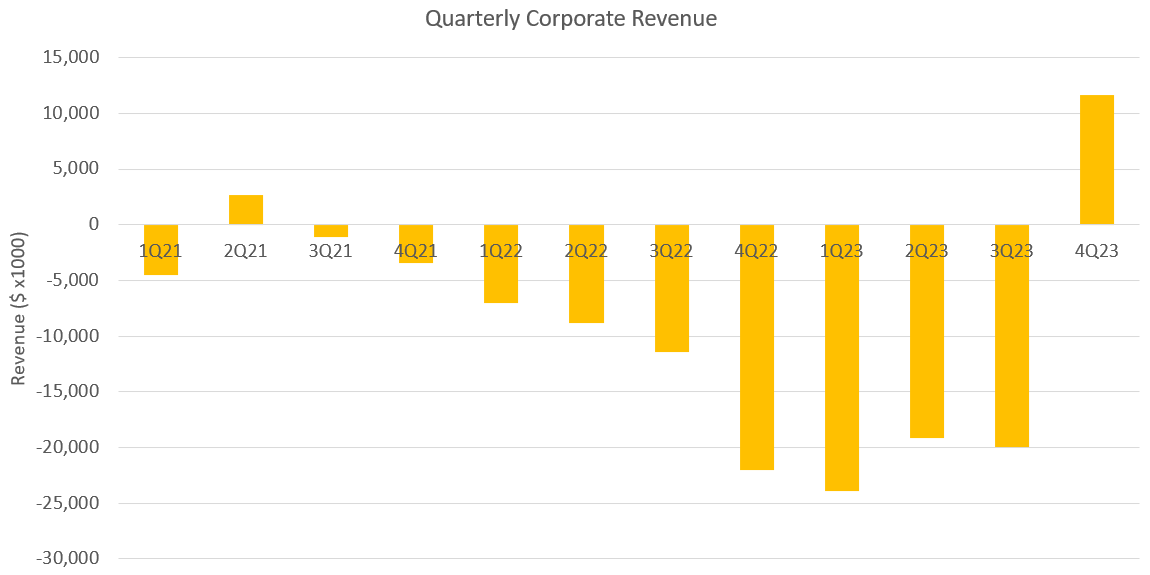

Corporate

This is the one that threw me for a loop last quarter. Corporate ANR is comprised mostly of interest that they pay on their revolving line of credit and some other stuff under their FTP framework. It had been consistently around -$20M for four straight quarters before it had a huge swing to +$11.7M in Q4 (the graph below already removes the revenue generated from the small buyback of 2026 convertible notes that happened in that quarter). GAAP Corporate revenue will be even larger in Q1 2024 than it was in Q4 2023 because of the $600M 2026 convertible note exchange, but that will be adjusted out for ANR.

I asked Investor Relations about this topic because it is extremely hard as an outsider to be able to model what is going on. What they said is to assume that the future run rate here should be more or less equal to the annualized 2023 Corporate run rate. In other words, moving forward their corporate revenue should be around the average of all four quarters in 2023. That means about -$12.8M per quarter going forward. It is actually possible that number may decrease if they use the cash raised from the 2029 convertible note deal to pay down the revolving line of credit. We’ll know a little more about that after this quarter.

DDI Prediction: Corporate ANR of -13M

Total Adjusted Net Revenue

DDI Prediction: Sum the four above and you get my prediction of $585M, which is $30M above the midpoint of their guidance, and $25M above the high end of the guidance.

SoFi, on the average, beats their guidance midpoint by $22M/qtr. The most they have ever beaten their guidance by was $39M. A $30M beat above the midpoint would be on the higher end of what they usually achieve, which indicates to me that my predictions are possibly too bullish. However, I try to do a bottom-up approach to my predictions and don’t adjust them based on SoFi’s own guidance. I think my predictions are reasonable, but do want to point out that if true, this would be a bigger beat than what SoFi typically has.

I have pulled back on my expectations for the lending business relative to what I thought last quarter, but it is possible I am still too bullish there. If I were to quantify the segments where my expectations might be too high, lending might be overestimated by about $10M, tech platform might be around $3M too high, and corporate revenue could come back down to the previous lower range again, which would mean $7M less than I predicted. However, even if I adjust all three segments down, that would still be around $565M, which would still be $5M above the high end of their internal guidance and $9M above analyst estimates of $556M-558M (analyst estimates are different depending on whether I take them from Yahoo!, Seeking Alpha, or Koyfin).

Adjusted EBITDA

SoFi’s own adjusted EBITDA guidance is for $110M-$120M. For context, Q3 2023 was $98M and Q4 was $181M. To get to EBITDA, we have to start with revenue and my revenue prediction would be a quarter over quarter decrease of $9M for the company relative to Q4 2023 revenue. I don’t expect them to increase expenses significantly in Q1 relative to Q4, although the swing down in corporate revenue will hurt the EBITDA line. Lending margins might also come down slightly from last quarter’s 65% contribution margin, which is close to an all-time high.

Technology platform margins, likewise, will probably be down as well. If you remember, they maxed out payroll taxes in the Tech Platform last year in the first half of the year, which provided an artificial boost to margins in the back half of the year.

So, I’m expecting a decrease in EBITDA contribution of around $25M from lending, $5M from the tech platform, $25M from corporate, and increasing expenses of around $12M. This is partially offset by an increase in EBITDA from financial services of around $12M. I think I’m being conservative with regard to their margins here, which hopefully leaves room for them to outperform my prediction.

DDI Prediction: Adjusted EBITDA of $126M. This is $11M above the midpoint of their guide and $6M above the high end of their guidance. Historically their average beat is $18M above the midpoint of their guidance. This would be a 21.5% adjusted EBITDA margin overall.

GAAP Net Income

I think that SoFi is going to once again be EPS positive this quarter. They guided for $10-$20M of GAAP net income, which translates to an EPS of $0.00-$0.01 because of the preferred share dividend of around $10M that will still occur in Q1. They did have layoffs in Q1, which will cause a one-time expense that is not included in the EBITDA, but will be included in the EPS. They will also have a large one-time profit from buying back the 2026 convertible notes, but I assume they’ll adjust this out of their net income line (and even if they don’t, my prediction here does subtract it out, so I’ll compare it apples to apples once the numbers are out).

From their guidance, which I posted above in the adjusted EBITDA section, they expect $100M difference in the reconciliations between adjusted EBITDA and net income. They have better insight into those than I do, so I’ll assume their estimate is correct.

DDI Prediction: GAAP Net Income of $26M.

EPS

As I mentioned above, they still have their dividend payment in Q1 of somewhere around $10M, which gets subtracted out from the $26M before calculating EPS. If they redeemed those shares and the dividend is prorated, it might be as little as $7M, but I’m not sure when they redeemed them, so I’m going to assume it was still $10M. That leaves $16M in the numerator for the EPS calculation. The shares are calculated as the average fully diluted share count. The total diluted share count increased quite a bit in Q1 because of the convertible notes deal. However, for EPS calculations, they use the weighted average share count for the entire quarter. The convertible note deal didn’t happen until the beginning of March, so the shares from that deal will only be reflected for a little less than 1/3 of the quarter. Fully diluted share count will probably come in somewhere around 1,065M-1,080M.

DDI Prediction: EPS of $0.015

It appears that analyst estimates are barely above breakeven, so this would be a beat. Keep in mind that EPS is always rounded to the nearest cent. My estimate is actually $0.01495, so if I’m right (and I obviously won’t be exactly right), it would show up as $0.01.

Predictions in one place for easy reference:

Members: 595k New Members

Personal loan originations: $3.65B

Student loan originations: $760M

New deposits: $3.1B

Lending revenue: $335M

Financial Services Revenue: $160M

Technology Platform Revenue: $103M

Corporate Revenue: -$13M

Total adjusted net revenue: $585M

Adjusted EBITDA: $126M

GAAP Net Income: $26M

GAAP EPS: $0.015

Can’t wait for Monday to see how the business is progressing.

Subscriber update

Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in SoFi.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

That will be fun, to see how close your predictions match up with actual results. Thanks for the article.

I can’t do that in depth, so much appreciated as always Chris.

My guestimate is 1.5c eps this qtr, growing q on q to 11c total for ‘24, that’d be 100PE at $11 SP.

Even factoring in dilution, i don’t see how from q2 on, circa $45M savings to bottom line won’t add to eoy eps?

The ever extending out of higher for longer, supports managements’ slight contraction stance on lending and i can’t see a SP higher than $12 max. being justified by the most likely numbers this year.

Given their caution on lending conditions, won’t they’ll pay down their revolver, assuming it is revolving? as in, they can access the money later on for originations in a more favourable market.

If most of any fed rate reduction cycle happens in ‘25, SP goes a lot higher on that and on ‘25 estimates imo, as long as they’ve not disappointed/missed but rather, had 5 consecutive profitable qtrs.

Personally, i see ‘26 as the peak year of SP growth because multiples will contract after that on more steady and consistent rev. and eps growth.