Highlights and Analysis from Anthony Noto at the Goldman Sachs Conference

SoFi CEO Anthony Noto was interviewed by Goldman Sachs analyst Mike Ng yesterday. The presentation was not as in depth as many others that have been done in the past, nor were the questions as probing. It was actually an excellent interview for any investor who is new to SoFi and wants an overview of the company, its history, and its trajectory straight from the CEO who pioneered that vision. Here are some highlights and analysis on what stuck out to me. Transcript snippets are from Seeking Alpha.

Regarding overall margins

One way [to look at how to achieve the target return on equity] is what does our EBITDA margin and net income margin need to be to get there? Our EBITDA margin needs to be 30% and our GAAP net income margin needs to be 20%. The things we have between EBITDA and GAAP net income will be about 10% and that’s kind of where they are today.

We’ve heard the 30% EBITDA margin number before, but I don’t recall them ever explicitly stating a target GAAP net income margin before. This is an excellent piece of information for modeling going forward and it gives investors a yardstick by which to measure the business. For SoFi, the big add backs from EBITDA to GAAP net income are depreciation, amortization, and stock-based compensation. That means they absolutely have to get SBC below 10% to hit their long term profit margin goals, a mark that they had guided for hitting by the beginning of 2024, but they will not yet achieve in that timeframe. This is one of the few things they have guided for and missed, and I’d like for somebody to ask them about this.

Noto actually also gave an excellent methodology for evaluating whether or not a company can actually achieve those margins and how they are making progress toward that number:

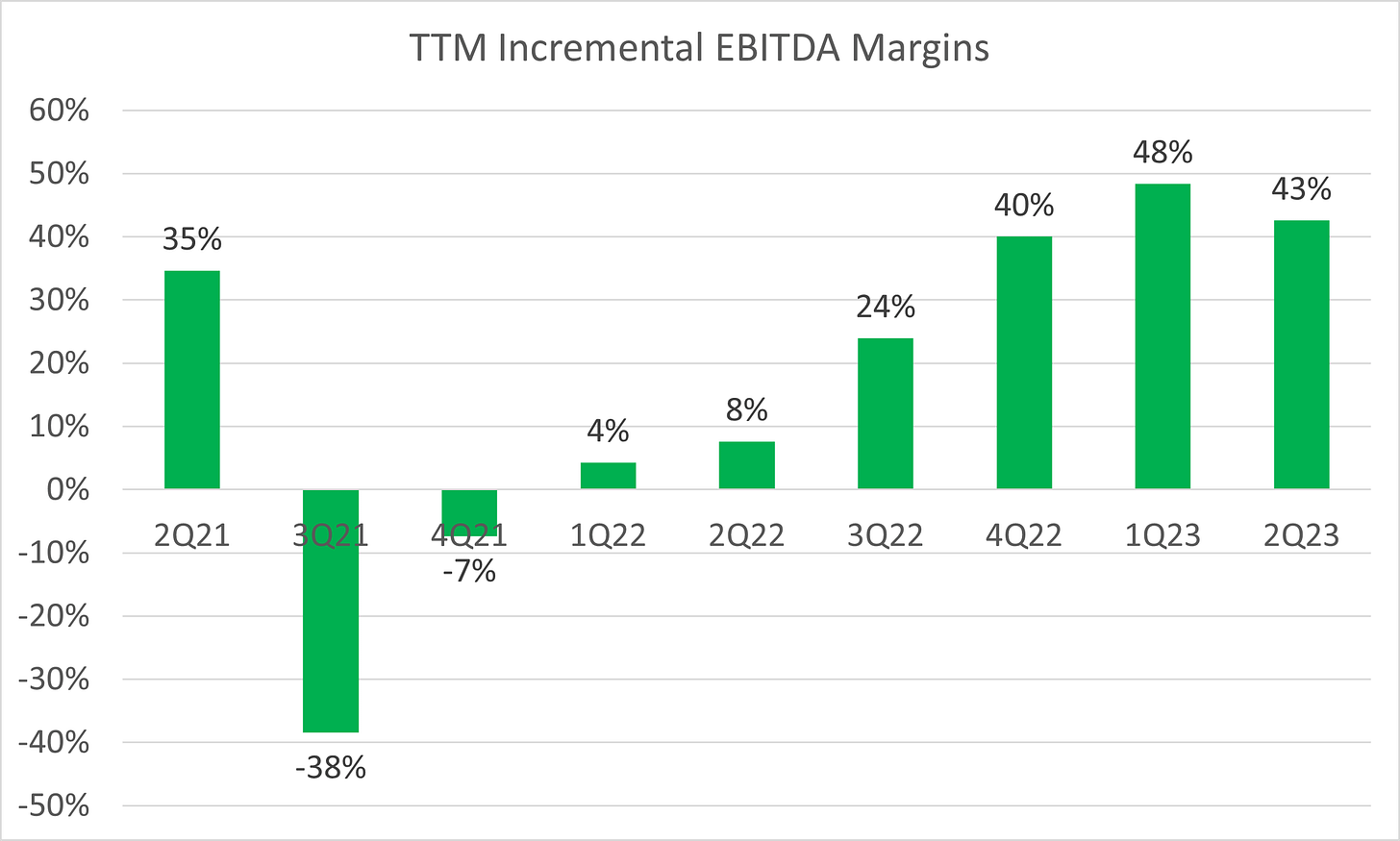

I used to do to convince our investing partners about the long-term margins of a fast growing company was I looked at their incremental EBITDA margins. So change of EBITDA year-over-year divided by change in revenue. And if the incremental EBITDA margin was 30% and it was consistent over time, asymptotically, you get to 30% margin. Well, this year, we have driven over a 40% incremental EBITDA margin while growing over 40% as a company. So I am very confident our long-term margins can be 30%.

Basically, if you get $10M more revenue this quarter than last quarter and you think you can get to 30% margins on that revenue, then your EBITDA should have increased by $3M in that same quarter. Makes sense. So let’s apply Noto’s own analysis method to SoFi:

As you can see, the data are pretty lumpy. This makes sense because the two are not always completely correlated every single quarter. Say you want to increase membership one quarter so sales and marketing expenses increase in that quarter, but you end up reaping the benefits later. That will mess with the data and make the quarter where you spent the extra marketing money look bad and the next quarter look better. Also, individual quarters where total growth is small can look really bad. For example in 4Q21, revenue only grew about $3M QoQ and EBITDA dropped by $7M, that ends up looking terrible in this graph even though the absolute numbers are not that bad. So for this particular category, I think it’s best to do this on a trailing twelve month (TTM) basis (where you add up the last four quarters of revenue and EBITDA, respectively) to try to smooth out some of those fluctuations.

Here we can see what Noto was talking about. They are driving 40%+ incremental margins for the last three quarters in a row on a TTM basis. Since the company has now been optimized for EBITDA growth, it’s nice to see it hitting something of a steady state in terms of incremental margin, and it’s extra nice that it’s above their long term goals.

Contribution margins

Big takeaway for me here was that Noto talked about 70% contribution margins for the lending segment. Here is the exact quote.

Some people may not realize this, our loans have a 70% contribution profit margin, and that steady state I wouldn’t expect it to go higher. If it did, I would reinvest to keep it at that level.

That isn’t completely true, as contribution margin actually peaked at 66% in 4Q22. However, I take this as a long term guidance for where they would like their contribution margin to be. Again, this is super useful for modeling. In the past the only “guidance” they’ve given here is to say that even at their worst projected life of loan losses, they want to have 40% contribution margin on their loans. That Noto discussed 70% publicly to me shows that’s what he expects.

He also highlighted that they want to get back to 30% contribution margin in the tech platform. We already knew that, and Chris Lapointe has talked about getting even higher than that in the future. We did not get a long term financial services contribution margin number in this interview, although it will turn positive this year. Here are graphs of contribution margins of the lending and technology business segments for reference.

Stadium Deal

We got more info on the SoFi stadium deal than we’ve ever heard before. I won’t analyze that here, but for people who do have concerns about naming the stadium, I’d heavily suggest that you give this portion of the interview a listen.

Student Loans

Two things here that I found interesting. First, it was clarified that the $200B in TAM is just referring to loans that would save money by refinancing at current rates. It did not include those who would be refinancing to extend their term to lower monthly payments.

The bigger deal here is that Noto said the following:

I think we will see the demand for student loan refinancing continue to sort of move back to where it was in 2019. It may take several quarters for that to happen. We said, we would see a small increase in Q3 and a bigger increase in Q4. We are not looking for returning Q4 to 2019 levels. It’s probably half of that or less than half of that.

As a reminder, their peak in student loan originations was $2.4B in 4Q19. In my own projections regarding student loans, my bearish, neutral, and bullish projections called for 4Q23 originations of $1B, $1.3B, and $1.6B. Based on Noto’s comments, we are looking at something close to my bearish scenario for originations. SoFi does have a tendency to under promise and over deliver with most things they say publicly, so we’ll see what happens in the next 4 months.

New Products

They will be expanding SoFi Credit Card partnerships into other categories like event tickets:

We just launched SoFi Travel, which is a better way to buy travel with reward points and discounts. We will add other categories like entertainment tickets. So we are helping people use their money the way they want without paying us anything and we are giving them maximum value.

Additionally, it looks like SoFi Invest is going to be launching alternate asset classes.

We are on the Instacart IPO and we will soon be launching hopefully in early next year, alternate asset classes.

The incredible bender9000 from Reddit seems to have dug up that this is actually already in beta. The verbiage in the code states, “Harness the potential of Mutual Funds tailored to alternative assets, offering a fresh perspective to portfolio diversification, coming from low correlation to traditional investments.” He expects that SoFi will offer Interval Funds such as Real Estate, Private Credit, Public/Private Equity, Long/Short, and use of leverage.

Losses from Invest and Credit Card

One of the more granular and interesting tidbits was that SoFi Money is pulling more than its fair share of the weight of the entire Financial Services segment. The Money product is dragging the whole segment towards contribution profit even though credit card and Invest (their brokerage platform) are losing the company $150M on an annualized basis. That’s a really big deal, especially considering that SoFi was supposedly going to begin to scale their credit card business in the back half of the year. This makes me somewhat hesitant about whether or not they are ready to scale the business. This was one of the businesses that I’d looked forward to seeing develop. Considering it is a big source of their losses right now, I’d like to see the unit economics improve before they begin to scale, but that will mean it will take longer for this part of the business to take some of the heat off of lending for growth.

It also highlights the need to get the Invest platform up to par. The fact that they still haven’t launched level 1 options is very disheartening. If they are already offering the ability to buy options, it seems like very low-hanging fruit to offer the ability to sell them. The IPO offerings are strong but what is the hold up with options?

Payback period decreasing

Another tidbit that might have slipped through if you weren’t listening carefully is that the payback period on their customer acquisition cost is getting shorter and shorter. Here was Noto at the KBW Fintech Conference in March 2023 (I’m adding the emphasis to all these quotes):

And we're currently losing money in the [financial services] segment as a result of there being about a 12- to 24-month payback period on the upfront customer acquisition costs and as a result of building our overall CECL reserves.

And here is what he said on the 2Q earnings call on May 1:

We continue to scale our top of the funnel products given the attractive monetization opportunities by capitalizing on our improved brand awareness and network effects. We saw this increased efficiency even with the fact that these products have a 12 month to 18 month payback period.

And here is what he said last week on September 6:

And so a world in which rates go down, we are only going to increase our market share gains or increase our spread, which allow us to invest more money in acquiring even more customers and we are acquiring them a great LTV and 12-month payback now.

In six months we went from “12- to 24-month payback” to a “12- to 18-month payback” to a “12 month payback”. This is great news, it means new members are accretive faster. I’m guessing that a large part of the faster payback period is the fact that they are now spending less to acquire each customer. Those familiar with my work will have seen this chart before, but it’s worth posting again:

Even if each new member brings in the same revenue as before, if you are paying less to acquire them, the payback period shortens quickly. I’ve said in the past that a single quarter is not enough to really call this a trend. However, the fact that the payback period has gone from 12-18 months in May to 12 months in September gives an indication that the lower CAC in 2Q23 is probably persisting into 3Q23 as well, and that would be excellent news.

Speaking of 3Q23 member growth. We didn’t get anything concrete here, but Noto did say this:

And then on the Financial Services side, we talked about $2 billion of deposits each quarter and feel super confident we are on that track and continue to have a very differentiated product in driving direct deposit and more spending and we are on that track and it’s helping us out with the Invest product.

Feeling “super confident” of being on track for another $2B in deposits speaks to another great quarter of member increases. Between football season starting, Taylor Swift having 6 straight sold-out nights at SoFi Stadium (which corresponded with the SoFi app moving up into the top 20 or so in the Finance category in both the App Store and Play Store), and the Instacart and ARM IPO access, we will hopefully be in for another excellent quarter of member adds.

Stealing Market Share from Legacy Banks

In the past, Noto and the management team have commented on how they are taking customers away from legacy players. I wondered how they knew where their new members were coming from. He answered that question for me in this conference:

The share we are taking is from the top five banks in the country. We are -- they probably don’t even know that we are taking share because they are so big and we are so small. But we see where the ACH is coming from.

So we know who they are, but it’s the largest banks in the country that are offering nothing in APY and they don’t have mobile products that are very good, they certainly don’t have the added value that we have across our platform with free certified financial planners and the ability to do these other products at great discounts and great value.

They can see exactly where the money comes from when new members add an initial deposit to the account because they have the ACH transfer information. I've also said in the past that the large incumbent banks don't care about the deposits they're losing because this is such a tiny fraction of their business. This quote confirmed that for me. That’s fine with SoFi, they’ll just keep gobbling up market share until they are too big to ignore.

Tech Platform

One final interesting point is that the primary focus of the tech platform is to serve SoFi's customers. Their business-to-consumer offerings take precedence over the business-to-business operations. Noto made this crystal clear:

The first job of the Technology Platform is to help us innovate faster than we could otherwise. No one has the same approach in being a one-stop shop all just on a mobile platform as we have. So no one really understands what technologies we need built. So having the Tech Platform allows us to control our own destiny, innovating faster than we could by just using other people’s technology. It also gives us an opportunity to be a low cost operator and being a low-cost operator typically becomes a competitive advantage. So we can innovate faster. We have better unit economics. […]

A lot of people will ask me do you want to be an enterprise company or do you want to be a consumer company? I do want to be 100% perfectly clear. Our mission is consumer focused, is to help our members achieve financial independence to realize their ambition and everything we do is to serve them. The Tech Platform needs to serve us well so we can serve them well. It just so happens the tech we are building is world-class and other people need it and so we can make money off it, which improves our returns, but it will always be to serve our end mission of a company.

To me, this highlights that the needs of SoFi will always supersede the needs of other clients. If they can cross sell an offering to other businesses and supplement revenue they will, but it seems SoFi will always be their most important client. Again, this helps give a framework to analyze whether the tech platform is delivering on its must important functions.

Conclusion

I didn’t cover everything that Noto talked about, but these were the parts that stuck out to me the most. Feel free to ask any questions or tell me what stood out to you in the comments section.

Subscriber update

Thank you to everyone who has become a paid subscriber. After the last article, I went from 42% of my tier 2 goal to 53%. As a reminder, I plan on ramping my content output as paid subscribers increase. Here are the content tiers:

Tier 1 – About 2 articles/month on the Substack. This is the level I’m comfortable at for now with what I’m making.

Tier 2 – A minimum of 4 articles/month on the substack

Tier 3 – Add a Weekly Twitter Spaces where I can engage better with followers and answer questions people may have

Tier 4 – I’ll start a Youtube channel and do at least one weekly video. Some ideas I have for the channel would be to present my articles as videos, discuss the basics of options, how I approach portfolio building, finances, my overall investment philosophy, a “Fundamentals of SoFi” series to lay out key concepts of the company, etc.

Disclosures: I have a long position in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Good research digging up the different payback comments CEO Noto made.