SoFi's Capital Raise is Bullish. So Why Don't I Like It?

I intentionally ignored the capital raise in my earnings review because I wanted to focus on the actual results. That isn’t to say I don’t have thoughts to share, because I certainly do. I did a similar article with the senior convertible notes last year. As before, there’s more good than bad, but I find it valuable to cover all sides of the argument.

What does it mean to dilute?

A company’s market cap is how much the stock market thinks that company is worth. Take the current stock price, multiply it by the shares outstanding, and voilà, you get market cap. Using today’s SoFi stock price ($25.63) and the latest data for shares outstanding (1.20B), SoFi has a market cap of $30.68B. I own a tiny fraction of that amount. For simplicity’s sake, let’s say I hypothetically own 1,200 shares. That means the percentage of the company I own is my shares divided by the total shares, or 1,200 / 1,200,000,000 = 0.0001% of the company. My hypothetical shares would be worth 0.0001% of the market cap, or $30,680.

Now, let’s say tomorrow that SoFi issues another 100M shares and gives them away and the market cap stays the same. Those shares didn’t create any value, but now I own a smaller amount of the business. All else equal, the stock would immediately rerate from $25.63 to $23.60, still maintain a market cap of $30.68B, and I’d own a slightly smaller piece of the total pie worth $28,320.

That’s dilution. My piece of the pie got smaller because I own the same number of shares, but the total number of shares has increased. Like watering down your kid’s kool-aid because you want them to get less sugar. The new shares are the added water, the total shares are the amount of liquid in the pitcher and the company’s earnings is the sugar, and darn it, I like the taste of sugar. Now it tastes worse because I get less sugar when they pour out the same amount of kool-aid (my shares) into my cup.

When dilution doesn’t dilute

Everything above assumes that the new shares don’t come with any upside. Most people, myself included, tend to think of things on an absolute basis. I usually chart revenue, contribution profit, EBITDA, and net income on an absolute basis. But really, it should all be on a per-share basis. What matters to investors is the revenue and profit generated for each share we own.

Last quarter, SoFi made 8 cents of earnings for every 1 share of public stock. That’s what EPS is. Let’s say that in the example above, those 100M shares were issued and bring in an extra $20M in net income in a quarter. That’s 20 cents of EPS ($20M / 100M shares = $0.20 per share). If the core business continues earnings 8 cents per share, the new, higher-earning shares raise the company’s average EPS to 9 cents per share. In that case, the capital offering isn’t actually dilutive, it’s accretive.

In the kool-aid analogy, this is like taking watered down kool-aid and adding concentrate to it. Am I adding more liquid (shares) to the pitcher? Yes, I am. But that water actually has more sugar (earnings) in it than the existing mixture. So when they pour out the same amount into my cup, I actually get more sugar overall. In this analogy, that sugar is a good thing (don’t tell my kids).

SoFi’s Capital Raise

On earnings day, SoFi announced that they would be raising $1.5B via an equity offering. Later that same day, the pricing for that raise was finalized. SoFi ended up selling 71,942,450 shares at a price of $20.85 to raise $1.5B. As of the end of Q2, there were 1,113,443,000 shares outstanding. So adding ~72M increased the shares outstanding by 6.46%. The stock immediately dropped in after hours trading from its closing price of $22.40 to $20.92, a 6.6% drop, which is logical, as it kept the market cap roughly the same.

Management Suffers from Dilution More than I Do

Anthony Noto, Chris Lapointe, and all their management team own orders of magnitude more stock than I do. These shares aren't going to them, so it isn't like there is a misalignment of interest here. Dilution hurts them more than it does me if it isn't for the long-term benefit of the company. Moreover, their PSUs expire next June, so they have a really large incentive to get the stock above the $25, $35, and $45 hurdles in those PSUs in the short term. So their incentives are for both the short-term and long-term benefit of the company.

Is this offering dilutive?

The core question is this: will the capital raised from these new shares increase earnings by more than 6.46%? What is SoFi going to do with that cash that they raised and how much is that worth? On July 31, SoFi Investor Relation’s X account posted an explanation about the plans for the capital that was being raised. Those plans include:

“Pay down expensive debt”

“Consider opportunistic acquisitions (though none are currently contemplated)”

Gives a “stronger position for potentially greater growth”

The pay down of debt would make it “neutral to EPS”

Let’s dive in and see if this share offering is dilutive or accretive. Are they watering down our kool-aid or adding concentrate?

Paying Down Debt in the Short Term

Paying off their highest-cost debt is the low-hanging fruit for this new capital. How much debt does SoFi have and how much does it cost them? We can find the answer in the 10-Q

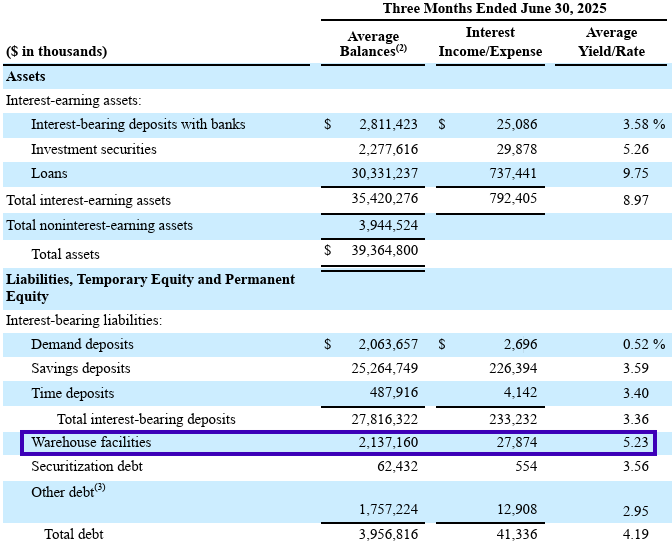

SoFi has a total of $3.94B in debt. The most expensive debt that they would be using this cash for is the revolving credit facility, of which they have $486M drawn at a rate of 5.92%. The risk retention warehouse facility, of which they have a mere $4.7M drawn at 5.95%, and their loan warehouses, where they have a total of $2,120M drawn at rates between 4.95% and 6.05%. Digging deeper into the 10-Q, the average rate they pay for the warehouse facilities is 5.23%.

Let’s assume they immediately pay off the risk retention warehouse and the corporate revolver. Combined, that’s just under $500M of debt they pay off to save $29.05M in annual interest. That leaves around $1B left to pay off around half of what is left in their warehouse facilities. Let’s assume that they pay off the highest cost debt and that the rate there is 5.3%, which would be $53M. So, all told, if the only thing they did was pay off debt, they are saving $82M annually in interest for the 72M shares they issued. That equates to $1.14 in saved expenses per year, or $0.28/quarter. Last quarter they earned 8 cents per share. So just paying off debt alone makes this capital raise accretive to the bottom line in the short term. Keep in mind that these interest rates move with the SOFR, which basically moves with the Fed Funds rate. So the interest savings will decrease as the Fed cuts rates.

Putting the capital to work in the long term

So, in the short term, it’s accretive. What can they do with this money in the long run? Raising an extra $1.5B in capital means that they can grow their loan book by around $8B-$10B. I detailed the reasoning behind that number in a previous article. Let’s take the midpoint and call it $9B. They make around 6% net interest margin on their loans, so that’s about an extra $540M in interest income per year. Then you have to subtract their defaults and other related expenses to determine the impact on earnings.

SoFi’s management has been very clear that they want to get 20%-30% return on equity. They are not yet fully optimized for profitability, but their ROE last quarter was already 8.6% and it’s growing quickly. I think the 20%-30% target is very achievable. That would mean that in the long term, that $1.5B in equity should turn into $300M-$450M in annual profits. Again, this is for 72M shares, so we’re looking at an extra quarterly EPS of $1.04-$1.56 for those new shares once they have all that capital fully deployed. That’s substantially more than the $0.08 generated last quarter, making the raise highly accretive in the long run.

Acquisition

The other possible use of the capital would be an acquisition. More than likely, we’d be looking at something in the crypto space. I think this is probably a fairly low probability since I’m guessing the valuation of things in the crypto space during this raging crypto bull run are probably fairly extended. I trust management’s capital allocation strategy in this regard as they’ve done a good job folding prior acquisitions into the ecosystem. I don’t want them to overpay, but I also think it’s unlikely that this happens in the near term.

This is not a dilution

So, this capital raise, even if they only pay off debt, is accretive in the short term. If you trust that they will allocate the capital in the long term to get 20%-30% ROE, then it’s extremely accretive in the long term as well. This is not dilution because the earnings that are generated from selling the shares add extra earnings to the bottom line.

That doesn’t mean I have to like all of it

My initial reaction was that I did not particularly like this offering. After a deeper dive into the numbers, I do like it. However, that doesn’t mean there aren’t downsides to this, and I have some dissenting opinions to share. Two of my concerns are about timing, one is about alternatives they could have employed, and then the final one is just about mindset.

Alternatives

Other ways to save on interest

This was absolutely an accretive capital raise, there can be little doubt about given what was presented above. However, there are alternative ways to accomplish the same thing. For example, SoFi has $25.26B in savings deposits. Decreasing the rate they pay on savings APY by 0.3% would give the same savings in their interest paid out as the capital raise. That might hurt their members, and I don’t know what the elasticity of demand is for deposits, so it might not be the right thing or even possible. I’m just trying to illustrate that there are other ways to accomplish the same thing for no increase in the shares outstanding.

I think there are other low-hanging fruit that could accomplish the same thing. The most obvious example to me is business checking accounts. Nerdwallet’s best business checking page has accounts that are paying a measly 1.5% APY as their top pick. I admittedly do not know what it takes for SoFi to launch business checking accounts. I don’t know if there are regulatory hurdles that make it so they can’t roll that out. What I do know is that SoFi would probably rocket to the very top of the list of best business checking accounts by offering like 1.6% and giving businesses reasonably good tools to work with. You know, like the same exact type of tools they already offer through SoFi at Work.

After receiving their bank charter, they easily grew their consumer deposits by over $2B/qtr for years. It’s hard to imagine with the large member base that they have that they couldn’t match that by offering SMB accounts. Even paying 1.6% would allow them to offset the same amount of interest and replace the expensive corporate revolver debt and warehouse facilities with low-cost deposits. It seems feasible they could achieve even more interest savings and have done so with no additional shares sold AND expanded the products they offer and the stickiness of their platform. And business checking does not seem a particularly high-risk product to launch. In fact, business checking deposits have the potential to offset more than $1.5B of high-interest debt. With high adoption, they could feasibly pay off the entire corporate revolver and all warehouse facilities in 2-3 quarters, saving even more than the capital raise.

Organic capital growth is accelerating

There was a time when SoFi’s capital was declining every quarter because they had not yet reached profitability. They are now past that stage and their organic capital growth is sustainable. They are now hitting an inflection point in their profitability. That means quarterly capital increases should already be accelerating from here. While the capital raise is accretive, the company was already on a path of sustainable organic growth.

Furthermore, they have made a big deal about shifting to a model that is based on capital-light fee-based income. A $1.5B capital raise signals a heavier reliance on their balance sheet for growth, not a pivot to more capital-light growth. I don’t care as much about this as others do, but there is a disconnect here between their messaging and their actions. The alternative to the capital raise is to sustainably grow the balance sheet organically as their profitability increases. A capital raise turbocharges the growth for now, but at some point the business has to become self-sustaining. As the graph below shows, they were already on the path to sustainability even without the capital raise.

I highlighted in my last earnings review that SoFi has been building out its student loan portfolio and in Q2 they even bought back student loans that were previously sold to other institutions. There might be something I am not understanding, but I do not see how that helps with their 20%-30% ROE goal. I calculate the returns on those loans to have lower ROE. They’ve grown the student loan portfolio almost the same amount as the personal loan portfolio over the past two years. Those are lower return assets, and buying back those low-yield loans eats up capital. If they had not bought those student loans, they might be able to raise less capital but get the same long-term returns. I trust management, and I readily admit I am not an expert here. They are certainly better allocators of capital than I am and I literally have no banking experience while they are running the fastest growing bank in the United States. I’m far from an expert, but I am going to point out things I see as an investor that leave me with unanswered questions.

Timing

I did not like the timing of this offering for two reasons. First, announcing the offering on earnings day took the shine off of the superb results. There were about eight hours where the exemplary execution, growth, outperformance, and profitability were the story. Then the offering was announced and derailed the entire conversation. I care much more about fundamentals than I do about the narrative, but that is actually the reason this bothered me so much. This capital raise took the focus away from the improving fundamentals and put it squarely back on the narrative. It often takes Wall Street some time to digest really good results. And while in the long run the fundamentals are shining through, I’d prefer for the emphasis to be there.

The second reason I didn’t like the timing is that it was fairly obvious the stock was heading higher, and they could have the same outcomes with fewer shares sold by waiting. If, for example, they had done the raise at $25 rather than $20.85, you get the same benefits, but for only 60M shares instead of 72M. So you get the same benefits, but for 20% less shares issued. I think selling those shares at $20.85 was below the company’s true value even if the outcome is accretive.

Again, I trust management. I know they’ve probably been waiting to pull the trigger on something like this for a while. I know that you have to strike while the iron is hot. I don’t have the information that they have. Maybe Jane Street, who it looks like was a major buyer of the offering, was only willing to go in at that price or there was a time element here that I don’t know about. I don’t have a peek behind the curtain to know anything for certain. I do know that, all else equal, waiting just a couple weeks could have made this offering 20% more accretive for all shareholders, including management.

Mindset

After this offering, I fully expect that there will continue to be capital raises in the future. SoFi has now used equity as a way to fund growth on four separate occasions. The first was the 2026 convertible notes, which were used to capitalize the bank. That was an absolute home run from a business standpoint. The second was the Technisys acquisition. While the jury is still out on that one, I think I’ve seen enough to know that in the long run, the vertical integration alone was almost certainly worth it. The third time was the 2029 convertible note deal, which saved them interest and helped alleviate capital constraints at a time when that was a much bigger concern. That was also a net positive. They are three for three in my book and I’m sure they’ll make it four for four. This has become a trend and it is something that management obviously views as a growth tool.

However, during the time of the 2029 convertible note deal, I wrote, “I don't like that they are diluting at such a low stock price because I think SoFi is very undervalued at these prices.” The stock at that point was trading at $9. As expressed above, I find I have a similar sentiment with this capital raise as well. I can’t shake the nagging feeling that I don’t know if management assigns its equity the same value that I do. I know what I think this company is worth and it is only finally starting to approach the bottom end of what I consider its fair value now. I don’t like raising capital through an equity offering of what I consider an undervalued company.

Using equity to raise capital is a tool they often utilize. And they do those raises at what I consider to be discounts to what the equity is truly worth. There will now always be the specter after every run up that they are about to drop an offering. If it is always accretive, the truth is that they absolutely SHOULD be doing these offerings. However, their willingness to issue equity at prices I consider undervalued does not sit right with me.

Conclusion

I don’t think there is a legitimate argument to be made that this is anything but bullish for the stock in the short term and the long term because it is accretive to earnings in both the short term and the long term. However, the fact that it is bullish does not mean there aren’t aspects that I consider bearish, which I also covered above. I’ll always give objective criticism when I see fit, but I’d also be a fool not to realize that the good obviously outweighs the bad. This management team has expertly navigated every imaginable headwind and perpetually pulled rabbits out of their hats when the market and the macro left them for dead. As an investor, I savor the prospect of watching this team deploy fresh capital as they finally enter their first period of sustained tailwinds. The future is extremely bright and this capital raise gives them the flexibility to take full advantage of this opportunity. I think we will see them cement their status as one of the preeminent companies and management teams of the decade in the next 12-18 months.

Subscriber update

The DDI YouTube Channel is live. Work has been extremely rough this year and demanded a lot more of my time. I’m going to get back to a more regular cadence of articles and YouTube videos as things should be settling down some in the coming months. If you want to support my work, you can subscribe here on substack, or on X, or, now, on YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up for SoFi, or discounts on Tesla or finchat.io:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get a discount on a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Now did this all over again with the latest raise :-(

Excellent well balnced article. I look forward to your edtimate of eps for quarter three incorporating lets half of the money raised to write down debt along with similar growth year on year when compated to Q3.

Will new member go past 900,000 ?

Thanks for your hard work.