SoFi: Going from 0 to 60 (cents of EPS)

SoFi stock has been really weak even as the S&P 500 and other indexes see all-time highs. Sentiment in the investor community is absolutely near all-time lows. Sentiment follows price and the price action has not been good. I don’t really care about any of that because I see a business that has outperformed every competitor and is fundamentally getting stronger with each passing quarter. Hopefully this article can help people take a step back and see the bigger picture. The impetus for this article is to simply answer the question of how will SoFi go from where they are right now, which is barely breakeven on a GAAP net income basis, to “between $0.55 and $0.80 in GAAP earnings per share in 2026.”

Why do we care?

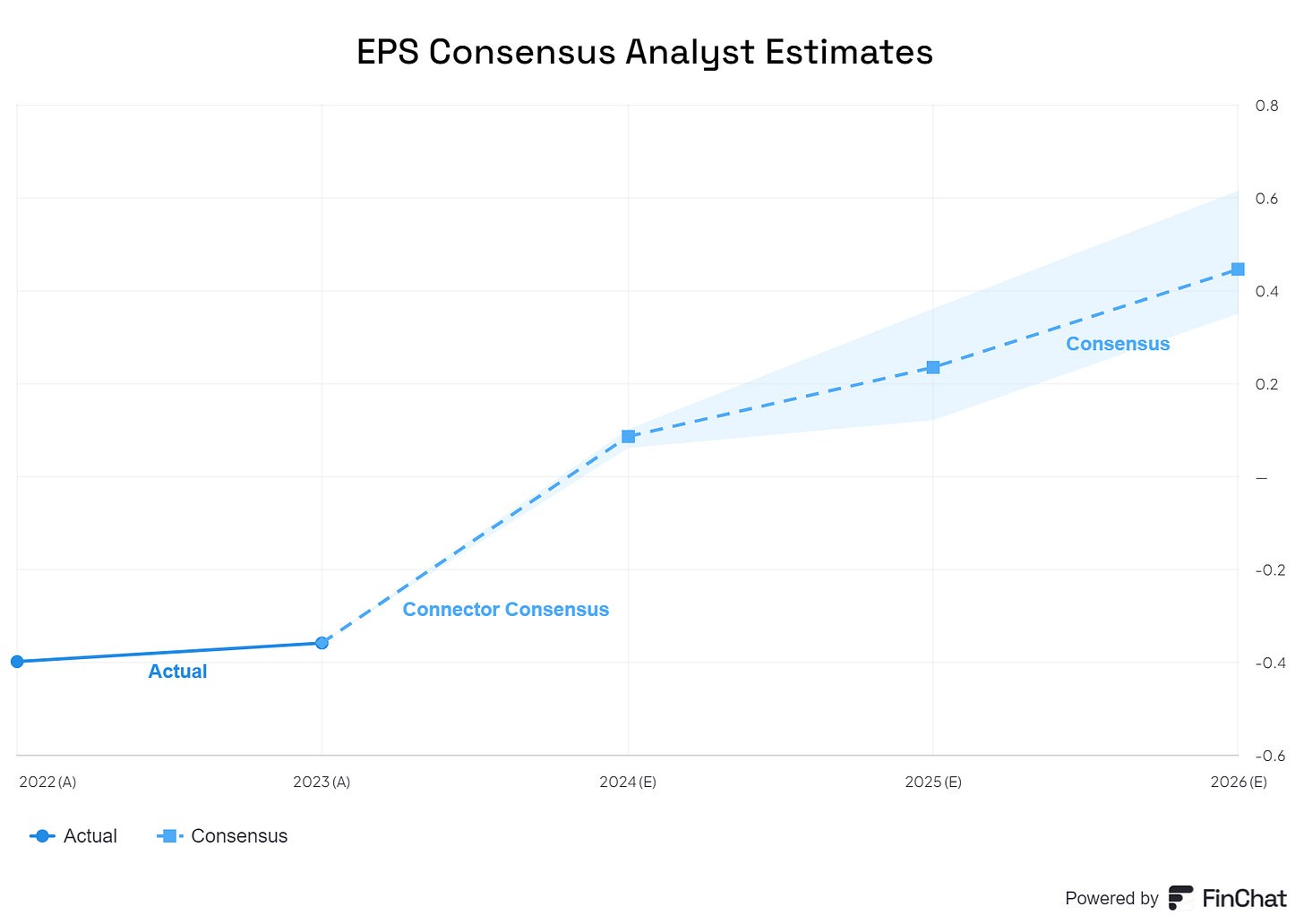

A little bit of background why this is so important. SoFi is in a transitionary period right now. They are going from a period of unprofitability with hypergrowth in revenue (like 50%+ over the last 5 years) to one with lower topline revenue growth (25%+) but profitability on a cash flow, EBITDA, and GAAP net income basis. That makes it a really hard time for investors to figure out how to value the company. P/E right now is useless since they just hit breakeven in Q4 2023. However, if the guidance they have given is true, we are trading around a 2026 FWD P/E of 10 right now. For a company that will be growing their earnings so rapidly over the next several years, that would be extremely cheap if that guidance is correct. It would also be significantly above analyst expectations for the company, which are only $0.44 EPS in 2026. The highest estimate for 2026 is actually $0.61, which is below the midpoint of SoFi’s guidance.

Here are the estimates for revenue and EPS for the next several years, as well as how many analysts are providing estimates for each year.

Projections

A quick disclaimer.

All models and projections are wrong. The ones I’m about to present are also wrong. My 9-5 job is as a chemical engineer doing complex thermodynamic simulations of cryogenic systems. At my job, we do our best to use first principles, science, and data to accurately determine what is going to happen in these systems, but the truth is that there is always error in any model. That error is small in the systems I simulate for work because the science is very well understood and highly predictable. As you get into more complex systems, like biological systems, the simulations get less accurate because living things are harder to understand and predict. Economic systems are even more complex and depend upon the decisions of billions of people and the complex interactions of governments, private sectors, investors, psychology, and countless other inputs. So I can tell you right now that these projections will be wrong.

So why do I take the time to do them? It gives an important framework for understanding the range of possible outcomes and which factors are most important to achieve the desired outcomes. Additionally, it helps us to understand if the guidance SoFi has provided is reasonable and achievable. If they hit that guidance, there is no doubt they are significantly undervalued today, so it’s very important to find out if they are going to hit it. Ok, disclaimer over, let’s get to the model.

Projection inputs

I am taking a bottoms up approach to estimating future revenues and profits. In order to do that, I need to estimate what is going to happen to all future revenues and expenses. I am also doing three separate scenarios to determine a range of possible outcomes. The base scenario is built on the public guidance that SoFi has given. The bearish scenario assumes that they cannot hit those numbers and the bullish scenario assumes outperformance. Some of the key inputs to the model that I’ll discuss briefly are segment growth, segment contribution margin, and indirect expenses growth. Also, as a bonus, I’m taking my model out 5 years to 2028 rather than just going out to 2026.

Segment Growth

In the Q4 2023 earnings call, SoFi gave some specifics for standalone 2024 growth and for the combined segment CAGR for 2023-2026. For 2024, they guided for lending to be 92%-95% of 2023 lending revenue, tech platform growth to be 20%, and financial services to grow 75%. For the three years from 2023-2026, this is what CEO Anthony Noto said.

For the 2023 through 2026 time period, we see 20% to 25% compound annual revenue growth, assuming no meaningful change in the macro environment and no significant new business launches or acquisitions such as small and medium business checking and savings or small medium business lending, a broader asset management business, insurance, a broader credit card portfolio, new technology verticals for the Technology Platform business or new geographies. The 20% to 25% compound annual revenue growth from 2023 through 2026 assumes a compound annual growth rate of 50% for Financial Services revenue, mid-20s percent for Tech Platform revenue and mid-teens for the Lending segment revenue. Simply put, this growth only reflects the benefits of the investments we've made in our existing businesses paired with continuing to build brand awareness, trust and adoption by new members and driving cross-buy from existing members.

That means, for the base case in 2024, I’m assuming the lending segment will have 93.5% of its 2023 revenue, the tech platform sees 20% revenue growth, and financial services sees 75% revenue growth. Thereafter, to hit the “mid-teens” (which I’m assuming to be 15%) 2023-2026 CAGR, lending revenue has to reaccelerate to 26% in 2025 and 2026. Tech growth has to accelerate to 27.7% to get to the “mid-20s” (which I’m assuming to be 25%). Finally, I am assuming financial services cools from 75% in 2024 to 45% in 2025 and then 33% in 2026 to hit the 50% CAGR outlined above. For the business as a whole, this results in a 26% revenue CAGR, which is slightly above the “20% to 25% compound annual revenue growth” that Noto outlined above. For the bearish case, I modify those numbers down quite a bit and bullish case growth rates are slightly higher than SoFi’s guidance. For 2027 and 2028, I assume moderating growth rates across all three segments. The table below shows the assumed annual growth rates for all three cases in all three segments.

The thing that really jumps off the page when you look at the table is going from negative growth in lending in 2024 back to +26% in 2025. It seems unreasonable at first, but remember that they are actively pulling back and keeping a lot of capital on the sidelines in 2024 while awaiting more clarity on the macro picture. Between the convertible notes deals earlier this year and organic tangible book value growth, they will have significant room to grow the loan book again in 2025 and 2026. They will also have easy comps in 2024, so I think this is very reasonable as long as the macro cooperates and we don’t have a hard landing for the economy.

Contribution Margin

Contribution margin is the amount of money SoFi makes after subtracting out all the directly attributable expenses from each segment. This includes salaries of the people who work in that segment, server costs, marketing costs, etc. For lending and tech platform, we have great data and management commentary on what to expect for contribution margin. Financial services is a slightly harder to nail down.

Here is what Noto said at the Goldman Sachs Conference last year about lending.

Some people may not realize this, our loans have a 70% contribution profit margin, and that steady state I wouldn’t expect it to go higher. If it did, I would reinvest to keep it at that level.

They’ve also talked about contribution margins in the tech platform being in the 30%+ range. Here are the historical contribution margins across those two segments.

Financial services has gone from extremely unprofitable to profitable very quickly. It is difficult to really know where the contribution margin is going to settle out in the long term. In my last article, I talked a lot about how financial services is a largely fixed cost business. That means that as you grow revenues, you don’t need to grow expenses very much. For example, you need mostly the same processes, servers, infrastructure, fraud detection, and personnel to house $1B in deposits as you do to have $20B in deposits, but you make a lot more revenue with $20B than you do with $1B.

Since Q3 2022, that infrastructure has largely been put in place. Since then, for every $100 in revenue growth, $88 has gone straight to profits. That's incredible leverage that is coming with scale. As a result contribution margin has seen incredible improvement over that time period, going from below -100% up to 24.7% last quarter.

In my projections, I have contribution margin ranging from 25% (barely above where it is now) to 40%. This is one of the variables I have lower confidence in, and hopefully we can get some guidance here from management in the future. Even if we don’t, a few extra quarters of data should help to gain a little more clarity here. The range of contribution margins I used for each scenario and for each year are given in the table below.

Other Expenses

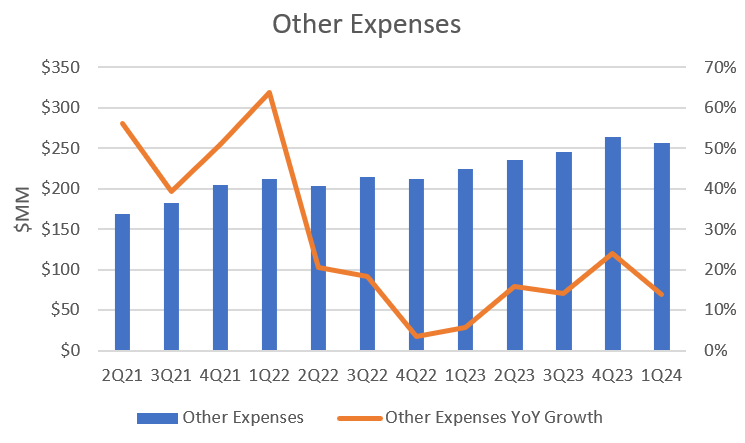

This is by far the most difficult one for me to project. These are expenses that are not directly attributable to any of the core business segments. These are things like brand marketing (like the SoFi Stadium, TGL, and NBA deals), management compensation, a lot of the general and administrative costs, stock-based compensation, depreciation and amortization, software tools and subscriptions, etc. Ostensibly these are costs that should not grow as significantly as the business scales. For SoFi to hit their targets, they will have to control these costs. Here is a graph of those costs since they came public and their YoY growth rate.

Ever since SoFi received their bank charter in Q1 2022, other expense growth has really come down. Q1 2024 was actually the first time ever that they decreased these other expenses from one quarter to the next. My model assumes that other expenses increase 10% every year for the next five years as this seems to be where the overall trend is going. This is the least confident I am in any part of these projections, and if there is significant error in my assumptions, it is probably here.

Bearish Case

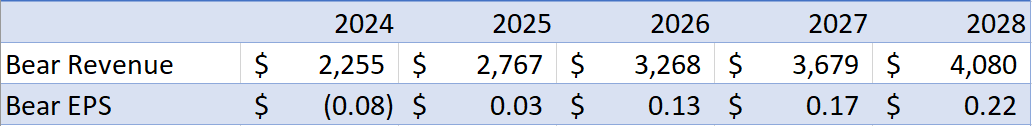

We’ll start with the case that falls short of every guidance that SoFi has put forward. This is below guidance growth across all three segments is also combined with lower contribution margins than I would expect, especially if they are seeing slower growth. Nevertheless, it’s instructive to see how things would proceed under this scenario.

Revenue

Surprisingly, revenue is actually not far off from analyst expectations even with the lower growth scenarios. Overall, the business as a whole with these inputs grows 9% in 2024, 23% in 2025 and 18% in 2026. Yet even with growth well under management’s expectations, revenue only misses 2026 expectations by a mere 1.8%. This tells you exactly how bearish analysts are on SoFi’s growth prospects moving forward. They do not expect SoFi to be able to achieve management’s expectations.

EPS

On EPS, the combination of lower growth and flat margins at low levels leads to very anemic growth. In fact, under this scenario, they have negative EPS in 2024 and then slow growth to $0.22 in 2028. Contribution margins in both lending and the tech platform were higher in Q1 2024 than the yearly assumption here, so part of the negative EPS is because it would mean a lot of underperformance in the next three quarters. If these projections were to come true, it would be a disaster for the company and the stock, but even in this bad scenario, SoFi is not at risk of bankruptcy or insolvency.

Base Case

This is the case that corresponds to SoFi’s guidance. Again, it includes no product launches through 2026 and assumes no meaningful changes in the macro environment. As a reminder of what that means, SoFi is assuming 5% unemployment and negative GDP growth at the end of the year, so their definition of “no meaningful changes” means a shallow recession and subsequent recovery in the following years. I think the only way we see them significantly underperform this guide is a hard landing and protracted recession. Otherwise, I think they hit this fairly easily.

Revenue

Analysts do not believe that there will be a meaningful reacceleration in the top line revenue in 2025. They see 16.4% growth in 2024 followed by 15.2% growth in 2025 and then 19.6% growth in 2026. SoFi’s guidance as I present it here leads to 18.4% growth in 2024, then 31.2% growth in 2025 and 29.1% growth in 2026, before tailing off to slightly under 20% growth in 2027 and 2028. If SoFi gets even close to its 2026 top line guidance, it represents significant upside to analyst estimates.

EPS

The same holds true for EPS. While SoFi did not give guidance for 2025, it is safe to assume it will fall between the $0.085 they’ve guided for in 2024 and the $0.55-$0.80 they guided for in 2026 (the midpoint of the 2026 guidance is $0.68). My projections have a slightly higher growth rate in 2025 relative to 2026. The results are that SoFi EPS will jump to $0.31 in 2025 before slightly more than doubling that again to $0.64 in 2026.

I find it very interesting that using their own guidance for revenue and my assumptions for contribution margin and other expenses, you come in almost exactly in the middle of their own guidance. This makes me think that my estimates for contribution margins and for the ramp in other expenses are close to what SoFi is expecting internally. It’s also interesting to note that my projections put 2024 EPS slightly lower than what SoFi is guiding for, meaning my contribution margins are slightly low or other expenses are probably slightly too high for this year.

Bullish Case

I keep track of SoFi’s guidance compared with their actual results. Those who are familiar with SoFi and with my work won’t be surprised to hear that SoFi, as a public company, always sandbags their guidance and always outperforms. We have seen this play out for 3 full years. Here are the revenue actuals compared to their guidance. On the average, they beat their revenue guidance by $22M each quarter.

Here is their adjusted EBITDA compared to their guidance. On the average, they beat their adjusted EBITDA guidance by $19M each quarter. This is one of the reasons I just do not understand why any analyst ever puts their estimates below the midpoint of SoFi’s own guidance.

Let’s assume for a minute that the 2026 EPS guidance, like every single public quantitative guidance that SoFi has ever given, is an underestimate to what they will actually deliver. The actual results then, would probably be something closer to the bullish assumptions that I gave above. Because I’m assuming greater growth, I’m also actually assuming other expenses in the bullish scenario rise at a 12% CAGR rather than a 10% CAGR since they’ll be reinvesting more into the core business. What are the results?

Revenue

Revenue vastly outperforms even the highest analyst estimates, which are $3.0B in 2025 and $3.6B in 2026. The bullish case results in 21.3% growth in 2024, 40.1% growth in 2025, and 33.1% growth in 2026, for an overall 3-yr CAGR of 31.3%. In this scenario, SoFi will have revenue of $3.5B in 2025 and $4.7B in 2026. A lot would have to go right for things to be that rosy, but with a few new product launches and a favorable macro of slowly dropping interest rates and no recession in the next three years, this is certainly within the realm of possibility.

EPS

Even with the slightly escalated pace of growth in other expenses, EPS also completely blows analyst estimates out of the water as well. My bullish scenario results in $0.93 EPS in 2026. The average analyst estimate is $0.44 and the highest estimate is $0.61. If my bullish projections, which are aggressive but certainly within the realm of possibility, were to come true, we’re looking at a stock that is trading at a 2026 FWD P/E of 7.5 for a company that just got their first profitable quarter less than six months ago. Furthermore, if you carry the scenario forward another two years, the estimated EPS is $1.95. Even at a “just aban” P/E of 10, this would be around a $20 stock at that point.

Because a picture is worth a thousand words, here are those results in graphical form. The first chart is revenue. I really have a hard time believing SoFi will not completely blow analyst top line expectations out of the water over the next several years given the analysis I just went through.

EPS is a different story. This is yet another indication to me that analysts sometimes don’t really know what they are talking about. They have basically the same revenue as my bearish case, but much higher EPS than the bearish case. That means they are assuming lower expenses by a wide margin than my assumptions. Assuming “Other Expenses” grow at 10% per year, they would need to be building in contribution margins of 70% for lending, 40% for the tech platform, and 40% for financial services by 2026 to arrive at their EPS numbers from their revenue. Either that, or the analysts are expecting “Other Expenses” to decrease over the next three years, which is a virtual impossibility considering SoFi is still growing and hiring. The analysts are simultaneously assuming SoFi won’t grow as quickly as they plan, but will have absolutely stellar margins. The more likely explanation is that they just don’t fully understand the business.

SoFi’s 70/30 Rule and Long-Term Margins

One last quick check to see if these numbers make sense is to compare them to SoFi’s previously stated goals for profitable growth and for their long term margins. They’ve said many times that they want to reinvest 70 cents of each incremental dollar back into the business and drop 30 cents to the bottom line. This is equivalent to saying that their incremental margins will be 30% during this growth phase for the business. Furthermore, they’ve stated that in the long term, they see their net income margins approaching around 20%.

The baseline case that I laid out above would have 37% incremental margins through 2026, which is slightly higher than the 30% they’ve guided for. Given that they have put a little bit more emphasis on profitability rather than growth recently, that seems reasonable to me. It results in an overall net income margin of 17.5% in 2026 and 23.6% by 2028, which also seem fairly reasonable and in line with their long-term guidance. Also, their actual incremental net income margins haven’t been below 30% since Q3 2022, so they’ve been outperforming on this metric for over a year and a half.

How does SoFi go from 0-60?

Ok, so all that analysis results in us finding out what, in hindsight, should seem obvious. The way that SoFi will achieve their 2026 guidance is by doing exactly what they said they would while staying disciplined with their other expenses. Still, that gives good guide rails and helps investors to focus on key areas moving forward. Here are those key areas:

Sofi must stay in line with long term contribution margin guidelines of at least low-to-mid 60s for lending, mid-30s for tech platform, and around 30 for financial services.

There will need to be a reacceleration in revenue growth in 2025 and 2026 to around 30% YoY growth. This is the part that it appears analysts do not believe will happen.

They need to stay disciplined with their other costs, allowing them to only increase by about 10% each year.

If they do those three things, they will hit their guidance. Of course, if they outperform in 2024 relative to their current guidance it also takes some of the pressure off of 2025 and 2026.

What do I think?

SoFi has never missed their public guidance. This stems from a combination of their conservatism and the pessimistic view of the economy that they build into their guidance. I also think we will see several product offerings in the next several years that are not built into the guidance. I would not be surprised to see them enter the SMB checking, savings, and lending space in 2024, and I would be disappointed if they didn’t launch those products at the latest in 2025. They are making strides in the wealth management segment, and have an opportunity with their SoFi at Work product to actually make inroads with some huge companies in that space.

They will absolutely be expanding the credit card portfolio in that time and an acquisition to bring insurance in house in the next few years might be on the cards. I think geographic expansion is a longer shot, but it is not fully off the table either. It looks to me that there is quite a bit of upside available as they expand their product offerings. If Galileo can also start being a credit card issuer and processor, or expand into other verticals, that would also be a great addition to their tech platform offerings.

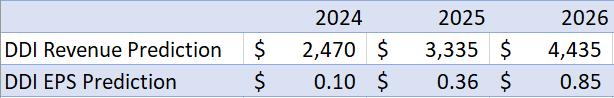

I think they’ve set themselves up to reasonably end up somewhere between the base and bull cases that I presented above. I don’t do price targets, but I do like projecting the fundamentals. Here are my projections for revenue and EPS for the next 3 years. As always, I will take full accountability when I end up being wrong and try to explain what I got wrong and how I will learn from it to be more accurate in the future:

Thanks for reading everyone.

Subscriber update

I’ve actually lost a decent number of paid subscribers recently. That’s what happens when the main stock you cover is stuck in a huge rut. That’s fine with me because that isn’t the main reason I do this. Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have a long position in SoFi.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Great job as always. If economy is good any reason they couldn't grow loan business at 30% per year. Is thought that they would run up against capital constraints?

Hi, Isn't the growth rate too small until 2027? As everyone knows, the bank's deposits serve as a source of revenue. Their deposit grew 154% year-over-year in 2023 and is expected to grow over 80% this year. I believe they are compelled to grow unless they face losses due to the interest paid to savings account holders. Assuming they are not mismanaging (which I don't believe they are), the fast-growing deposits should drive further growth in loans or financial services. In the long term, I think the growth rate of deposits and revenue should be equal-paced. Currently, the company has experienced extremely fast growth, so they need some time to stabilize and reorganize their current loan portfolio. However, starting from Q3, revenue growth should follow deposit growth, which should increase SoFi's growth rate. Could you please share your thoughts on the deposit growth?