SoFi's Next Growth Vectors Part 1

As is often the case with me, I ambitiously started writing this and realized it was too long for a single post and so I’m breaking it into two. This one will provide necessary context for the discussion and then talk about where growth will come from in the lending segment. I’ll have a follow up article discussing financial services and the technology platform.

I think the biggest risk moving forward with SoFi is that the growth story breaks. I’m invested in this company because I see it as a secular compounding growth story. My core thesis is that SoFi is going to disrupt the banking and finance industry, and that doing so would lead to 30%+ CAGR over a decade. I bought my first shares in 2021 and in that year, they did $1B in revenue. A 30% annualized CAGR from there would mean that in 2031, they would be doing almost $14B in revenue. Assuming a 20% long-term margin (which is what they’ve guided for), that’d be a company with $2.8B in net income and with a P/E multiple of ~30 (which is reasonable for a company with a proven growth track record), that’s an $84B company. I bought most of my 2021 shares when SoFi was around a $12B market cap, so that would be a return of about 7x over a decade.

Fast forward two years and the company is actually ahead of schedule. They’ll do a little over $2B in revenue this year, meaning they need about ~27% CAGR from here to reach that $14B number I had penciled out. However, what happens if the the growth slows? If they can only compound at a modest 15% from here it would mean only $6.1B in revenue in 2031. With 20% margins and a P/E of 10 (because they’d be a slow-growing bank), now the company would only be valued at $12.2B, and my initial investment would be flat over a full decade. Growth is vital to the investment thesis.

I have increased my number of shares at lower prices since 2021, but even those would have a small return if the growth story breaks.

Where has the growth come from so far?

Let’s look at revenue since the beginning of 2020 broken down into their business segments.

The majority of SoFi’s consistent growth has come from growth in their lending segment. The first quarter reporting as a public company in 2Q21, they had $172M in lending revenue and it has almost doubled to $322M in the most recent quarter, a total increase of $150M in 2 years. Financial Services grew from $17M to $98M in the same time period, helped significantly by higher rates. This is because much of this revenue is paid by the Lending segment to the Financial Services segment to fund loans. Total financial services revenue growth was $81M. Finally, the Technology Platform grew from $45M to almost $88M, a much more subdued $33M or so in growth.

You’ll also notice the negative Corporate revenue. A lot of this is from the interest they pay for their “revolving credit facility”, which is long term debt that the company holds. It has a variable rate so that cost increases at higher rates.

Let’s quickly analyze the past growth before we start looking to the future. Lending revenue has benefitted from increasing net interest income as SoFi has increased their loan book over the past year, and has also benefitted greatly from increasing originations as they continue to gain market share and see great member growth.

Financial Services, as mentioned above, has benefitted from increasing rates. It has also seen a large increase in interchange revenue as more members use the debit and credit cards as their primary way to pay. Interchange revenue has almost tripled from 2Q22 to 2Q23. Brokerage revenue has also grown modestly as well.

The Technology Platform saw excellent growth for the first two years after they acquired Galileo in 2020, but has been pretty much flat for the past year. The struggles in the tech platform come from macro challenges, the shift in focus from new fintech customers to more established clients with existing customers, and from the integration costs of folding in their 2022 acquisition of Technisys into their Galileo offering.

Future Revenue Growth

I’m going to focus on growth vectors that are most likely in the next 6-8 quarters. Yes, there are hints of exciting possibilities for SoFi in the future like international expansion of the bank, becoming the primary on their insurance business, business checking, and business lending. However, none of these products are realities right now. Even if they were to launch tomorrow, they are unlikely to have a material impact on the business in the near term. SoFi likes to keep their new products small at first and iterate on them multiple times before scaling. For this discussion, I’ll ignore parts of the business I think are insignificant to revenue growth in the next 18-24 months. Let’s start with the lending segment.

Lending Growth

In my last post about capital ratios, I talked a lot about how SoFi’s net interest income has been growing as a result of them holding more loans on the balance sheet. More loans means more interest income. Lending revenue growth in the last year and a half has been helped significantly by their growing loan portfolio.

Deposits

What is often glossed over is that net interest income has also been helped significantly by their deposit growth decreasing their weighted average cost of capital. SoFi primarily funds their loans through deposits or warehouse facilities, which are lines of credit they can draw on from other banks to lend out to their members. Those other banks charge interest to lend that money to SoFi, and, unsurprisingly, they are a much more expensive source of funding than using deposits. In fact, the difference between the cost of their own deposits and the cost of the lending facilities has only grown over time.

This table shows actual cost for their deposits compared to warehouse facilities since they became a bank. As you can see, the spread between the cost of their own deposits and warehouse facilities has doubled from around 1% to more than 2% in a year. The last column shows how much revenue they saved each quarter by using deposits compared to if they would have had to fund all their loans with the average interest they pay on warehouse facilities. For an example of how this calculation works, they had an average of $11.1B deposits in 2Q23. If they would have been paying 6.02% interest on that capital as a warehouse facility compared to the 3.85% they actually paid for deposits, they would have lost $60.1M in interest revenue.

Scroll up a bit and look at the SoFi Lending Revenue Breakdown graph again and it will help to digest what I just said. In 2Q23, SoFi’s total net interest income was $232M. So in the hypothetical scenario where SoFi grew its loan book to the same level just with warehouse facilities, their net interest income for 2Q23 would have been only about 3/4 of what it actually was. For fun, let’s look at what their lending net interest income would have been in the quarters since receiving a bank charter if they were fully funding those loans with warehouse facilities.

Now remember that SoFi never would have chosen to grow their balance sheet the way they have without the bank charter, and they don’t even have enough room in their warehouse facilities to do what I’m outlining here. So this is a purely hypothetical scenario. Nevertheless, this graph illustrates yet another reason it was so important for SoFi to get their bank charter. If SoFi hadn’t received their bank charter but had executed the business the same way they have up until now, rather than increasing net interest income by $138M, which is what has actually happened, it would have only increased by $77M. That’s how powerful lower-cost deposits are.

Deposit Growth is an Easy Growth Vector for 2024

Alright, what does this mean for growth going forward? Last quarter, SoFi still had a little over $4B drawn on their warehouse facilities. Let’s assume based on the capital ratio analysis that I did, that they get to a full balance sheet at the end of 4Q23. They have also been drawing about $500M on their warehouse facilities every quarter for the last 4 quarters, so let’s assume that trend continues over the next two quarters as well.

At the end of 4Q23, SoFi will have $5B drawn on their warehouse facilities. Once the balance sheet is full, any new deposits will be used to replace warehouse facilities. SoFi is guiding for over $2B in deposit growth per quarter, so it will take them about 2 quarters to build up enough deposits to offset the $5B in warehouse facilities. Assuming also that the 2.17% spread stays the same, this means $13.5M of revenue growth per quarter in 1Q24 and 2Q24 as a result of lowering their cost of capital. That means $13.5M extra revenue in 1Q24, and $27M extra revenue for the next three quarters. That’s an extra $94M in revenue in FY24 compared to FY23. That would translate to about 7.5% growth in the lending segment just from lower weighted average cost of capital in 2024 compared to 2023.

Student Loans

For a full breakdown on how much SoFi stands to gain from the return of student loans, please see my article from the end of August. I’ve used my baseline scenario from that article, but have adjusted originations lower to only $1.1B in 4Q23 because of Anthony Noto’s comments at the Goldman Sachs conference. Using the assumptions outlined in that article, I think student loans bring in roughly $205M of extra revenue in FY24 compared to FY23. That’s about 15% growth in the lending segment from student loans.

Personal Loans

Deposits and student loans coming back make those growth vectors easy to predict and lower risk for execution. Growth in personal loans is a little more nuanced. Many have argued that once they become balance sheet constrained that revenue growth will stop. I don’t think that’s true. I think the evidence suggests very strongly that excess capital has not driven their growth, but rather that it is driven by product adoption.

First, let’s examine the argument that growth comes from deploying excess capital. If that were true, then any company who has excess capital in the lending space would have grown significantly. LendingClub became a chartered bank in 2021, giving them excess capital to deploy. If that’s all you need, then why does LendingClub have a -4% 5-yr revenue CAGR compared to SoFi's 53%? How is LendingClub’s revenue shrinking if excess capital is all you need and they got a bunch of excess capital to deploy? The only logical conclusion is that excess capital alone cannot be the only explanation for growth.

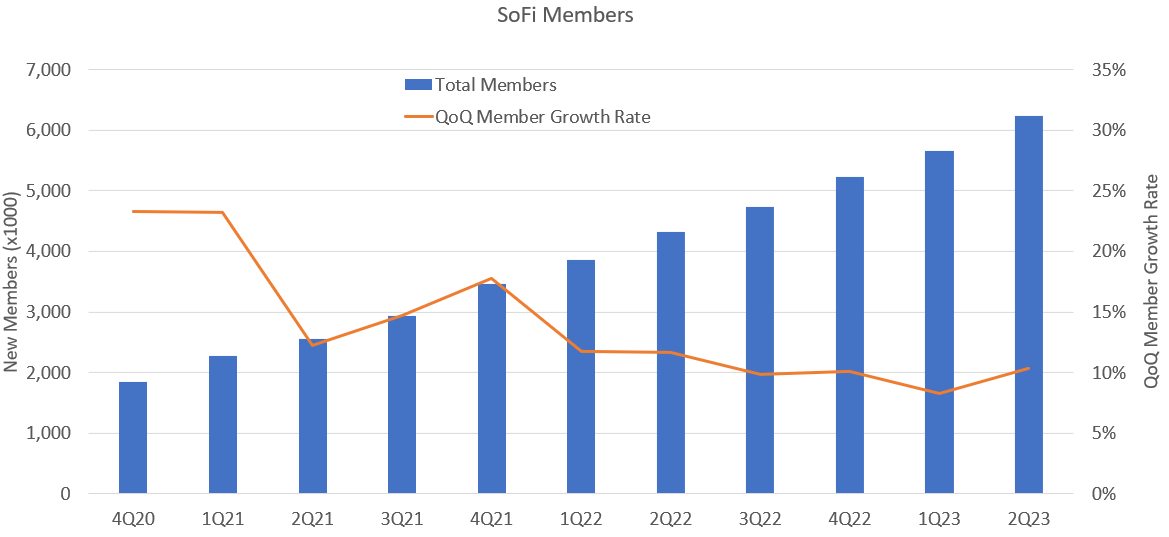

Utilizing excess capital is how SoFi is maximizing its growth, but it is not the root cause of why they have grown and will continue to grow. The actual reason for their consistent growth is their ongoing rapid member growth. They've only ever had one quarter where they were under 10% QoQ member growth. A key reason for their lending growth is not only the fact that they are holding loans for longer, it's also that they are growing their pool of borrowers.

Some argue that the growth in originations is because SoFi has room on the balance sheet to house those loans. That's only one part of the equation. Even more important is that they are constantly adding and monetizing new members. You don't go from $1.3B originations to $3.7B in originations while tightening lending standards without significantly growing the pool of borrowers. Member growth matters a lot. It matters way more than excess capital. If you are growing membership by 40% YoY, does it really seem that ridiculous to think you could grow originations 40% per year?

The data says that's exactly what happens. Quarterly originations/member has been roughly flat as the membership has grown from 2.5M members in 2Q21 to 6.2M members in 2Q23. In fact, the highest origination per member number ever just happened in 2Q23. An even more bullish trend is that 3Q has been the higher origination/member quarter in each of the last 3 years. That bodes well for 3Q23 numbers.

Even if the balance sheet becomes constrained, origination growth means higher noninterest revenue growth as SoFi is able to cycle the balance sheet faster. This obviously assumes that SoFi is able to sell their loans at the fair value marks they have on the balance sheet. Personally, I think that the fair values are accurate, although others disagree. We will have a clearer picture of how accurate they are in the next 9 months as they will be forced to start selling loans. We will also see if becoming balance sheet constrained will force them to pull back on originations. I think they’ll find buyers for their loans and that they will continue to grow originations roughly in line with member growth. I could be wrong about that.

The math can get complicated here, but the concept is simple. If SoFi continues to grow their members, they will grow their personal loan originations. If they grow their personal loan originations, it will lead to higher revenue from personal loans either from higher interest income or higher noninterest income. It is harder to put a number here than the deposit or student loan sections above, but another 7.5% growth in lending revenue from continued growth in personal loan originations seems very manageable. Oh, and as soon as they are GAAP profitable in the 4Q, they’ll have retained earnings as well that will allow them to continue to growth the balance sheet, albeit and a significantly slower pace than the past two years.

Conclusion

SoFi needs 30%+ revenue CAGR to hit my personal goals for the stock. While it is true that SoFi is becoming capital constrained, that is not a core reason for the growth to slow. Lending makes up 2/3 of SoFi’s revenue. Between continued net interest margin expansion (7.5% growth), the return of student loans (15% growth), and continued personal loan origination growth driven by member growth (7.5% growth), 30% revenue growth in the lending segment seems quite manageable. Part 2 will look at Financial Services and the Technology Platform.

Subscriber update

Thank you to everyone who has become a paid subscriber. I am now at 71% of my Tier 2 goal. I plan on ramping my content output as paid subscribers increase. Here are the content tiers:

Tier 1 – About 2 articles/month on the Substack. This is the level I’m comfortable at for now with what I’m making.

Tier 2 – I’ll start a Youtube channel and do at least one video every other week.

Channel ideas: Present my articles as videos, discuss the basics of options, how I approach portfolio building, finances, my overall investment philosophy, a “Fundamentals of SoFi” series, how I approach portfolio management, etc.

Tier 3 – A minimum of 4 articles/month on the Substack

Tier 4 – Add a weekly Twitter Spaces where I can engage better with followers and answer questions people may have.

Disclosures: I have a long position in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Excellent Read! These articles help me summarize the exact levers I should be paying attention too and cancelling out the noise. Looking forward to Part 2. Galileo has been making some strides. I work for a B2B large cap tech company and my educated guess leads me to believe that these features they are rolling out are to sign new clients based on contract proposals.

Beatifully written Chris H!