Q2 2025 Earnings Preview: Can SoFi Grow 40%?

It’s Christmas in July, or, as most people call it, SoFi Q2 earnings. Two or three years ago, every earnings call represented a potential dagger into the heart of a retail community that was desperate for good news on a stock that was beaten down, severely shorted, and where news of its demise, a recession, and a default apocalypse was lurking around every corner. That’s a very different picture than we are seeing today. The stock is up over 100% since April lows, above $20/share for the first time since November 2021, and the bears are in hibernation (although I’m sure they’re ready to emerge from their cave at any moment). What’s more, SoFi has built a fantastic and consistently improving business with a strong fundamental foundation underpinning the recent share price appreciation. The biggest question for me is not one of defaults or delinquencies or fair values, it’s this simple question: can SoFi put up 40% YoY growth in the quarter? Here are my predictions.

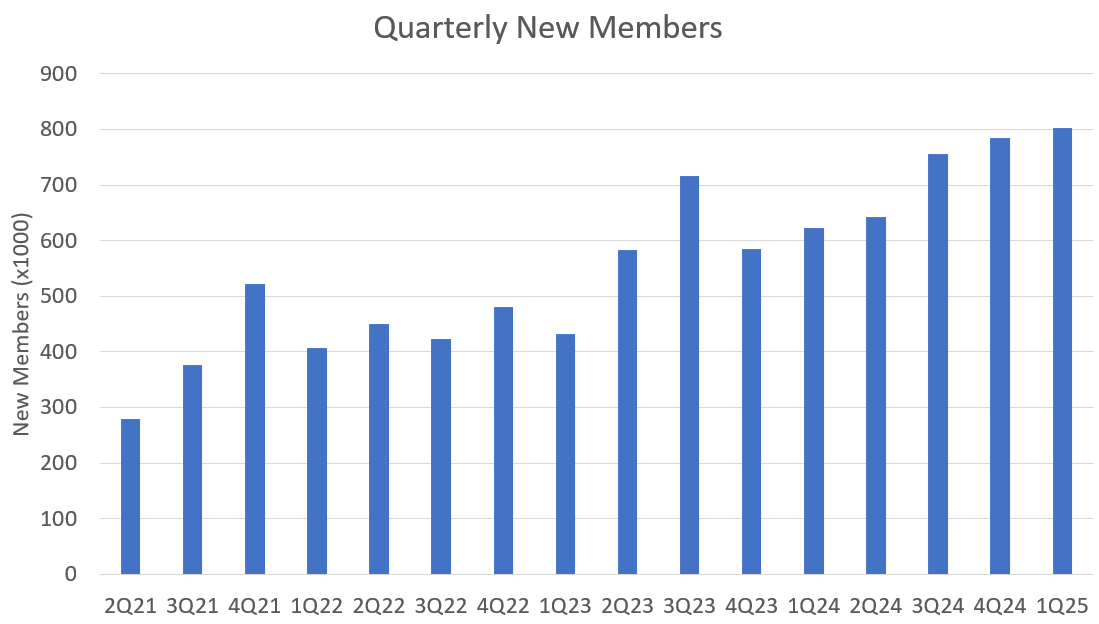

Members

Members are the most important metric. Why? Because they are the lifeblood of the company. The ecosystem they’ve built is what allows them to monetize an ever-growing member base with existing, improved, and new products. A huge, loyal, and sticky user base is what allows them the agility to go after opportunities as they present themselves. If you build the ecosystem, then you can lean in on whatever opportunity is available to monetize the members. The LPB is the most recent example of this, a product with massive ROI that is only made possible because SoFi has a deep pool of existing borrowers to draw from and because they have become a trusted name.

SoFi will be over 11M members for certain this quarter. There has been strong website traffic numbers, and with the LPB, they have a greater license to reinvest into sales & marketing. Member growth is going to be a big factor of marketing spend, and I think with the ramp up of LPB and the fact that they are leaning into growth will push them to another record quarter for new members of 835k.

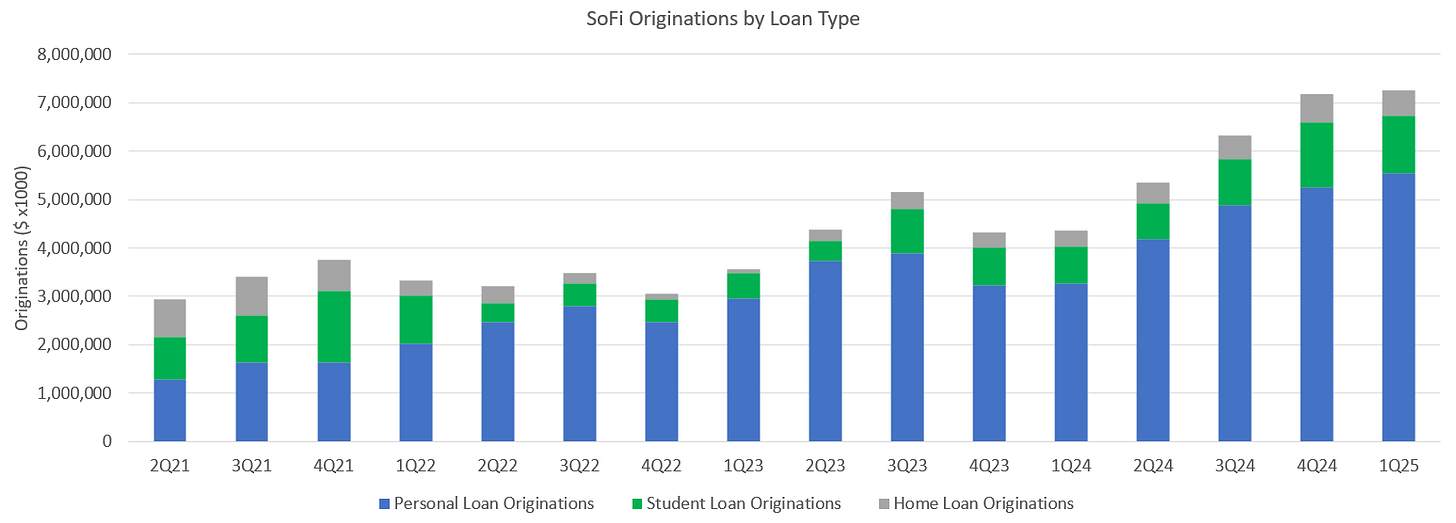

Originations

Personal Loans

We unfortunately did not get any information on when exactly the Blue Owl Capital deal started, so this is still a bit harder to predict than I’d like. Loan delinquencies continue to look great and while there was the tariff scare in April, most of the quarter was marked by strength from the consumer, especially high-income consumers. Each and every quarter, SoFi’s profitability grows, which allows them to continue to grow the loan book at the same capital ratio. They’ve been able to sell plenty of loans at record gain-on-sale margins, and the LPB just keeps growing. The virtuous cycle will continue, LPB originations alone should grow by $200M+, and they’ll set another record for personal originations in this quarter. My prediction is for $5.8B personal loan originations in the quarter.

Student Loans

I think this will be slightly down QoQ. The only reason that it wouldn’t be is if they were able to sign up a partner for student loans for the LPB, which would be a big deal. SL Q2 originations have been down each of the last 3 years; I think that trend holds and there will be $1.1B in SL originations.

Home Loans

The housing market is still not great, but Q2 is traditionally the best quarter for mortgage originations. 30-year mortgage rates have stayed mostly flat since November, so there probably won’t be a massive bump, but I think it will be slightly higher than Q1 at $550M.

Revenue

Lending

Lending revenue last quarter was disappointing relative to my own expectations because of non-interest revenue. That portion is always going to be slightly lumpy, but I don’t think we see the drop again that we did last quarter. I see a strong quarter for originations, with a new ATH for personal loan originations and decent student loan and home loan originations.

Net interest income will continue to climb higher as the book of loans continues to grow. APY on deposits has stayed at 3.8% throughout the entire quarter, so that should be relatively close to what they had throughout Q1 (the last drop from 4% to 2.8% was on January 23). Rates have stayed mostly flat, so hedges and fair values won’t have moved much either. as a result, I think there will be a return to growth here and we see $457.5M of lending revenue.

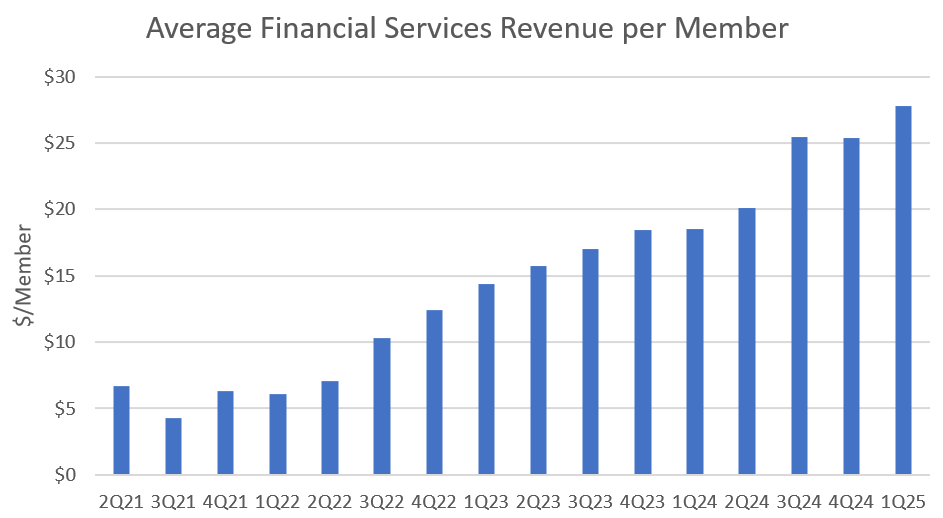

Financial Services

The apple of every SoFi investor’s eye right now is the LPB. Last quarter’s jump in both originations and take rate was amazing. Revenue per member hit a new all-time high as a result. We know there will be at least some modest growth in LPB originations to $1.75B+. If they can start to expand outside their credit box for personal loans, or include student loans or home loans in the LPB, we could see some more fireworks here.

I’m not building any of that into my predictions here. I’m assuming that they continue to monetize members at the same rate as last quarter, but that still results in financial services revenue of $322.6M, which is still an 81% YoY increase. If they managed to expand the LPB, this could be a low estimate.

Tech Platform

Tech Platform has been the drag on the company’s growth for the past year. There are plenty of green shoots here, with the deals that management has been talking about that are coming online in 2025 and early 2026. The Wyndham deal has been live for a while, but it will take time to scale. That’s also true of many of their deals. The drag from Chime leaving should be done, and the other deals should give some modest growth. I’ll continue to be skeptical of Galileo until we see consistent sustainable growth, and I’m only expecting $106M in revenue for the quarter. I don’t really predict Galileo accounts anymore because they are fairly uncorrelated from revenue, so they aren’t really that important to me for projections. One possible tailwind here is actually that there may be a jump in intercompany revenue as SoFi is close to fully transitioning its entire stack to Technisys’ core.

Corporate

Corporate revenue for the last three quarters has been -$40.0M, -$43.0M, and -48.2M, respectively. I am penciling it in at -$44M for the quarter. Not much else to say here.

Total Adjusted Net Revenue

Sum those up and you end up with my prediction of $842.1M in total adjusted net revenue. Q2 2024 was $597.0M, which means my prediction is for revenue growth of 41.1%. Q2 of last year was a fairly weak quarter, but Q2 2024 was still 22% YoY growth from 2023, so that’s still a pretty decent bar they are trying to clear. For comparison, the last time that Palantir had a stronger comparison they were going against was Q2 of 2022. That’s right, it’s been three years since Palantir had a harder comp than what many people are calling this “weak comp” for SoFi.

40% revenue growth for a company that many wrote off as dead for years and have said exists in an industry where sustained 20% growth rates are impossible would be incredible. SoFi’s guidance for the quarter was only $795M at the midpoint and analyst estimates are for $804M at time of writing. If my predictions are accurate, it would represent a very sizeable beat.

Adjusted EBITDA

This one is also a little difficult to predict. SoFi said to only expect 30% incremental EBITDA margins in 2025. Last quarter they came in above that at around 35% YoY incremental margins. I’m expecting a similar value for this quarter.

That means significant reinvestment back into the business, as I’m predicting only $13M of EBITDA growth QoQ to $223.7M. That’s only $13M of EBITDA growth from $70M of QoQ revenue growth in the quarter. I’m completely ok with that as I would much rather they reinvest into growth instead of paying more taxes by dropping more to the bottom line. Get members into the flywheel, grow the LPB, invest in greater marketing now because the long term returns should be huge as they continue to build the ecosystem. I do want to see them continue to prove out their margins by keeping them around 30%+, but I’m a growth investor and I care more about 25%+ growth than I do about whether this quarter has 7 cents or 9 cents of EPS. Analyst expectations here are $205.7M and their own guidance was $205M at the midpoint, so this would not be a massive beat.

Net Income and EPS

Using what I think are reasonable estimates for the line items between adj. EBITDA and GAAP net income, I come in with a net income of $83.7M. Now, one big caveat here is when they gave their Q4 guidance, they said they expected a 2025 tax rate of 26%. In Q1, their tax rate was only 11%. I am assuming that the Q2 tax rate is going to be close to Q1. If their tax rate is in fact 26% in this quarter, net income would drop to $61.6M. I say this as a warning because I don’t think anyone else, including analysts, are building that higher tax rate into their models. If the EBITDA looks good, but the net income and EPS do not look great, go check the tax rate before jumping to conclusions.

My net income number comes out to $0.072 EPS. Analysts are expecting $0.06 and SoFi’s guidance is only $0.055 at the midpoint. SoFi is not trying to grow net income right now, and while many want a blowout EPS number, I don’t think we’ll get it this quarter or this year. And again, I’m not only fine with that, I’d prefer it. If the higher tax rate actually does happen, there is a decent chance they’d miss on EPS. Just something to be aware of.

Guidance

Tariff macro fears, which were still very prevalent when they reported Q1 earnings, have mostly subsided. Inflation hasn’t really reaccelerated, the labor market is still strong, and probabilities still favor around 2 rate cuts this year. The lower uncertainty should mean they are slightly less conservative with guidance. They’ll raise guidance as they always do, but don’t expect a huge raise simply because that isn’t their style.

Product Announcements

SoFi often likes to announce things on their earnings calls that aren’t public knowledge yet. They did it with the Blue Owl deal in Q4 earnings. There have been a lot of app updates recently that point to crypto and level 1 options being very close (like this post on X from today). Moreover, we’ve also seen Cash Coach live in beta form as well. I would not be surprised if we get one or more product announcements on Tuesday.

Price Action

I don’t need to tell the people reading this article that SoFi’s price action has been fantastic recently. The stock has a tendency to pull back even on strong earnings. Be prepared for that to possibly happen again. I’m fully prepared to revisit the teens again. Nevertheless, I think $25 this year is extremely doable, and I actually still think we hit a new ATH for the history of the SoFi ticker (which is $24.65), and also including IPOE (which was $28.26) this year.

Tuesday morning can’t come soon enough for me.

DDI Predictions in One Place

New Members: 835k (815k net new members with 20k churning off the platform)

Personal Loan Originations: $5.8B

Student Loan Originations: $1.1B

Home Loan Originations: $550M

Lending Revenue: $457.5M

Financial Services Revenue: $322.6M

Tech Platform Revenue: $106M

Corporate Revenue: -44M

Adjusted Net Revenue: $842.1M

Adjusted EBITDA: $223.7M

Net Income: $83.7M

EPS: $0.072

Subscriber update

The DDI YouTube Channel is live. Work has been extremely rough this year and demanded a lot more of my time. I’m going to get back to a more regular cadence of articles and YouTube videos as things should be settling down some in the coming months. If you want to support my work, you can subscribe here on substack, or on X, or, now, on YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up for SoFi, or discounts on Tesla or finchat.io:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get up to $2500 off a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi and PLTR

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

I don’t think we see a pullback if they hit the revenue growth you forecast and announce at least one of options and crypto. That being said I still think macro could bring the whole bull back to earth. Probably good for SoFi in long term but not great in short term

Great content! I have similar insights