SoUndervalued: Part 1, Bottom Up Valuation and Book Value

Valuation, like everything else in investing, is only useful with the proper nuance and context. There is no single number that tells the whole story for any company. That being said, I think it would be wise for me to start this article by talking generally about how I look at valuing investments. The guiding principles for me are as follows:

Any business needs to be evaluated in the context of what stage it is at in its lifecycle

Growth matters

It’s useful to look at things from a bottoms up approach (like a discounted cash flow model) and from the top down (by comparing it to similar companies)

Industry matters, but I actually think that in general, too much emphasis is placed on industry

Execution matters

I’m going to break this analysis into two articles. This one will discuss SoFi’s valuation using a bottom up approach and also touch on why I think tangible book value is less valuable as a metric for SoFi.

What Stage Is SoFi in as a Company?

I have two pet peeves with valuation. First, way too many people have a favorite metric and then apply it to everything as if it were the only way to truly place value on a company. Second, people often try to use metrics to value a business that are not applicable to that business. For some people it’s P/E ratio, for others it’s PEG, some people use Free Cash Flow (FCF) almost exclusively, lots of people hate on EBITDA, others think a discounted cash flow is the holy grail of valuation, etc. I also have my favorite metrics, but I think its worthwhile to look at as many different metrics as possible as long as those metrics are applicable to the business. Looking at a lot of different data points often helps me get a more holistic view of what I think the business should be worth.

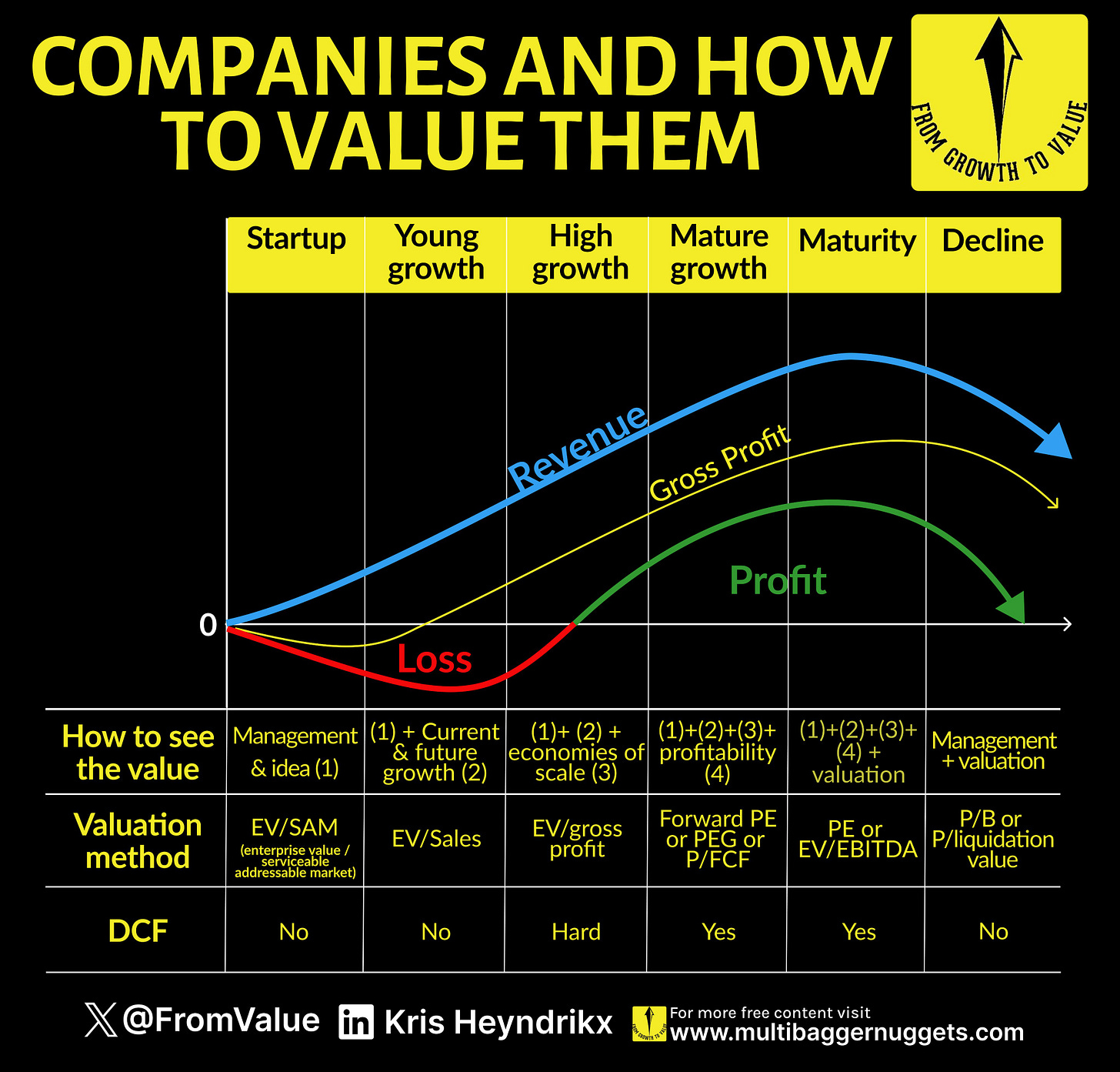

On the second pet peeve, how do we know what metrics are applicable? You have to look at where the company is in its lifecycle. I love the illustration made by Krix Heyndrikx that I’ve included below (I also really enjoy his writing which you can find at Multibagger Nuggets and his X account is a great follow as well). The point of the diagram is to show that companies go through different stages. A big reason that many people miss investing in early stage growth companies is because they rely on metrics that are only applicable to later stage companies like FCF and GAAP net income.

This graphic also isn’t completely comprehensive. Companies can move from mature growth back into high growth. Some recover from decline and move back to maturity and even growth. The underlying point is to use metrics that make sense in the context of the company you are trying to value.

For example, as I previously covered, P/FCF will always be a terrible metric to use for SoFi even when it is a mature growth company because it includes net change in operating assets. Essentially, how many loans they originate and sell in any given quarter has an outsized effect on their free cash flow, which skews the metric and makes it worthless. Similarly, anybody who is remotely concerned with its price/earnings within a few quarters of its first profitable quarter is looking at a metric that is completely meaningless until 2026 or so after the company has several years of positive earnings behind it.

SoFi is squarely in the “High growth” stage, so the primary metrics I’m going to be looking at in my next article are Price/Sales, Price/Gross Profit, EV/Sales, EV/Gross Profit, and those same metrics adjusted for growth. In this article we’ll take a look at a couple DCF scenarios. But first, I’ll briefly touch on Price/Tangible Book because that’s a thing people think is important to talk about with banks.

Should SoFi Be Priced on its Tangible Book Value?

My opinion here is unequivocally no. Many disagree with me. That’s fine. I’ll present my arguments as to why I think like I do and others are welcome to counter. Thus far I’ve never heard a good counterargument other than “that’s how you are supposed to price banks”, which takes all nuance, context, logic, and first principles thinking out of the debate. I don’t consider that to be a valid argument. Here are the three reasons I don’t think SoFi should be priced on tangible book value:

Its growth and earnings are not limited by its tangible book value.

From a first principle perspective, the only reason to ever price anything by its book value is if its future earnings potential is limited by its book value. Here is SoFi’s revenue growth since 2018:

2019: 87.5%

2020: 37.6%

2021: 62.6%

2022: 52.5%

2023: 36.1%

Does that look like a business whose growth is constrained by its tangible book value? Going forward, they are estimating that earnings will grow to $0.55-$0.80 in EPS in 2026 and then 20-25% per year beyond that. Again, that looks nothing like a company whose earnings are constrained by its book value.

I covered this in my last article, but SoFi has grown at a 48.6% compound annual growth rate (CAGR) over the last 3 years and is guiding for a 20%-25% revenue CAGR for the next 3 years. The fastest growing bank in America not named SoFi has a 3 year trailing revenue CAGR of 18.52% and a 2 year forward CAGR estimate of 16.43%.

Finally, pricing it on tangible book value completely and totally ignores the entire technology platform. That is 100% capital-light revenue that is independent from tangible book value. If you price it on tangible book value, you are ignoring one third of the company that makes up about 20% of their revenue.

Warren Buffett agrees that banks should be valued on earnings, not book value

Cash flow matters and earnings matter. Book value is a foolish way to value a bank. Warren Buffett agrees. He was asked about this specifically in 2013. Here is his response:

A bank that earns 1.3% or 1.4% on assets is going end up selling above tangible book value. If it’s earning 0.6% or 0.5% it’s not going to sell [above book value]. Book value is not key to evaluating banks. Earnings are key to evaluating banks. You earn on assets. Now, it translates to book value to some extent because you’re required to hold a certain amount of tangible equity compared to the assets you have, but you’ve got banks like Wells Fargo and USB that earn very high returns on assets and they sell at a good price to tangible book, you’ve got other banks, like maybe the two you mentioned [Bank of America and Citibank] that are earning lower returns on tangible assets and they’re going to sell below book.

The GOAT has spoken. Book value only matters insofar as it translates into earnings. That’s my opinion too.

CEO Anthony Noto, who was actually an equities analyst for Goldman Sachs in the past, had an excellent response to this same question.

We’re a diversified financial company that delivers our value proposition via technology and so analysts can value us any way that they would like. If they want to value us like a technology company or as a bank. If you look at us as a bank, we’re a bank that is structuring our business over the long term at steady state to have a 30% ROE. Banks that have a 30% ROE trade at 4-5 times tangible book. We’re trading below that today, so that’s my point of view if you want to value us as a bank.

Currently tangible book value is $3.86/share. So at a P/TB of 4-5, the stock would be trading at $15.44-$19.30. To be completely fair, they have not justified a 30% ROE at this point. They are nowhere near it, but that’s because they are a high growth company, and 30% ROE won’t come until their margins hit steady state in 5-10 years. Use the tool that is meant for the job. Using P/TB for a high growth company is just the wrong valuation tool. It might be applicable in 10 years for SoFi. It isn’t right now.

Discounted Cash Flow

If we had a completely efficient market, the current price of any equity would be the total of all future cash flows discounted back to their net present value. That’s where the concept of a discounted cash flow originated and its why people like to use them. The analytical engineer in me loves the DCF. It’s a mathematical model that adequately rewards growth, removes the vagaries of pricing multiples, and is applicable across almost every industry. It’s a great way to get an estimate for the intrinsic value of a company to compare to where they are trading.

Now, many people don’t like doing DCF's for banks. The purists are probably already mad at me for being so dismissive of book value. They are now certainly fuming that I am eschewing their favorite valuation methodology (P/B or P/TB) in favor of one that, in their eyes, is not applicable. They probably think it ironic that I’m using a metric to value a business that is not applicable to that business, which is exactly my own pet peeve mentioned above. Let me explain two reasons why I think a DCF is a reasonable methodology to use here.

First of all, SoFi has a bank, but SoFi is not a bank. There is an important distinction there that lots of people miss. SoFi is a technology-enabled financial services company. That’s how the company thinks of itself and structures its business and financials as well. As they analyzed the types of products that they needed to offer in order to fulfill their goal of being a one-stop shop to help people get their money right, they realized that the best way to fulfill that mission was to get a banking charter. That would be the best way to serve their members and the most profitable way to operate the business. So they acquired a bank and a bank charter. That’s why they report their numbers weird for a bank. That’s why you don’t get standard banking metrics in their financials. It’s why you see them reporting adjusted EBITDA. That’s why they split financial services and lending segments the way they do. People who say SoFi is a bank are forcing their paradigm of what they think SoFi ought to be onto the company. SoFi is not a bank, they have a bank. They are a fintech, and I think a DCF is a fine way to judge a fintech.

That is not going to sate the appetite of the banking purists either, so I’ll also put it in a different way that might translate better. The way I’m doing this DCF, “cash flow” is basically synonymous with “tangible book value growth”. SoFi isn’t paying out dividends or buying back shares, so all their positive cash flow and retained earnings are being reinvested into the business and growing their tangible book value. That should be true for the 10 years the DCF covers. So every time I say “DCF”, you can substitute “Discounted Tangible Book Growth Model” instead. And again, I’m not basing my entire valuation of SoFi off just a DCF. It’s one tool to estimate the value of a company. It’s one data point, so if you don’t like it, go ahead and throw it out. I think it’s valuable.

What is a DCF?

The problem with a DCF, as with all models, is that it is only as good as its assumptions and the data you put into it. The DCF is heavily reliant on the ability to accurately predict the future growth of the company’s cash flows. Without accurate cash flow projections, you get an inaccurate result. I’ve never presented a DCF before in my articles, so I’ll take a minute to describe conceptually how it works.

A DCF calculates the current value of expected future cash inflows and outflows by discounting them at a rate that reflects the cost of capital, risk, and time value of money. You project how much cash flow the company is going to make each year going forward. You then use a discount rate to discount those future cash flows back to today to give them a value in today’s dollars. As I mentioned above, you need accurate cash flow estimates to get an accurate outcome. Usually at this stage, SoFi would not be a good candidate for a DCF because it only recently went profitable. That makes projecting future cash flows very difficult. However, the long-term guidance they’ve given actually make the picture much clearer and make it much more accurate as long as you believe their guidance is correct.

One of the key variables in a DCF is the discount rate. This the rate that is used to discount future cash flows to their present value. It is supposed to reflect both the time value of money and the risk premium for holding an equity rather than putting your money in a risk-free place like treasuries. DCFs for equities usually use discount rates somewhere between 8-12%. I think that 12% is a good discount rate for SoFi given that there is higher risk associated with investing in a younger growth company and because they do have a lot of personal loans on their books.

I also like to use a reverse DCF. A DCF projects future cash flows to estimate a stock's intrinsic value. A reverse DCF starts with the current stock price and calculates the growth rate implied by that valuation. It basically answers the question of “how much future growth is baked into today’s stock price?” Like everything else, it isn’t a perfect metric, but it gives us a starting point. So let’s start there.

Reverse DCF

I use my own calculation (you can find out how I calculate it in this article) for SoFi’s cash flow to get a TTM cash flow of $341M. I assume a 2% dilution rate for the next 10 years and a discount rate of 12%. I also assume a terminal growth rate of 2% (meaning after 10 years, the company only grows at 2% for the rest of time). So, given those fairly negative assumptions, what is the 10-yr CAGR that SoFi has to hit to justify today’s stock price of $6.38? I'm using a modified spreadsheet whose template I got from Brian Feroldi and Brian Stoffel’s website for this and for the following DCF.

It’s 0.95%.

That’s right, if the company only grows by 1% for the next decade and then 2% after that, and you discount all those future cash flows back to today at a rate of 12% per year, you get a total present value of all future cash flows of $2.52/share, including future dilution. Remember, this is equivalent to saying that its future tangible book value growth discounted back to today would be worth $2.52/share in today’s dollars if it only grows at 1% for the next decade. Add that to today’s tangible book value of $3.86/share and you end up with $6.38.

Tell me, do you think SoFi will grow its cash flows at a rate greater than or less than 1% on average for the next decade? SoFi is incredibly undervalued at today’s prices.

Standard DCF

Let’s keep that same 12% discount rate and 2% dilution rate, but look at a more realistic growth scenario than 1%. Usually doing a DCF on a company at this stage is fraught with errors. However, as I pointed out above, the fact that SoFi have given long-term guidance out to 2026 actually makes it much easier, and, if you assume the guidance is accurate, should yield a useful result.

Last year their total cash flow was $283M. The implication from their adjusted EBITDA guidance of $595M in 2024 is a cash flow of around $460M. Let’s assume they hit the midpoint of their 2026 EPS guidance, which is $0.68 in EPS. That implies a cash flow of just under $1B by 2026. They are guiding for 20%-25% growth after 2026, so I then assume a growth rate of their cash flow from 2027 onwards that starts at 25% and tapers off to 10% by 2033. Finally, I set the terminal growth rate of 4% thereafter. You might also notice that the TTM cash flow is lower than in the reverse DCF above. That’s because I intentionally used FY 2023 cash flow as the starting point rather than the trailing twelve months so that this DCF matches full year numbers and guidance.

With these assumptions, the net present value of future cash flows is $16.21. Add that to today’s tangible book value and I get an intrinsic value for todays stock price of $19.85. And just to give you an idea of how much the discount rate affects these calculations, if you use a discount rate of 10%, today’s intrinsic value would be $26.49. At an 8% discount rate, today’s intrinsic value would be $40.01.

Cash Flow Growth

So, how realistic is it that we see long-term growth in those ranges? Two data points show that it is not unreasonable. First, their cash flow has been ramping nicely. Q4 of 2023 was always going to be an outlier because of their massive focus on profitability in that quarter. However, the company is showing nice consistent growth. The DCF’s $460M cash flow projection for this year seems reasonable considering they already generated $100M in Q1 and are expected to ramp up in the back half of the year.

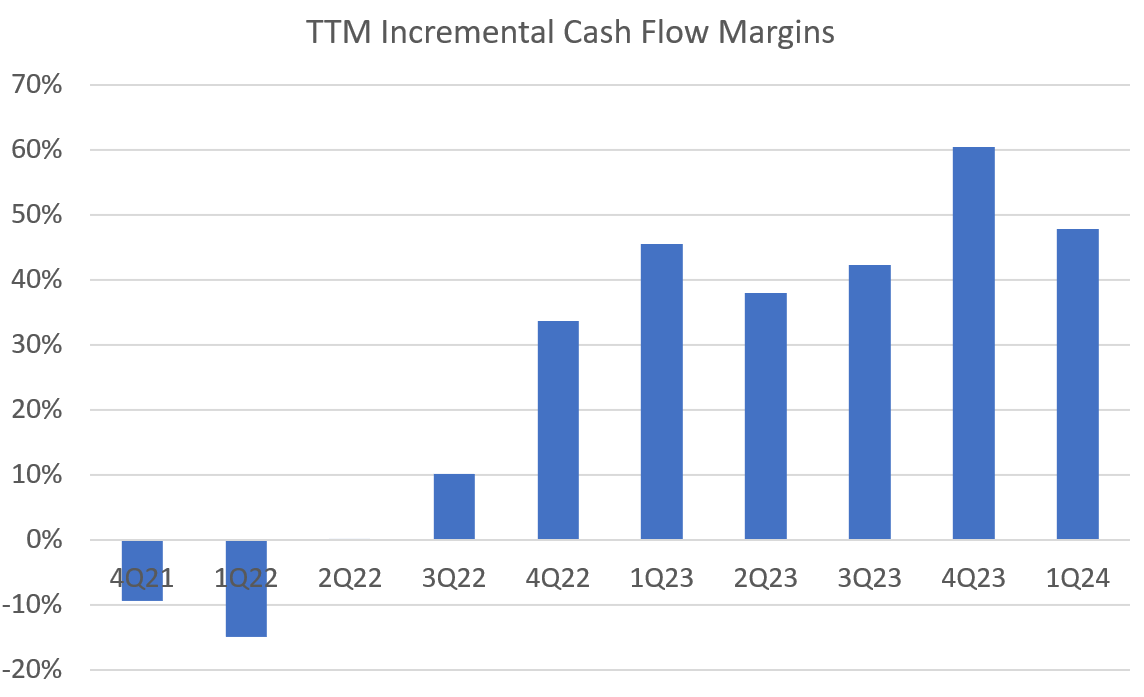

The real question is whether they will be able to reaccelerate growth into 2025 and 2026 as management has guided. The DCF calls for $676M of cash flow in 2025 and $994M in 2026. If they hit the midpoint of their GAAP EPS guidance, that is what is implied, so if you believe they are accurate in their guidance, that’s the cash flow that will happen. That would also imply a cash flow margin of around 24%. That number does seem very reasonable given their TTM incremental cash flow margins seen below.

Conclusion

In part 2 I’ll look at valuations like revenues, gross profits, and PEG ratios compared to other companies and especially other fintechs. However, if you take a bottom up approach to value SoFi, the only logical conclusion I can see is that it is extremely undervalued. It is priced for literally 1% growth for the next decade based on a reverse DCF. This is a company that has grown at 48% CAGR for the past 3 years and is guiding for 20%-25% CAGR for the next 3 years overall. 1% growth for the next 10 years is a laughably low bar to clear.

A DCF based only on their own guidance, which does not include any new products for the next 3 years, results in an intrinsic value of $19.85. That is a 211% premium to today’s closing price of $6.38. That’s using a high discount rate of 12%, and the intrinsic value would be much higher than that if you use a more conservative discount rate. Any way you slice it, SoFi looks extremely undervalued at the current price.

Subscriber update

I’ve actually lost a decent number of paid subscribers recently. That’s what happens when the main stock you cover is stuck in a huge rut. That’s fine with me because that isn’t the main reason I do this. Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have a long position in SoFi.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Again very informative and clearly made article, even if you are not a SOFI investor it helps you understand how you can look at companies. Keep it up! You will be not forgotten. :)

Great article Chris! This was a very informative read. I agree with your points completely. I have learned a lot from reading your articles and I look forward to the second half when it comes