Is SoFi's "AWS of Fintech" a total flop?

Alright, in my last article, I promised a deeper dive into the technology platform and the post-earnings vibes. I was—luckily or unluckily—off the grid the week after earnings. The SoFi community had a massive meltdown about the tech platform and its lack of growth. That was exacerbated by the fact that Robinhood, Affirm, and Upstart—three SoFi fintech competitors—popped 14%, 22%, and 32% on earnings, whereas SoFi had dropped 10%. There’s nothing worse for sentiment than watching competitors’ stocks soar to the moon while your investment languishes in no-man’s-land.

Here were the arguments I saw pop up again and again that I’ll discuss:

The tech platform is horribly underperforming.

There is no clarity on what is going on behind the scenes.

SoFi will never get a hybrid multiple until we see some growth in the tech platform.

Underperformance

SoFi’s tech platform is primarily composed of two large acquisitions. The first was the purchase of Galileo in 2020, followed by Technisys in 2022. These have been folded into a single entity under the Galileo moniker, a wholly owned subsidiary of SoFi. SoFi often touts their vision for Galileo to become the “AWS of fintech.” In fact, the very first article I ever published here was about that vision. If you want a refresher on what the tech platform does, I’d suggest revisiting that article and reading the section titled “Three Pillars of SoFi's Technology Segment”. Even back then, two years ago in April of 2023, this is what I had to say about Galileo’s execution.

However, the last year has raised questions about the long-term viability of the business across the entire business cycle and exposed their reliance on neobanks. SoFi's other segments have flexed their muscles and shown strength in a tough environment, but the same cannot yet be said for their "AWS of Fintech" offering.

Plenty of data shows the tech platform hasn’t met the expected standards.

Technisys Guidance

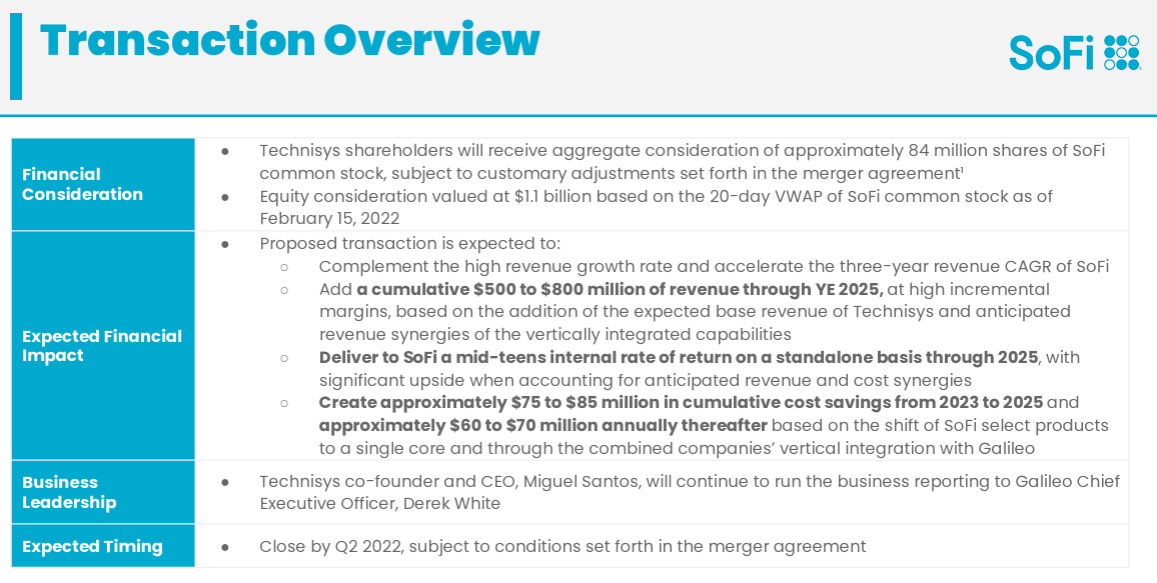

When Technisys was acquired in 2022, they claimed it would add $500M-$800M of revenue through year-end 2025.

While it’s impossible to pinpoint exactly how much Technisys has contributed, we can make a decent approximation. Let’s assume Galileo’s existing payment issuing and processing grew by about 8% annually since the acquisition (which is probably a low estimate), with all additional tech platform growth coming from Technisys. If so, through the end of 2024, Technisys has added roughly $334M in revenue. To hit the midpoint of their 2022 acquisition guidance ($650M), they’d need about $315M in 2025 growth alone.

It’s safe to say that won’t happen, and at this point, even reaching the low end ($500M) seems a huge stretch. We’ll never know for sure, though, because SoFi doesn’t break out revenue from legacy Galileo products (like payment processing and card issuing) versus legacy Technisys offerings (like the banking core). Investors gave up over $1B worth of dilution to make the Technisys acquisition happen. We should at least be able to tell what we’re getting for it and we can’t.

Goodwill impairment

When a company makes an acquisition, goodwill is the amount paid above the fair market value of the acquired company’s net assets. For example, if you buy Company ABC for $100M but its net assets are worth only $70M, you assign $30M to goodwill, representing intangible assets like brand, expertise, or intellectual property, and carry it on your balance sheet.

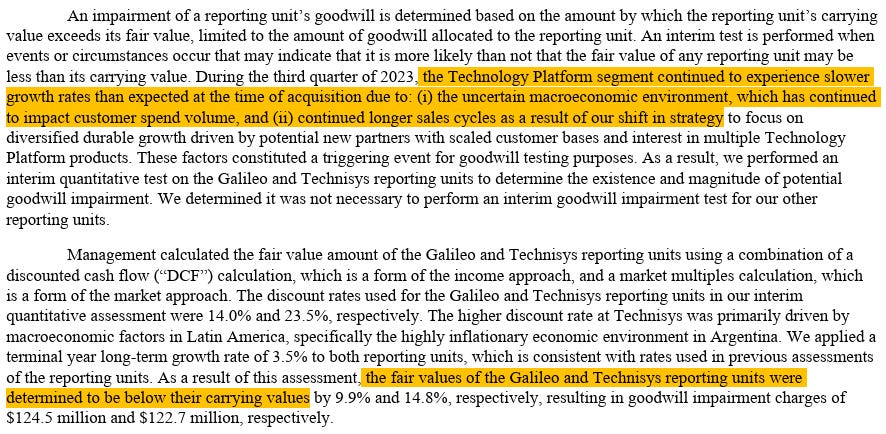

Periodically, you must reassess that goodwill’s accuracy. If the acquired company underperforms, you write down its value. In Q3 2023, SoFi took a $247M goodwill impairment tied to both the Galileo and Technisys acquisitions. The 10-Q for that quarter explains why, and I’ve pasted it here with key portions highlighted:

This came just a year and a half after the Technisys acquisition. Already at that point, the tech platform had underperformed SoFi’s own projections and expectations. The growth rates were low enough that they had to take away $247M worth of value off the goodwill they’d initially assigned to those acquisitions (a $124.5M impairment of the Galileo acquisition’s goodwill and a $122.7M impairment to the Technisys acquisition’s goodwill). There’s also a small risk of further impairments if underperformance continues. If that were to happen, it would be a direct one-time hit to the GAAP net income during the quarter where the impairment occurs, causing an earnings miss.

2024 Guidance Miss

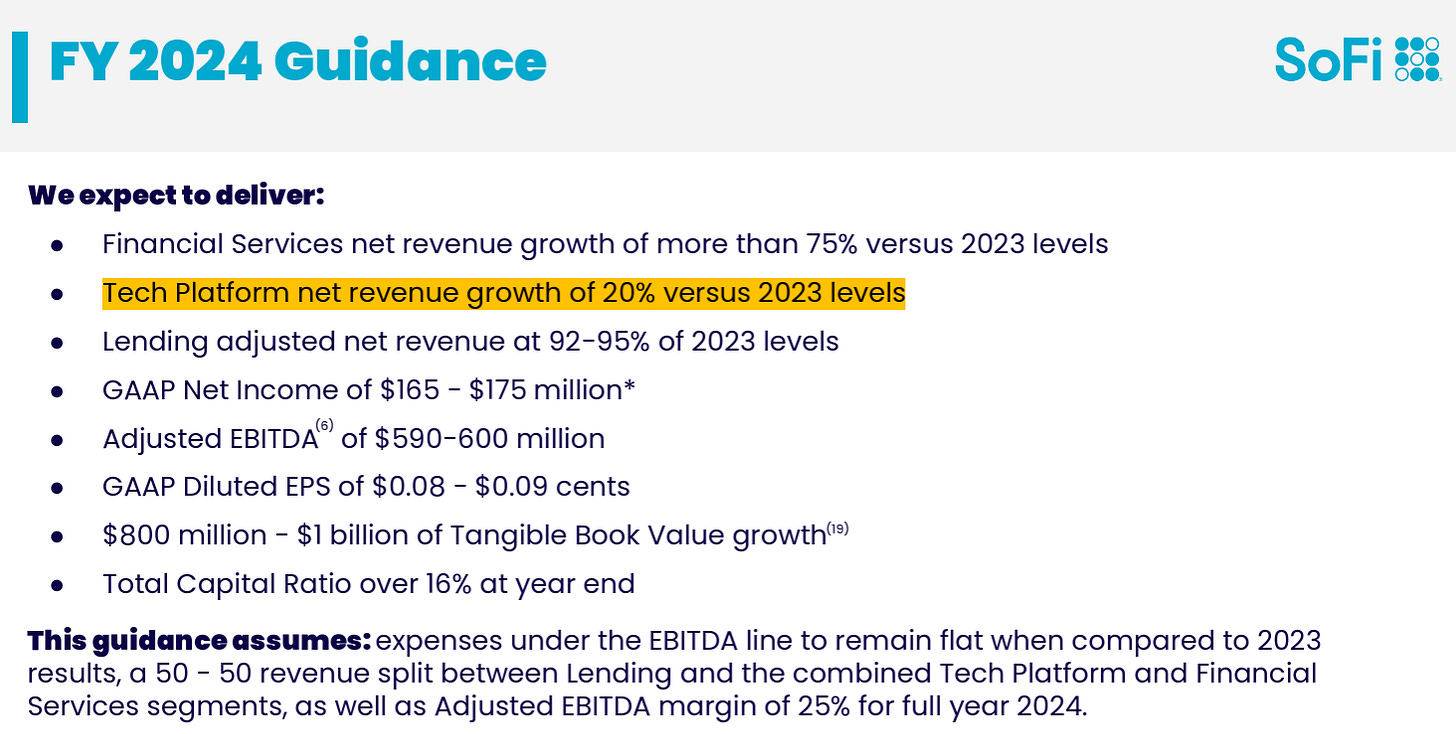

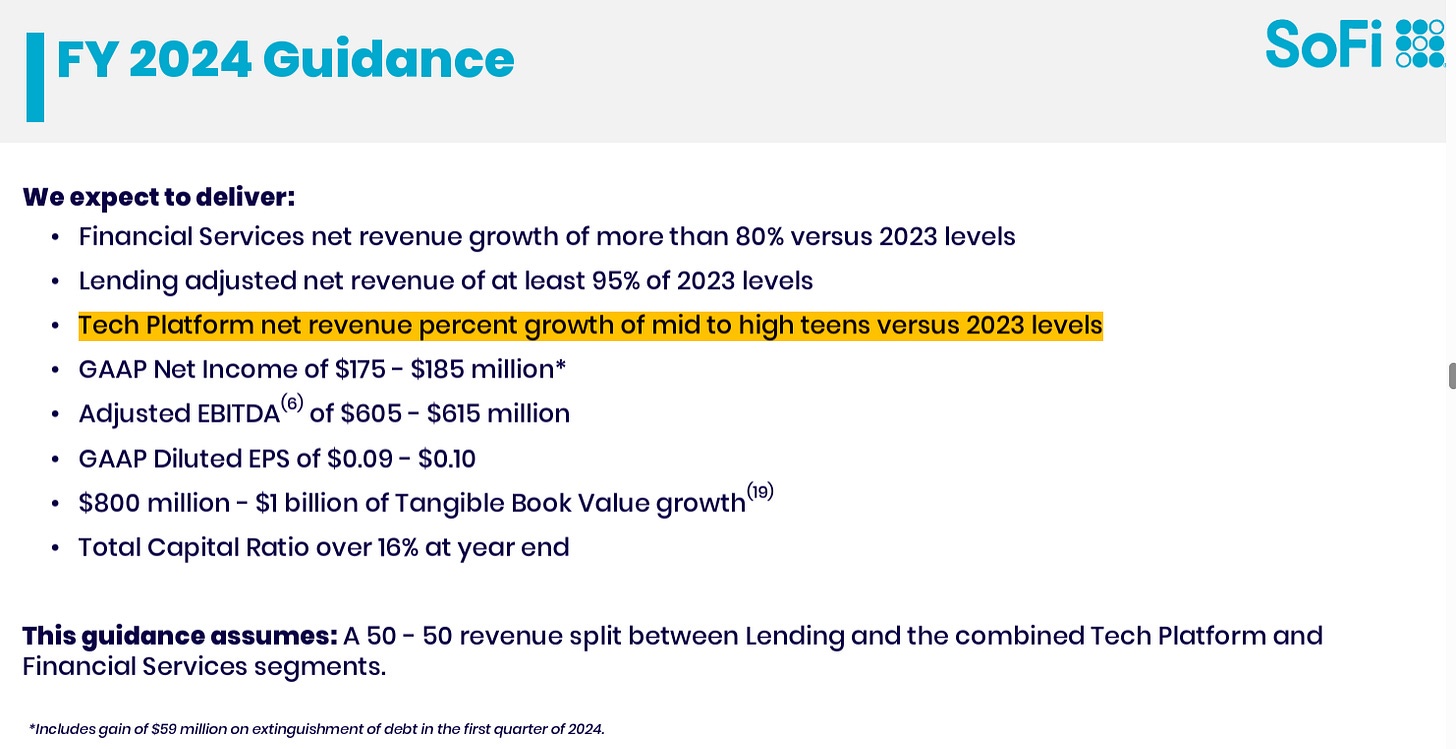

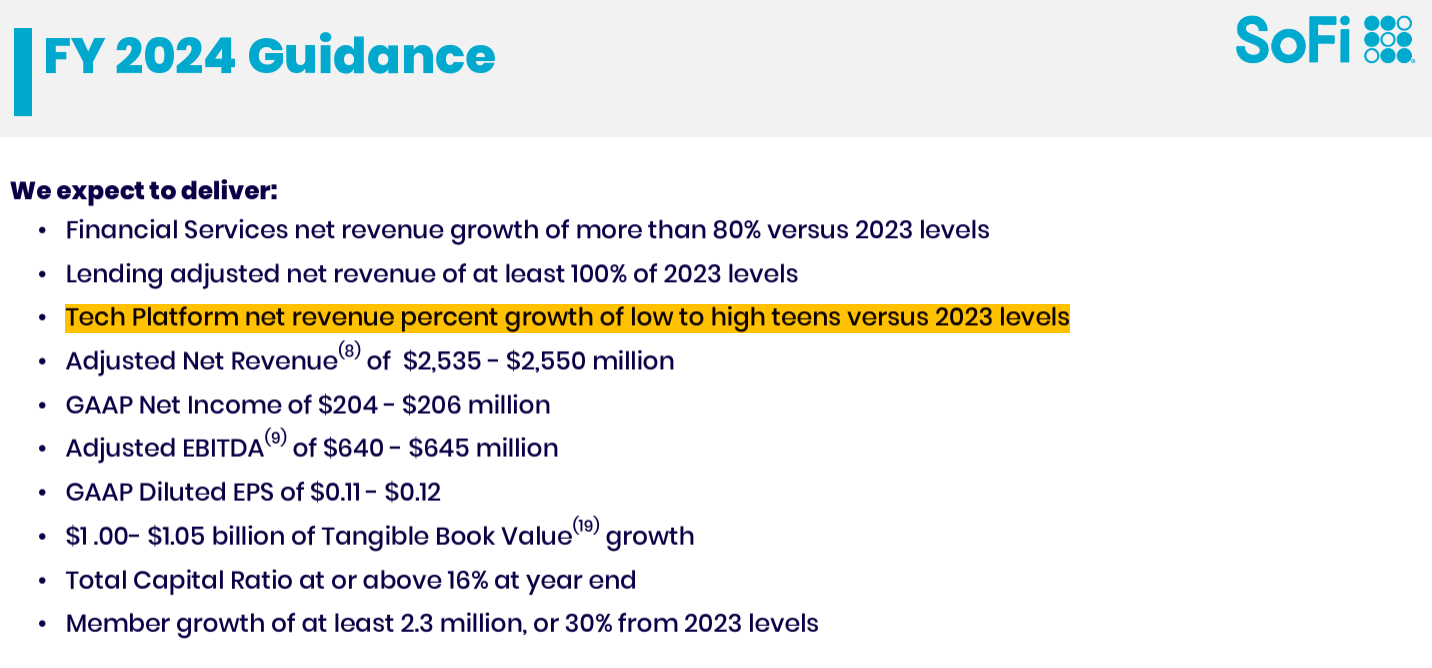

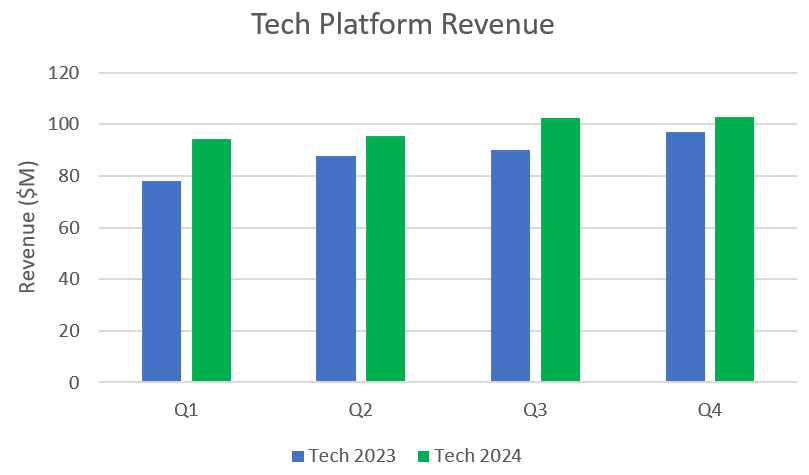

SoFi has never missed their overall guidance for any quarter in their history as a public company. Last year, they provided segment-specific guidance for their lending, financial services, and tech platform segments. While they crushed financial services and lending targets, they missed tech platform guidance by a wide margin. In their Q1 presentation, even after one quarter of the year, they said they expected 20% growth from 2023 levels.

In Q2 earnings, that guidance changed to “mid to high teens”

In Q3, it dropped again to “low to high teens”

2024 tech platform revenue ended up at $292.3M, a 14.45% increase from the 2023 levels of $255.4M, firmly in the mid-teens range. It isn’t just that the tech platform growth is low relative to investor expectations, it’s that it was low relative to their own expectations. Something shifted significantly between April’s 20% projection and year-end reality, and investors deserve a clearer explanation of what changed. Unlike the rest of the business, SoFi seems unable to accurately project the revenue they will receive from Galileo. This seems particularly concerning given that many of these contracts should have been negotiated prior to issuing guidance. Ostensibly this should make the tech platform one of the easier segments to guide for.

Communication

I like management teams that take radical accountability for both their successes and failures. SoFi didn’t hit their guidance, and actually, that isn’t really too big of a problem because they had other parts of the business that outperformed. Stuff underperforms sometimes. You can’t have everything hitting on all cylinders all the time. However, when something does underperform, I think you owe your investors a better explanation than “extended sales cycles”, which is essentially the only explanation that we’ve received. I realize that it is considered a faux pas in business to highlight your failures, but it’s something that I, personally, think is a differentiating factor that makes management teams truly exemplary.

Earlier in this article I said it was impossible to tell exactly how much Technisys has added in revenue since the acquisition. That fact highlights my biggest complaint and my biggest criticism of the tech platform. There is a dearth of information and lack of transparency in this underperforming segment. I even asked a question about this in the 2023 investor Q&A. It was one of the top voted questions, but was not answered. I realize that there are things that cannot be disclosed with regards to the contracts that are signed by Galileo. But to blame the lack of information investors receive on non-disclosure agreements is a cop out. There are plenty of easy ways to share more data while still honoring their NDAs.

A big portion of my frustration with Galileo stems from not knowing what’s going wrong—I can’t tease it out from the data because that data is nonexistent. This is a business that has a $400M+ annual run rate and yet the only numbers investors get to see are total Galileo accounts (which doesn’t include Technisys at all), total revenue, contributions profit, and intracompany revenue. That’s basically it.

I cannot tell why it is underperforming. Is it that existing Galileo partners are struggling to sign up new members? Is there a lack of new fintech partners signing up? Is total payment volume from their existing partners down? Are the number of banks using Cyberbank Core increasing or decreasing? How many platforms (like Toast) are using them? Do they have additional retail partners out there like the Wyndham hotels deal that we don’t know about? How many credit unions, regional banks, national banks are using Cyberbank Core? How many of those are domestic vs. international? I have opinions about the answers to these questions, and we have vague commentary about some of the answers, but I have no data to back any of it up. It’s all just opinions, and opinions are noise.

There is a significant amount of data they could share without violating non-disclosure agreements but they choose not to, and at this point it is a deliberate choice. As a shareholder, Galileo is a total black box, and that’s really frustrating. Communication is something that is totally within their control, and I’d appreciate a lot more clarity. The Loan Platform Business, nonexistent before Q3 2024, already offers more data and transparency than the tech platform, which predates SoFi’s 2021 public debut. I’m not ok with that.

This should not have caught anyone off guard

Just a quick observation. I saw a ton of consternation about the tech platform after Q4 as if this took people off guard. Q4 Galileo results were poor, with a smaller YoY growth rate than any of the previous three quarters of the year. However, this has been a problem for much longer than that. After Q2 of this year, I put the tech platform in the penalty box and said “I will not be fully convinced until I see four straight quarters with 15%+ YoY growth.” If Q4 was the first time you noticed a problem, you haven’t been paying attention.

Mitigating Circumstances

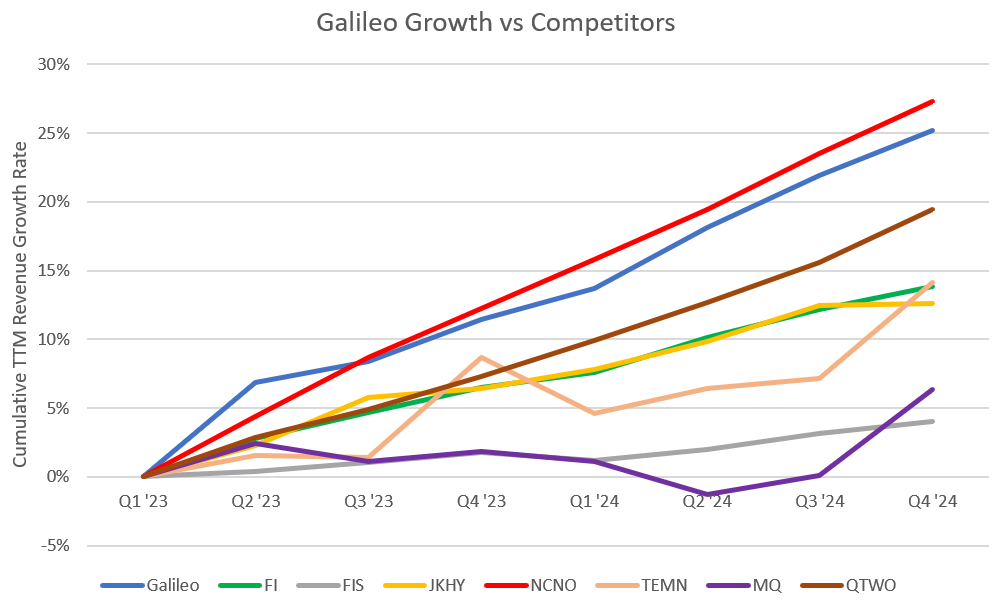

Ok, all that being said, there is some broader context that I’d like to add to the discussion that I don’t think has been covered anywhere else. If you look at Galileo’s results in a vacuum, especially compared to the rest of SoFi’s business, they are underwhelming. However, businesses don’t operate in a vacuum. Galileo powers SoFi’s own offerings as well as generates revenue from other third parties like Robinhood, Chime, Dave, etc. To get an idea of whether Galileo really is struggling, we need to zoom out and consider how they are doing relative to their competitors. Galileo primarily provides banking-as-a-service (BaaS) offerings, card issuing, and payment processing. Let’s see how their growth compares to others who offer similar products.

A comparison with their competition

There is no one-for-one competitor with Galileo, but several companies overlap significantly. Marqeta (MQ) is an issuer processor, nCino (NCNO) is a BaaS and banking core provider, Fiserv (FI), Fidelity National Information Systems (FIS), and Jack Henry (JKHY) all offer some combination of core banking systems, payment processing, digital banking platforms, and merchant services, Q2 Software (QTWO) provides cloud-based platforms for online and mobile banking, and Temenos (TEMN on the Swiss stock exchange) is a digital banking core provider. Again, none of these are perfect comps, but they provide a pretty wide range of publicly traded companies to compare against.

We only really have revenue from Galileo, so that’s the only metric we can use to compare Galileo’s growth with its competitors. A couple quick points of clarification so that this data has the proper context. First, Marqeta changed the way they count revenue in the last couple years, so I’m going to use gross profit growth for them as a proxy for revenue growth because gross profit remained consistent through the change. Second, FIS sold off their merchant solutions business, so I’ve subtracted that out from some prior quarters where it would have been applicable. Third, some of these businesses experience seasonality, so we’ll use trailing-twelve-month (TTM) revenue to smooth that out. Last, it would give an unfair advantage to Galileo if we started before the Technisys acquisition, which was completed in Q1 2022. Therefore we’ll compare TTM revenue growth of each company starting in Q1 2023.

Galileo’s 25.2% cumulative TTM growth ranks second, behind nCino’s 27.3%. Of these seven companies, TEMN, NCNO, MQ, and Galileo have approximately the same magnitude of revenue/gross profit, JKHY is slightly larger, and FI and FIS are significantly larger. You would expect the smaller companies to be able to scale more quickly, but this still highlights that relative to their competition, SoFi’s tech platform has actually done quite well.

One reason for the fairly anemic growth across the board is that the rate hike cycle in 2022 had a huge cooling effect on the fintech industry at large. Galileo’s bread and butter prior to that was to sign up new fintechs and neobanks and help them scale quickly. However, funding for those companies dried up in 2022. As a result the growth strategy pivoted to target larger existing fintechs, banks, platforms, etc. This means longer sales and implementation cycles. A recent Bloomberg article with Plaid’s CEO Zach Perret contrasted the last few years in fintech with what they expect in 2025, putting it this way:

[It] was a lean time for most fintechs, particularly those that serve consumers. As interest rates increased after the Covid-19 pandemic, fintech funding dried up and borrowing suddenly became drastically more expensive. […]

“There’s just this truly renewed sense of optimism going into 2025,” Chief Executive Officer Zach Perret said in an interview. “It’s way more fun to operate in fintech spring than it was to operate in fintech winter.”

Galileo and their competitors slow growth the last several years is confirmation that they were also hit by the fintech winter. Hopefully they begin to see the same green shoots of a fintech spring moving forward, although the recent uncertainty brought about by Trump’s tariff announcements could have a similar chilling effect as the rate hike cycle. Galileo is a US-based company and only sells digital products, so tariffs don’t affect them directly. However, the uncertainty and resulting chaos has left many companies hitting pause on their plans until the macroeconomic picture has more clarity.

Just a bank rears its head again

Those who are familiar with my work know that it frustrates me to no end when SoFi gets referred to as just a bank. The reason it bugs me so much is that it’s just lazy analysis. It’s a soundbite, not a cogent argument. SoFi investors constantly hear about how it’s just a bank, and therefore deserves a bank multiple (meaning it should trade on a low multiple of its price/book value ratio or in the single digits on a price/earnings ratio). Moreover, you’ll often hear about how a fintech multiple hinges on tech platform growth.

Those are all stupid arguments for a number of reasons. I won’t go into detail about all of them, but I do I want to highlight that that last argument is particularly idiotic. Saying a “fintech multiple” is totally dependent on Galileo growth is a completely arbitrary standard that for some reason people apply to SoFi but do not apply to anyone else. Think about Robinhood, Affirm, Upstart, Pagaya, Nubank, Shift4, Toast, or even Paypal or Block. How many of these companies would you refer to as a fintech? I would call all of them fintechs, as would most people. Yet how many of these companies sell the backend software they use for their own products to other companies as a SaaS offering? I am not aware of any of these other companies selling their software as a service.

Think about how illogical this is. If you build a technology that allows you to sell your own digital financial services, you can be anointed fintech and receive a high valuation multiple. But if you build a technology that allows you to sell your own digital financial services, and in addition to that, you sell that technology to third parties, you can be a fintech if and only if your third party offering is growing quick enough. Can you see the logical disconnect there?

Think about this scenario. Say that tomorrow, Robinhood chooses to license its software and clearing house to allow other brokerages to run on Robinhood’s backend. Let’s call that service Da Vinci and say that it’s immediately a ~$300M/yr revenue business in 2025. Let’s say that in 2026, their core business that exists right now were to grow at, I don’t know, 28.6%, but Da Vinci only were to grow by 12% to $340M/yr. Would they lose their status as a fintech because this extra revenue source isn’t growing fast enough? Would that make it so that they ought to be valued as “just a brokerage” and the only way they could get a multiple higher than Schwab is if their Da Vinci software arm grew fast enough? Do you see how ridiculous this whole concept is? Was that 28.6% an oddly specific number? Yes, because excluding Galileo, SoFi grew at 28.6% last year. Galileo may have only grown at 12%, but it also enables the 28.6% growth in the rest of the business. Remember this quote from Noto (emphasis added by me):

A lot of people will ask me do you want to be an enterprise company or do you want to be a consumer company? I do want to be 100% perfectly clear. Our mission is consumer focused, is to help our members achieve financial independence to realize their ambition and everything we do is to serve them. The tech platform needs to serve us well so we can serve them well. It just so happens the tech we are building is world-class and other people need it and so we can make money off it, which improves our returns, but it will always be to serve our end mission of a company.

I want to see the tech platform compound at a mid-20s CAGR. However, if it only grows at 10% indefinitely, but allows SoFi to have better margins, faster innovation, and better serve their customers so that the business as a whole has a mid-20s CAGR, that’s still fantastic.

Perspective

Two last things to highlight how people need to have some perspective and then I’ll close.

Margins

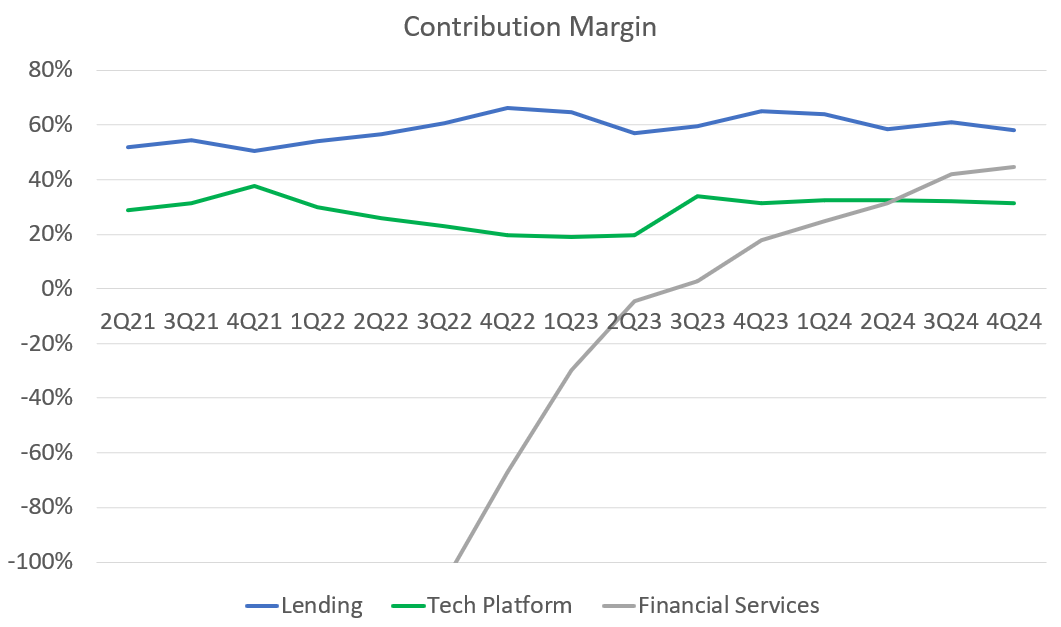

People seem to think that growth in the tech platform would lead to huge margin expansion because software margins are really high. That isn’t true. The tech platform is now the lowest margin business that SoFi operates. In other words, one dollar of revenue growth for the tech platform is worth less in profits than a dollar of growth in either lending or financial services. Here is the contribution margin of each of the business segments over time:

At the end of the day, the thing that most investors should care most about is a company’s earnings growth and the cash going into a that company’s coffers. If that describes you as an investor, and if you had to choose one segment to underperform, you would choose the tech platform. Having the lowest margin segment of your business underperform really isn’t the worst thing in the world.

Another argument bears use to justify a lower multiple is SoFi’s capital-intensive nature. Galileo is capital-light fee-based revenue that comes with lower risk. Logic argues that if that part of the business isn’t growing, then the multiple SoFi receives should be lower. However, the Loan Platform Business (LPB) is also capital light, fee based, and low risk, and its margins are significantly higher. LPB revenue is not as sexy as a “Technology Platform”, but if I had to choose between high-growth LPB and Galileo, I’d choose LPB every time. Here is why:

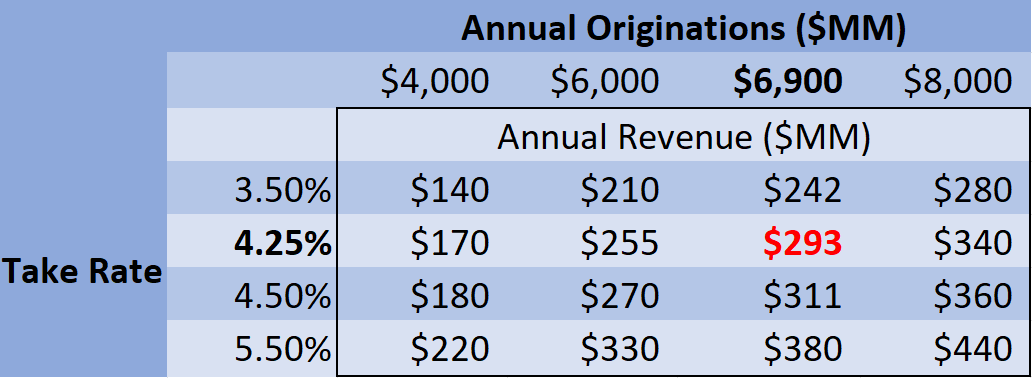

After SoFi’s recent confirmation of the Blue Owl Capital agreement, and assuming no other deals or growth from Q4 levels, the annualized origination rate for the Loan Platform Business is now $6.9B. In both Q3 and Q4, take rate was around 4.25% excluding servicing. If that holds true for the Blue Owl deal as well, it means that the LPB is now on an annualized revenue run rate of $293M. This business went from $0 to $300M in about 9 months (again, excluding servicing, which is at least another ~$5M/qtr so far). Not only that, but this is high-margin revenue, with a contribution margin north of 50%, an EBITDA margin of probably 40%+, and a net income margin of probably 30%+.

Why do I bring this up in an article about the tech platform? In order for Galileo to bring in the same amount of increase in contribution profit since Q2 2024 as the LPB is bringing in, the tech platform would have needed to grow its quarterly revenue by around $110M in the last three quarters. Remember, it’s total quarterly revenue is only like $103M/qtr total. That’s right, the LPB, by itself, is now worth more in terms of profits to SoFi after 9 months than the entire tech platform. The tech platform would need to grow at more than 100% in the next year to replicate the profits the LPB is already generating in just 3 quarters.

A comparison that people will hate.

People hate when I compare SoFi to Palantir. Hopefully they’ll be more ok with this one because I’m just comparing perspectives about the companies, not the companies themselves. They’ll probably still hate it, but I think it’s a worthwhile thought experiment.

SoFi’s tech platform is 14% of revenue and grew 12% in 2024. People’s response was to lose their minds like it’s the end of the world for the company. Palantir’s international revenue makes up 14% of their revenue and grew 4% in 2024. Karp pointed this out multiple times during their earnings call. Nobody even cares.

Does the fact that Europeans and other allies aren't adopting Palantir’s products make their technology any worse? No, that is ridiculous. Palantir's business operates on the bleeding edge of the most innovative sector of technology. They are executing at an exceedingly high level and their products and value proposition are clear. Nobody is freaking out that Palantir is "just an American company" and can't grow internationally.

Sofi's tech platform is still not completely proven commercially. However, they are powering the back end of SoFi's operations, and SoFi is taking market share in every single vertical where they operate. The business has executed at a high level for years. Yet everyone is freaking out that they are "just a bank" and can't sustain their growth. It's just plain silly.

Conclusion

I want to see better growth, more transparency, and greater accountability when the tech platform misses expectations. I want to see better communication and significantly more metrics so we can track its progress and understand what is going on behind the curtains. I am legitimately disappointed that Galileo is not performing as well as I expected and as well as SoFi expected. I know some of SoFi’s management will read this and I hope they reconsider their communication strategy surrounding Galileo’s results. But the fever that gripped the SoFi community was an overreaction. Zoom out. Have some perspective. SoFi grew total revenue by 26% overall in 2024 during their “transitional year”. Growth is accelerating in 2025. Galileo is powering SoFi’s growth even if the revenue growth from third parties could be better. Take a deep breath everyone, it's going to be ok.

Subscriber update

The DDI YouTube Channel is live. I’m still figuring out how to do everything there, but expect to see more as we go. A sincere and heart-felt thank you to those who support my work. If you do want to support my work, there are several ways to do so. You can subscribe here on substack, or on X, or, now, on YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up, or Tesla, or finchat.io for a discount on those products:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get up to $2500 off a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in HOOD, NU, PLTR, PYPL, and SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

I think you captured the most likely reason for slow growth well: "the growth strategy pivoted to target larger existing fintechs, banks, platforms, etc".

Selling into banks and larger enterprises vs. FinTechs is day and night. FinTechs are not as regulated and have smaller orgs so the sales cycle is much shorter. Selling into banks is 18+ months at a minimum. Layer on top of that longer implementation times... it could take 3 years until you see revenue.

Great insights. Regarding Galileo the strategy of shifting to capture larger customers is maybe a natural progression from securing smaller accounts. That is not to day I dont value smaller accounts,every customer is a valued customer with greater value if we consider them as lifetime accounts.

I look forward to Q1 2026 to see where ee are regarding revenue from Galileo. Hopefully this will include more corporate card revenue like the Wyndam Hotels deal.

Finally it would be great to see new business for the LPB . I am optimistic that we will see sales of lower fico business via the platform.

Finally home mortage, student loans and insurance may see hiher growth than currently expected this year going into 2026.

A lot will depend on the macro with global conflicts, tariffs and interest rates. I teresting times ahead.

Keep up your excellent analysis.