KBW's SoFi Analysis Is Historically Dead Wrong

Keefe, Bruyette, and Woods analyst Timothy Switzer downgraded SoFi to a sell with a price target of $8. Their analysis is bad. I very rarely write articles in direct contradiction to other analyst reports, but this one is so egregious, that I’m going to make exception. Let’s take a look at KBW’s track record on SoFi, and then we’ll get into this report in particular.

KBW and SoFi: A Brief History

KBW is an investment banking firm that specializes exclusively in the financial services sector. I bear no ill will toward anyone there or toward Timothy Switzer. I am certain they are doing their best to get their investors good returns and to provide good analysis. If they didn’t succeed in doing so, they wouldn’t have clientele and a business, so they are doing something right. However, I do take issue with bad analysis, and their analysis on SoFi has been nothing but hot garbage. This is a professional institution who published this research, makes money on those reports, and obviously those reports affect the companies they report on. Personally, I have nothing against them, but I will not pull my punches when I critique their professional analysis, and will include a healthy amount of sarcasm. My articles may not move markets, but I hope it helps to establish some accountability for these analysts where none seems to exist.

January 2024 Downgrade

On January 3, 2024, almost one year to the day from today, KBW downgraded SoFi to a sell. The best thing about that report is that I still have it and can call them out for how farcically wrong they turned out to be. The stock sold off 14% on that downgrade, which at the time was the second worst day the stock had EVER had. Today, it has sold off 10% as of the time of writing. So their analysis must be insightful and accurate for them to hold that much sway, right?

No. Virtually everything they said last year has proven to be dead wrong. I’ll go through their analysis, use only their numbers and direct quotes from their key points and we'll see how accurate these predictions ended up a year later. Let’s start with the numerical values and then proceed to the written analysis. The question I’m trying to answer here is “should I put any weight onto their analysis based on their track record?”

By The Numbers

Price Target

This one is easy, KBW’s price target was $6.50. Price targets are one year out. Even after today’s stupid sell off, SoFi is still at $14/share. Their price target was off by 115%. They were dead wrong. This means either their valuation framework or their predictions or both were wrong.

Revenue

KBW's revenue forecasts for 2024 by quarter were as follows:

$550.5M, $567.9M, $586.6M, and $593.8M

That equates to a grand total of just under $2.3B in revenue for the year. We haven't gotten Q4 numbers yet obviously, but so far, this is the revenue reported by SoFi by quarter and their guidance for Q4:

$580.6M, $597.0M, $689.4M, $675M*

KBW underestimated SoFi's revenue by $30M in Q1, another $30M in Q2, and $95M in Q3. If SoFi's guide for Q4 (which they will beat) is accurate, KBW will end up being wrong on their revenue estimates by around $250M, which is more than 10% of total revenue. They projected around 11% revenue growth for the year. SoFi will come in at over double that growth rate around 23%. So KBW got revenue and growth dead wrong. (Asterisks indicate estimate based on SoFi’s guidance).

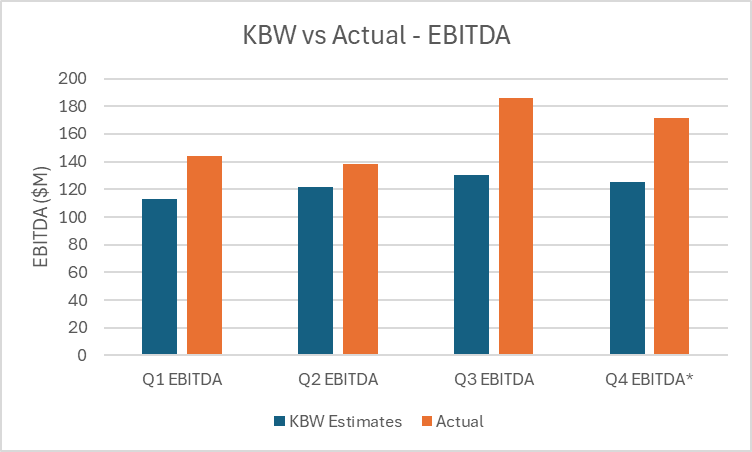

Adjusted EBITDA

If KBW got revenue estimates wrong, they were even more wrong about profitability. Here were KBW's estimates for adjusted EBITDA by quarter:

$113.2M, $121.5M, $130.3M, $125.2M

That gives a a full year total of $468M. Here are the actuals and SoFi’s guidance for Q4:

$144.4M, $137.9M, $186.2M, $171.5M*

That's a full year total of $640M. So KBW's estimates were low by around 37%. Incremental EBITDA margins have been above where KBW expected them to be even with higher growth the whole time. KBW expected adjusted EBITDA to grow by a paltry 8.5% in 2024. It will grow by at least 48% in 2024. Their growth estimates here were off by a mere 566%. So KBW got EBITDA dead wrong, projecting lower profitability on lower growth than actually happened.

EPS

Same story. KBW estimates:

-0.02, -0.01, 0.00, 0.00

Actuals:

0.01, 0.01, 0.05, 0.04*

Their total full year profitability estimate was -$0.03. SoFi is expected to come out with +$0.13. KBW expected them to be unprofitable for the year after SoFi literally said they’d be profitable every single quarter moving forward in their investor Q&A in December 2023. Dead wrong. Again.

Analysis

Ok, so they got the numbers wrong, but maybe their root analysis was still accurate? Nope. Here were their key points in their own words compared to what actually has come to pass in the last year.

“Why Slower Origination Growth in 2024 Is Most Likely Outcome”

That was literally their heading. Here were their main arguments for why origination growth would stall, again in their own words:

“Likely near the peak of market share gains”

They argued that SoFi is likely near the peak of their market share gains and that other companies (they call out LendingClub by name) will grow at the same rate or faster than SoFi in 2024. What actually happened?

In Q3 2024, LendingClub put up their very first increase in YoY originations since Q3 of 2022. SoFi, meanwhile, has never had a single quarter of negative YoY originations. SoFi has continued to gobble up market share at the expense of their competitors like LC and Upstart. KBW’s analysis was, you guessed it, wrong.

“Bank will hit capital restraints if loan sales do not resume”

Like most banking analysts, KBW did not account for the fact that management can, you know, actively manage their company. They only see what the archaic legacy banks have done and cannot fathom that an agile dynamic fintech can do things that alter their path. You know, things like restructuring their debt structure to add $500M in total capital and completely alleviate all capital restraints for the company. Which is exactly what they did in March of 2024. They are now raking in retained earnings each and every quarter since they are profitable. That allows them to sustainably grow the balance sheet. They now have a very healthy buffer between their current capital ratios and the 14%-15% level where I expect them to operate longer term.

“We believe there is risk for lower coupon rates to work against fair value marks in 2024 should rate cuts materialize”

Ah yes, the fair value argument surfaces again. Rising rates would hurt fair values in 2022 and 2023 is what everyone told me. Then KBW comes out and says that falling rates will also hurt fair values in 2024. They also, ostensibly, walk uphill both ways when they go to work. There are two incredibly salient points that made it so that their arguments turned out to be, you guessed it, dead wrong.

First, SoFi hedges their fair values against rate movements. No hedge is perfect, but SoFi’s hedges have proven to be incredibly close. Fair values were not significantly affected by rising rates. They have not been significantly affected by falling rates this year. Hedges weren’t even mentioned in their January 2024 note.

Second, and this is something that every bearish analyst seems to ignore, loans are worth more held to maturity than what is embedded in the fair value marks. The math isn’t this simple, but directionally, this is accurate. Today SoFi writes a personal loan with a 14% interest rate. The fair value on that loan when originated is about 106%. When you take into account their cost of capital and loss rates, SoFi makes around 108% annually by holding the loan. Average life of loans is around 1.5 years, or six quarters.

In this case, SoFi has $100M of loans that have a fair value of $106M. If they hold the loans to maturity, they make $112M. Over the next year and a half, the loans get paid down and the fair value amortizes over those six quarters, that’s around $1M in fair value amortization each quarter. That is a $1M drag on revenue per quarter ($6M amortized over 6 quarters). But they make $2M in net interest income each quarter. They make more by holding the loans than selling them even accounting for depreciation of fair values. As a SoFi investor you WANT them to hold the loans as long as possible and you WANT them to take that fair value markdown because the extra money they earn from interest they get is more than the defaults and the fair values markdowns put together.

Yes, there is default risk, which could make everything worse. However, defaults already peaked, much to KBW’s chagrin (more on this in the bonus wrong prediction below). So fair values are less a risk today than they ever have been before.

In much shorter terms, KBW’s concerns about the fair value marks in 2024 were wrong.

Bonus wrong prediction

KBW also had another note a couple weeks before Q2 earnings where they told investors to short SoFi before the earnings call. Why short it? Their analysis showed that SoFi's net charge-off rate would be between 6.3%-7.1%. The actual result? 5.4%, inclusive of the losses on the late-stage delinquent loans they sold. On a portfolio of about $20B in loans, that’s $260M less defaults than was predicted. The analysis was dead wrong there too. Default rates have improved ever since.

Should I put any weight onto their analysis based on their track record?

You can answer for yourself, and I think KBW is probably excellent at analyzing regional banks as they claim to be. That doesn’t change the fact that they were comically bad at analyzing SoFi last year. I am highly skeptical of KBW’s SoFi analysis given that they were so farcically incorrect about everything when they made this same call at this same time last year.

January 2025 Downgrade

Let’s get to this year’s downgrade. We’ll grow through their 2026 estimates, then cover the analysis including their valuation model.

2026 estimates

Revenue

Their first point is that the “Path to Long-Term Guidance Appears Long & Difficult”. I agree with that statement, but trust that SoFi management has things well in hand. As Anthony Noto said in the Q2 earnings call, “Hard is not for everyone, but for me and those who stay at SoFi, it fits just fine”. Compared to what they did to grow massively during the headwinds in 2022 and 2023, this long and difficult path is actually fairly straightforward. KBW gives a breakdown of their own 2026 annual revenue CAGR guidance compared to management’s 2026 guidance:

I just went through a very detailed analysis about why SoFi is way ahead of schedule on their 2026 guidance in Lending and Financial Services. They are slightly behind on the Tech Platform, but the outperformance on Lending and FS has more than compensated for that underperformance.

KBW just came off a year where they are got severely burned on their estimates by not taking SoFi management at face value. KBW are doubling down on that call, and saying that despite the previous outperformance, SoFi will still be unable to grow as guided. SoFi management has never missed a quarterly or annual guidance as a public company. That’s three straight years of exceeding what they’ve said they’d do. By contrast, KBW were egregiously wrong every single quarter last year. I think the balance of evidence favors SoFi management.

Adjusted EBITDA

SoFi has shown incredible operating leverage for the past two years. Their incremental EBITDA margins have been 40% or greater for eight straight quarters, with an average at 53%. That means of for every $1 of extra revenue they make, they drop 53 cents of it to the EBITDA line. The data are pretty definitive that the 30% long-term adj. EBITDA margins are almost certainly sandbagged. KBW cites that 30% number heavily in its analysis.

Apart from the fact that KBW thinks that growth will be significantly less than SoFi is guiding for, they also have incremental margins for the next two years at 36%. That seems like an extremely low number to me given that they haven’t had a single quarter that low for two full years. So when you combine foolishly low growth with lower-than average incremental margins, you risk compounding your errors to the downside. I think that is a mistake in this analysis.

EPS

KBW was off on 2024 EPS by a full $0.15. SoFi management is guiding for $0.55 - $0.80 of EPS. Management’s guidance assumed no new product lines (they already have more product lines), a slight recession in 2024, higher unemployment in 2024 than we’ve seen, and a overall pessimistic macro view. KBW’s 2026 EPS estimate is 0.36, which is less than half of the midpoint of SoFi’s guidance. That implies an incremental net income margin of 32%. Here is that incremental margin since 2022. SoFi came in above 32% in every quarter except one. KBW is combining low growth with lower-than average incremental margins here as well.

Analysis

Apart from the difficulty in achieving long-term guidance, which I covered above, their main arguments might sound familiar. They are fair values, capital restraints, and valuation. You’ll notice that those are the exact same concerns they had last year that all proved to be wrong. We’ll cover these briefly one at a time.

“Fair Value Accounting Methodology and Imperfect Hedging Program Still Present Some Risk”

This is such an easy go-to argument for bears at this point because it’s complicated and relies on fear of the unknown. The same fear of the unknown that plagued the company in 2022…and also 2023…and also 2024…and never came to fruition. Yes, hedges are never perfect. Yes, there are assumptions built into the fair value calculations that are not possible for an outsider to fully verify. Yes, there will be fluctuations from quarter to quarter.

No, it’s not going to result in some monstrously crippling $400M write-down in a single quarter that brings the entire company to its knees. If that were going to happen, it would have happened in 2022 when we got historic rate hikes or 2023 and 2024 when defaults were spiking and nobody knew exactly where they would level off. This is a less volatile rate environment than 2022 and defaults already peaked and are coming down. There is no monster hiding in SoFi’s fair value closet. The actual reality of the situation is that their hedging strategy has been more than sufficient and the fair value marks have been proven again and again by market-clearing loan sales. This is a tired argument at best.

Furthermore, remember what I said before. Worst case scenario is that they hold the loans and recognize, *gasp*, more revenue from net interest income than is currently embedded in the fair value marks. Until something material changes here (like a deep recession), I see no reason to think that fair values are something we’ll ever have to worry about as SoFi investors.

“Adjusted Capital Thinner Than Reported Levels”

KBW’s argument here is that if you were to exclude the extra revenue from the fair value marks, then SoFi’s capital ratios would be lower. That’s a true statement. It’s also a completely and totally irrelevant statement. It is doing analysis in a parallel dimension that has absolutely nothing to do with reality.

KBW knows this. You know how I know they know this? Because SoFi clarified it at the KBW Fintech Conference in February of 2023. That’s right, they got a chance to ask this question to CFO Chris Lapointe publicly at their own conference. He gave them a straightforward answer and yet they still trot out this tired argument as a stick to beat SoFi with. Here is the exchange:

Analyst: I believe the accounting rules -- you mentioned a phrase, the intent to sell. I think they're fairly liberal around that intent from a timing perspective. But are there any limitations? Can you hold these loans 8, 9 months in the capital and funding? Like is there any kind of restrictions we should think about in that regard as you guys continue to grow?

Chris Lapointe: Yes. So as long as you have an intent to sell, you would end up -- yes, you would end up marking them as held for sale. Even in an environment where you were to account for these in a fair market value way, you can switch from held for sale to held for investment and hold them to maturity with no implications on CECL or anything. You would always be marking them to market.

There is no scenario where SoFi is magically forced to switch accounting methodologies. Arguing that their capital ratios would be different if they did have to change accounting methodologies is a fruitless endeavor. It’s a hypothetical scenario meant to foment fear in investors just like the fair value argument. The fact that we were talking about this two years ago and it still never actually came up in spite of everything that has happened in those two years tells you everything you need to know. I asked SoFi Investor Relations directly if they are planning on moving any new personal loan originations to a held-to-maturity portfolio. They said no. This argument is another red herring.

Also, as stated above, SoFi’s increasing profitability now gives them extra capital each new quarter in the form of retained earnings. That means they will keep growing their capital. The profitability that KBW did not predict already came in 2024. SoFi’s earnings now provide them the capital they need to grow the loan book. The debt restructure last year freed up their capital restraints then, and earnings gives them all the buffer they need going forward. The increased demand from asset managers for unsecured consumer debt has been a consistent theme across SoFi, LendingClub, Upstart, and Affirm for the last six months. Capital constraints are less a problem today than they have been for years.

“Valuation Overstretched Even if Most Ambitious Targets Are Hit”

This, to me, is an irresponsible and absurd claim. The claim is that even if they hit their EPS target of $0.55 - $0.80, they’d still be overvalued at current prices. Their argument is that even for companies who return 20%-30% on their tangible common equity (ROTCE), the average P/E is around 10. In KBW’s own words “two banks that already generate the return profile SOFI is trying to hit (TBBK and CASH) both trade at only 10x 2025E EPS, demonstrating that the market still assigns bank-like multiples to differentiated, digital, high-return, high-growth bank models.” The analysis completely ignores two very important factors. The first is that they are analyzing SoFi as if it were already optimized for profitability. The second is that completely ignore the one thing that all investors should truly understand — the power of compounding.

The power of compounding

The two examples they pull out are Pathward Financial (CASH) and the Bancorp (TBBK). They call them “digital, high-return, high-growth bank models”. Let’s check that assumption of high growth compared to SoFi. In 2018, Anthony Noto took over as CEO at SoFi. Fortunately, in 2018, all three companies had nearly identical annual revenue at $269M for SoFi, $271M for TBBK, and $286M for CASH. Let’s look at their revenue charts since then (data courtesy of finchat.io), including 2025 estimates for each company. Despite starting out at the same point (actually, SoFi was the narrowly the smallest of the three), SoFi now has 3.5x the revenue of CASH and 5.3x the revenue of TBBK.

This gap will only widen over time as SoFi is still growing at a faster CAGR than either CASH or TBBK. Calling all of these “high growth” and leaving it there is irresponsible. Furthermore, focusing only on one single profitability metric (in this case return on tangible common equity) makes you lose the forest for the trees. SoFi’s revenue growth alone in this year is projected to be $500M. TBBK’s total revenue for the last entire year is only $472M. That’s right, SoFi’s revenue growth is higher than all of TBBK’s revenue even though they started at the same place 6 years ago.

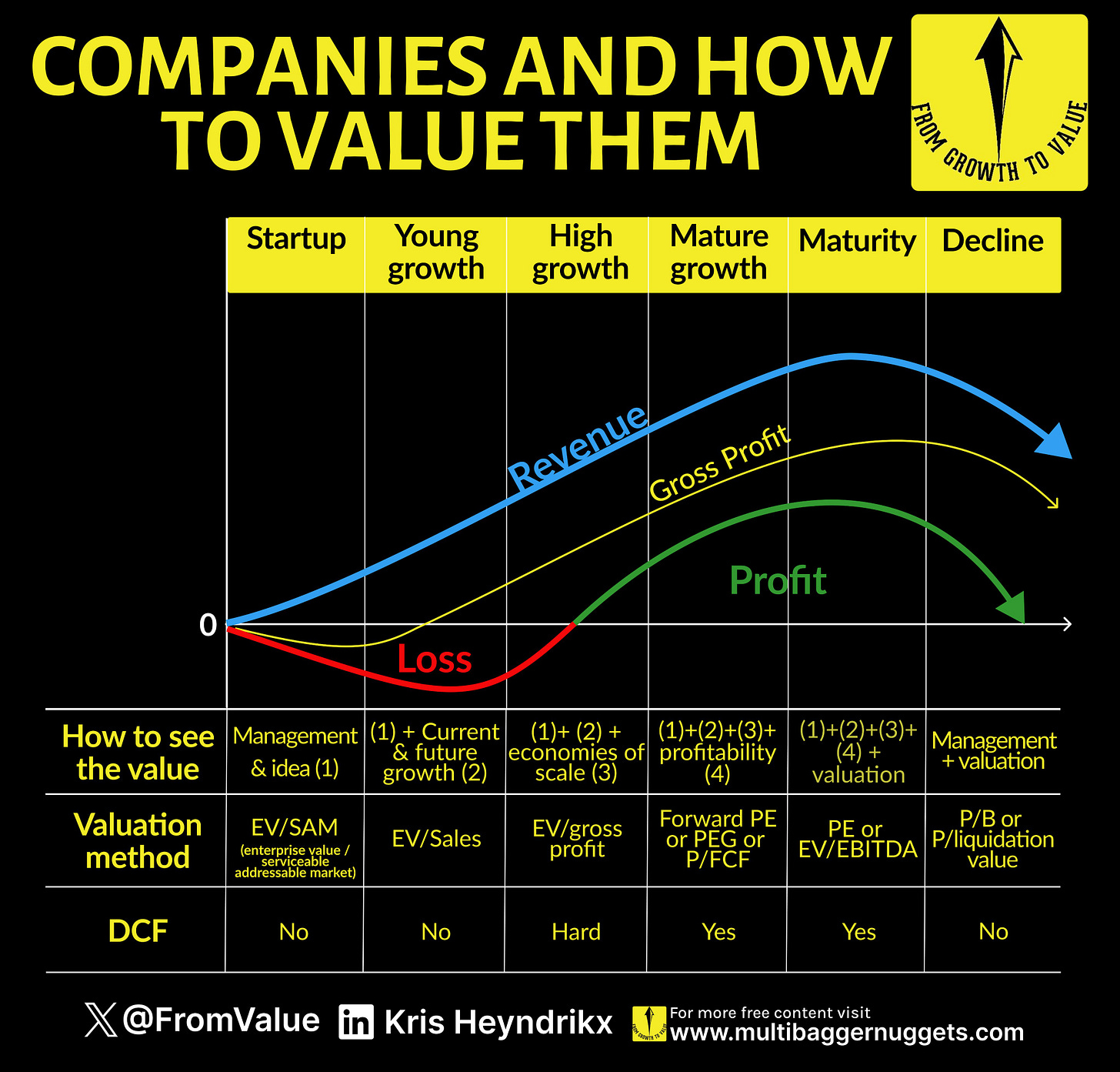

Proper valuation metrics

Imagine you hired someone to hang up Christmas lights on your home. They pull up in their truck and you don’t see a ladder. You ask them if they have one or need to use yours and their response is “It’s alright, we brought our sledgehammer.” Would you be concerned? Of course you would be concerned. A sledgehammer has no use in hanging up Christmas lights, whereas a ladder seems pretty critical. A sledgehammer is the wrong tool for the job.

TBBK and CASH are in their maturity stage. It makes sense to use PE for them. However, using a static trailing PE with a company with SoFi’s growth profile is about as useful as bringing a sledgehammer to set up Christmas lights. Trailing PE is meant for mature companies who don’t grow quickly. As we just established, SoFi is very much still growing compared to these other companies. The chart below gives a good framework for what valuation metric is applicable at what stage for the company.

Let’s go back to KBW’s analysis. They say that, “given management’s own outlook [meaning ROTCE of 20%-30%] and our own more conservative projections, our base case scenario for the purposes of this valuation exercise assumes SoFi reached a sustainable 20% ROTCE in 2028 — this implies a price target about $8 and 46% downside given a 10x multiple on earnings power of $1.10 discounted back two years at 14%.” They are using almost too many assumptions to count in there. Discounting an already ridiculously low PE ratio back at a discount rate of 14% is an interesting strategy. We also already established how accurate their “own more conservative projections” have been in the past. Regardless, let’s take that earnings number of $1.10 in 2028 at face value.

At that point, SoFi will still be somewhere in between the “high growth” and “mature growth” stages. Given what we talked about concerning growth earlier, I think using a PEG ratio is a superior valuation method than the PE ratio. Assuming SoFi hits the midpoint of their 2026 guidance, they’ll get $0.67 of earnings in 2026.

To get to $1.10 in earnings in 2028, they’d need to continue to compound earnings at 28% in both 2027 and 2028. A PEG under 1 is considered undervalued and the average PEG ratio for S&P 500 companies is 1.5. If SoFi were to trade at $8 in 2028 on $1.10 of earnings that were growing at 28%, they’d be trading at a trailing PEG of 0.29. I consider NU an exceptional deal right now. It’s a bank and it’s trading at a FWD PEG of 0.47. The only reason it’s trading so low is that it has sold off 33% recently because of massive geographic risk with what is going on in Brazil and the Brazilian currency.

Let’s use CASH and TBBK as examples. CASH is trading at a PEG of 1.09 and TBBK is trading at a PEG of 0.66. Neither of those are remotely close to the ridiculous 0.29 PEG implied by their $8 price target. Even using a PEG of 0.66 on their 2028 hypothetical framework would give a SoFi stock price of $20.32. That’s a 10% annualized return after today’s nasty sell off. That would likely beat the market over the next four years.

Even at the undervalued PEG of 1, the stock would be at $30.80, a double from here, which would be an excellent return of 22% annually. At the average PEG of 1.5, the stock price would be $46.20, or around triple its current stock price and a four-year return of 35% annually. And remember that all of these assume that KBW can accurately predict revenue growth with greater accuracy than SoFi’s management, which has thus far been very untrue. If SoFi management’s guidance is accurate, the returns would be much higher.

Valuations are always going to be subjective. There are always going to be varying opinions and I don’t claim that PEG is the best or only metric you should use. There is no one-size-fits-all approach. In fact, I spent two full articles covering the valuation recently across a massive host of metrics including PS, PS/G, P/GP, P/GP/G, PEG, a reverse DCF, a forward DCF, and price to cash flow. I don’t know what the exact right answer is here. However, I do know that the market should and does reward companies who prove to be consistent growers. I also know that you shouldn’t use a sledgehammer to hang up Christmas lights.

Conclusion

KBW’s prior analysis for 2024 was absurdly incorrect. Let’s recap just exactly how wrong they were:

Revenue growth was predicted to be 11%. Actual growth is around 23%. That’s a 109% miss.

EBITDA growth was predicted to be 8.5%. Actual growth is around 48%. That’s a 550% miss

EPS was predicted to by -$0.03. Actual EPS is around $0.13. The percentage miss doesn’t even make sense because they got it so wrong.

Stock price (based on their valuation framework) was predicted to be $6.50. Before this ridiculous downgrade, it was $15.40. That’s a 137% miss.

They missed every numerical prediction by over 100%. Their bogeyman bear cases of capped market share on originations, fair value fears, and capital constraints were all proven demonstrably false. This year, they are recycling the exact same monster-under-the-bed arguments about fair values and capital constraints while doubling down on their valuation framework that ignores growth completely.

The data show that they misunderstand the core business, resulting in predictions that were far off the mark. SoFi management’s guidance is far more trustworthy, as they have beaten every single quarterly and annual guide for 14 straight quarters. You can form your own take on what you think about KBW’s analysis. I think it’s garbage.

Subscriber update

The DDI YouTube Channel has started! My first video was a live Q&A on the day of earnings. I’m still figuring out how to do everything there, but expect to see more in the new year. A sincere and heart-felt thank you to those who support my work.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in SoFi, LC, and NU.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Their hate of SOFI is an opportunity for anyone who understands the business. Same was said of Amazon early on. So much hate for that company 20+ years ago.

Thank you for this great post!