SoFi Growth Vectors Part 2

If you haven’t read Part 1, start there, because it provides the proper context for this post. As a quick recap:

I think the biggest risk factor moving forward for SoFi is slowing growth

I am looking for 30%+ revenue CAGR on an annualized basis between 2021 and 2030

Many, including myself, want to be able to see where the next phase of growth will come from now that SoFi does not have extra room on their balance sheet to continue adding loans indefinitely.

I’m going to focus on growth vectors that are most likely in the next 6-8 quarters

I already talked at length about where I expect to see 30%+ growth in 2024 for the lending segment. Let’s move on to the financial services and technology platform segments.

Financial Services

Financial services used to be the smallest segment of SoFi, it was experiencing large losses and growth was inconsistent. Then the bank charter happened. I could put chart after chart of massive growth in financial services here to prove my point, but I’ll only put one. The first is revenue growth, and the second is contribution profit. Contribution profit, for SoFi, is how much profit the segment makes when including all fixed and operating costs that are directly attributed to that segment.

Yes, it was starting from a small base, but from 2Q22 to 2Q23, the financial services segment grew 223%. Not only that, but profitability has been increasing meaningfully each quarter, going from a contribution profit of -$53.7M to -$4.35M. This begs the question: why has it seen such massive growth? The answer, like a lot of things in the past year, is rooted in the bank charter.

Noninterest Revenue

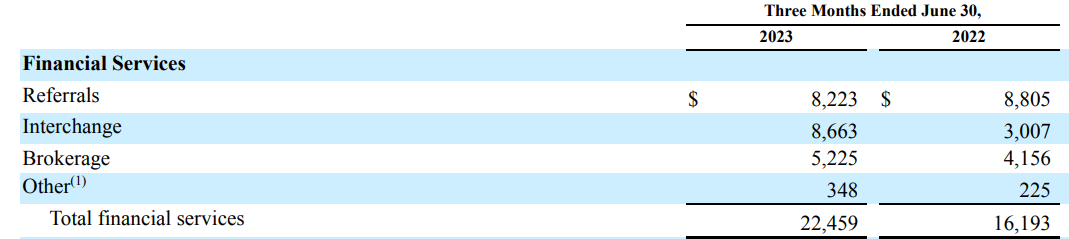

Financial services revenue comes in the same two flavors as lending revenue: net interest income and noninterest income. Let’s tackle noninterest income first. Most of the growth in noninterest income in the financial services segment comes from interchange fees. Interchange revenue is driven by how many people are using their SoFi debit cards and credit cards for purchases. It almost tripled from $3M to 8.7M in the past year. While that is not very material from a business standpoint, it does indicate that more people are continually switching to SoFi as their primary bank. Noninterest growth has been good, 39% YoY is nothing to sneeze at, but does not make up the bulk of the growth in financial services.

Referrals will continue to be flat or down until the credit markets begin to loosen up and brokerage has a chance of becoming a bigger piece of the pie as they expand their offerings there (including level 1 options which are taking entirely too long to roll out). Interchange should continue to see healthy growth as they continue to gain members who use them as their primary bank account and credit card.

Interest income

As with the lending segment, most of the growth in financial services has been growth in interest income, growing from $12.9M in 2Q22 to 74.6M in 3Q23, a 478% increase. Financial services makes interest income in two ways. The first is that they put their credit card business under financial services and not lending, so any credit card interest goes to financial services. Second, deposits are used to fund loans, and the lending segment “pays” the financial services to use those deposits. This is referred to as a “funds transfer pricing framework” or FTP framework. We do not have a breakdown of how much comes from credit card compared to internal. However, the amount of growth in credit card loans over the past year only went from $174M to $238M, a 37% increase. That can hardly explain 478% YoY growth, so it is very safe to say that most if it comes from FTP framework.

We also do not get a direct breakdown of how much the lending segment pays the financial services segment to lend out that money, but it’s probably worth giving an example of how this works. These are all just indicative numbers, and are completely made up just to illustrate how the accounting works. Let’s imagine that SoFi has $10B worth of loans at an average rate of 9% that are backed by $10B worth of deposits SoFi is paying 4% interest on. For the sake of simplicity, none of those default.

For the entire business of SoFi, in one year, they would collect $900M in interest from borrowers and give out $400M in interest to their depositors. That would make their total net interest income $500M (the difference between the two). Total net interest margin, or NIM, is 5%. On a segment level, they spread that net interest between lending and financial services. For example, the financial services segment is paying out that 4% in APY to depositors, but charges the lending segment 5% to fund loans. In this case, the lending segment takes in $900M and pays $500M to financial services. The financial services segment takes in $500M and pays $400M to depositors.

The point is that as long as deposits are growing, financial services net interest income will continue to grow. As I showed in Part 1 of this look to at growth, deposit growth will continue to offset higher cost warehouse lines of credit until at least 2Q24. Right now, financial services is growing revenue by $15-$18M per quarter mostly just because deposits are growing.

Let’s assume $15M in growth in the segment through 2Q24 and then it stays completely flat in the back half of 2024. That would result in total revenue of $420M from the segment in 2023 and $617M of revenue in 2024. That is 47% YoY growth in 2024 basically just on the strength of almost guaranteed deposit growth. This assumes no growth in noninterest income, even though that’s currently growth at a 30% CAGR as well. Remember my goal is 30% growth. Financial services will hit that number without even trying.

Technology Platform

Galileo is the most opaque of SoFi’s businesses. They don’t publish much about it even in the 10-Q, so it’s the hardest for me to model going forward. It was also by far the weakest business segment and the most affected by the weak macro environment for fintechs and neobanks. As such, I’ll be leaning heavily in this section on comments from management to figure out future growth. Here is probably the best quote on what they expect from the last earnings call by Anthony Noto during the Q&A.

We expect the Tech revenue will be flattish in Q3 and then accelerate year-over-year in Q4, as we get more contribution from those new partners that are either already on-board or that will be on-boarded.

And I'm really excited about 2024, when the investments that we made this year and onboarding new partners start to kick in even more. So, I think it will be a slow, steady melt up in revenue over-time with the acceleration on a year-over-year basis coming in the fourth-quarter.”

Personally, I don’t see the reason for why Q3 would be flat relative to Q2. They are adding new clients every quarter and all their new client adds already have existing customers that are being migrated into Galileo. The reason that revenue was down in 1Q23 was that Galileo lost a large client. However, they made up the difference with new clients and got back to record revenue in 2Q23. Unless they are losing another client, I cannot understand why that growth would not continue as I’m sure they’ve added new clients again this quarter.

Let’s take what they say at face value and assume 3Q23 is flat from 2Q23 and then a 5% QoQ growth rate to Q4. That’d result in $345M revenue in 2023. This year would also make for very easy comps in 2024. To get to 30% growth, that’d mean they need an additional $103M of additional revenue in 2024 compared to 2023. Fortunately, based on the above analysis, financial services is going to be outperforming by $71M, leaving only $32M in growth required for the tech platform to allow SoFi as a whole to grow at 30% YoY. That’s only 9% growth required in the tech platform. Given Noto’s enthusiasm for 2024, that seems extremely manageable.

It is also important to note that growth in profitability in the tech platform will outperform revenue growth as they’ve guided for contribution margin to move back toward 30%. Noto also described this in the recent Goldman Sachs conference:

[In] the Tech Platform, the pipeline is as robust as it’s ever been from big financial institutions. We said we wouldn’t see an acceleration in the fourth quarter, but things would be relatively flat between here and there, and that’s been the case, but with improving margins and we feel great about that still.

Conclusion

I think that SoFi will easily maintain its 30% growth CAGR in 2024. In fact, I think it is pretty easy to see that they should outperform that number. Analyst estimates only assume 24% revenue growth from 2023 to 2024. SoFi will continue to beat analyst revenue estimates (and don’t get me started on EPS estimates, for which they only think SoFi will generate 4 cents of EPS across FY 2024). More importantly for me personally, they will be able to continue on the growth trajectory that I have expect in order to see my investments compound.

Subscriber update

Thank you to everyone who has become a paid subscriber. I am now at 70% of my Tier 2 goal. I plan on ramping my content output as paid subscribers increase. Here are the content tiers:

Tier 1 – About 2 articles/month on the Substack. This is the level I’m comfortable at for now with what I’m making.

Tier 2 – I’ll start a Youtube channel and do at least one video every other week.

Tier 3 – A minimum of 4 articles/month on the Substack

Tier 4 – Add a weekly Twitter Spaces where I can engage better with followers and answer questions people may have.

Disclosures: I have a long position in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Great work as always. Any chance you could take a stab at fy25 cagr? Obviously much more of a guess but would love to get an idea there. Or if not that, best guess at fy24 growth and the new average needed over next five years to maintain average of 30% cagr through 2030.

I didn't realize loan income was also funding credit cards. In the example, what is the $400M paid out to depositors for, within Financial Services? Is that to pay customer credit card charges?