SoFi is going to crush 2024 estimates because of student loans

It’s been almost 3 months since I wrote a piece on how the end of the student loan moratorium was going to affect SoFi. There have been a few moving pieces since I wrote that article, so I’ll go over what has changed in the last 3 months and then proceed to give my updated analysis based on those changes. A lot of effort went into this analysis, so hopefully this is helpful to SoFi investors.

State of DDI Announcement

Before I get into it, I want to do a quick state of Data Driven Investing. Feel free to skip this section if you want to and go straight to the analysis below.

I moved from Seeking Alpha to Substack in April for a few reasons. First, I wanted the ability to publish whatever I wanted without an editorial staff to tell me what is and isn’t allowed. Second, I don’t like having my work behind a paywall. Third, I hoped to build a following that would make it worth it financially to do this.

The first two have been awesome. Counting this article, I’ve published 18 pieces on the substack, and it’s really nice that I can just share them freely with everyone. However, the truth is that it is taking me a lot more time each week than I used to spend and I’m making less. On Seeking Alpha I published 1-2 articles a month and I made more than I make here publishing weekly. I understand that it takes time to ramp, but had I published these articles on Seeking Alpha, I conservatively would have made over 5x for the same amount of work. It’s also not as much about the compensation as it is about whether doing so much work is worth the time it takes away from my family. If I’m doing that, it needs to be worth it.

I also realize that up to today there was literally no benefit to being a paid subscriber here on Substack or subscribing to my patreon compared with being a free subscriber because everything I publish is free. I don’t want to paywall my articles. If I did, it would probably be ones like this where I know the level of analysis is deeper and more thorough than what you find elsewhere. I also simultaneously realize that I need to provide an incentive for people to subscribe. So here is my proposed compromise.

First, I’m going to set up a private group chat for paid subscribers on X (formerly Twitter) or a Discord server if that is what people prefer. Second, I will ramp my own output of content in proportion to how much I make doing it. Doing an article every week right now is just not worth the time it takes away from the wife and kids. I hope that if my content is valuable then people will want more of it and be willing to help make that a reality. If not, then this will remain more of a hobby rather than what it is right now, which is almost a part-time job. Honestly, I’m good with it either way.

Here are the tiers as I imagine them right now. I’d also love feedback from subscribers and followers about what you want to see most from me, and I’m willing to change up what type of content falls into the different tiers depending on the feedback I get.

Tier 1 – About 2 articles/month on the Substack. This is the level I’m comfortable at for now and that I consider more of a hobby.

Tier 2 – A minimum of 4 articles/month on the substack

Tier 3 – Add a Weekly Twitter Spaces where I can engage better with followers and answer questions people may have

Tier 4 – I’ll start a Youtube channel and do at least one weekly video. Some ideas I have for the channel would be to present my articles as videos, discuss the basics of options, how I approach portfolio building, finances, my overall investment philosophy, a “Fundamentals of SoFi” series to lay out key concepts of the company, etc.

I have preset levels of annualized monthly income for each of these tiers. I’ll give an update in each article about progress towards those goals. Right now I’m at 42% of what I’d need for Tier 2.

Ok, on to the analysis.

News

Some things have changed or need to be reiterated since the last time I wrote about the student loans. Let’s cover all the news briefly that I’ll be factoring into my analysis.

The Supreme Court struck down student loan forgiveness

There will be no forgiveness of $10,000-$20,000 of student loans as the Supreme Court ruled that the Biden Administration’s student loan forgiveness program was unconstitutional.

Interest accrues this week and payments resume in October

Interest will begin to accrue on student loans again this Friday, September 1. Payments will be due starting in October.

Treasury yields have hit new highs.

The 5-year and 10-year treasury yields are higher now than they’ve been since before the Great Financial Crisis.

Saving on a Valuable Educations (SAVE) Plan details announced

According to the administration this plan could lower, or even eliminate, monthly loan payments for more than 20 million borrowers. We’ll cover the details of the plan below, but this is a rebranding and revamping of what was previously known as income driven repayment.

A 12-month on-ramp to repayment has been established

Running from October 1, 2023 to September 30, 2024, there are no repercussions for missing monthly payments on federal loans other than interest accruing on student loan borrowers accounts. Per the White House press release, “borrowers who miss monthly payments during this period are not considered delinquent, reported to credit bureaus, placed in default, or referred to debt collection agencies.”

What the news means for SoFi

Forgiveness

My rough estimate from my last article was that something around 35% of potential SoFi borrowers would have qualified for student loan forgiveness and that would have moved the average loan size from around $70,000 to around $65,500. No student loan forgiveness means that originations will be something like 7% higher than they would have been with forgiveness.

The SAVE plan

This one is a little more nuanced and requires some extra background, which I’m happy to provide. The new SAVE plan replaces the old income-driven repayment (IDR) plan. Under the SAVE plan, monthly student loan payments are capped at 5% of discretionary income for undergraduate loans and 10% for graduate loans (it used to be 10% across the board). So if a borrower doesn’t make a lot of money, they do not have to make their full payment every month. If their income is below a minimum threshold, their payment will be $0. Furthermore (and I believe this is new), additional interest does not accrue on the loan if the monthly payment is made, even if that monthly payment is $0 according to the plan. After 20 years on this plan for undergraduate loans or 25 years for graduate loans, student loan debt will be forgiven. This is only 10 years for a “qualifying public service employer”.

So how does this affect SoFi borrowers? Discretionary spend is defined as income above 225% of the federal poverty guidelines (this used to be 150% under the old IDR plan). I’ve posted the poverty guidelines table here for quick reference:

You can run as many scenarios as you want, but I think most potential SoFi borrowers will not qualify for IDR. Average US family size rounds down to 3. The federal poverty line for a family of 3 is just under 25k. So for the average family, discretionary spend is anything they make above $56.25k. SoFi’s student loan borrowers average salary is $173k, so that would leave them with $113.75k in discretionary income. That means their payment has to be over $488/month to qualify for IDR as an undergrad or over $975/month if they have grad loans. For a single person, those numbers are $584 or $1168, respectively. The vast majority of SoFi’s refinances are for graduate loans.

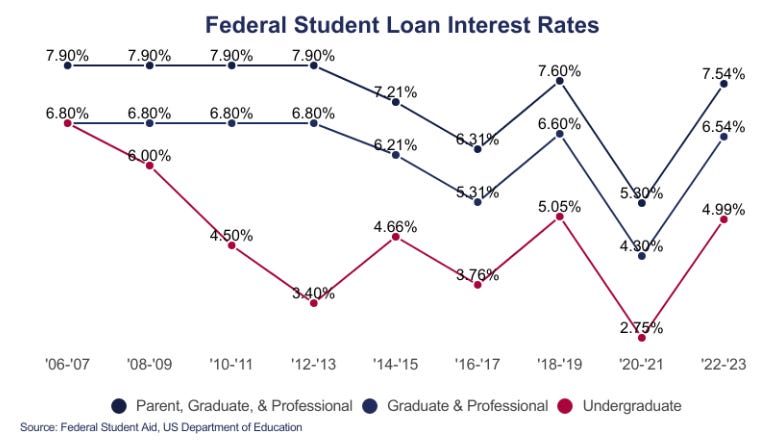

Federal student loan interest rates can be seen in the chart above. Direct graduate loans are the lower of the two graduate loans and graduate PLUS loans are the higher. Graduate students qualify for around $20k/yr in direct loans, after which they can get a PLUS loan to any limit to cover attendance for their program. All federal student loans have a 10-year term. A $70k loan even at a 7.9% interest rate results in a monthly payment of $846, so even with a family of 3, the average SoFi borrower doesn’t qualify. A single person would need loans over $100k to qualify. Some potential customers will qualify for SAVE, but most of them will not. If it's a dual-income family, it is even less likely that they will qualify.

Treasury Yields

The primary source of student loan originations is refinancing existing loans. Increasing rates decrease the amount of people that will benefit from refinancing and will result in a lower total addressable market (TAM) and in lower student loan originations than if rates had remained low. Anthony Noto addressed this directly in the Credit Suisse conference on November 30, 2022:

As I mentioned, we were doing about 2.4 billion [student loan originations] in the fourth quarter of 2019. We still think there's a really big TAM with rates up as high as they are now. It's a $200 billion of TAM that people would save in student loan financing in our credit box today. And so, we think we can get back to the high ones low twos on a normalized basis when payments resume.

Student loan rates move approximately with treasury yields. Treasuries are now 0.6% higher than they were in November when Noto gave that quote. That means the TAM is now smaller than it was and originations will probably be less than they expected at that point. On the other hand, SoFi always sandbags the numbers they state publicly, so we should also take that into account.

The On-ramp

The on-ramp plan basically removes all the teeth from not paying back your loans. If borrowers choose not to pay their loans, it won’t affect their credit scores, they won’t be delinquent, and their loans won’t be sent to collections. The administration removed every negative consequence from missing payments except for accrual of interest. Given that many prioritize the short term over the long term, I think there are going to be a lot of people who just don’t pay their loans and will gladly accrue interest in exchange for not being forced to change their current lifestyle and spending habits.

Part of the what SoFi was counting on in their estimates is that some people would elect to refinance their loans for a longer term to lower their monthly payments. They stated this publicly. For example, a $70,000 loan with a 7% interest rate with a 10-year term has a monthly payment of $813. The borrower might instead choose to refinance at 8% but with a 20-year term so that their monthly payment decreases to $586, even if it costs them more in the long run. I think the on-ramp program incentivizes this type of person to just not pay their loan at all rather than refinance, which will decrease originations.

Let’s get to the numbers

I’ll break this section into originations, net interest income, noninterest income, and EBITDA.

Originations

Noto spoke of “high ones to low twos on a normalized basis”. At the time, that means he expected to see something like $1.7B-$2.3B in quarterly student loan originations. Despite the fact that SoFi always gives very conservative numbers publicly, higher rates and the on-ramp program are a much bigger drag on originations than the slight bump from forgiveness being ruled unconstitutional. Despite the fact that SoFi now has almost 6x the number of members they did when the moratorium began, I think $1B-$1.5B/quarter is more realistic until rates begin to fall.

Net interest income

The spread between what SoFi pays for their deposits and their weighted average interest rate earned on student loans has been shrinking every quarter. This is because their weighted average cost of capital, or WACC, ramped from 1.34% in 1Q22 all the way to 4.34% in 2Q23. All the while, the depressed originations in their student loan business means they weren’t able to refresh their student loans with new loans at higher APRs. The consequence is that they are barely making any interest income at all on their student loans right now.

Currently their overall net interest margin, or NIM, on student loans is a paltry 0.59%. Fortunately, newly originated loans have a much higher interest rate than the existing portfolio. With a lot of effort (seriously, sussing out all the information I needed to make this calculation took a while), I’ve managed to back out that the weighted average interest rate of newly originated student loans was around 8.0% in 1Q23 and 8.3% in 2Q23. Those numbers are not exact because there are some assumptions I have to make in the calculation, but they should be close. That means their NIM on newly originated loans in the last two quarters at the time of origination is around 4%. If originations pick up then they can refresh their loan book by selling old loans, and interest income from student loans will accelerate meaningfully. WACC should also decrease as they grow deposits and since rates should not be rising significantly moving forward.

Noninterest income

Historically SoFi gets 4% gain-on-sale margin (GOSM) on their student loans. That means when they sell a tranche of loans with $100M of remaining principal, the buyer pays $104M for them. However, rising rates have hammered the value of long-term assets like student loans. Who wants to buy loans with a 4% APR and risk losing money on defaults when you can get 5.25% risk free from the Fed? That’s right, nobody. SoFi’s loans that were originated during the ultra-low-rate times in 2021 and 2022 are going to be hard to sell until rates come back down. In fact, the fair value of SoFi’s student loan portfolio is now actually less than the remaining principal of those loans. That means that right now, if they sold their student loan portfolio, they’d be worth less on the open market than the remaining amount that the borrowers owe SoFi.

There is one huge caveat here, which is that SoFi management was prudent enough to hedge their loans. Thank heavens they did. SoFi knows that their costs are variable and highly dependent on the movement of the Fed Funds rate, even though their student loans are almost entirely fixed rate loans. SoFi did not want to be left holding the bag if rates went up, increasing their interest costs, while interest received stayed flat. They are smart, so when SoFi was originating those loans in 2021 and 2022, they also bought hedges. Those hedges mean that while the nominal interest rate they are collecting on the loans might only be 5% as shown in the chart above, the amount they earn from the hedges compensates for the loss in fair value of the loans as interest rates have risen. If you want to learn more about how their hedging strategy works, I wrote about it here. The point is that they made sure they would recoup any costs from rising rates in other ways. Incredibly, SoFi has managed to keep their GOSM including their hedges at 4% throughout the entire rate hike cycle.

A couple quick notes on this chart.

The 3Q22 loans sold were variable rate loans, so they were unhedged and that is why the GOSM was the same with and without hedges.

There were no student loan sales in 4Q22 or 1Q23, which is why those quarters do not appear on the chart. I'm not cherry picking data, this is all the data we have.

These are not available in the 10-Q, so we are relying on management commentary in the earnings calls to get these numbers, which is why they are such round numbers. They also often say things like "more than 4%", which I just put down as 4%.

That’s a lot of detail on noninterest income, but there are two main takeaways. First, newly originated loans should maintain a GOSM of around 4%. Second, SoFi can still make a profit when they offload existing loans at their fair value, even if that fair value is less than the currently remaining principal on the loan. They were smart enough to hedge those loans so that even if they sell at a loss without the hedges, they are still selling at a gain including the hedges, like they did in 2Q22.

EBITDA

The student loan business is already fully built and ready to go. There are minimal scaling costs here and the entire product is already fully integrated on their in-house tech stack. The student loan business is like a Porsche that has been stuck in bumper-to-bumper traffic for over three years. It’s a well-tuned machine that was built for a scale of at least 10x where it has been operating. That means that the incremental cost to go from $400M-$500M originations per quarter to $2B-$4B is almost nothing. SoFi’s student loan Porsche is finally within eyesight of the Autobahn. The margins on this are going to be very high, and should be easily around or above the 60% contribution margin that the lending segment has been delivering through the past year. Management guides for 30% of incremental revenue to drop to the bottom line, so my calculated EBITDA margin is 30% of incremental revenue.

A Bearish, Baseline, and Bullish Simulation

Ok, so using all this information, let’s construct a few scenarios about what could happen moving forward. My model has gotten a lot more sophisticated since the last time I did this, especially when it comes to NIM. I also found a few errors in the calculation that have been corrected.

Bearish

For a bearish scenario, I assume that they only have $1B in originations in 4Q23 and only grow originations by 6% each quarter, which is lower than their member growth. I also assume and that the balance sheet stays stagnant at $5.5B of student loans, which is about where it is now. I assume their NIM on newly originated loans is only 3%, and that they only get a 3% GOSM, both of which are well under their historical and recent marks. Finally, I’m also assuming only 50% contribution margin, which is a lower margin than they’ve ever posted as a public company.

Baseline

For the baseline scenario, I assume a starting point of $1.3B of originations in 4Q23. I assume 8% QoQ origination growth, which is in line with their member growth and assumes no benefits from any movement downward in rates. For the other variables, I assume 4% GOSM and 3.75% NIM on new originations, 58% contribution margin, and a small growth in the balance sheet to $6B by the end of 2024. All of these numbers are in line with or below historical norms.

Bullish

The bullish scenario assumes $1.6B in 4Q23, 10% QoQ origination growth, 4% GOSM and 4% NIM on new originations, a 65% contribution margin and the balance sheet grows to 7.5B by the end of 2024. The 10% origination growth and higher NIM would be the expected result if there are rate cuts in 2024. Even with this bullish scenario, the originations in 4Q24 are still less than what SoFi had in 4Q19, so this really isn’t that much of a stretch.

I’m taking my calculated numbers and comparing them to what I calculate SoFi earned from student loans in 2Q23, which was 4% GOSM on $400M of originations with a 0.59% NIM on an ~$5B loan book to figure out what the incremental revenue and EBITDA are. Here are the results:

So even in the bearish case of historically low NIM, GOSM, margins and very low originations, we are looking at an extra $156M in revenue and $23M in EBITDA per quarter. Every one of those assumptions are extremely unlikeley, but even if they all happen, that’s a free 8% growth rate in revenue and 7% growth in EBITDA. Most banks would be very pleased with those results.

The baseline numbers, which I consider conservative, would result in $310M of incremental revenue and $54M in incremental EBITDA (and hence, $54M in extra net income) for FY2024. As a reminder, SoFi guided for about $2B in revenue for FY2023 and to break even on GAAP net income in 4Q23. Analysts are forecasting $2.53B in revenue and an EPS of $0.03 for all of 2024. In other words, with the baseline scenario, student loans would cause them to beat full year EPS and provide 60% of expected revenue growth for the year. The bullish numbers would give $0.09 cents of EPS on their own and results in 20% YoY revenue growth for the entire business. Earnings and revenue estimates provided by Yahoo! Finance are included below.

Conclusion

Most people have no idea how much SoFi will get back when the moratorium ends. This was their bread-and-butter business and it’s going to be a huge catalyst for the company. I invest in businesses, I don’t buy stocks. Specifically I like to invest in businesses that are misunderstood, because the difference between expectations and actual performance is where you make the most money. SoFi is set to blow 2024 Wall Street expectations out of the water on the strength of their returning student loan business.

Disclosures: I have a long positions in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Do a twitter sub! I will follow u there in a heart beat! Please don't do a discord! Substack has a great chat and messaging service.

Subscribed!