SoFi: Shifting into Second Gear

Earlier this year I wrote an article outlining SoFi’s path from 0 to 60 (cents of EPS). At the time, they were just barely profitable, and I detailed what it would take to get from that point to 60+ cents of EPS in 2026. Every six months or so, I think it will be beneficial to check in and see how things are progressing and whether they are staying on course. Here were the key takeaways on what they needed to achieve from that article:

Lending segment growth needs to be ~15% CAGR from 2023-2026 and it needs to maintain a contribution margin of low-to-mid 60s.

Tech platform segment growth needs to be ~25% and contribution margins need to be in the mid 30s.

Financial services segment growth needs to be ~50% and contribution margins need to be around 30%.

They need to stay disciplined with their other costs, allowing them to only increase by about 10% each year.

Since we’re talking about going from 0 to 60, let’s continue the car analogy. Every six months or so, they'll need to shift into higher gear, so let's see if they have enough speed to shift from first gear into second gear. We’ll check in on each of the segments individually and then look at expenses.

Lending

At the time I wrote the article, SoFi was guiding for 2024 lending revenue to be only 92-95% of 2023 levels. We are now three quarters of the way through 2024, and SoFi is significantly ahead of where they planned to be. Rather than shrinking YoY, lending has been growing. In fact, through the first three quarters of the year, 2024 lending revenue is 6.7% higher than it was in 2023, driven by the massive outperformance in Q3.

SoFi has also changed their guidance to be “at least 100% of 2023 levels”, which is probably the understatement of the year. To get to those levels, they only need $280M in lending revenue in Q4. That would be down over $100M QoQ and the last time lending revenue was that low was Q2 of 2022. It’s safe to say they are comfortably ahead of their growth guide. As for contribution margin, it’s holding steady exactly where it needs to be. Q1 was slightly lower in 2024 than it was in 2023, but both Q2 and Q3 were higher this year.

Lending has outperformed thus far. Lending is still their biggest and most profitable business, so when it outperforms, that means SoFi as a whole will probably outperform. Just as importantly, it takes the heat off of this segment in both 2025 and 2026. If lending revenue really were to have contracted by around 7% in 2024, it’d need to see 26% growth in 2025 and 2026 to get to the 15% CAGR specified above. If they end the year at 6% YoY growth total, they only need 20% each of the next two years to meet that goal. Lending is ahead of schedule relative to where I’d thought it would be and with easing rates, loan buyers returning, and delinquencies and defaults peaking and coming down, the prospects for the lending business look excellent moving forward.

Tech Platform

Galileo is the opposite story for 2024. Their original guidance for the year was a 20% growth rate. Here is the data so far

There is growth here, but it is not 20% growth. Overall through the first three quarters of the year, 2024 shows 14.4% growth relative to 2023. Moreover, SoFi adjusted their guidance to only “low to high teens”. In their Q2 earnings call, when they lowered the yearly guidance for the tech platform, they said “While this is lower than our original 20% guidance for tech platform, we view this as transitory and still feel confident in our multi-year growth guidance for this business.”

However, underperforming today means overperformance is required in the future to make up for it. That puts pressure on this business to really start delivering in 2025. Previously, they would have needed to accelerate the business from 20% growth this year to around 27.7% growth in the next two years. Now, to hit their longer term guidance for this segment, that number has increased to 30.2% required in each of the next two years. Achievable, but it will require better execution than what we have seen in this segment up until now.

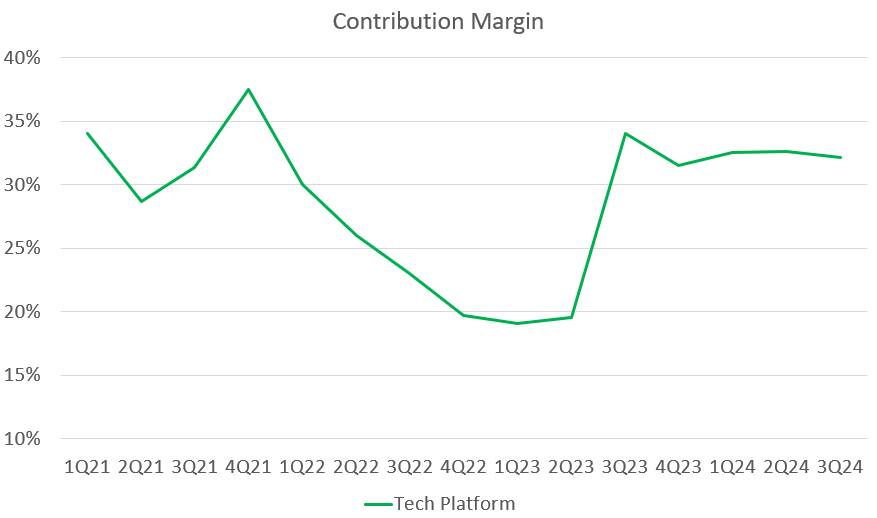

As for contribution margin, they are doing quite well. Contribution margin here has been rock steady around 32%-33%. You would think that further growth should help these creep up as fixed costs remain steady as they scale the business, but contribution margins in this range are sufficient to get them where they need to go.

There are several green shoots for tech platform that show they are starting to get some wins. Three in particular have cropped up in the last month or so. Rapid Finance started a pilot earlier this year. That pilot was obviously successful as they chose to expand the partnership with Galileo. Second, Galileo was chosen as the debit card issuer and processor for Direct Express®, the US Treasury’s largest prepaid debit card program. That is a five year contract that begins on January 3, 2025, so that should help next year’s growth. Finally, just recently, SoFi announced a partnership with Mesh Payments.

The Mesh Payments partnership is of particular note because they are using using Galileo as the payment processor, SoFi as the sponsor bank, and Cyberbank Core for the core banking. That is the very first time that any client is using all three services as far as I’m aware. It’s an excellent proof of concept and evidence that they have a unique product offering that nobody else can offer and that there is demand for all these services.

Financial Services

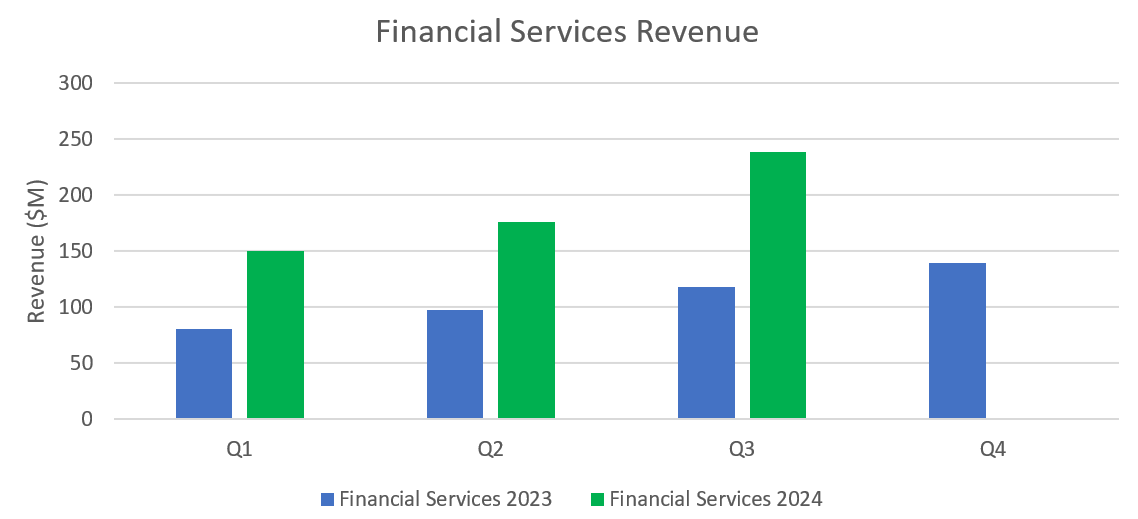

Honestly, when SoFi guided for 75% YoY growth in financial services, I was pretty skeptical to start. A lot of the growth in Financial Services over the past few years has been from deposit growth offsetting higher cost of funding. I wasn’t sure where they were going to supplement that growth as their deposits would no longer be offsetting as much as they used to. My skepticism was remedied in Q3 when they debuted the new loan platform business and blew all previously reasonable-sounding estimates completely out of the water. The data are honestly incredible.

That Q3 number was stupendous. Through the first three quarters of the year, financial services is up 90% compared to the first three quarters of last year. They need $221M in Q4 to hit their new 80%+ growth guidance. They are absolutely killing it with financial services.

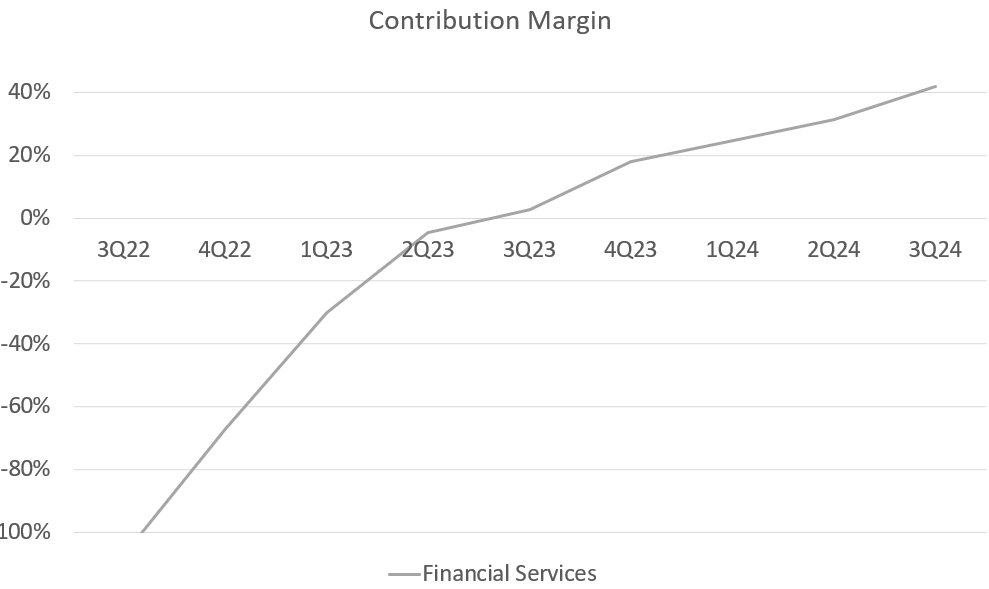

Not only is growth ahead of schedule, but the new loan platform business is highly incremental to margins. The contribution margins of the LPB are closer to lending margins at 50%+, meaning that contribution margin for the overall segment is exploding along with growth. And massive growth coupled with margin expansion is a recipe for huge outperformance relative to where I thought they’d be at this point.

As a reminder, contribution margin here needed to be around 30% by 2026 to hit their EPS guidance. It is already north of 40%. And remember that both credit card and brokerage right now have negative contribution margin. If they can get those positive, there is a decent chance that the segment could get to a margin north of 50%. Long term margins are going to depend heavily on the mix of where the revenue is coming from, but it seems very safe to assume that 30% margins were a severe underestimate after the debut of the new business.

Expenses

In that original article, I said that the most difficult part to project was other expenses. Contribution margin takes care of the expenses that are directly attributable to each segment. All other expenses, like brand marketing, management compensation, stock-based compensation, etc. are harder to project. However, the hope was that long term, those expenses would grow at a rate around 10% per year.

It’s almost as if they had this modeled out and came to the exact same conclusion themselves. Almost as if they know exactly what they are doing. Q2 and Q3 YoY other expenses growth came in at 9.1% and 10.8% YoY growth, respectively. So while overall they are outperforming on their growth objectives, their other expenses have fallen to exactly where they need to be.

They already shifted into second gear

In two of their three segments, they are already far ahead of where they need to be in terms of the growth trajectory they laid out. It also happens to be the case that those are their two biggest segments with the two largest contribution margins. The extra growth in lending and financial services has more than made up for the underperformance of the tech platform. Not that that is an excuse, but if the goal is $0.55-$0.80 EPS in 2026, they are well on their way.

SoFi wasn’t supposed to reaccelerate lending until next year. They started in Q3. They weren’t supposed to be able to grow financial services this fast when deposit growth made less of a difference moving forward as it did in the past. They debuted a new business that moved it forward even faster. And they did that while masterfully controlling costs.

Updated Bearish, Base, and Bullish Predictions

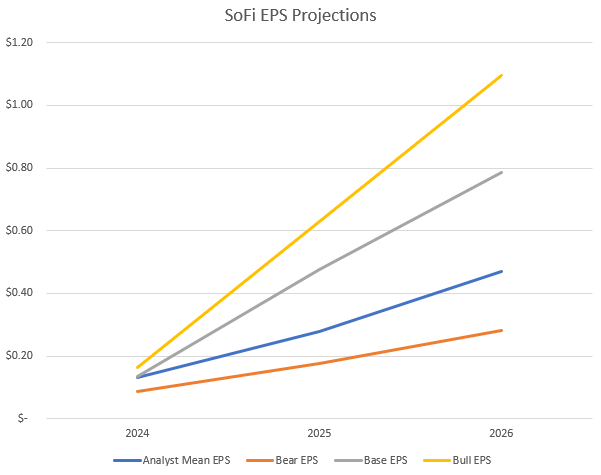

In that previous article, I gave bearish, base, and bullish predictions for where I thought revenue and EPS could end up through 2028. With an additional six months of data, I have amended those scenarios. I won’t step through all the assumptions here, but will provide the outputs. Basically, the outperformance this year raises the 2024 revenue and EPS enough that it becomes much easier to achieve and outperform their goals. My updated bear, base and bullish predictions for revenue and EPS are below. Bolded values are updated December 2024 predictions, the gray are the values from my previous article for comparison.

SoFi’s outperformance has been so great that my base case revenue and EPS scenario is now up to the top of SoFi’s 2026 guidance at $0.78 of EPS in 2026.

Analysts are still Woefully Behind

Because I’ve built up a bit of a network, I can now get ahold of most analyst reports on SoFi. At this point I am completely convinced that most of these analysts have very little idea what they are talking about. They cover a ton of names and haven’t taken time to understand the intricacies of SoFi’s different businesses and business strategy. Their estimates are evidence that they often miss important parts of the picture. Six months ago, analyst estimates were for $0.08 EPS in all of 2024. They’ve already hit that in the first three quarters. They'll probably beat that projection by 50%-75%.

Yet somehow, this outperformance hasn’t affected analysts’ long term projections much at all. You would think that if SoFi can beat 2024 estimates by 4-6 cents, that would mean they can probably beat 2026 estimates by at least that much. Yet 2026 estimates have only moved from $0.44 to $0.47. My bear case revenue estimates are above the mean analyst estimate for revenue. There will be continued upgrades as analysts catch up to reality. Here are the bear, base and bull revenue and EPS compared to analyst expectations in chart form:

My projections aren’t meant to be completely accurate, but they should give a decent range of what to expect. Unless the macro turns extremely sour (unlikely), or SoFi stops executing (even less likely), I think there will be significant upward revisions each and every quarter as they continue to prove analysts wrong. Moreover, I think the biggest upward revision will probably happen in about one month when they release 2025 guidance and analysts are caught off-guard, again, with how low their estimates are relative to what SoFi believes is possible. I’ll probably revisit this briefly again after Q4 earnings so I can update everything with their new guidance and see how close I am to what they project. The biggest takeaway is SoFi is ahead of schedule on their guidance, and that Wall Street is nevertheless still underestimating them.

Subscriber update

The DDI YouTube Channel has started! My first video was a live Q&A on the day of earnings. I’m still figuring out how to do everything there, but expect to see more in the new year. A sincere and heart-felt thank you to those who support my work.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in SoFi.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Thank you for the time, effort and smarts to write such a compelling post. I've upped my position to 8500 based on this post and other sources

Great article, factual and incisive.

Thank you.