Q2 Earnings Preview: It's Time for SoFi to Control the Story

I usually spend most of the time if my earnings previews diving deep into my predictions, why I think that way, and throwing up lots of data and graphics to explain my thoughts. This preview is going to be a little different. I'll still make all my normal predictions, but I want to more time discussing why this quarter is such a critical one for both bulls and bears and where I think the narrative could go based on this earnings and why it is imperative that management steers the narrative appropriately. On to the predictions.

Members

Members are the lifeblood of the consumer-facing business and the primary growth driver for the business. They guided for 2.3M members added in 2024, which is 575k/quarter. Last quarter they added 622k new members. This quarter they should have the tailwind of the NBA playoffs brand awareness as well as several Copa America games at SoFi stadium. I think they add 640k new members, coming in slightly above Q1 numbers.

Originations

SoFi is intentionally pulling back on lending despite having room in their capital ratios to go harder if they wanted to. I will continue to believe they will do so until they guide otherwise. I predict they come in at $3.15B in personal loan originations and $720k student loan originations. This is a pullback from the $3.28B and $752k in originations from Q1. Part of the reason is that I haven’t seen any personal loan securitizations this quarter, and we saw two in Q1, so I’m not sure if they will have as many loans sold this quarter. If they don’t sell as many loans, they won’t originate as many. Also, they said in their Q1 earnings call that they expected lower originations in Q2.

Deposits

I think member growth will continue to be strong and therefore quarterly deposit increases will continue to tick up. I think this is the first quarter where deposit growth crosses the $3B threshold, after coming in at $2.98B last quarter. I predict $3.05B in new deposits in Q2.

Revenue

Lending

I predict that originations will be down, and therefore lending revenue will also be down. I’m predicting a contraction of $15M to $310M.

Financial Services

Last quarter actually saw lower growth than I expected here. I think a lot of the growth will be on the back end of the year as they scale the credit card business. I expect around $20M in growth this quarter and have financial services revenue coming in at $170M

Tech Platform

After listening to the Galileo podcasts that they’ve been publishing, I feel like for the first time I have been able to really grasp the vision of the tech platform and have a better understanding of how the business operates. I’m also getting more bullish on it. I think this quarter is the first time we revenue above $100M and I’m predicting $103M in revenue, which is a 17.5% YoY growth in the tech platform. I’m hoping there is more upside here, but the tech platform for me still needs to prove its growth with results. It’s a great story, but the execution needs to match that story.

Total Adjusted Net Revenue

I think that corporate revenue will be slightly positive in the quarter with +$2M in the quarter, mostly from the cash they would have been holding in short-term treasuries or similar vehicles with the $330M in cash they raised that they used to pay off the preferred shares at the end of May. That leads me to a total ANR of $585M. Analyst estimates are for $566M and the midpoint of SoFi’s guidance is $560M

Adjusted EBITDA

I’m projecting a revenue shift from lending to financial services. Lending has the highest contribution margin and financial services the lowest contribution margin. The shift to lower margin revenue means that in spite of a slight increase in revenue QoQ, I think SoFi will see a decrease in adjusted EBITDA relative to Q1, with adjusted EBITDA coming in at $135M compared to analyst estimates of 122.5M and SoFi guidance of $120M at the midpoint.

Net Income and EPS

SoFi will be paying its final dividend on the preferred shares this quarter, but for only 2 quarters instead of 3, so it’ll be somewhere around a $7M payments. I think there will be $110M in adjustments between EBITDA and GAAP net income, so I predict $25M in GAAP net income, which translates to about $0.018 in EPS. Analyst estimates are for exactly breakeven at $0.00, which matches SoFi’s guidance.

Why Q2 Results Don't Matter Too Much

Ok, so I just went through all my predictions for Q2 earnings, but I actually don't think any of that is going to move the needle either up or down. SoFi always beats on revenue and EPS and they'll probably do so again. That's great, but more than any other quarter, I think Wall Street and investors are firmly focused on where SoFi is going from here. Unless it’s a massive beat or a massive miss, I don’t think SoFi stock moves much based on Q2 results, but rather on forward-looking indicators.

I usually don't worry that much about short term price action. However, I do think that SoFi at this point is taking some brand damage from the underperformance of the stock. The narrative on SoFi, the stock price, and the trajectory of the company are going to hinge on two things: net charge-offs (NCOs) and guidance. People are very worried about SoFi's exposure to personal loans and whether or not their fair values are justified. If NCOs come in high and guidance is weak or a minimal raise, bears will have a heyday and be able to control the narrative and the stock will suffer. If NCOs come in lower and guidance is strong, the opposite will happen. It will give extremely strong evidence that the bullish case that SoFi's high-quality borrowers and excellent execution will persist and add confidence to their ability to achieve their long term guidance.

NCOs

When a SoFi borrower hasn't made payments for 120 days, they default on their loan and the entire loan is charged off, meaning SoFi takes the remaining principal as a loss on the books. NCOs are the total amount of loans that were charged off in a quarter. The annualized NCO rate is the percentage of loans that would be charged off if all 4 quarters saw that same rate of charge-offs. For example, if SoFi had $10B in personal loans, and they charged off $150M in the quarter, that would be an annualized NCO rate of 6% ($150M * 4 / $10,000M = 6%).

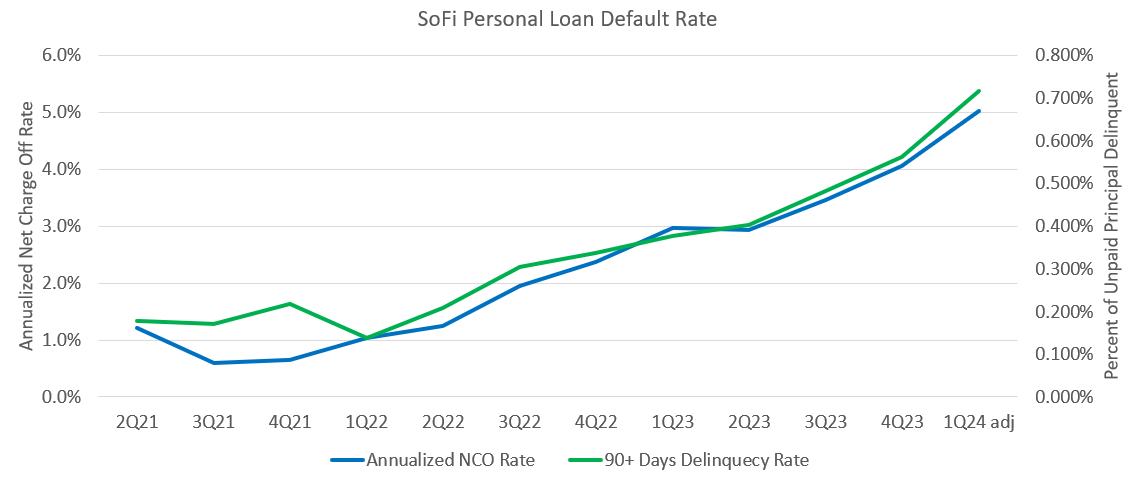

SoFi reports two numbers for their loans in their quarterly reports that indicate their loss rates. They report their NCOs, which I just defined, and they also report their 90+ day delinquencies. These are loans whose payments are more than 90 days late, but haven't been charged off yet when the quarter ends. As you can see, both delinquencies and NCOs have been rising quickly and they mirror each other fairly close. The 1Q24 numbers are adjusted to assume that the late-stage delinquent loans they sold off last quarter would have all gone delinquent instead. The unadjusted number for 1Q24 was 3.4%.

Many analysts use the 90+ day delinquencies as a forward indicator of what the next quarter’s NCOs will be. They use a roll rate to predict how many loans will go into default. I’ll describe briefly how this works and what it leads to as a prediction for Q2 NCO rate.

If the 90+ day delinquency rate was 1%, and the company has a roll rate of 80%, then you can project that the next quarter’s annualized NCO ratio would be 9.6%. You take the delinquency rate and multiply by 3 because there are three months for the 90-day delinquencies to turn into 120-day charge-offs, and then multiply by the roll rate of 80%. A roll rate of 80% means that SoFi would be able to get 20% of the people who are haven't paid their bill in 90 or more days to start paying again. That gives you a quarterly NCO rate, so then you multiply by 4 to get the annualized NCO rate. In this case, you end up with 1% * 3 * 0.8 * 4 = 9.6%.

KBW ran this analysis and issued a recommendation to short the stock going into earnings. I've tried to replicate their numbers and I cannot do it, so I'm not certain how they are calculating their roll rate, but my analysis leads to similar conclusions, if somewhat lower, results. You can see my calculated quarterly roll rate below. Again, this is the percentage of loans that are delinquent that they get charged off the next quarter.

Remember that the 1Q24 roll rate is a worst-case scenario. The range of roll rate since 4Q22 has been between 67%-78%. If I apply that range to last quarter’s 90+ delinquency rate, I get a range of possible annualized NCOs for Q2 of 5.75%-6.7%. For comparison, the range that KBW gave in their analysis for their expectations for Q2 was 6.3%-7.1%. Again, I tried as hard as I could to replicate their calculation methods and just couldn’t get it to work. They gave a range of roll rates from 75%-85%. I honestly don’t know how they are coming up with those numbers

Nevertheless, even if my range is accurate, the optics of having an NCO rate around 5.7%-6.7% are bad for two reasons. The first is that it looks like a MASSIVE spike QoQ going from 3.4% all the way up to around 6.2% (the midpoint of my range). That’s almost a double in charge-offs in a single quarter. It's easy to look at the graph and think, “Well, the bears are right, defaults on these unsecured loans is spiking and SoFi is going to lose so much money on them!” If you are a bear, it’s easy to publish this graph and say “I told you their unsecured personal loans were risky, here is the proof and it’s going to get worse.” Here is what that graph would look like. I can easily imagine the bears showing this graph of SoFi defaults on their unsecured personal loans as being the only thing that’s going to the moon.

The second reason the optics are so bad is because SoFi's fair values have an assumed 4.85% annualized life of loan NCO rate. It doesn't take a PhD to realize that 6.2% is way bigger than 4.85%. The obvious bear argument is to cry foul that SoFi is juicing their numbers by claiming fair values that only have an NCO rate of 4.85% when their current NCO rate is way above that. That’s a dishonest argument, but they’ll make it anyway.

If you’ve read my recent article about how SoFi beats the bears, you’ll realize why it’s dishonest and I’ll cover the reasons why again briefly here. When SoFi’s NCO rates were below 2% in 2022, the NCO rate for the fair values were around 4.7% because their loans were so young that they hadn’t hit the part of their curve with peak losses. Right now, most of their loans are showing peak losses, so the NCO rate for this quarter can be 6% or even 7% or more and the average annualized loss rate across the life of the loans can still be accurate at 4.85%. Again, I’ll use a slide from LendingClub to illustrate this.

Most of SoFi’s loans are in that peak net charge off rate where the annualized NCO rate is really high even (the 7.5%-9% annualized NCO region in Year 2) though the “Lifetime ANCL” (the equivalent of what SoFi uses for their fair value calculations) for this example is still 4.7%. In other words, if the NCO rate for Q2 is above the NCO rate they use for their fair value calculations, discerning investors shouldn't be concerned. That being said, how many investors do you know, especially about banks, who are not particularly discerning and are easily spooked by this type of argument? The bears already have their articles written. You know better. Don’t get spooked.

There are some things that management can do to alleviate these problems. They could easily sell late-stage delinquent loans again this quarter, which would improve the optics of the NCO rate. Like it or not, looks are just as important in reality a lot of the time, and this would help things look better. They can also work with borrowers to rework their loans to prevent default. As a fundamental investor, I’ll be interested in seeing how they handle this because I don’t think I’m the only one who saw this coming and it will be interesting to see what management has done to mitigate losses. I’ll also be listening for them to reiterate and express confidence in their 7%-8% life of loan guidance estimates like Chris Lapointe did in the recent Mizuho conference.

Furthermore, I think SoFi management need to address this in the prepared remarks and in the Q&A session and completely put to bed any narrative that the bears could stir up after the fact. They need to be absolutely crystal clear that loans will come in line with the 7%-8% life of loan losses guidance or they run the risk of the bears injecting their own story into any void that is created by a lack of communication. I think even more than in past quarters, they have to come out swinging in this quarter with their commentary and confidence in the business moving forward. They’ve killed it in terms of execution, and I think it’s time they start demanding the respect their results should justify.

Guidance

If NCOs are where the bears are ready to sink in their teeth, guidance is the one place where the bulls are potentially sharpening their horns. SoFi has taken a very conservative approach to their loan book and has stated that they are waiting for clarity on rates before becoming more aggressive in the lending business. I think the recent Noto interview on CNBC had a lot of really important nuggets in it for discerning investors who have ears to hear what he is potentially saying.

What is the trigger for SoFi to lean back into lending? They have the capital that they freed up with the convertible note transactions in Q1, so what are they waiting for?

From the Q4 earnings call:

We are taking a conservative and pragmatic approach toward our Lending segment revenue, expecting to largely maintain it, given our concerns about the 2024 macro environment as it relates to uncertainty on rates, the economy and industry liquidity.

They want certainty on rates, the economy, and industry liquidity.

From the UBS Financial Services Conference:

Looking forward, I think an awful lot would have to change for us to take a different stance on originations over the course of the next 12 months. There's still a ton of volatility with respect to rates. If rates do come down 4, 5, 6 times as expected, what does that actually mean and imply?

Yes, it may be great for a refi business. But does that necessarily mean that the economy is doing well and we should accelerate lending. So we would have to evaluate at a given point in time, given all the factors that are at play. But right now, a lot would have to change and a lot more certainty with respect to the macro would have to change for us to get comfortable.

They want less volatility with respect to rates and more certainty with respect to the macro.

From the Q1 Earnings call:

As you see, our lending business is actually performing quite well. We're driving great returns there, good steady credit performance as expected. It's not that we're expecting a huge drop off the cliff or huge deterioration. It's that we've gone from in the last 6 months, the market anticipating 6 rate cuts as you got into the sort of October time period to then now, we're down to 1 to 2 rate cuts. And prior to the 6 rate cuts, people were talking about higher for longer in October.

And so there's been a complete swing of the interest rate environment. As you just saw in the banking industry, that creates liquidity issues for different banks. We're concerned about others not being able to manage the liquidity issues. […] We have excess capital well above we started the year with at 17%. So we have the option to grow the business much faster if we choose to. […]

Could we be more aggressive in the lending business? 100%. We have the capital. We have the go-to-market strategy. We have the flexibility on the balance sheet, and we have the opportunity to be able to do it. We're just taking a very conservative view to make sure; we don't go into an environment that we're completely unprepared for.

Again, rate uncertainty and liquidity, and reemphasizing that capital is not an issue.

From the Mizuho Technology Conference:

If we rewind back to when we first started setting the plan for 2024, everyone was talking about rates staying higher for a longer period of time [this would have been around October or November].

Fast forward 2, 3 months when we actually established our 2024 plan, there was 6 rate cuts baked into the consensus. Fast forward another few months, 3 rate cuts. Where are we today? 1 to 2 rate cuts. This morning, rates are rallying 15 basis points off the CPI print.

So there's just a ton of volatility with respect to rates, there's geopolitical risk, there's liquidity concerns. So that, coupled with the fact that we have 2 very large segments in our Financial Services and Tech Platform businesses that are growing meaningfully and delivering meaningful profit gives us the ability to be flexible and not unnecessarily grow our Lending business when we don't need to and when we can take a conservative approach.

So that's why we're doing it. We feel really good about the underlying credit trends that we're seeing in our business. But from a broader macro perspective, there's too much volatility to grow that business more than we need to.

[…] Now what would change our outlook on opening up or scaling the lending business, I think the macro would have to change. We'd have to get much better visibility. Rates would have to stabilize. We'd have to have much better visibility into what's happening with fears of a recession, unemployment, et cetera, or rates would have to come down. Our capital ratio -- total risk-based capital ratio today is 17.3%. So we have plenty of headroom above and beyond where the regulatory minimum is at 10.5%, to scale the Lending business if and when we choose to do so.

We're being cautious today. If rates come down, that will open up the gates for our student loan refinancing business and our home loans business, which is really small right now.

Again, rate volatility, macro uncertainty. The message is clear. If the market can come to a consensus on when rate cuts are coming and the macroeconomic picture remains stable, they are ready to turn on a dime. They need to see those signals play out first though. Contrast those prior comments to what Noto said on his recent CNBC interview.

I think the consensus view is starting to come into picture and people believe we’ll continue to get the data points on inflation, continue to see an uptick in unemployment, but not too bad, and we’ll have one to two rate cuts by the end of the year.

Then later on in the interview:

For the first time I’d say in two years, there’s a more central consensus view about rates, and where credit is […] all in all I think we’re setting up for a pretty strong back half of the year and 2025 if we get the right fiscal policy

After this morning’s PCE inflation print, which was mostly just barely higher than expected, but still below 3%, and yesterday’s GDP print, which surprised to the upside, I think Noto’s comments about there being consensus is only strengthened. The data agree. Markets are now pricing in a 100% chance of a rate cut in September. That includes a 12% chance of 50 bps of cuts between now and then. That seems like a very strong consensus indeed, and showing more certainty of a rate cut than we saw one week or one month ago by a wide margin.

All SoFi has to do to really catch Wall Street off guard is say that they've seen the consensus view become clear enough that they are taking a slightly less conservative approach to lending and that it will be flat to slightly positive on the year. That, combined with the typical double beat would allow them to raise revenue guidance by over $100M, EBITDA by around $40M, move the bottom of the guidance for annual growth in tangible book value up to $900M (up from $800M), and increase EPS for this year from its current guide of $0.08-$0.09 to around $0.13-$0.15. I don't think this is going to happen, but it would put anyone with a short position in a very tight spot. The stock would almost certainly see a significant move up if that were the case.

SoFi, historically, has been very conservative in their calls and their guidance and they let their results speak louder than their words. I still expect for them to say that they are not going to accelerate until there is complete clarity on rates or until the first cut comes. That means we probably don’t get commentary on reacceleration in lending until the Q3 earnings call. I think they maintain their typical strategy and they will raise guidance, but probably not enough to cause anything like a short squeeze. I still think SoFi is extremely undervalued, but I do not think this is the quarter where we see a massive move to the upside.

Management Needs to Bring Their A-Game

The company is performing and I feel very confident we get another beat on revenue, beat on EBITDA, beat on EPS, and full year guidance raise. Long term I am extremely confident in my investment. However, more than any other quarter, I think what happens to the stock is extremely dependent on the story regarding NCOs and guidance. I think by far the most important thing that management can do is look to control the narrative. They need to be high energy, they need to be confident, and they need to dispel any questions they know will be coming before they come. The battleground for this company is whether the reacceleration in growth will actually materialize, whether their loans will remain profitable and defaults will come inline with expectations, and, as always, whether the fair values are justified. In this battle, they have the chance to take the high ground and take the first shots, and they should take full advantage of that opportunity.

Subscriber update

Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in LC and SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Thanks for the article. Much about Lending, not much about the Tech Platform or the Financial Services platform. People are crying for transparency in the other areas; not your fault of course. It's hard to explain the 3 legged stool vision with so little news.

Hi Chris. I sent a couple tweets; don't know if I've been doing it right. I have a question:

Someone shared recent reserve ratio data for SoFi; would you explain why the ratio dropped so much, or are we misinterpreting? This doesn't seem good to me. Thank you.

Q1 2024

Cash $3,693,390

Deposits $21,604,594

Ratio 17.1%

Q2 2024

Cash $2,334,589

Deposits $22,996,963

Ratio 10.2%