SoFi Q4 Earnings Preview: Time to Take the Gloves Off

As I went through these projections, I ended up very enthused about the prospects of Q4 being a true inflection point for the company. As per my usual earnings previews, I’ll start with my projections for the reported quarter. I usually add some sort of commentary afterward about what I am looking forward to or find most interesting for this particular quarter. This time, we are going to explore the difference between what I believe SoFi is going to give as their 2025 guidance compared to what Wall Street expectations are. Let’s get into it.

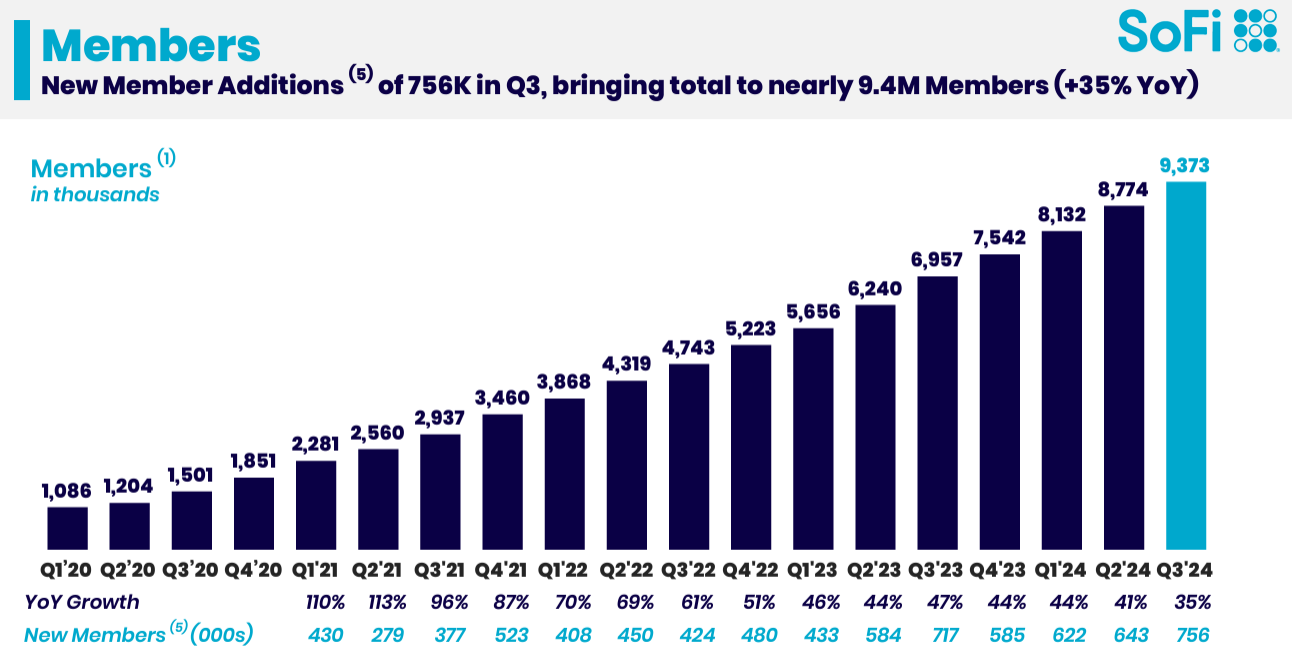

Members

We actually got an excellent piece of data in December when SoFi published that they’d crossed the 10 million member mark. In the press release, SoFi actually disclosed that the number was accurate as of December 12. That means that in the 63 days between the end of Q3 on September 30, and December 12, SoFi added 627k members, which is an average of 8,600 new members each day. If you extrapolate that to the entire quarter, you’d end up with 790k new members for the quarter. That would be a new record number of new members.

It’s worth noting, however, that this assumes that there were no churned members in the quarter. Churned members only really started being recorded this year. In Q1, there were 32,000 churned members. In Q2, it was only 2,000. In Q3 it jumped to 157,000. I asked Investor Relations about this and they said that most of the account removals are due to their development of better fraud detection capabilities. Fraudulent members are being removed from the platform for breaking the terms of service.

That makes me think that the number of accounts removed in Q4 will be non-zero, and I’m guessing it’ll be in the range of 30k (this really is just a guess as the data are so noisy on churned members so far). I also believe they would have included churned members in their 10M member number. However, I also think signups most likely slow down over the holidays, but only by a little. I am therefore going to predict that total member adds will be north of 800,000 for the first time ever at 810,000 new members.

Originations

Personal Loans

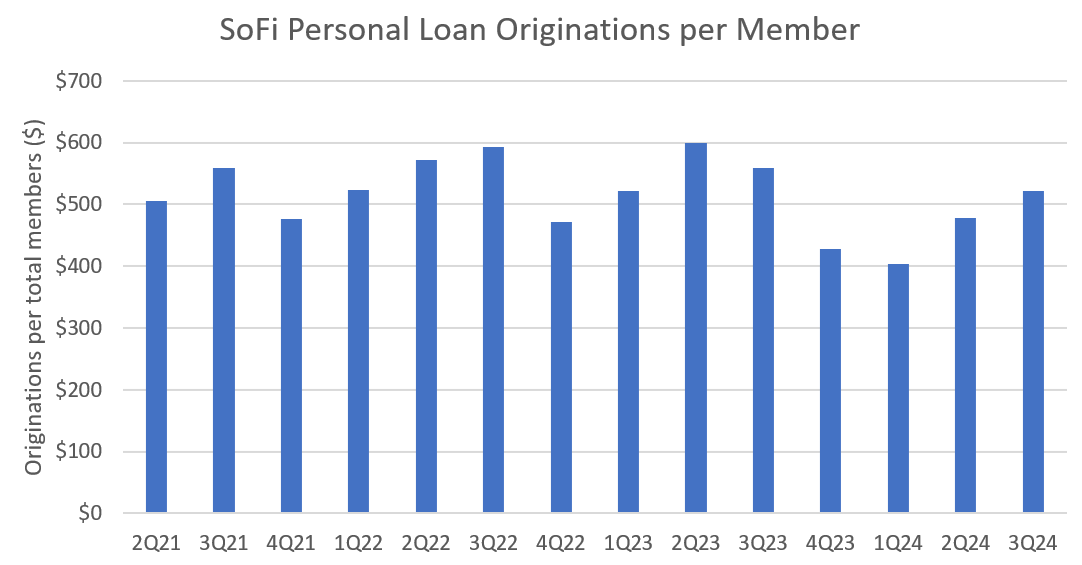

Lending is still SoFi’s biggest segment, and originations fuel lending growth. Q4 is historically a weaker quarter for originations, and was their lowest origination per member in each of the last three years.

SoFi did really slam on the brakes with originations this time last year, whereas they are now in the beginnings of reaccelerating the lending business. I don’t expect Q4 originations per member to be quite as low as they were in Q1, so this won’t be the lowest per member quarter of the year, but I do think they’ll come in slightly lower than Q2 at around $450/member. However, since this quarter promised to be a record for new member additions, we can still expect a lot of originations. I’m estimating $4.55B in personal loan originations for the quarter.

Student Loans

I also expect fewer student loans this quarter than we saw in Q3. Students are returning to school in Q3, so it usually gets an origination bump from in-school loans. Even though the Fed cut rates, treasuries have stayed high and I do not think the rate cuts will materialize into higher student loan refis for now. While it is true that starting on October 1, the federal government again began to report delinquent loans to credit agencies, I don’t know if that will really create a sizeable bump in refi originations. I’m guessing we see $790M in SL originations for the quarter

Home Loans

Q4 is historically the worst quarter for mortgages because people hate moving after school starts and before the holidays. Additionally, mortgage rates rose for most of Q4, so there is a dual headwind compared to Q3, which had $490M in originations. I think they will come much closer to $400M in originations in Q4.

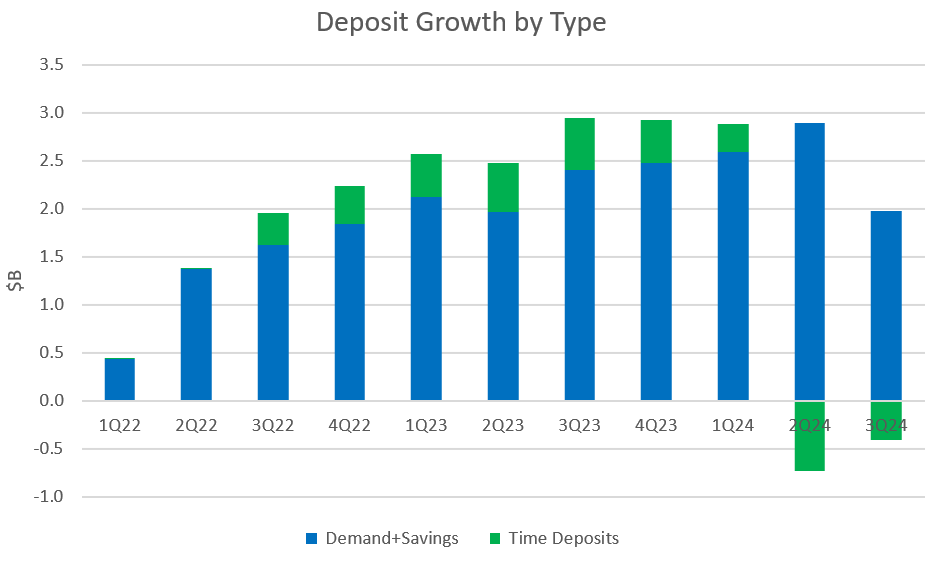

Deposits

SoFi’s overall deposit numbers have not been as strong recently. Part of that is because they’ve been letting time deposits run to term without issuing new ones, and part of it might be that they are not pushing as hard now that most of their loans are backed by deposits instead of high-cost warehouse lines of credit. Additionally, their APY, while still excellent, has been cut from a peak of 4.6% APY to 4.0% APY. While most other neobanks have done the same, there is now a slightly lower impetus for people to move from traditional accounts like Chase, Citi, and Wells Fargo to SoFi. Balancing this, however, is the fact that this is going to be a strong quarter of member additions and SoFi Money (their checking and savings), is the fastest growing product they have. I think they’ll add around the same amount of demand & savings deposits as last quarter, with the member adds balancing the dropping rates (demand deposits are checking account deposits). I’m predicting $2.1B in demand and savings deposit growth and another decrease in time deposits.

Revenue

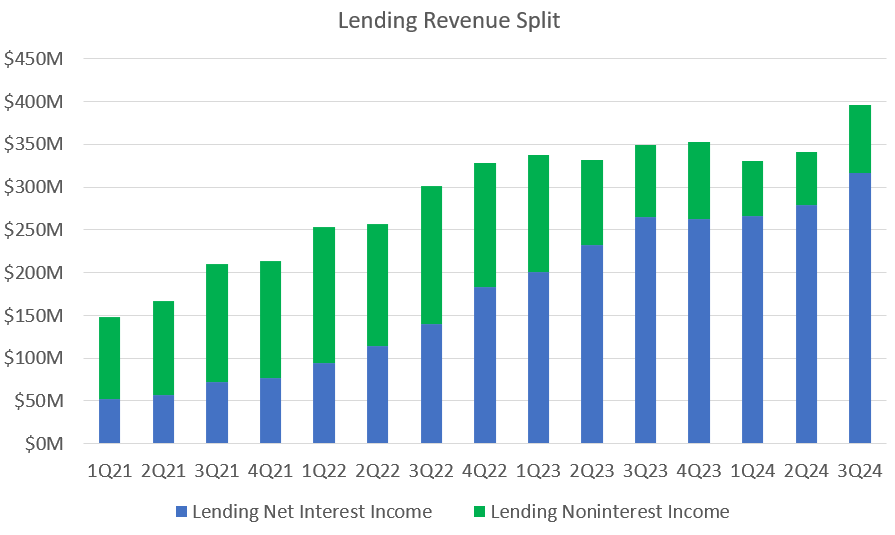

Lending

I anticipate origination contraction across all three loan types that they offer. However, the bump they get by fair values is less important each quarter as their portfolio grows. The personal loan portfolio was around $17B at the end of last quarter. The interest income they generate from that portfolio is growing each quarter, making the contribution of revenue they get from fair values of new loans originated a smaller and smaller percentage over time.

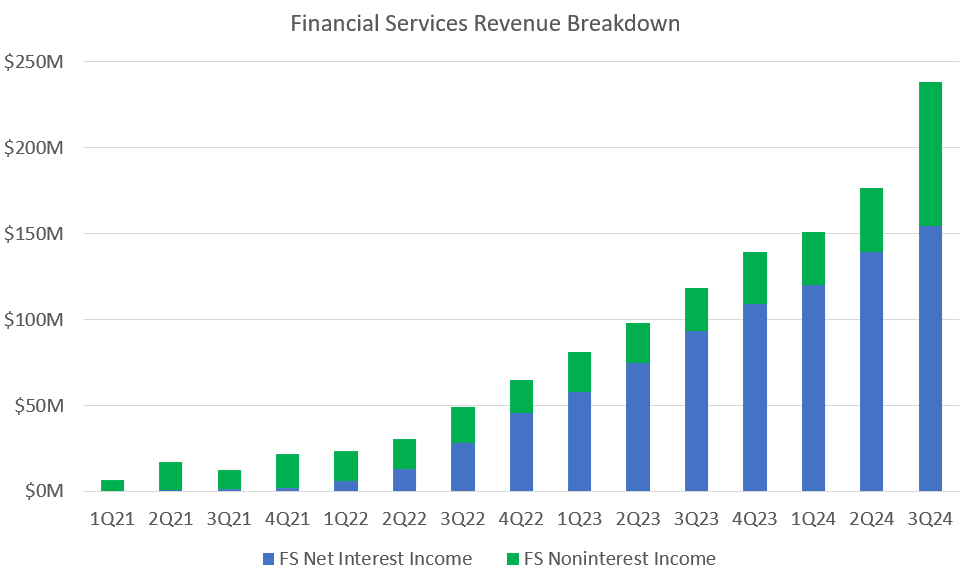

This is shown quite clearly in the chart above. The blue bars are net interest income and the green bars are noninterest income. The trend here is obvious. Even in the quarters where they tapped the brakes in Q4 2023 and especially Q1 2024, interest income was flat or slightly increasing. Moreover, in Q4, they dropped the APY on their deposits, but the existing loan book still has the same rates. This should increase the spread they recognize.

We know they completed a $525M securitization in Q4, so loan sales look like they were also probably robust. So even if it's a slightly weaker quarter from an originations standpoint, that doesn’t translate one-to-one with revenue. I am predicting $365M in lending revenue in Q4. Based on the chart above, that actually seems fairly conservative.

Financial Services

Financial services was a huge winner in Q3. Led by the expanded Loan Platform Business, it saw massive growth above and beyond what everyone was expecting. The growth trajectory here is incredible and well beyond what I expected to see. Again, we’ll split this between net interest income and non-interest income.

That massive spike in noninterest income last quarter was the Lending Platform Business. You can read all about it in this article if you are curious. Or if you prefer, I did a YouTube video on it here. Either way, it was a complete gamechanger. Last quarter they did $1.0B in LPB originations. One of the biggest things I’m looking for this quarter is whether they were able to add to that number. The continued demand and savings deposit growth should continue to fuel net interest income growth as well. I’m optimistic about them increasing their LPB volume as the product certainly should have gotten more publicity after they reported their Q3 earnings.

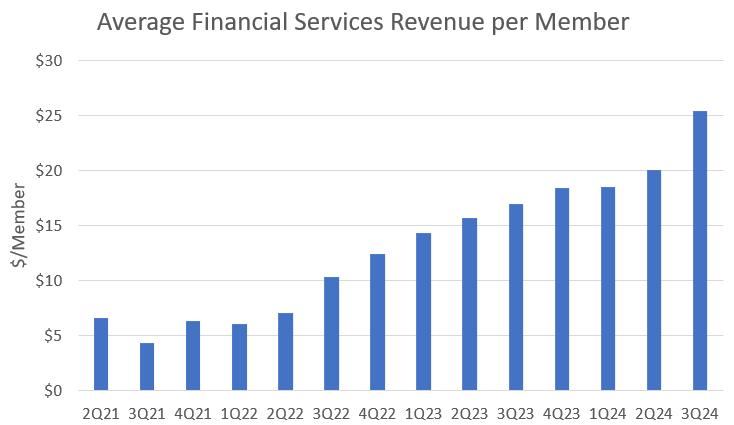

Moreover, since becoming a chartered bank, SoFi’s FS revenue per member has never decreased QoQ. Last quarter it was $25.42. Even if I assume it remains flat, I end up with $259M in FS revenue, an increase of about $21M compared to Q3. Again, that seems slightly conservative, but very reasonable.

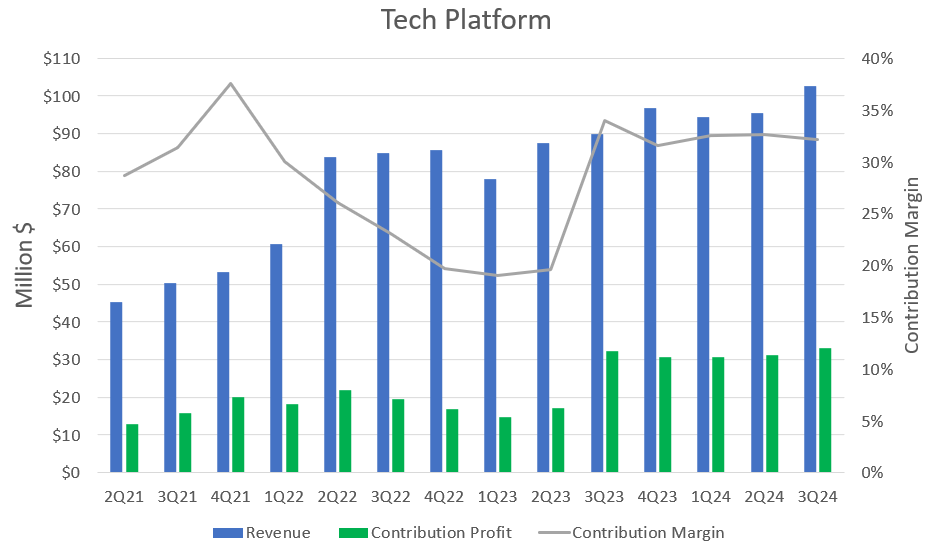

Technology Platform

Galileo also has seasonality, but whereas Q4 is a historically weak quarter for lending, the opposite is true of the tech platform. One of Galileo’s core products is debit card issuing and processing. Every time somebody pays using a Galileo-issued debit card, they get a tiny fraction of the revenue from that sale. Q4 is the highest spending quarter because of Christmas, so Q4 is seasonally strong. SoFi also guided for “low to high teens growth” overall for Galileo vs 2024. Revenue of $112.5M would put them right at 15% YoY growth. Q3 was $102.5M, so this would be fairly significant QoQ growth, but neobanks are seeing strength again, and Galileo powers a lot of those. Hopefully they also start recognizing some revenue from their smaller Technisys deals they’ve been signing over the past few quarters.

Any Galileo contract announcements would be more important than the actual results here. If they announce that they signed a whale this quarter, that would mean so much more than a big quarterly beat. We’ve been hearing about a robust pipeline for over a year at this point without too much to show for it in terms of revenue. The Fed cooperated by cutting 50 bps in September, 25 bps in November, and 25 bps in December. Hopefully that encouraged other companies, especially banks, to feel more free to devote budget to things like upgrading their core technology. I’m not holding my breath for any announcements, but they would certainly be welcome.

Corporate

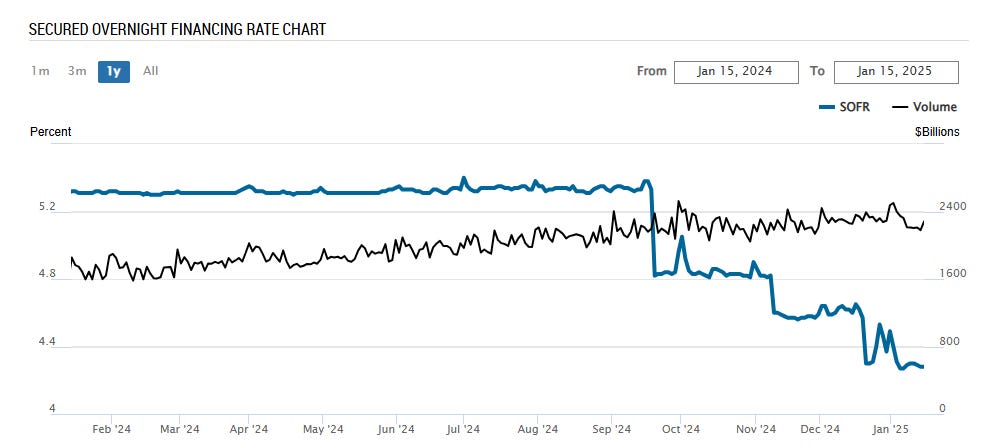

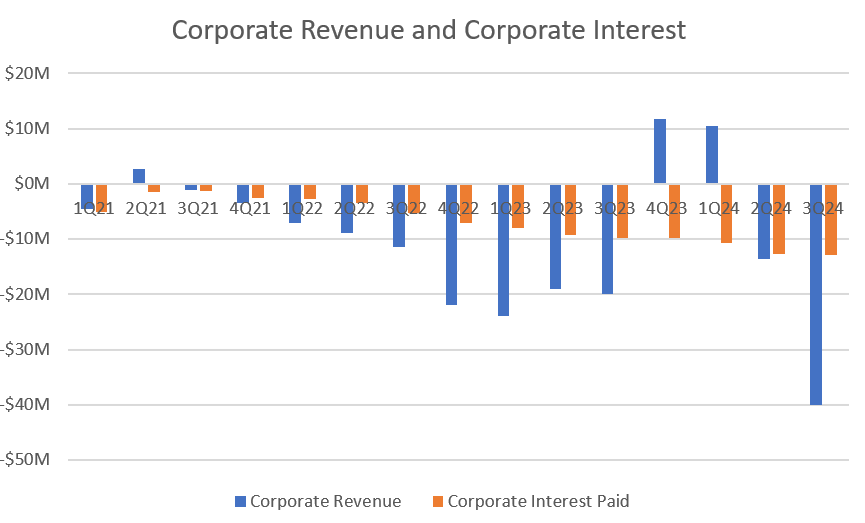

This is going to get technical. If you don’t care about the details, feel free to skip this section and go straight to the part labeled “Prediction” below. Corporate revenue is extremely volatile and hard to predict. It will continue to be volatile and hard to predict. There is one contributing component that is straightforward. That is the interest on corporate debt. This is the interest they pay on their corporate revolving credit facility and their senior convertible notes. The amount charged on the corporate revolver is tied to the SOFR, which is tied to the Fed Funds rate.

SOFR has been coming down this quarter, so although corporate interest has been increasing over time, it actually should come down this quarter for the first time in a while, which is good. However, that is not what leads to the volatility, as you can see the contribution of the corporate interest compared to the quarterly corporate revenue.

So, why is corporate revenue so volatile? The answer is the Funds Transfer Pricing, or FTP. FTP is the way that SoFi (and all banks) divvy up the net interest income between their different segments. There is a lot of accounting mumbo jumbo that goes into the calculations, but it's easiest to understand with an example. These numbers are made up and are indicative, not representative of reality, and I’ll try to use round numbers to make the math easy.

Let’s say lending has $100M of loans bringing in 12% in interest. They make $12M annually in interest. Financial services is paying 4% in APY on $100M of deposits, so they pay out $4M annually in interest. The net interest income for the company as a whole is $12M - $4M = $8M.

However, the company needs to decide how to split that $8M between the lending segment and the financial services segment. It’d be awesome if that were simple, but because it’s accounting, they have to make it convoluted for no reason. They use the FTP. In the FTP, the lending segment does its fancy accounting using some assumptions and comes up with a number of 5% that it is paying to financial services. The financial services uses a separate set of assumptions, because accounting is confusing, and instead comes up with a rate of 6% that they charge lending, and they are paying out 4% to their depositors. So the lending segment says it made $100M * (12%-5%) = $7M, and the financial services segment made $100M * (6%-4%) = $2M. So combined, the lending segment and financial services segment made $7M + $2M = $9M.

If you look at the numbers at the end of the last two paragraphs, they are not the same. Somehow, the company as a whole is reporting $8M in net interest income, but if you combine the net interest income of the lending segment and the financial services segment, you end up with $9M. Those are not the same number, and never will be because the financial services and lending segments use different accounting methodologies to come up with their interest rates. However, you can’t make up revenue out of thin air when you reconcile the books for the entire company. So how do banks do that reconciliation? They assign that difference to “Corporate” revenue. So corporate revenue for the quarter has to be -$1M so that the books balance. So now, for the entire company, you have +$7M for lending, +$2M for financial services, and -$1M for corporate and the total net interest income is $8M as it should be.

However, the next year maybe instead of a shortfall for corporate revenue, there is a surplus. This leads to the volatility from quarter to quarter that you saw above. It also makes corporate revenue essentially impossible to predict, because there is no way to recreate all the assumptions required to do the calculations.

Prediction

All of this is to say that apart from the corporate interest portion, I can’t predict this so I’m not going to try. Moving forward, therefore, my assumption is that the FTP portion of corporate revenue is going to be flat from quarter to quarter. It will therefore always be wrong, but because I’m basing all my other predictions on change from the previous quarter, it means my total adjusted net revenue number should be fairly accurate. So, my prediction for Corporate revenue is -$39M.

Total Adjusted Net Revenue

That means I am predicting for total ANR of $697.5M in revenue, a slight increase QoQ. Analysts are predicting $678.5M and SoFi’s guidance is for $675M at the midpoint. A $22.5M beat compared to their guidance is about where you’d expect them to come out. This seems very reasonable to me.

Adjusted EBITDA

I’m assuming a QoQ incremental EBITDA margin of 45%, which is slightly below where they’ve been over the past year. That means adjusted EBITDA ends up at $189.9M. Analysts are expecting $171.9M and SoFi’s guidance is $174.0M. My prediction is a $15.9M beat compared to their guidance, which again, seems about right.

Net Income and EPS

That adjusted EBITDA corresponds to a net income of $63.9M. Fortunately we no longer have to adjust for preferred shares dividend payments, so we divide that by diluted weighted average shares outstanding, which I assume will be 1,115M, and you end up with $0.057 of EPS, which rounds up to $0.06. Analysts are expecting $0.04 (technically $0.038, but it also rounds up). This would be a pretty sizeable beat.

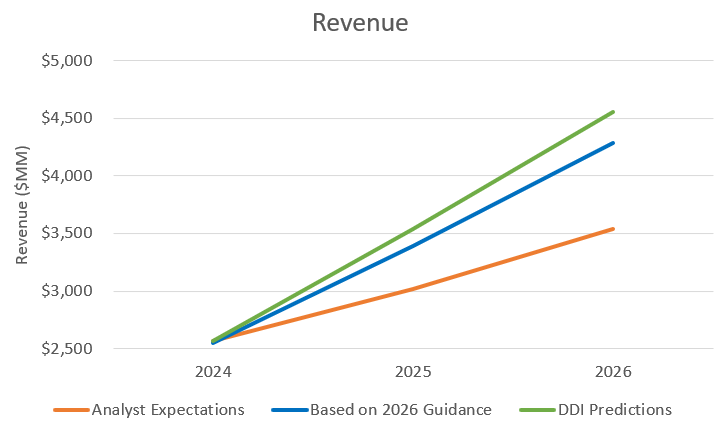

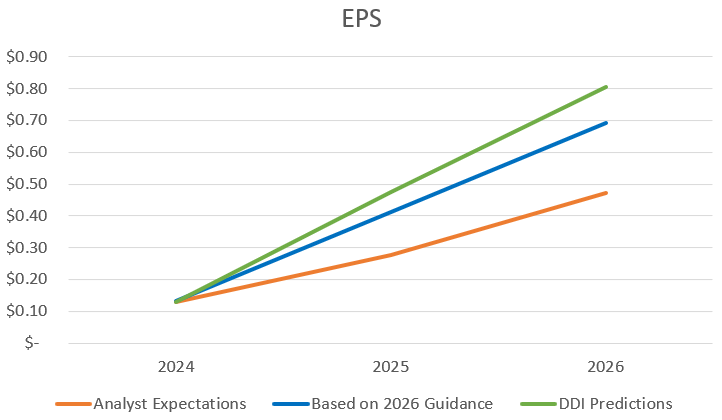

Guidance

Alright, this is the really fun part. Anybody who follows me knows I’ve been highly critical of analyst expectations for 2025. They are only predicting $3.02B in revenue for next year, which is only a growth rate of 17.8% for next year. This year, which was a “transitional year” for the first half of the year, will end up with a growth rate around 23.7%. As I covered recently, my own projections and SoFi’s long-term guidance call for a reacceleration in growth rate in 2025, not a decline. My own predictions call for 38% growth in 2025, while SoFi’s guidance would result in around 33% growth.

On the EPS side, SoFi’s 2026 guidance is for $0.55-$0.80. If you assume linear EPS growth from 13 cents this year to the midpoint of 67.5 cents in 2026, that would imply they need around 40 cents of EPS next year, which matches my projections of their guidance, which come in just above that at 41 cents. My own prediction is for 47 cents next year. Analyst expectations, meanwhile, are for 27.8 cents of EPS, which is obviously much lower than what management has forecasted.

SoFi management knows that Wall Street expectations are low and they can easily beat them. They also like to guide conservatively so that they can raise that guidance every quarter. I expect that they’ll come out with a guidance that is based on very conservative assumptions, probably no rate cuts throughout all of 2025 and only marginal growth in GDP for the next year.

However, even with those conservative assumptions, analyst expectations are so bearish that they can do exactly what they like to do. They’ll come in with numbers that beat expectations but leave lots of upside to be realized throughout the year. Although I think that internally they are looking for $3.4B+ in revenue next year, their guide will only be for around $3.15B-$3.25B. That’s still about a $200M beat to expectations. Similarly, while I think they’ll be targeting that $0.40 EPS mark internally, their guidance will be for something like $0.30-$0.35. They’ll set the bar above where analysts have it, but at a height they know they’ll easily clear.

This also gives them the opportunity to revise their 2026 guidance. As I covered before, they are ahead of schedule already on that guidance. I don’t know if they will be bold enough to raise the top end of that guidance, but I do think there is a decent chance they raise the floor and say they are now planning on $0.60-$0.80 in 2026.

There is a chance that they decide to throw caution to the wind and not be as conservative. In that case, I think they could easily guide for $100M more revenue and about 5 cents more EPS than I outlined above. I don’t expect that to happen, but it is in the realm of possibility. Even with conservatism built in, however, I expect them to easily beat 2025 analyst estimates across the board.

A big year for management

SoFi’s management has a LOT riding on 2025. Yes, it’s the transitional year to see how they get to their 2026 guidance, but it’s also the last full year they have to get push the stock higher before their Performance Stock Units (PSUs) expire. For those who aren’t aware, senior management like CEO Anthony Noto, CFO Chris Lapointe, and Galileo CEO Derek White have stock that only vests if they hit certain stock price thresholds in the next year and a half. The PSUs are broken up into three equal buckets that are only awarded if the stock price exceeds a volume-weighted 90 day trading average of $25, $35, and $45 on or before Jun 1, 2026. So to realistically have a chance at receiving all their PSUs, they need the stock to already be over $35/share by this time next year.

How much is it worth to them? Noto could get a total of 6.43M shares. Lapointe can receive up to 831k shares, and White would earn 750k shares. Here is how much their net worth increases with each individual award, and the growth in their total cumulative net worth if the stock trades at an average price of $45/share before the 2026 target date.

(these numbers are before taxes and the cumulative column assumes they keep all their shares until they are worth $45. After-tax earnings are basically these numbers divided by 2):

So there are approximately 360 million reasons why they are going to push as hard as possible to deliver the goods in 2025. For those who think this is out of reach, remember that at this time last year, Robinhood was trading in the $10-$11 range and today is at $46. Management has always been in the shareholder’s corner, but their interests are especially aligned over the next 16 months.

Noto is a fighter and a winner. I think he is absolutely ready to take the gloves off. In the Q2 earnings call, there were several times he spoke boldly and directly to analysts and investors. I think we’ll see more of that again this quarter as they communicate the vision of where they are going. I also think there is a decent chance we get a product announcement this quarter. Something like Cash Coach or the paid SoFi Plus subscription or full rollout of the new credit cards. I think we get some fireworks or surprises in the earnings call. I can’t wait.

Subscriber update

The DDI YouTube Channel is live. I’m still figuring out how to do everything there, but expect to see more as we go. A sincere and heart-felt thank you to those who support my work.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I have long positions in SoFi.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Hi Chris, I'm wondering where you saw the "churn" numbers? I looked through some Q3 earnings material and didn't find it, though you said the numbers are this year (maybe 2025)? Without pulling up other 8-Ks and etc., the "Members" definition in Q3 seems to be the same or similar at first glance. "Once someone becomes a member, they are always considered a member unless they are removed in accordance with our terms of service, in which case, we adjust our total number of members."

Thank you; it's just something I've been curious about for a long time.

Excellent work, thank you.