SoUndervalued: Part 2, Fintech multiples

If you haven’t read part 1, I suggest you start there. It gives some background on how I think about valuation, why I don’t think tangible book value is the right metric for SoFi, and results of a few different discounted cash flow models,

I’m going to quickly list the guiding principles I have for valuation again here because they’ll be important for the discussion below:

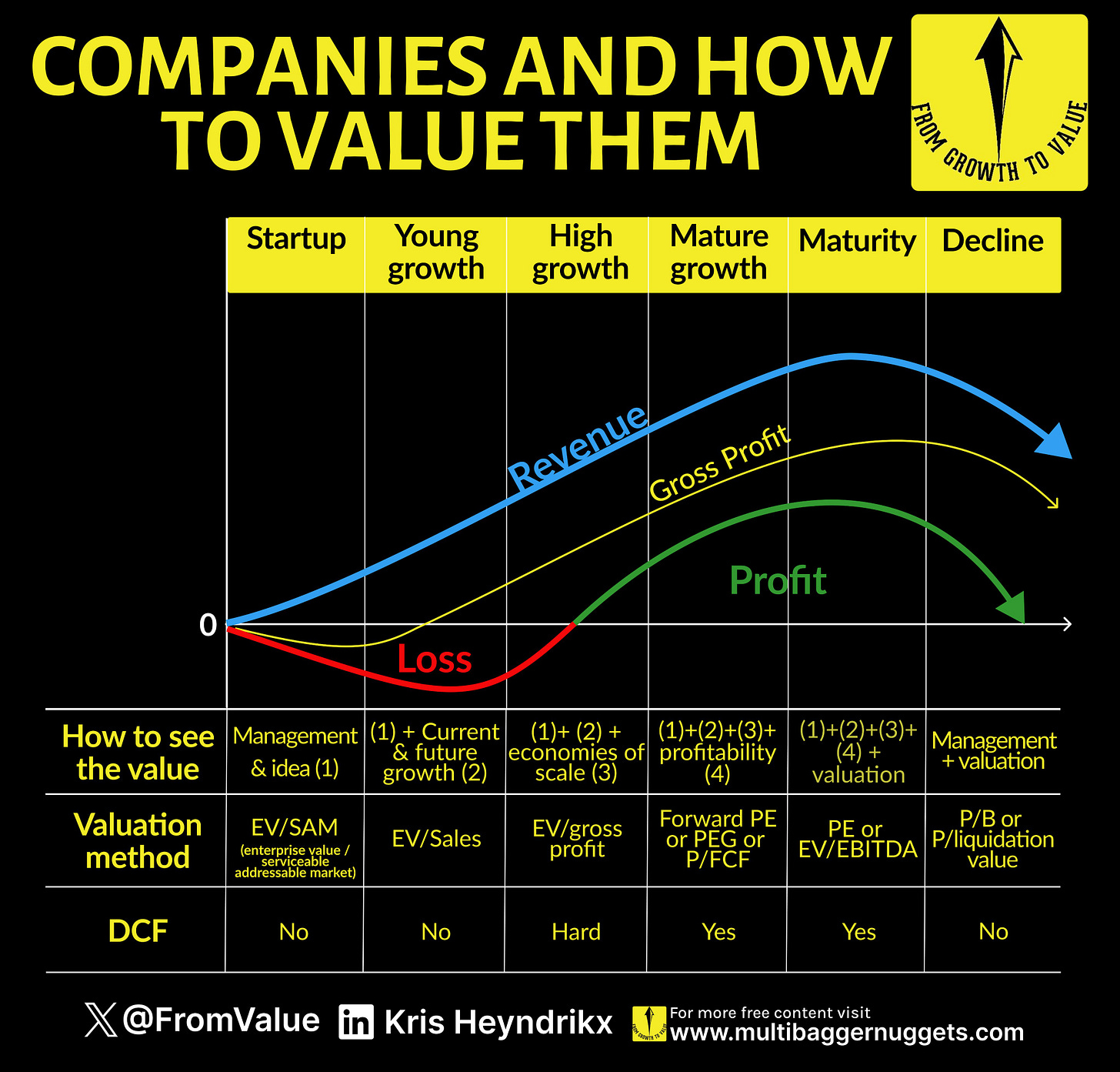

Any business needs to be evaluated in the context of what stage it is at in its lifecycle

Growth matters

It’s useful to look at things from a bottoms up approach (like a discounted cash flow model) and from the top down (by comparing it to similar companies)

Industry matters, but I actually think that in general, too much emphasis is placed on industry

Execution matters

Valuations are a tool

Judging a growth company by metrics that are designed for mature companies leads to false conclusions. Judging mature companies by metrics that are designed for growth companies also leads to false conclusions. Valuations are a tool. You don't use a screwdriver to drive a nail and you don't use a hammer to drill a hole. Those are the wrong tools. You don't use P/E, ROE, and P/B to judge a growth company in its early stages. Those are the wrong tools. Similarly, P/S or P/GP are less instructive for a mature company. Those are the wrong tools. Pick the right tool for the job.

SoFi is a high growth company as defined in Kris Heyndrikx’ methodology above, which I think is a good framework. The most useful tools for evaluating companies at that stage are price/sales and price/gross profit. I think it’s also useful to adjust those numbers by growth, similar to how the PEG is typically more important for mature growth companies than a standard P/E. We’ll take a look at those metrics and then we’ll take a brief look forward into SoFi’s future PEG. Note that for most companies EV/S and EV/GP is actually better because it gives companies credit for having lots of cash and low debt. Enterprise Value, or EV, is really cumbersome or completely inapplicable for financial companies because their balance sheets are quite convoluted, so I’m not including it in this discussion for that reason.

Thoughts on Comparing Companies

Comparing a company to one in its same sector is always preferable. The closer two companies look, the more likely they are to be valued similarly. However, I think entirely too much emphasis is placed on giving multiples in line with the same industry. The entire purpose of using valuation metrics is to make comparisons. You compare the company's price to what it is making in order to decide if it is worth investing in. You compare it to its industry to determine whether it is a best-in-class company. You compare it to the rest of the market to see if that's a good deal relative to other companies. I don’t think you should automatically dismiss a comparison of two companies out of hand just because they operate in different sectors or are somewhat different. The point is to discuss the differences to determine if the difference in valuations is justified.

Let me use an analogy to explain why I find this so strange. I work in a company that primarily operates in the energy and oil and gas sectors. In the market, these companies typically have low valuations. I have several neighbors who work at SaaS companies. Wall Street gives a premium to these companies. However, when I go grab lunch with a neighbor and we each order a $10 burrito, my buddy Josh doesn't give the cashier $2 and say "that should cover it because SaaS dollars are higher quality.” Likewise, I don't have to pay $20 because "oil and gas profits are worth less.” That's stupid. It makes no sense anywhere, and it doesn't make sense in investing either. A dollar of profit is a dollar of profit. It doesn't matter how that dollar was earned.

That doesn't mean it's wrong to give companies like Palantir, Snowflake, Duolingo, and Crowdstrike a premium to companies like ExxonMobil, Shell, and Occidental Petroleum. The reason SaaS gets a premium is because their margins are higher, their fixed costs are low, each incremental dollar of revenue is typically higher margin, scaling costs are lower, growth is higher, capex is lower, SaaS has higher replacement costs, their sector is growing much faster, etc. Those are legitimate reasons to give them a higher premium. "It's a SaaS company" is not a legitimate reason if said SaaS company does not have those characteristics.

If I find an energy company that has the same cost structure, margin profile, and growth as a SaaS company, it should get the same premium as a SaaS company. If there is a SaaS company that has high capex and anemic growth like an energy player, it should be priced like an energy company. It's not about the industry, it's about the business operations and the future profits the come from that business. I think people put way too much emphasis on the industry and ignore the fundamental reasons WHY those industries typically do or do not get a premium.

What are the best comparable companies for SoFi?

All that being said, there are plenty of fintech companies to compare to, so that is where I’ll do the comparisons today. A lot of them have similar margin profiles, aspire to be high growth companies, are still newly profitable, and try, but usually fail, to grow at the same pace as SoFi. Banks are terrible comps. None of them grow remotely fast enough to be decent comps, and most of them are mature companies. SaaS companies are actually excellent comps as well, but as I said, I’ll spend most of the article comparing to fintechs, even though a comparison to SaaS would result in way higher multiples for the company. We’re going to take a look at SoFi against fintech BNPL provider Affirm, credit decisioning firm Upstart, brokerage Robinhood, crypto brokerage Coinbase, card issuing and processing firm Marqeta, payment processors Toast and Shift4, the Brazilian neobank Nu, and BaaS provider nCino. The respective tickers are SOFI, AFRM, HOOD, COIN, UPST, MQ, FOUR, TOST, NU, and NCNO.

Execution and Growth Matter

All else equal, I am willing to pay more for companies who are managed better, execute better, and grow faster. I also think a premium ought to be paid for companies who are more profitable on a GAAP basis now because profits in today’s dollars are worth more than profits in future dollars because inflation is a thing. So let’s start with providing context for these numbers based on past growth and execution. Most values were takenfrom finchat.io without adjustments made. The exceptions are COIN and NU, because their gross profit and revenue did not match those published by their investor relations websites. I took those numbers directly from their investor presentations. Forward growth estimates were taken from Seeking Alpha. Here are the annualized growth rates for the past 3 years and 1 year respectively.

NU is in a class all of its own, but as we’ll see below, it’s been rewarded for that growth with a higher multiple. SoFi is in the next tier, just below the payment processors TOST and FOUR over the past 3 years and way ahead of every other fintech except AFRM. Over the past year, it’s in that same second tier. So its execution has been superb, especially considering that this time period included the fastest rate hike cycle in history and a 3+ year student loan payment moratorium. One of the takeaways for me here is that HOOD, UPST, and COIN are probably going to be very cyclical. HOOD and COIN will move with market cycles and crypto cycles. UPST is beholden to capital markets who are willing to originate or buy their loans, so they’ll rise and fall with those companies. It appears that leaves NU, FOUR, TOST, SOFI, and AFRM as the secular growers. Secular growth should, in my book, result in a premium.

The main takeaway as it pertains to SoFi is that it is among the top tier fintechs (outside of NU, which is in a class of its own) for growth. This is in spite of the fact that SoFi has faced stronger headwinds than any of these other firms because of the student loan moratorium. Based on historical performance, they should be getting the same type of execution premium as you’d give to TOST, FOUR, and AFRM, and probably more premium compared to companies like HOOD, UPST, COIN, and NCNO. NU deserves the best execution premium of them all.

Let’s briefly look at GAAP profitability briefly as well. Below is the FWD P/E for each of these companies. Only half of them are profitable, so if you also want to give credit for profitability, it should also get a premium to the companies that aren’t profitable yet like AFRM, UPST, MQ, TOST, and NCNO. So the list of secular profitable top tier growers from this list is NU, FOUR, and SOFI.

Ok, we’ve looked at past performance, but what about forward revenue growth? Again, SOFI trails NU and the payment processors, but are in the same tier as AFRM, HOOD, and COIN. AFRM, HOOD, and COIN are up 288%, 262%, and 697% off their 2022-2023 lows, respectively. SOFI is up 82% off its low.

If you look at the data as a whole, Sofi is in the upper tier for past growth, is profitable now, and shows future growth in line with its peers, even though 2024 is supposed to be a transition year with lower growth before reaccelerating again in 2025 and 2026. You can objectively say that in terms of execution, overall growth, and profitability, SoFi is very much an above-average fintech from this list. It should therefore warrant above-average multiples.

Pricing Multiples

Price-to-Sales

SoFi is not getting above-average multiples. I’ll start by looking at Price/Sales, which is just the market cap divided by annual revenue. These numbers are accurate as of market close on July 16, 2024, since that’s when I froze them to write this portion of the article.

On a revenue basis, SoFi gets a lower-than-average multiple. The average P/S on this list is 6.8 and SoFi is at 4.0. That means that if SoFi were trading at just the average multiple of everyone on this list, it should be trading at $13.37 today. If you look at a FWD P/S multiple, again SoFi is on the low end. Average for this list is 5.7 and SoFi is at 3.2. If SoFi were to be valued at the average valuation, it would trade at $13.60 today.

I am a firm believer that if you do not include growth in these numbers that it makes them less comparable. For example, I’m very much willing to pay a higher multiple for a company growing at 50% than I am for one growing at 10%. The final column takes FWD revenue growth rate and divides it by the forward estimated growth rate. This is similar to a PEG ratio if you are familiar with that metric, but for P/S instead of P/E. The idea is that if you have a company that is trading at a P/S of 5 but growing at a 50% rate and another trading at a P/S of 1 but growing at a 10% basis, both of them would have a P/S/G of 0.1 (5/50 for the high-growth company and 1/10 for the low-growth company), indicating that on a growth-adjusted basis, they would be valued approximately equal.

On a growth-adjusted basis, SoFi again gets a lower multiple than its fintech peers, coming in at a P/S/G of 0.15 compared to the average of 0.25 for the group. Again, if SoFi were valued at the average value here, it would be trading at $13.43. MQ and UPST are anticipated to have negative growth rates over the next 12 months, which is why their P/S/G metric is shown as n/a. You might notice that NU, FOUR, and TOST, which are the fastest growers, also rank pretty low on the P/S. If one should pay a premium for growth, as I assert, then why are these priced so low? The answer to that lies in the next metric…

Price-to-Gross Profit

P/GP is, to me, a better metric in general than P/S. The reason for this is that gross profit removes the costs of goods sold (COGS) from the revenue. For most companies, this is things like raw materials and other inputs. For fintechs, COGS are things like network fees, which end up making a large dent in several of the businesses, especially the payment processors. Here is the gross profit margin for the fintechs we are analyzing (per Seeking Alpha and verified with finchat.io, except NU and COIN because I got their numbers directly from their investor relations page)

What you’ll immediately notice is that the payment processors FOUR and TOST have much lower gross margins than the other companies. NU is the next lowest on the list. These business have high inherent costs to their business and so the quality of their revenue is not as good as those with higher gross margins like COIN, HOOD, and SOFI. Let’s compare the multiples using gross profit rather than revenue and see how things shake out.

When you look at gross profit, it becomes obvious just how undervalued SoFi is. You’ll also notice that on a gross profit basis, NU and TOST are rewarded for their growth and get multiples well above the average. It also highlights why FOUR is probably undervalued at these levels and that’s part of the reason I initiated a position when it pulled back into the high 50s recently. But even compared to FOUR, and even compared to companies whose business is contracting like UPST, SoFi’s multiples are insanely low. SoFi’s market cap could go up 50% tomorrow and it would still be tied for the cheapest multiple of every company on this list. SoFi is completely mispriced.

This is one of the three businesses that is a profitable secular grower. It is a business that is easily above average on this list in terms of actual execution, yet if they were trading just at the average here, we are looking at a stock that ought to be trading around $20/share. Most of these companies were trading at these type of low valuations at some point in the last few years, but have since rerated and become multibaggers off their lows. SoFi the business is comparable or better, but SoFi the stock hasn’t rerated at all. I’m not saying it is destined to become a multibagger, but when you look at the data, it is certainly reasonable to think it could happen.

PEG

SoFi is not yet at a stage where it makes sense to use price-to-earnings or PEG. However, because they’ve given long-term guidance, this can be one more data point to assess. A PEG ratio takes the P/E ratio and divides it by the company’s earnings per share (EPS) growth rate. For example, if a company has a P/E of 15 and is growing their EPS at a rate of 10%, their PEG would be 15 / 10 = 1.5. The average PEG across the market is around 1.5.

SoFi’s guidance is for $0.55-$0.80 in 2026. That means over the next several years, we’re looking at triple digit EPS growth, so PEG makes no sense unless that is sustainable, and triple digit growth is not sustainable. However, they’ve also said they expect 20-25% growth every year thereafter. In fact, Noto is on the record saying they want to grow the business at 20% for decades. Not for 5 years or 10 years, but for decades.

Let’s assume that they are going to hit that guidance. Let’s assume 22.5% forward growth for 2027 and apply a PEG of 1.5 to their 2026 EPS. The EPS range is $0.55-$0.80 in 2026, so that corresponds to a price of $18.56-$27.00 in 2026. There is obviously risk involved that they do not, in fact, hit that guidance, so we need to discount that back to today to price in that risk. Being very conservative and using a 15% discount rate for two-and-a-half years means that if you believe that guidance, the stock would be fairly valued at a range from $13.09-$19.04.

Tech Platform

The reason I included NCNO in these comparisons is because it is one of the best public comps for Galileo, which is SoFi’s tech platform. Galileo has a 3Y revenue CAGR of 39%, a 1Y revenue CAGR of 13.1%, a FWD CAGR of 20%, and a TTM revenue of $380M. NCNO has a 3Y revenue CAGR of 30.3%, a 1Y revenue CAGR of 14.8%, and FWD CAGR of 15.4% and a TTM revenue of $476M. In other words, these are fairly comparable from a growth standpoint and NCNO is slightly larger right now but Galileo expects faster growth going forward.

You’ll also notice in the above comparisons, that despite being on the lower end for growth, NCNO gets a pretty good premium with its multiples. This is most likely because it is a banking-as-a-service platform, and software plays like them usually carry higher multiples. If you apply the same P/S/G to Galileo that is currently being applied to NCNO, then Galileo would be valued with a market cap of $3.36B. SoFi does not break out gross profit for its tech platform explicitly, so we can’t really do a comparison on that metric. SoFi’s total market cap, as of July 16, was $8.19B. Just one more comparison to throw out there.

Conclusion

I try to look at valuation and pricing through a variety of lenses. No matter which lens I use, SoFi appears to be incredibly undervalued. If you use a DCF, the fair intrinsic value is $19.85. It is an above average fintech, but even if you just price it as an average fintech, it appears extremely undervalued at the current price in $7s even after the recent runup in the stock.

If you just look at a host of P/S metrics, you come up with a fair range based on comparable fintechs of $13.37-$13.60. If you look at gross profits, which I would suggest is a more fair way to compare the companies, SoFi ought to be trading in the range from $19.82-$20.97. If you give them a slightly higher multiple for their excellent execution and profitability, you can easily see how a number above $20 seems completely reasonable. Finally, if you take their forward guidance at face value and use an average PEG discounted back to today even at a high discount rate of 15%, the range you come up with is $14.03-$19.04.

SoFi really is so undervalued. People have often asked me what I think a fair trading range is for the stock. I’ve often replied that it should be trading in the mid teens at a minimum and probably around $20 is close to its fair value. The analysis here and in the last article is the reason why I think those are very reasonable estimates for where it should trade. I’m not a real sell-side analyst, but if I were, I couldn’t see myself setting a price target any lower than $14. For comparison, the highest price target out there today is $12.

Thanks for reading and think about becoming a paid subscriber if you enjoy my work. Q2 earnings preview coming next week!

Subscriber update

Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in FOUR, NU, and SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Love it! Thanks for the writeup!

Excellent as always. Can’t wait for earnings