SoFi: The Moat is Being Built - Part 2: Lending

In Part 1, I wrote about how the data are showing that SoFi is differentiating itself from other neobanks. Let’s move on to some more data that shows another part of the moat that is growing. Today we will discuss SoFi’s lending segment and how its results are also becoming differentiated from peers.

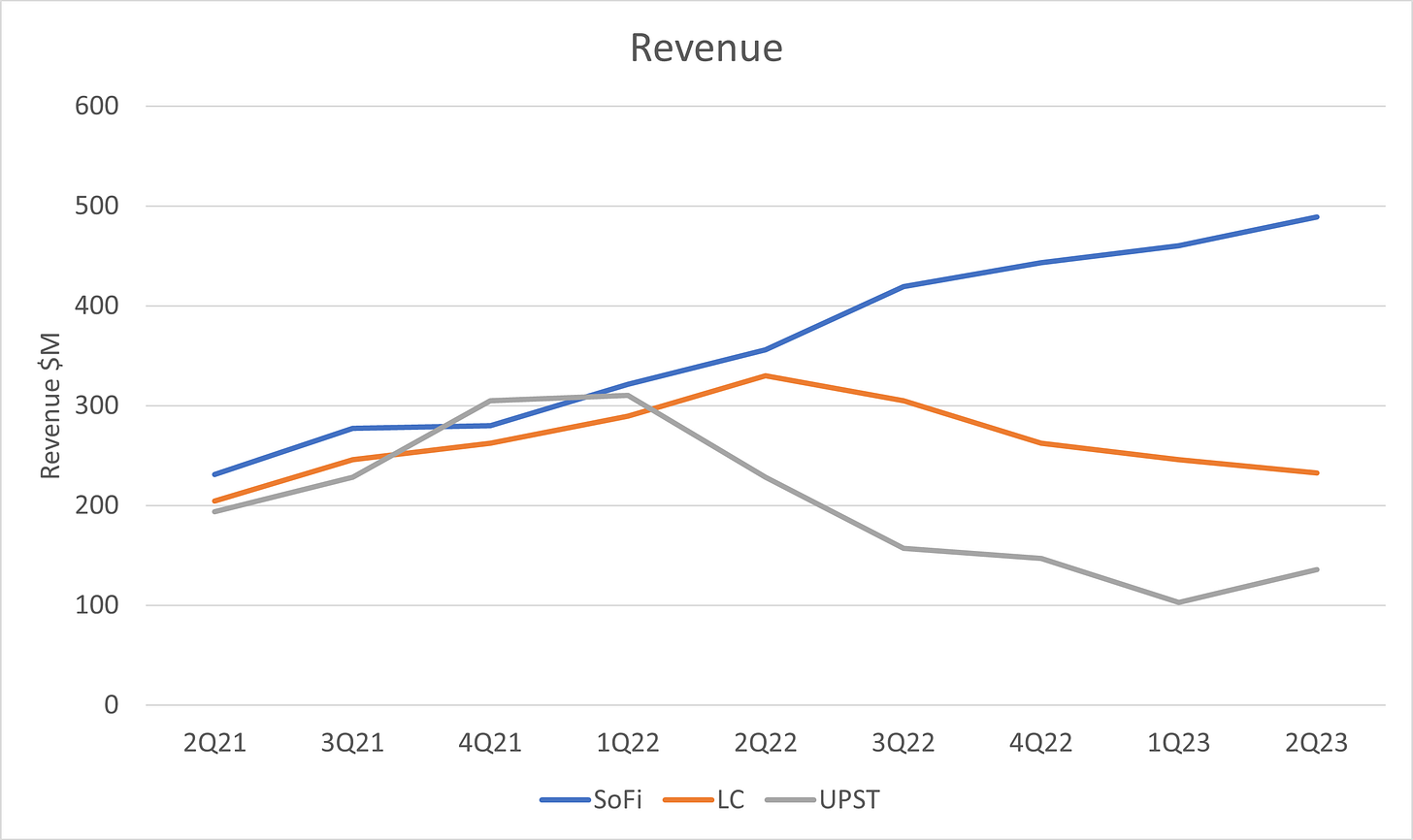

Last November I wrote on Seeking Alpha that SoFi was pulling away from LendingClub (ticker LC) and Upstart (ticker UPST), the two other fintech companies who operate primarily in the fintech lending space. I’ve been getting some pushback on Twitter as to why I should not be comparing these companies. I fully realize they are very different companies. I listen to every investor conference and quarterly report from all three companies. However, saying that they aren’t comparable is, to me, really strange. All three of them, at the moment, rely on personal loans as their main source of revenue and income. All of them are competing for borrowers and selling loans to the same debt investors. I’ll go into more details below, but the main caveats are that they are catering to different sections of the borrower market, and they are selling at different timescales. I think the performance of these three companies since that article proves my analysis at the time was prescient.

I still think it is very instructive to compare these companies. You wouldn’t say that Tesla is not comparable to Ford or GM because it’s selling electric cars instead of gas cars or because it sells directly to consumers instead of using dealerships. Tesla, Ford, and GM are direct competitors. They all sell cars. Tesla happens to be a much better business who makes a ton more money on each car sold, has significantly higher growth and isn’t saddled with massive debt like its competitors. They also have better unit economics, lower marketing costs, better vertical integration, and they bypass the middleman dealerships, in addition to other advantages. They have a better business model, but that doesn’t mean the companies can’t be compared.

Macro Backdrop

All three of these fintech businesses have to deal with a supply and demand issues on two fronts. They are offering their loans to people who want a personal loan. These may be trying to refinance high variable rate credit card debt into lower fixed rate personal loans, or renovating their house, or financing solar panels, or any other reason. I’ll refer to this as borrower demand, and it is extremely strong right now. People are looking at their credit card statements, feeling the pain, and seeking to refinance.

On the other side of the equation are debt investors. These are banks and asset managers such as hedge funds, sovereign wealth funds, pension funds, etc. These are the entities that buy loans from companies like SoFi, LendingClub, and Upstart. All three of these companies sell loans to these debt investors, and depend on them for liquidity and, to an extent, their revenue and profits. I’ll refer to this as investor demand, and right now it is weak. As a result of the banking crisis, most banks are actively looking to offload assets like personal loans to decrease their risk profiles and increase liquidity. Bank demand for personal loans is very low and in fact they are selling loans. This results in excess supply of assets at the moment. Asset managers are happy to step in, but the increase in supply means that they can be very picky about the pricing and the quality of the loans they are purchasing. The result is that investor demand is very weak right now.

Business Model Differences

I like to give context for my analysis, so let’s briefly review the similarities and differences between SoFi, LendingClub, and Upstart

Upstart

Upstart's target market is near prime and subprime candidates whom Upstart believes are higher quality borrowers than their FICO score would indicate. They do not disclose the average FICO score of the loans they fund or refer to their partners. Upstart, for the most part, does not hold loans on the balance sheet. They use their machine learning algorithm to determine credit worthiness and approve or deny the loan at a given APR. The majority of their revenue comes from fees they charge up front for finding and approving the loan and let someone else hold the loan and collect interest.

Upstart has two cohorts of buyers of their loans, the banks and asset managers mentioned above. Upstart does have its own set of partner banks who can use Upstart as the de facto credit check service for their own customers and also can house Upstart loans. Upstart immediately ran into issues as soon as rates started to increase. Origination growth was only positive 1Q22 because Upstart stepped in and used their balance sheet to fund the loans. While they have continued to use their balance sheet, it hasn't been enough and demand to buy their loans has completely collapsed. Originations plummeted for 4 straight quarters before seeing a slight uptick in 2Q23.

LendingClub

LendingClub targets near-prime, prime, and prime plus customers who are serial users of credit. The average borrower of the loans they hold on the balance sheet, as of 4Q22, had an average FICO score of 729 and an average income of $116,000. The entire servicing portfolio, which includes loans they’ve sold to others, had an average FICO of 717 and average income of $113,000 at that same time.

LendingClub also has two cohorts for the loans. The first is themselves. LendingClub, as a bank, takes a portion of their loans and puts them in their "Loans Held for Investment" (HFI) portfolio. These are loans that LendingClub intends to hold on their books through maturity. The remaining loans are sold on what they refer to as their marketplace, which is comprised of the same type of debt investors referred to above. So they have a pretty steady rate at which they add loans to their own HFI portfolio as the existing loans are paid off, and then a variable amount of loans they sell on top of that. The amount of variable loans they sell fluctuates based on demand from their marketplace.

In their 2Q22 earnings call, LendingClub warned that the marketplace demand might soften as rates rise. LendingClub CEO Scott Sanborn explained, "For certain investors, their funding costs will move based on the forward curve, meaning where the fed is expected to go. These investors are seeking more yield to cover their increased costs." Investor costs move with where people expect rates to go, so their costs went up faster than the actual funds rates. LendingClub’s loan pricing, by their own admission, lags the Fed Funds rate hikes by at least a few months. Investors were getting squeezed with higher costs now but the loans they were buying did not yet have higher interest rates to offset those costs.

This is exactly what happened. During 3Q22, marketplace originations dropped 15% from $2.82B to $2.39B, correspondingly dropping their revenue from those loans from $213.8M to $181.2M. This drop in marketplace originations has continued every quarter for the past year. Part of the reason for the marketplace drop is because they keep the highest quality prime and prime plus loans their HFI portfolio and sell the lower quality prime and near prime loans to investors.

SoFi

Now let's move on to SoFi. SoFi employs a slightly different model to Upstart and LendingClub. Rather than have two separate cohorts for their loans, SoFi holds all originated loans on their own balance sheet for a period of time before selling them on to debt investors. They previously guided for 6-7 months holding period, but right now they’ve been holding them much longer because of the weakness in investor demand. In this way, SoFi's balance sheet acts more like a shock absorber, giving them liquidity and optionality. SoFi can absorb or release loans as needed. As CEO Anthony Noto put it previously:

We run to where the opportunity is. And in some quarters, that opportunity may be driven by being able to raise WACC. In some quarters, the opportunity would be driven by a really strong securitization market. And some quarters are going to be driven by a really strong wholesale market.

Right now, the opportunity lies in gobbling up market share of their core target demographic - high-earning, high-quality customers not well served by the current banking system. As Upstart and LendingClub are slowing originations, SoFi has continued to increase them. In 1Q22, SoFi was only originating less than 2/3 the volume of personal loans as LendingClub and less than half the volume of Upstart. Now they are originating a little under double LendingClub and more than triple Upstart.

SoFi’s borrowers are also the most affluent and highest quality of the three companies. Their personal loan borrowers have an average FICO of 745 and an average income of $164,000. Futhermore, SoFi has actually been front-running the fed’s interest rate hikes. They raised their APY faster than the Fed hiked rates and faster than their competitors due to the strong demand caused by their network effects and simultaneously increased originations. Their key underwriting variable is cash flow, because they want to make sure that borrowers have excess monthly cash flow to cover their loan payment.

Why SoFi is Winning

All three of these companies have a ton of borrower demand at the moment, so that does not explain the discrepancy in originations. SoFi is proving their lending moat is expanding in three ways: superior availability of funding, choosing resilient customers, and better underwriting.

Availability of Funding

LC underwent origination growth in 2021 and 2022 since they got their charter in December 2020. However, their marketplace originations have tanked in 2022 and 2023 because of rising rates and tightening credit as described above. They do not leave room on the balance sheet to absorb any fluctuations in investor demand, so originations and noninterest revenue from selling loans boom and bust in real time with fluctuations in investor demand.

Upstart has virtually no control over their funding sources, so they are almost completely dependent on the macro. LC has been able to maintain some stability in originations because they hold a portion in the bank to maturity and can replace those as they hit their term. When demand from banks and asset managers for new loans dries up, Upstart gets hit the hardest. They have had to give preferential pricing and take risk to supplement volumes in hard times. It is not a durable business through a full market cycle. Upstart is a cyclical business, and needs to be treated as such.

SoFi got their bank charter in 1Q22, they have had significantly more flexibility to add loans to their balance sheet throughout 2022 and 2023 because they are the funding source. It's part of the plan to be vertically integrated across the entire business and own the whole process.

SoFi's business model to hold loans on the balance sheet for a variable amount of time and then selling them when the economics make sense appears to have given them the most flexibility to combat the headwinds. It even compares favorably to LC's business model even though both have bank charters. The timing of the bank charter was also fortuitous, no doubt about it, and has allowed them to continue scaling because they had plenty of room on the balance sheet to hold their own loans. However, I would argue that the business model is still superior because of the extra flexibility it gives them. Business model and execution are part of SoFi’s expanding moat.

Resilient Borrowers

SoFi's decision to only loan to affluent and high quality borrowers is a part of the business model that also makes them more resilient. SoFi could easily have loosened credit standards in the fast and loose zero interest rate policy (ZIRP) days, but deliberating decided to build a robust business model instead that can grow through an entire cycle. LC and Upstart leaned into to lower quality borrowers during the ZIRP days to boost growth, but as investor demand pulled back, they have been forced to move up the value chain to higher quality borrowers.

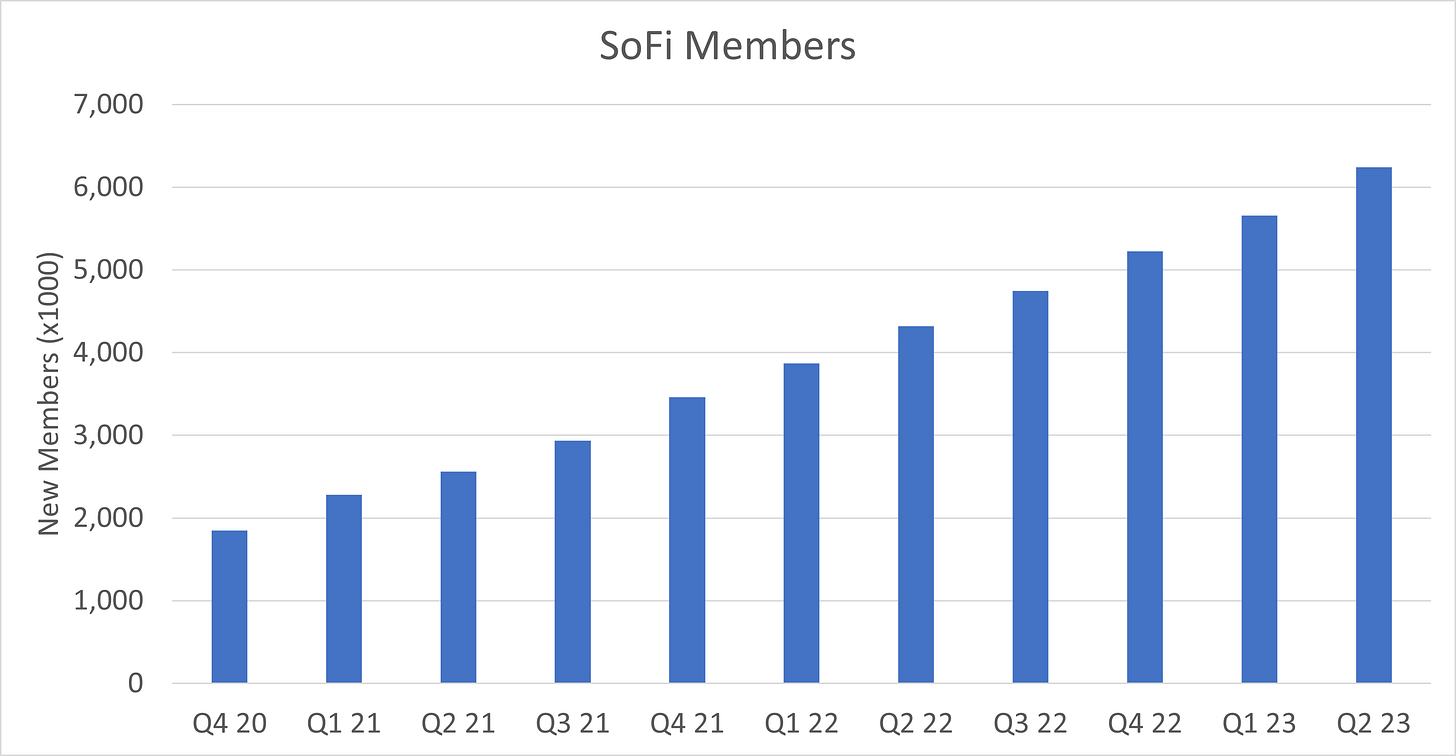

SoFi was already focused on this pool of borrowers and has not seen their potential clientele shrink in the same way. In fact, SoFi’s all-in-one platform has attracted record members, meaning that as they grew originations more than 6x in less than three years from $614M in 4Q20 to $3.7B in the most recent quarter, they have not had to compromise on credit quality.

SoFi chose an antifragile business model and it has resulted in consistent and sustainable growth through the significant headwinds that all three businesses have faced in the last year and a half. That means they are now far and away the market share leader in the fintech personal lending space, and even more so in their credit box. This gives them an advantage to maintain that position moving forward. When the credit cycle turns and demand returns, they will be in position to ramp originations to maintain their place as the leader, selling loans as required at a profit to facilitate the increasing volumes.

Better Underwriting

SoFi’s credit outcomes are demonstrably better. The first reason for this dovetails with their resilient clientele. Higher quality borrowers hold up better in adverse economic conditions. Upstart publishes what they refer to as their Upstart Macro Index or UMI. It gives a value that predicts how many of their borrowers will default on their loans relative to historical norms. If default rates are normal rates, UMI is 1. If loans are overperforming because of the macro environment (like because the government gave out a bunch of stimulus checks), UMI is less than 1. If loans are underperforming (like when stimulus checks run out and inflation is at 40 year highs), the UMI is above 1. UMI has literally never been higher than it is today. Upstart’s borrowers are defaulting at rates 69% higher than normal.

SoFi outperforming Upstart is to be expected as affluent customers are more resilient to the macro. That does not explain how SoFi is seeing lower defaults than before the pandemic. LC’s borrowers are ostensibly in the same credit box at SoFi, yet LC borrowers defaults crossed over prepandemic level in 1Q23. SoFi just reiterated again in their 2Q23 earnings call that their credit outcomes are still above prepandemic levels. Not only that but their default rates actually decreased between 1Q23 and 2Q23.

I do not know of a single lender of any type - bank, fintech, or otherwise - who can make that same claim. The underwriting is best in class and leads to better credit outcomes. When SoFi’s balance sheet does eventually fill, I think their superior credit outcomes and higher rates charged on their loans should allow them to find buyers for their loans easier than competitors, although this is a claim that cannot yet be proven with data. LC did mention in their earnings call that the one source of robust demand is for their seasoned prime personal loans, which happens to be exactly the type of loans SoFi has in abundance.

The moat is wider than it’s ever been

Businesses differentiate themselves in the hard times. The differentiation in outcomes is data that supports the argument that SoFi really is building a business that is better than its peers. SoFi has a robust business model built on a more resilient client base that utilizes superior underwriting. That has led to better outcomes in hard times. I think the evidence makes those statements undeniably true. When the headwinds slow, differentiated results will continue to separate them from competitors.

Thanks for reading everyone. Please make sure to become a free subscriber by entering your email, or a paid subscriber if you feel you’ve gained value from my work. Always 100% voluntary.

Disclosures: I have long positions in SOFI and LC.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Hey is there a way to reach out to you directly?