This is How SoFi Beats the Bears

One of my favorite scenes from the Dark Knight trilogy is where Coleman Reese, a Wayne Enterprises employee, confronts Lucius Fox (one of Batman’s right-hand men along with Alfred) after discovering that Bruce Wayne is Batman. He lays out clear evidence of what he has found before telling Lucius, “I want ten million dollars, a year, for the rest of my life”. Fox’s answer is brilliant.

“Now, let me get this straight. You think that your client, one of the wealthiest, most powerful men in the world, is secretly a vigilante who spends his nights beating criminals to a pulp with his bare hands... and your plan is to blackmail this person? Good luck.”

The scene is worth a watch if you haven’t seen it. The reason I am sharing this clip should become more clear as the article continues.

Once in a while, it’s worth taking the time to zoom out from the minutiae of fair value accounting, quarterly earnings beats and misses, and convertible notes and look at the bigger picture. This article should serve that purpose. It is worthwhile to take a wholesale look at what SoFi the company has done and accomplished since going public in 2021 and use it to understand where the company is going in the future.

Almost every article I write about SoFi is written with bulls as the audience. This one is a little different. I will mostly be addressing the bears and anyone shorting the stock, although there will be plenty of things the bulls will enjoy reading along the way. My tone will be more sarcastic than normal as well. I respect many of the bears, but I’m a little bit fired up so I’m going to let that show in my writing. Don’t take it personally. This might the most comprehensive article I have ever written. That’s a short way to say that this is a long article packed with a lot of research, charts, and analysis. Buckle up.

The Bear Cases

The bear thesis changes from time to time because SoFi keeps proving them wrong. If you think that’s hyperbole, let me point you to a Seeking Alpha article I wrote over two years ago in April 2022 where I pointed out that the main bear cases at the time were:

Stock-based compensation is too high

SoFi is reliant on their student loan business and if the moratorium were extended, the company would end up folding

SoFi isn’t profitable and never will be

SoFi has no moat

We’ll discuss several of these in detail in this article to illustrate the point that I’m trying to make, but first let’s discuss the current bear cases. They are summarized very nicely by IP Banking Research (for whom I have great respect even though our opinions often differ). He may or may not believe these are good arguments (right now I think he is mostly neutral on the stock), but he did a good job of articulating them.

The current bear cases are therefore 1) the riskiness of the unsecured loan portfolio if the macro deteriorates and 2) the fact that they are a bank and should be priced like one. I would also add that having looked at analyst expectations, one more bear case is that growth has stalled and will not reaccelerate. This one is not vocalized as clearly or as often, but underpins a lot of the “it’s just a bank” narrative. If you agree with these bear cases, here is what I think you should know.

Past Bear Cases

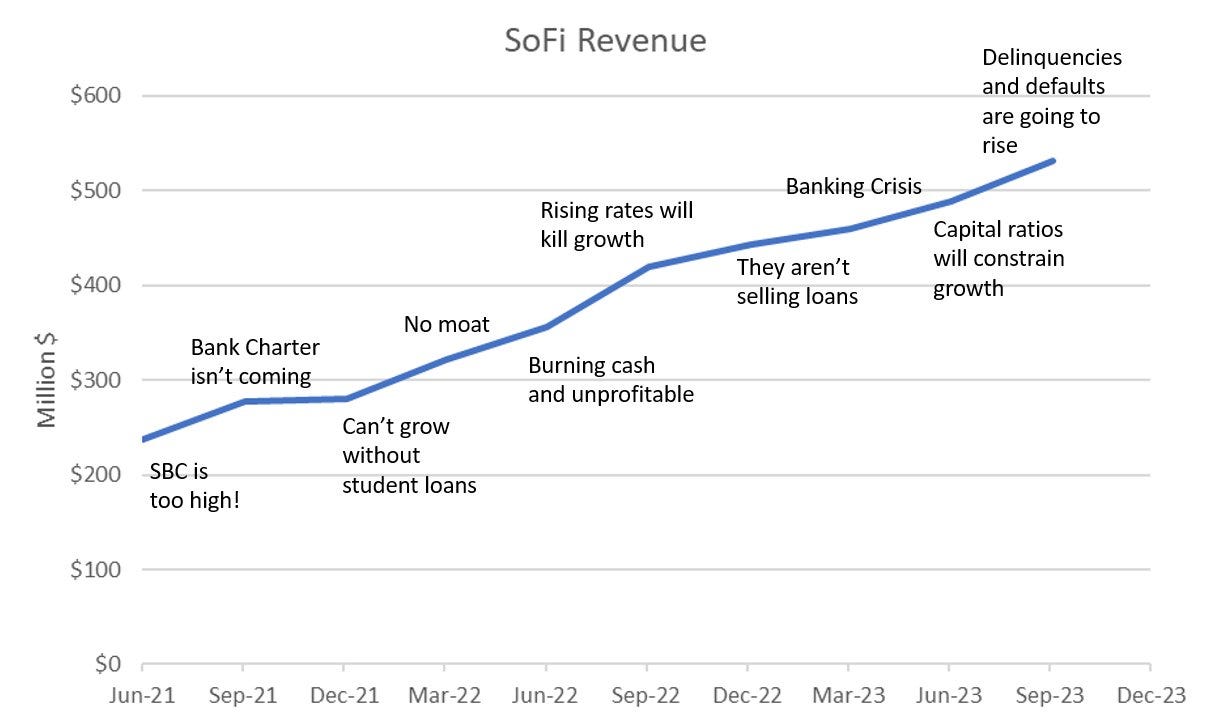

Let’s start with talking about how things went with the past bear cases. Here is a chart I made six months ago of the biggest bear cases at the time vs. the company's revenue.

The reason this is important is because those of you out there betting against the company need to realize the type of management and the type of execution you are betting against. Let’s start from the beginning and go through what happened to the key bear arguments. Brevity is not my strong suit, but I’ll try to keep these points short.

Stock-Based Compensation

Bear Case: SoFi was giving out too much SBC and would continue to do so in perpetuity

This was the biggest bear case after the company first went public. In Q4 2021, Chris Lapointe said “We expect longer term that our SBC as a percentage of revenue should come down.” They gave more detailed quantitative guidance in November 2022 when Chris Lapointe said the following:

You have the stock-based compensation, which is about $75 million to $80 million per quarter. One-third of that is related to performance share units, which were issued as part of the IPO. And those performance share unit expenses will roll off in Q1 of 2024. And the residual portion of that is about 12% of revenue today, and we expect to get that down to single digits over the course of the next several years.

Here is SBC total and as a percentage of revenue since the company came public:

SBC has come down in absolute and relative terms. “Over the course of the next several years” actually happened in less than a year and a half because SBC as a percentage of revenue was under 10% in 1Q 2024. Management gave quantitative guidance over a year in advance which they reiterated several times. They fulfilled that guidance. The bear case was dismantled.

Student Loans

Bear Case: SoFi is a student loan company and therefore the student loan moratorium will destroy the company.

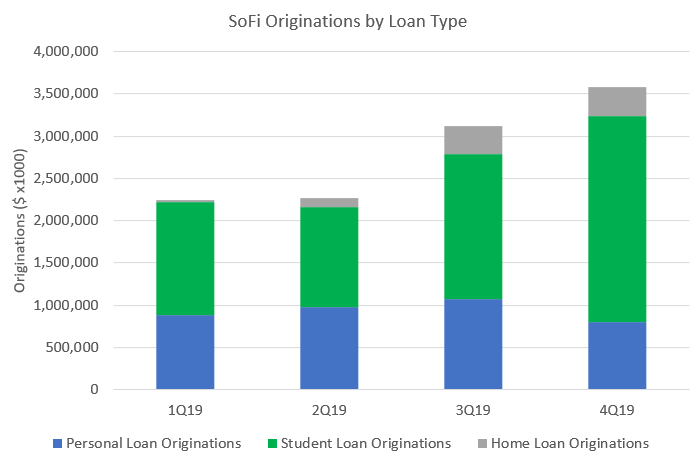

I’m going to spend a little more time on this one because nobody takes the time to really think about how incredible it is that SoFi isn’t bankrupt right now. Before Noto took over as CEO in 2018, SoFi’s only real product was student loans. It also remained their hero product for the first two years he was running the company (2018 and 2019). In 2018, 99.5% of SoFi’s revenue came from lending, with student loans comprising 55.6% of their originations. In 2019, lending was still 98.9% of their revenue, and student loans had grown to 59.7% of originations. We don’t have detailed quarterly data from before 2019, but if you look at the data available, the trend is clear. Student loans were becoming an increasingly large piece of the SoFi lending pie, and therefore an increasingly large piece of SoFi’s revenue.

By the end of 2019, the lending business was firing on all cylinders and student loans were leading the way, representing 68.2% of all originations in 4Q19 and growing at a very fast pace. Then COVID-19 hit and on March 13, 2020 the CARES Act paused all federal student loan payments and set interest rates to 0%. The student loan refinance business predictably fell off a cliff thereafter. It is now four years later and it still has not recovered to anywhere near where it used to be, especially when you consider that SoFi has 8x as many members now as they did in Q1 2020.

If anyone would have told me in March 2020 what was about to happen with student loans and in the same breath said that SoFi would nevertheless grow at an annualized CAGR of 46% in the four years between 2019 and 2023, I would have laughed them to scorn. Name a single leadership team that has executed such an incredible pivot due to external forces in such a narrow time window. What they have accomplished is truly mind boggling.

Let’s put this into the context of other companies. Remember, 99% of revenue in 2019 was from lending and 68% of originations were student loans in 4Q19. Imagine any other business with a product that represents ~65% of its revenue getting cut down by 60-75% due to an emergency act of Congress, and sitting there being forced to watch that product continue to shrink for the next four years. This is the equivalent of Apple immediately losing 75%+ of their iPhone sales, Nike losing 60%+ of their shoe revenue, Starbucks selling 60%+ less coffee, Tesla selling 50%+ less cars, or Disney losing 100% of their Parks, Experiences and Products revenue and then another 6% of their total revenue from other sources. Then the business is forced to operate as the revenue from those products continues to shrink four full years (2020, 2021, 2022, and 2023).

Think about it. How would Disney be doing if their parks and cruises were still 100% closed and had been since the pandemic? Now fast forward four years and somehow the company’s revenue ended up being 4.5x what it was in the year before losing their biggest revenue generator. That is what SoFi just pulled off. SoFi, as we’ll continue to see, is one of the most nimble and agile companies in the market. The student loan bear case was totally dismantled.

(quick disclaimer: this is obviously an unfair comparison. I wanted to use examples of companies and products that everyone is familiar with, so all the businesses mentioned are well established. Growing revenues by 4.5x revenues in four years for a business who already has revenues in tens or hundreds of billions is different than doing it from a base of $450M like SoFi. However, in terms of percentage of total revenue, it is not an exaggeration at all. The chart above clearly shows student loans were just as important to SoFi's business as those products are to their companies. The point is that any company that could handle that kind of a drop in their most important product and remain solvent is impressive, one that could grow without skipping a beat is virtually unheard of)

Profitability

Bear Case: SoFi is uninvestable because it is wildly unprofitable and burning cash.

SoFi management made 25 separate statements in 2023 that they would be GAAP profitable in Q4 2023. In spite of this, I was told plenty of times by many bears that SoFi would not turn profitable until the end of 2024. Even if they did hit it in Q4 2023, it would be a one off and they’d go back to unprofitable thereafter. They hit their guide in Q4 2023, and then they were profitable again in Q1 2024 to prove it was not just a fluke and they’ve guided to being profitable every quarter from here on out. Management gave a quantitative guidance about a year in advance which they reiterated several times. They fulfilled that guidance. The bear case was dismantled.

Rising rates will kill growth

Bear case: In the fastest rate hike cycle in history, SoFi would be forced to shift from cheap capital to expensive capital. This will stall growth and hurt margins.

This bear argument makes a lot of analytical sense. For example, when they released their savings account in early 2022, they only paid 1% APY for deposits. They now pay 4.6%. Rising rates did in fact cause SoFi’s cost of capital to skyrocket. The argument was that rising costs will squeeze net interest margin (NIM) and kill growth. Bears were right that their weighted average cost of capital would balloon very quickly, especially in the back half of 2022, as seen below.

What the bears didn’t take into account was that SoFi had a trump card up their sleeve that is unique to them and has not been replicated by their competitors. Member growth leads to a larger pool of possible borrowers, which increases demand for their personal loans. That increased demand means that SoFi was able to front run the Federal Reserve’s rate hikes. Even as the Fed was hiking rates at unprecedented speeds, SoFi was increasing the interest rate they were charging their borrowers at an even faster rate. This is in stark contrast competitors like LendingClub. LC saw the interest rates they could charge on their loans lag the Fed by 100 bps according to their own Q3 2022 earnings call. This led to a collapse in LendingClub’s NIM. SoFi’s ability to lead the Fed rate hikes resulted in SoFi’s NIM expanding overall during the rate hike cycle, rather than contracting. Compare that to what happened and is continuing to happen to LendingClub’s NIM during the same time period. The bear case was dismantled by being agile and by excellent execution.

Banking Crisis

Bear Case: An unproven neobank like SoFi will fold like a house of cards during the banking crisis.

In March 2023, several banks folded and there were ridiculous calls about how SoFi was at risk of a bank run. Silicon Valley Bank was the first to fall on March 10. At that point, over 90% of SoFi deposits were already insured, so their risk of a bank run was virtually 0%. Nevertheless, 8 business days later on March 22, SoFi rolled out a program that increased FDIC insurance coverage to $2M per account, increasing the amount of their insured deposits to above 98%. It still sits above 98% today. SoFi made a quick and agile change to quell fears and implemented the change in less than two weeks. The bear case was dismantled. By now you should be noticing a trend.

Moat

Bear Case: SoFi has no moat.

This bear case is still up for debate. I think SoFi’s moat is small but expanding. I wrote two full articles on this for those who are interested here and here. What I just presented between SoFi and LendingClub is another pretty good argument for an expanding moat. We’ll leave this one as undecided for now.

Fair Values are wrong because they aren’t selling loans

Bear Case: SoFi is inflating the value of its loans by using fair value accounting and juicing their numbers.

Declaring a complete victory here is still premature, but the balance of evidence in my opinion is now thoroughly on the bullish side. After the recent light that has been shone on this by the bears, it might require a full article to go through this in depth, but I’ll cover it briefly here. Between Q4 2022 and Q3 2023, this was the skeptics favorite talking point. The argument went like this: SoFi was artificially inflating the fair values of its loans to juice revenues. The real fair values were much lower than the stated fair values. The evidence for this was that they weren’t selling any personal loans. The logic was that they weren’t selling them because they could not sell them without taking a massive markdown on the entire portfolio. SoFi management clarified this multiple times by stating very definitively that they could sell the loans if they wanted to, but were getting a better return by holding them, and they were going to maximize returns.

The rubber would meet the road around Q4 2023 or Q1 2024 as they got closer to their capital ratio minimums. Skeptics were giddy that the inflated values would be proven wrong. They assumed that management was blowing smoke and SoFi would be forced to sell loans at actual market value that would be significantly lower than the fair values. If SoFi sold loans, it would be below the fair values and they’d be forced to write down their fair values, leading to a massive revenue and earnings miss. The other option would be that SoFi would be forced to pull back extremely hard on lending because they’d refuse to sell so they could keep their inflated values.

Neither of those things happened. Q4 2023 rolled around and not only did SoFi sell over $1.2B worth of personal loans (the second highest total they’d ever sold), but they did so at levels well above the fair value marks. They did that again with a slightly larger amount of loans sold in Q1 2024, but the sales were executed at even higher levels. Management gave a definitive statement a year in advance which they reiterated several times that the values were justified and they were holding the loans on purpose. That statement, based on the evidence we have, was true and completely justified. There are still some questions surrounding fair values, discount rates, and loss-sharing agreements, but what better justification for the “fair value” of the loans can you have than over $2.4B of actual loans sold to the market in the last six months. The bear case has been, for the most part, dismantled.

Quick addition after the recent video about fair values from some prominent skeptics

As a point of clarification here, there is a lot of debate surrounding the discount rate that SoFi uses in these calculations. This was also clarified in the Q1 2024 earnings call by Chris Lapointe, when he said “Importantly, the benchmark rate change and the spread change are empirical as they are actual market observed inputs, not assumptions.” So the spread assumptions that bears harp on, and the discount rate that they highlight as a red flag are not an assumption that SoFi pulls out of a hat, they are based on empirical market data.

The debate about fair values and discount rates was much more convincing when SoFi weren't selling loans and didn't have market data to justify the marks. Now that the market data is there, the argument holds considerably less weight. The accusation is that they're cooking the books and lying to investors. There is always going to be a gray area and obviously calculating fair values isn't an exact science (I might add that CECL provisions have the same subjectivity and fungibility), but at this point questioning the marks is essentially calling management's integrity into question. Here is the full Chris Lapointe quote that for full context.

If you think management is lying on their quarterly earnings calls then this entire article is purely academic because there is fraud taking place. As for me, I think management has done more than enough to prove they are trustworthy.

Previous Bear Case Recap

For those keeping track at home, the score for past bear cases is now SoFi ahead 6 - 0 with one still pending. In every case, the bear case was dealt with in one of two ways. SoFi management either set a quantitative guidance or statement that they met or exceeded (SBC, profitability, and fair values), or was able to demonstrate incredible agility and execute their way out of a tight spot that was caused by forces outside their control (student loans, rising rates, banking crisis).

Current Bear Cases

So let’s return to the current bear cases which are 1) Exposure to unsecured lending, and 2) It’s just a bank (which encompasses both the argument that it cannot continue high growth, and that it should get a low valuation). Let’s analyze these individually.

Exposure to unsecured personal loans

This is going to be the most technical part of the article. Let’s start by establishing two things. First, SoFi is providing definitive guidance here by saying their life-of-loan losses will be between 7%-8% on their personal loan portfolio. Secondly, the data are showing increasing delinquencies and defaults right now, and that is expected.

Delinquencies and charge-offs are increasing in SoFi’s personal loan portfolio. There is absolutely no doubt about it. I’ll post the chart in a second, but it needs a little context first. In Q1 2024, they “sold $62.5M of of late-stage delinquent personal loans principal”. If the entirety of those loans were charged off rather than being sold, which is the worst-case scenario, the net charge-off (NCO) rate would have been 5.03%. Realistically it probably would have been very close to that number.

This next part is going to get a little technical, but it’s worth it for the later discussion. LendingClub had an excellent slide in their most recent investor deck with a curve of losses compared to the age of the loans that is really instructive. For a mock portfolio of $100M of loans with a 4-year term, the rate of losses peaks at around 5 quarters into the life of the loans (Q1 of Year 2 in the graph below). Average life of loans for this portfolio is about 20 months. If the average loan term is shorter (like in SoFi’s case where it is less than 18 months), the peak in net charge offs happens slightly earlier.

There a few more things that I want to highlight here. Look at the NCO numbers that appear below the graph. Notice that the annualized NCO rate in Year 2 (7.5% to 9.0%) is much higher than the lifetime average charge-off rate of 4.7% (this is important for fair values). In this example, it is also higher even than the total net charge-offs over the lifetime of the loans (which you can see in the table are only $7.8M of the original $100M of principal, or 7.8% life of loan losses). So the annualized NCO rate is just one piece of the puzzle and needs to be combined with other information, like the average age of the portfolio and weighted average life of loans, to be meaningful. Putting too much stock in the annualized NCO number by itself without context is a mistake I’ve fallen into in the past as well.

SoFi’s personal loan originations peaked in Q2 and Q3 of 2023. Their weighted average life of loans used to be 18 months, but has actually come down as they’ve seen “a shift towards shorter duration loans being taken out, which is resulting in losses happening at an earlier stage in a loan's life cycle, which is creating some of this lumpiness that we see in NCO rate as well” (quote from CFO Chris Lapointe at the Mizuho Conference two weeks ago). That squeezes the curve shown above and pushes the timeline further forward from the example in LendingClub’s slide. Therefore, peak losses will probably be during the time the loans are 10-14 months old rather than 12-15 months old. SoFi’s originations peaked in Q2 and Q3 of last year, so that means NCOs are likely to peak in Q2 and Q3 of this year when those loans are in that 10-14 months old range. The average age of SoFi’s portfolio is moving up the curve and probably going to reach peak losses sometime in the next several quarters.

So, for the bears out there, do not celebrate too hard if the annualized NCO rate gets above 5% or even to the 6% or 7% range. SoFi doesn’t guide for annualized NCO rate at any given time. They guide for life of loan losses. Here is how those are trending according to Chris Lapointe at that same Mizuho conference two weeks ago (emphasis is mine):

So what I would say is what gives us confidence in that 7% to 8% life of loan loss level is we have over a decade of experience in underwriting high quality credit. In addition to that, we're seeing really favorable trends in some of our more recent cohorts. So I mentioned this during our Q1 earnings call, but just to provide a little bit of incremental detail, if you look at our Q1 through Q3 cohorts of 2023 and compare that to Q3 2022 cohort at similar levels of unpaid principal balance on the balance sheet, you would see that our losses of recent vintages are 20% to 40% better than Q3 2022.

If you take that a step further and rewind back to 2017, the last time we saw life of loan losses that even came close to 8%, it was still below 8%, but nonetheless, it was the highest cohort that we had. Our losses, again, comparing to similar levels of unpaid principal balance remaining on these loans are performing 40% to 50% better than 2017 levels. So we feel really optimistic and comfortable and increasingly confident in our 7% to 8% life of loan loss guide that we provided. And we're really optimistic about the underlying trends that we're seeing.

One last point before I move on. The fair values have an assumed weighted average annual default rate, which is currently at 4.85%. This is the equivalent of the ANCL in the LendingClub slide above. Again, the annualized NCO rate in any given quarter can go over this number, and significantly above this number, over the next few quarters and it does not mean that the ANCL is wrong. It does not mean that the fair values are wrong. That number is the average across the entire life of the loans and will almost always be higher or lower than the annualized NCO rate at any given time. Remember this paragraph when Q2 numbers are released, because I’m certain there will be people who cry foul that the annualized NCO rate is greater than the ANCL and how it’s another sign the fair values are wrong. Remember that I already told you why your argument is wrong.

So, to recap, there is a bear case that SoFi’s exposure to personal loans will lead to losses. In response, management has given a very explicit quantitative guidance. Sound familiar?

What about in a deteriorating macro?

That is all well and good, but what if crap hits the fan in the economy and we go into a recession. How will SoFi’s $15B of unsecured personal loans hold up then? There are two answers to this question. The first has to do with the quality of their loan book. The second has to do with their guidance.

This is why they target high-quality borrowers

Let’s start by talking about risk from first principles. Personal loans are not risky just because they are unsecured. Mortgages, similarly, are not safe just because they are collateralized. The Great Financial Crisis in 2007-2009 was not caused by rampant defaults on personal loans, but on ostensibly “safe” mortgages that were backed by physical real estate that was acting as collateral. It turns out having “secured” debt didn’t save us from the worst financial downturn since the Great Depression.

Risk is not defined by the type of loan or asset, it is determined by the the odds that the bank loses money on that loan or asset. Personal loans are bad is not a legitimate thesis. A global recession has never been triggered by unsecured lending. The worst one since the Great Depression came about by giving out a huge amount of subprime mortgages targeted at low-income homebuyers.

Even the recent banking crisis wasn’t caused by unsecured debt, but overexposure to long-duration assets like treasury bills and mortgage-backed securities. If you look at the banking sector today, the riskiest assets are not short-duration assets, they are long-duration assets and commercial real estate loans on office buildings whose value has deteriorated. SoFi has virtually no exposure to the actual riskiest parts of the banking sector right now.

Yes, personal loans are unsecured, which means that if the borrower defaults, the bank (in this case SoFi) has to eat the losses on unpaid principal. However, this is offset by the fact that borrowers have to pay significantly higher interest on a personal loan than a mortgage or auto loan to compensate for the higher potential losses that would be incurred. Analyzing the “risk” that SoFi carries is therefore not as simple as saying that since they hold $15B in personal loans they hold a risky portfolio. It is significantly more important to look at the people to whom those loans are going and their propensity to repay, even in a recession. That is the most important measure of risk.

SoFi lends to very high quality borrowers (see chart above), which should keep them from large losses even in times of financial trouble. SoFi’s weighted average FICO score on their unsecured personal loans has mostly hovered between 745-750 since they came public. They are also given to very high-earning borrowers, as enumerated by CFO Chris Lapointe two weeks ago, “on the personal loans front, we target prime borrowers who have average FICO scores in the 750 range with average incomes of $160,000.”

Now, the next piece of the puzzle is to see if those things protect SoFi in a downturn. If only there were some neutral third party who had published data on exactly how unsecured personal loans faired according to FICO score during the last recession. That way we would be able to have an idea on whether or not having high FICO borrowers insulated those lenders from significant losses. It would be even better if it was based on the FICO score at the time of origination, which would match the data that SoFi provides.

Turns out we have that exact analysis. Transunion, one of the premier reporting agencies, published just that data for personal loan and credit card delinquencies during the Great Financial Crisis. We’ll focus on the personal loan data. They looked at the FICO scores of borrowers in 3Q 2007 who held personal loans at that time and tracked their delinquency rates over the next three years. The table below shows their findings:

This data includes all loans that had been originated and were still to be paid off, so it also includes seasoned loans with vintages prior to 2007. However, the data clearly show that FICO score provides a significant margin of safety to lenders. SoFi's borrowers fit squarely in the Prime Plus category, which showed a cumulative delinquency rate from 2007 until 2010 of less than 1%. This is a core reason that you’ll forgive me if I’m not overly concerned about SoFi’s personal loan portfolio if we go into a recession. Delinquencies and defaults will certainly get worse in a recession, but I find it very unlikely that the credit crunch of any forthcoming recession will be worse than what happened during the GFC. Even if it is that bad, the data are clear. Giving loans to high-quality customers as measured by their FICO score gives excellent protection even in a recession.

Guidance

Hard Landing in 2024

“WhAT aBOuT a hARd LanDINg?!?!?” I hear the bears cry. The fair values will crumble with increasing defaults, the total-risk-based capital will follow, and fire and brimstone will rain down from the angry OCC gods upon the unsuspecting heads of Anthony Noto, Chris Lapointe, DDI, and all SoFi investors.

Let’s pull back from the hyperbole and terrifying rhetoric for half a second and look at the actual facts. What exactly is a hard landing? What assumptions is SoFi using in their own scenarios for guidance. What assumptions do they use to stress test their loan portfolio? What does a recession mean for SoFi’s business?

SoFi’s guidance, as best as I can tell, is based on Moody’s S3 scenario. I know it was definitely based on that for their 2023 guidance and I suspect that’s what they used for their 2024 guidance as well. Moody's Analytics is a company that hires economists to get together and project a range of possible future outcomes for the economy. They have a baseline scenario of what they think will happen and then have a range of scenarios for what things look like if the economy is better or worse than that baseline. The S3 scenario is the 90th percentile worst scenario. In other words, if there were 100 possible outcomes for the year, 90 times out of those 100, reality would end up looking better than the S3 scenario. Said another way, 9 times out of 10, what actually happens is going to be better than what they project in the S3 scenario. The S3 scenario is a hard landing. SoFi’s guidance includes a hard landing.

Let’s make this completely clear by comparing the FOMC projections from their meeting two weeks ago (June 11-12, 2024) to SoFi’s assumptions for their guidance. Here is what was said on the Q4 2023 earnings call as a precursor to giving full year guidance (again, the emphasis is mine):

I want to review some of the larger macro assumptions that underpin our financial guide. We assume a contraction in GDP in 2024 and an increase in unemployment to higher than 5% and broadly a continuation of uncertain capital markets activity and continued normalization of consumer credit. From an interest rate perspective, we are assuming four rate cuts in response to a contracting economy, higher unemployment, and deterioration and normalization and credit performance with Fed funds rate reaching approximately 4.5% by Q4 2024.

So, if the economy were to deteriorate in line with SoFi’s guidance, we are looking at ending 2024 at >5% unemployment and negative GDP. Currently, unemployment is at 4.0% and GPD growth was 1.3% in Q1 2024. Here are the FOMC projections from two weeks ago. I’ve highlighted the full range of GDP and unemployment projections from the entire committee.

You’ll notice that even the most pessimistic members of the committee think we close out 2024 with +1.4% GDP growth and the top estimate for unemployment is 4.4%.

SoFi’s guidance for this year is based on a hard landing. So what happens in a hard landing? Well, they’ll probably hit their guidance. This is something that it seems none of the bears take the time to actually look at.

What about in a crash landing, something like the GFC? Is SoFi’s business in trouble then? SoFi’s internal stress tests use the S4 scenario to test whether or not they get close to their regulatory minimums. The S4 scenario is the 96th percentile scenario, so a one-in-25 chance of getting there. In the example S4 scenario they provide, the S4 scenario results in a -4.5% GDP decline and unemployment peaks above 10%, both of these would be worse than the GFC.

Under that scenario, SoFi’s stress tests showed they were able to stay above their regulatory minimums when their capital ratios were at 14.3%. They are currently at 17.3% and expected to stay at those elevated levels until the macro clears up. Again, the bears and shorts will spin tall tales of forced asset liquidation and capital raises. The truth is that SoFi has so much extra capital that even if we get a second GFC, they’ll still be above any regulatory minimums. In that scenario, their growth will stall as capital markets will freeze up and they’ll almost certainly be forced to hold their loans to maturity. However, as we covered above, those loans are almost certainly going to be profitable even in a GFC-like crash. The stock will suffer, and we might even see revenue and earnings contract, but the business will almost certainly be just fine.

Will a recession hurt their business? Of course, it hurts all businesses. Will it lead to higher defaults and delinquencies than a growing economy? For sure. But will it blow up the fair values, cause a fire sale of assets, and a bank run? I’d give it a miniscule chance, and if the type of people SoFi lend to are defaulting en masse, I think we’ll all have bigger problems than SoFi’s stock price.

Future Guidance

Moreover, SoFi is providing guidance of 20%-25% revenue CAGR for the business as a whole in 2023-2026 and GAAP EPS of $0.55-$0.80 in 2026. Remember all the examples above of previous bear cases where SoFi provided a quantitive guidance? Remember how they have always beat those numbers when push came to shove and the bear case was left dismantled? What do you think the most likely outcome is in 2026?

In case the above examples weren’t enough, I’ll also leave here graphs of SoFi’s revenue guidance and adj. EBITDA guidance vs performance since they’ve come public.

So far, in three years, if SoFi gives a quantitative guidance, they do not miss. Their guidance also calls for a reacceleration of growth in 2025 and 2026 after a more cautious 2024. If management hits this guidance, which would result in growth greater than 25% in 2025 and 2026, the argument that they can’t grow because they are just a bank who is limited by their capital ratios will be proven thoroughly wrong.

Valuation

Ok, this also deserves an article all on it’s own, but I’ll just tell this story at a high level as quick as I can. The “just a bank” argument here means they should be valued as a bank, and that banks are valued on a multiple of their tangible book value. First of all, this argument presupposes that SoFi doesn’t have a technology platform or that their tech platform should also be valued based on the bank’s tangible book value. Apart from that, I try to think from first principles. So why, from a first principle perspective, should a bank be valued on its tangible book value? The only reason is if its growth and earnings are limited by its tangible book value. If that assumption is untrue, then there is no fundamental reason to value it on its book value.

SoFi has grown at a 48.6% CAGR over the last 3 years and is guiding for a 20%-25% revenue CAGR for the next 3 years. Let’s do a screener (courtesy of finchat.io) for any other banks that have grown at that pace to see how many banks can do what SoFi is doing. Limiting this to banks over $500M market cap and excluding ones that have grown via a merger. Here are the results.

Ok, we’ll loosen it up to 40% 3Y CAGR and 25% FWD CAGR. Here are the results.

Maybe 30% and 20%?

20% and 20%?

15% and 15%?

We finally got one. Here is the revenue growth of SoFi vs. AX over the past 3 years. Remember, this is SoFi vs the next best bank in the entire market. These are GAAP revenue numbers since I pulled them directly from finchat.io.

There is no comparison here. SoFi is in a class of one. Even if you drop the requirements to 10% and 10%, there are only a grand total of 6 banks that fit the criteria. Banks don’t grow like SoFi. This is why my opinion is that the assumption that SoFi should be valued as “just a bank” is laughable. It grows nothing like a bank. It is not limited in its growth by its tangible book value so I do not think it is reasonable to use that as the basis for its valuation. So, if they don’t grow like a bank, what do they grow like?

Crowdstrike and Duolingo are the comps in my own portfolio that come closest. There are only three public SaaS companies that grew revenue 30% last year, are projected to grow revenue 30% this year, and are currently GAAP profitable. Two of those companies are Crowdstrike and Duolingo. These are the crème de la crème of SaaS. Yet when I put up a chart of SoFi’s growth compared to these high-flying SaaS companies, they are virtually indistinguishable. In fact, if I took away the legend, you’d have almost an impossible task telling these apart on revenue growth (again, these are GAAP revenue numbers).

And before everybody gets all upset at me for focusing only on the top line. Here are the net income numbers. These are in absolute terms since using percentages when they all started off in the negative makes no sense. For complete transparency, I adjusted out the one-time items from this graph, like the goodwill write down in Q3 2023 for SoFi.

SoFi has seen the highest growth in net income for these three companies, growing earnings from around -100M level to around +20M, a swing of around $120M/qtr. Crowdstrike’s net income has improved by around $100M/qtr. Duolingo’s has improved by about $50M/qtr in the same timeframe.

There are no banks that have grown like SoFi over the past five years. There are none that will grow like SoFi in the next several years (assuming that they hit their guidance). Saying it should be priced “like a bank”, meaning a single digit P/E or a very low multiple on their tangible book value seems short sighted. It ignores every bit of rational context for how companies should be valued in service of shoehorning SoFi into the “just a bank” box that skeptics have created for it. You should only be valued like a bank if your financials look like a bank, including the anemic <10% growth rates that banks display. Valuing SoFi like any other bank would completely ignore the growth and execution. Doing a valuation of a high-growth company by completely ignoring all the growth is shortsighted at best and just plain stupid at worst.

When it grows like a market-leading SaaS, has the margins of a market-leading SaaS, and has profitability like a market-leading SaaS, how should you price it? That's right, you should price it based on its tangible book value. That makes complete sense.

I Might Be Wrong

It’s obvious that the market, for now, disagrees with my opinions about how to value SoFi. I truly believe Benjamin Graham’s adage that, “In the short run the market is a voting machine and in the long run it’s a weighing machine.” Peter Lynch expressed a similar sentiment when he said, “Often, there is no correlation between the success of a company's operations and the success of its stock over a few months or even a few years. In the long term, there is a 100% correlation between the success of the company and the success of its stock.”

The market can continue to stay irrational for years, and it is certainly within the realm of possibility that the market will remain blind to SoFi’s exceptional execution and growth when it comes to the stock’s valuation. I can certainly see a reality where the valuation stays compressed due to macro fears. It’s even possible that SoFi stock will not see any appreciation until it grows to the point that it is trading at a price/earnings ratio of 10 even as they hit their 2026 guidance. It would be astounding to me if that were the case, but as dumbfounding as I find that possibility, I acknowledge that it is, in fact, a possibility.

Additionally, as IP Banking Research mentioned in his most recent article, “There is little doubt that if the U.S. economy goes into a hard landing coupled with higher unemployment, consumer-focused banks with a large unsecured book are going to experience materially higher delinquencies. Mr. Market is likely to shoot first and then ask questions later.” Despite everything I laid out above, the reality for SoFi stock has been that sentiment has mattered significantly more than fundamentals. If we do hit a hard landing, despite their guidance for that environment already, it might sell off anyway. In that scenario, I’ll keep adding to my position as long as the core business keeps performing.

Execution in a Recession

Even if we get a crash landing, what happens then? Do people really think that Noto and team, who executed their way through multiple macro headwinds, detrimental government policies, and fears of bank failures are going to just sit on their hands? The team has proven time and again that they are agile and adaptable. They also have more tools at their disposal now than they’ve ever had before to navigate that potential recession.

Conclusion

Some people pretend that SoFi is wearing a little red hood and blissfully unaware of the macro environment as it skips its merry way down the path to grandmother’s house, not realizing there might be a big bad recession wolf wearing granny’s clothes waiting in the forest. Please allow me to disabuse those people of this notion.

CEO Anthony Noto was the Head of Communication Media and Internet Equity Research Business Unit at Goldman Sachs during the dotcom crash and was the Co-Head of Global TMT Investment Banking at Goldman Sachs during the Great Financial Crisis. He was the lead professional analyst covering internet companies during the early 2000s. He watched which ones survived and which failed and was talking to their CEOs the whole time. He was in charge of investment banking at a bank during the time of the most bank failures in history. He had a front-row seat during the dotcom bust and was in the trenches during the GFC. This isn’t his first rodeo. It isn’t even his second rodeo.

Anyone who doesn’t think SoFi is adequately prepared for a downturn does not understand who Anthony Noto is, what drives him, and how incredible of an operator he is. SoFi lost the business that was generating over 50% of its revenues in 2020 when the student payment moratorium was announced. That business still hasn’t come back, and SoFi grew through it anyway. SoFi has a pattern of dealing with bear cases. They execute through them, reducing them to a footnote, or set a definitive guidance to prove it wrong. Then they exceed that guidance and usually do it sooner than expected. Every. Single. Time.

Do you really think the same management team that navigated losing 50% of their revenue by an executive order without warning as a result of a global pandemic doesn’t have a plan for the most telegraphed recession ever? People have been calling for a recession since 2022. SoFi has been guiding for a recession for the last two years. You think they’re just going to arrive unprepared and crumble? Please.

To the bears and shorts who think this is easy money, here is my response:

Now, let me get this straight. You think that this company, one of the most agile, best run fintechs in the world, who quadrupled revenue when its hero product was taken away, expanded its NIM during the fastest rate hike cycle in history, grew through the banking crisis, and constantly outperforms its and analysts’ guidance, is lying when they tell you that will deliver 20%-25% revenue growth and 10x EPS growth in the next two years... and your plan is to short this company at all-time low valuations?

Good luck.

Subscriber update

Paid subscribers continue to dwindle. I’m guessing those are going to be highly correlated to SoFi’s stock price. That’s fine with me because that isn’t the main reason I do this. Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in SoFi and LendingClub.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Brilliant closing paragraph Chris, keep up the goodwork and I look forward to the stock price reflecting reality oneday soon. Cheers

This was an excellent read thank you Chris. Amazing article that trashes any bear thesis out there right now.