Why This Time Really is Different for SoFi Stock

SoFi’s stock performance sucks. There, I said it. It’s the truth. It has vastly underperformed where it ought to be, especially in comparison to its peers. Here is the return you would have gotten from SoFi and several other fintech stocks if you would have bought them from the bottom in 2022 until today:

Affirm: +389%

Upstart: +243%

Robinhood: +230%

SoFi: +83%

The worst part about it is that SoFi is just as good or better as a company than the others on this list, but you wouldn’t know it from the stock price. It’s frustrating, and leads lots of people to regret their decision buying the stock. I get daily responses on X about the opportunity cost of holding the stock. I focus mainly on the company and its fundamentals, and will continue to do so, but I want to share the reasons that I think the stock price will see a sustained move up over the next 6-12 months.

I realize that SoFi has seen a lot of catalysts that have come and gone without a significant move in the stock price. This includes moving to GAAP profitability, the end of the moratorium (although the massive run of 100%+ from the summer of 2023 did materialize from the news of the moratorium ending, it has not gotten back to those highs since), and rate cuts, among many others. I understand those who are jaded and say this time will be no different. Here are the reasons I think this time really will be different.

Full-year profitability

SoFi’s Q3 2023 GAAP results were hampered significantly by the goodwill write down of their Galileo and Technisys acquisitions, resulting in a quarterly GAAP EPS of -$0.29. Despite the fact that SoFi has been GAAP profitable every quarter since then, the trailing twelve month EPS still looks terrible. That number will be replaced by a positive number as soon as SoFi reports Q3 earnings. Algorithms, institutions, quants, and many investors look at that number when making financial decisions. In about three weeks, nobody will ever be able to point to any published trailing or forward-looking number and say that SoFi is unprofitable. That does count for something. On the chart below, the orange line, which is TTM EPS, will jump from where it sits now below the blue line (the quarterly EPS) at -$0.24 to above the blue line at +$0.09 or more.

Index inclusion

That brings me to my next point, which is that in addition to a sentiment change around profitability, there is another important reason that having a positive TTM EPS is important. It is a requirement for inclusion in indexes like the S&P indexes. I’m not talking about S&P 500 inclusion in the short term. I think S&P 500 inclusion is unrealistic until 2H 2025 at the earliest and it is much more likely to be at least 2026 before it happens.

However, the S&P Midcap 400 is a real possibility in the near future. The market cap requirements for S&P 400 inclusion are from $6.7B to $18B, and SoFi already meets the liquidity, share structure, and all other requirements. Full-year profitability is the last remaining hurdle. I think that it’s possible for SoFi to get in at the next rebalance at the end of the year, but I think it is very likely to be included when the rebalance happens in the Spring. Some people will try to front run index inclusion, which typically leads to buying pressure. Moreover, once the stock has been included, it usually leads to an initial pop and buying pressure afterwards as funds buy shares. For example, Duolingo jumped over 5% the day of its inclusion in the S&P 400 Midcap earlier of this year, and it has seen significant appreciation overall since then as well. hims & hers just got news of inclusion in the S&P SmallCap 600 yestaerday and was up 5.5% after hours on the news. There are also other funds that have similar restrictions where SoFi will be added as they reach TTM profitability, but the S&P funds are the most consequential.

Shifting macro and rates

I already spent an entire article describing why it is that rate cuts help SoFi’s business. However, they also help SoFi’s stock in other ways. Despite the fact that SoFi is now a profitable business, those profits are still fairly limited at this point. It’s FWD P/E is 80, so we aren’t talking about a company that currently has significant profits. It’s still only marginally above breakeven on a GAAP basis. That means the majority of its returns are in future dollars, which also means you need to account for them by discounting them back to the value of today’s dollars.

One of the big reasons that stocks as a whole dropped so hard in 2022 was not only because of the fear of recession, but also because alternatives to holding equities, like holding bonds, became much more attractive. The risk free rate of return went from almost nothing around 0.5%, to its peak of 5%+. Instead of investing in stocks, you could just buy a treasury and guarantee yourself a 5% return (see the 10-yr treasury yield below as an example). That means investors have to demand a much higher return from equities because they have inherent risks that bonds do not. That means a higher discount rate, which means lower valuations.

Companies with high potential future profits, but fairly low or even negative current profits, like SoFi, were especially hurt. Uncertain future returns have to be discounted back to current dollars using a discount rate. The discount rate, in theory, takes into account both the risk-free rate of return that you could get by just buying bonds, and the risk premium associated with the equity you are holding. So if the risk-free rate of return goes up by 5%, the discount rate goes up by 5%, and the value of those future earnings goes down, and it goes down by a lot.

To illustrate how big of a difference this can make in a stock’s valuation, let’s use my discounted cash flow model (DCF) for SoFi. I previously had a post on valuation that talked through the assumptions of a DCF generally, and how I set up this specific DCF for SoFi if you want to see the details. Below are the results of two DCFs which are exactly identical, except for the discount rate. The first has a discount rate of 12%, while the second has a discount rate of 10.75%. This mimics the 1.25% drop in the 10-year treasury yield that we’ve seen since its peak in October 2023. The key number here is the “Estimated Intrinsic Value” number in the green box on the right. That is how much the stock should be trading for today if my assumptions are accurate. Also take note that “Cash Per Share” is actually tangible book value in this case.

12% Discount Rate DCF Results

10.75% Discount Rate DCF Results

As you can see, a drop in long-term yields, and therefore a drop in the discount rate assumptions for stocks, makes a large difference in the current valuation of the company, even if the company’s results would be exactly the same in both scenarios. With the assumptions of my model, a 1.25% difference in the discount rate makes a 20% difference in the estimated intrinsic value of the stock, making it increase from $22.05 to $26.17. Independent of all the benefits associated with rate cuts for their core business, SoFi stock should see multiple expansion solely due to the continued decrease in rates.

Fundamentals will continue to get better

One of my favorite charts to share about SoFi is this one that shows their fundamentals compared to their stock price.

Why do I love this chart so much? Because I think Peter Lynch was right when he said, “Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100 percent correlation between the success of the company and the success of its stock. This disparity is the key to making money; it pays to be patient, and to own successful companies.”

This is a successful company. The results speak for themselves. Investors in successful companies are rewarded in the long term. I can be patient and wait for that to happen.

It also brings to mind this timeless clip from Jeff Bezos about Amazon and its stock price.

The whole clip is great, but here is the part I most want to highlight:

The stock is not the company and the company is not the stock, so as I watched the stock fall from 113 to 6, I was also watching all of our internal business metrics. [...] Every single thing about the business was getting better, and fast. So as the stock price was going the wrong way, everything inside the company was going the right way [...] so we just needed to continue to progress.

Substitute the numbers to 24 and 4, and that quote could easily be written about SoFi. Selling because of price action when the fundamental company just keeps improving seems extremely short sighted to me. The stock does not reflect the strength of the improved fundamentals. All the internal metrics are going up. At some point, as they continue to progress, the stock will also go up.

Analyst revisions

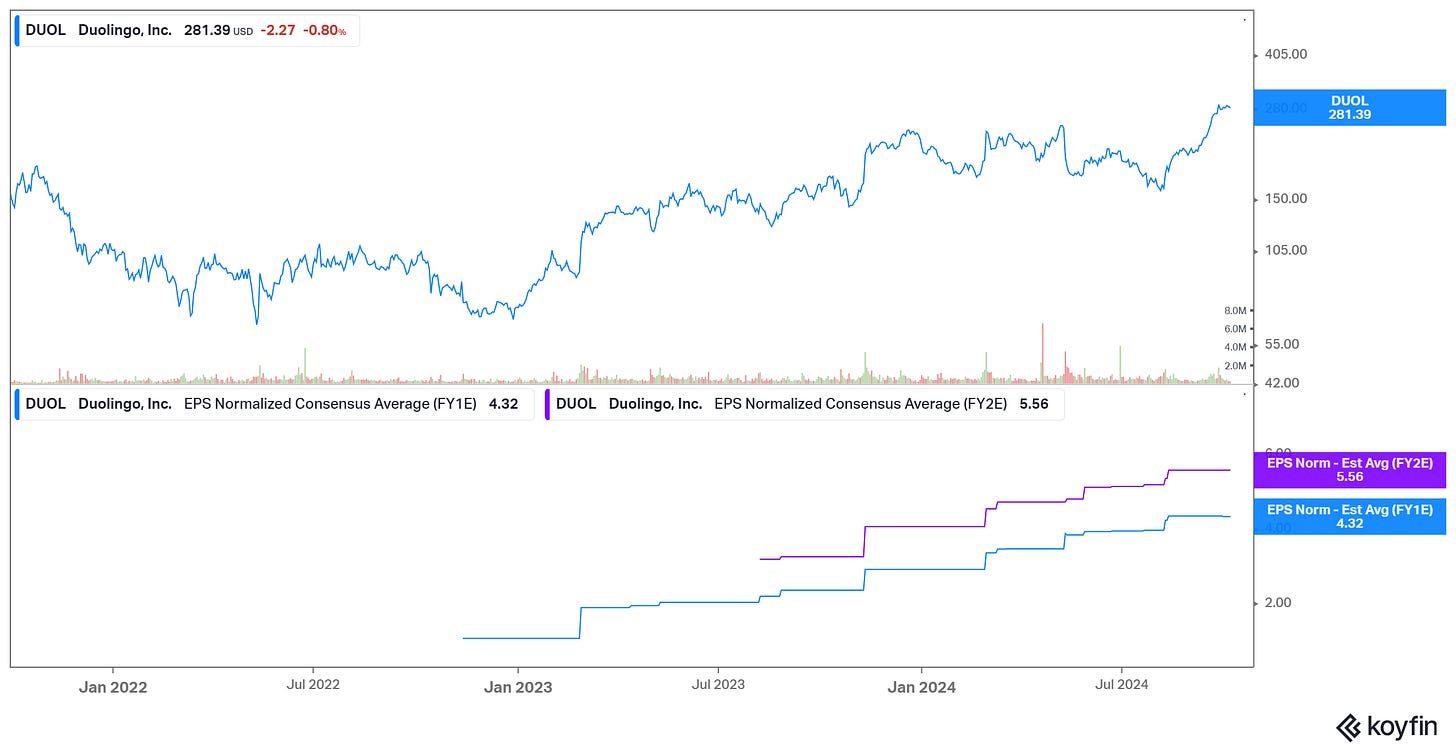

Let me put up what I find to be an interesting chart from several stocks that have seen significant appreciation over the past several years. Let’s look at hims & hers, Duolingo, Palantir and Robinhood. These graphs show the stock price and analyst EPS estimates for 2024 and 2025 (labeled FY1E for 2024 and FY2E for 2025). See if you notice a correlation.

HIMS

DUOL

PLTR

HOOD

Every move up has coincided with, or been sustained by, upward revisions in the EPS estimates for the company. Let’s look at that same chart for SoFi.

SOFI

I think one of the reasons SoFi stock has not run is that analysts are still underestimating the future prospects of the business. If you’ve read my previous article on how Sofi gets to 60 cents of EPS in 2026, you’ll know that I think these analyst estimates are woefully inadequate. I expect that, starting with Q3 earnings, analysts are going to begin to see how off they are. Analyst expectations for 2025 and 2026 for EPS are $0.20 and $0.41, respectively. If SoFi only succeeds in hitting their own guidance, I estimate that they would end up with $0.31 and $0.64, which are each 50%+ greater than analyst estimates. My own predictions, from that same article, are $0.36 in 2025 and $0.85 in 2026. I think that starting at the end of this month when Q3 earnings are reported, there will be more significant upward revisions which will likewise be reflected in the stock price.

Valuation and execution are risks

Everyone should recall that my track record on short-term price action is atrocious, so I could be way off and overly optimistic.

There are also real risks to the stock price in this same time period. I’ll cover several that I find probable. I’ve written at length about why I find this company ridiculously undervalued. However, there are plenty of others that disagree. No matter how well SoFi executes, there is a chance that the market will continue to believe it deserves to be “valued as a bank”, which in this case means a P/E ratio of around 10 or a P/TBV (tangible book value) around 1-2. If that happens, even as it goes from marginally profitable today to $0.60+ of earnings in 2026, the stock wouldn’t move much, if at all. I think that type of thinking is unjustified, and that this outcome is pretty unrealistic. I think the stock will be rewarded if the company continues to show consistent 20%+ revenue growth and 100%+ EPS growth for the next several years. However, I acknowledge that this is a possibility. If it happens, I’ll continue to hold because the thesis would hold, even if I’m not rewarded with an increase in the stock price.

Another risk is that SoFi could fail to meet their guidance. They’ve always hit it in the past and so they’ve earned my trust. I expect them to succeed in meeting their targets moving forward. However, past performance is certainly no guarantee of what will happen in the future. They could fail to execute and miss their guidance. For example, they lowered full year 2024 tech platform guidance down in Q2. That is the first time that they have given quantitative guidance that it looks like they will fail to achieve. While they stated that the overall tech platform growth guidance through 2026 is still in place, this is a small chink in the execution armor. Overall, their execution has truly been incredible, and while that does give me a lot of confidence, it does not guarantee anything.

Additionally, not everything is under management’s control. A previous wildcard for years has been uncertainty around the future of the student loan business. While every quarter this is a smaller and smaller part of the business, it still drives part of the narrative, and narrative drives price in the short term. Nevertheless, Harris has completely avoided the topic of student loans during this election cycle. It has been a very public failure of the current administration that they were unable to deliver on their forgiveness promises, and it appears Harris has completely distanced herself from the issue. The student loan payment moratorium has also now been completely rolled back after more than four years of extensions and 11th-hour modifications. I think the student loan payment and forgiveness saga is mercifully drawing to a close regardless of the outcome of the election. There may be a surprise here, but I think the odds of there being future student loan drama are diminishingly small.

Finally, the economy is still on somewhat uncertain footing. I continue to think that the bulk of the macroeconomic data is directionally positive. I think the most likely path forward is slow and measured rate cuts as the economy normalizes and that the US has a shallow recession or avoids a recession entirely. However, if we see a large downturn in the economy and a spike in unemployment, SoFi could easily miss their 2026 guidance. I do not believe SoFi will struggle to maintain their current profitability even during a downturn, but their growth would almost certainly stall, causing them to miss. Additionally, as I’m sure almost everyone reading knows by now, many people love to bet against SoFi as a hedge to a deteriorating economy. Selling and shorting have kept this stock suppressed even as the fundamentals have rapidly improved. In the hard landing scenario, the stock will probably suffer worse than most, even though I think the selloff would not be supported by deteriorating fundamentals.

Conclusion

SoFi the company has continued to outperform even as SoFi the stock has been basically flat for over a year. I think there are significant reasons to be optimistic about both. It has been a while since I’ve been as enthused in the lead up to an earnings as I am for the Q3 earnings at the end of this month. I think an inflection point is coming. I’ll continue to focus on the fundamentals, and make my decisions based on those, but I do expect that those holding the stock will see some significant share price appreciation in the next 12 months.

New DDI Paid Subscriber Perks

I’ve tried to figure out how to add additional value to paid subscribers, and I’ve come up with two ideas, which I am going to start this week.

I am less than 10 paid subscribers away from the goal that I set for myself to start a YouTube channel. That would mean more appearances from me on the SoFi Weekly, possibly collaborating with others on a regular stream about HIMS or other stocks, and of course, releasing my own videos as well. These articles get several thousand views, so if less than 1% of the people who read this were to sign up, I’d get those 10. It’s totally voluntary, and it’s $5/month. I don’t paywall anything I write, but if you want to see more content from me, this is how it’s going to happen. Here are the new things I’m rolling out to hopefully provide more value to those who do voluntarily support my work:

New Paid Subscriber Benefit #1: My Weekly DCA list

I dollar-cost average every single week. I adjust what percentage of my DCA I am allocating to different stocks based on my conviction and their current valuation. From here on, every week when I execute my DCA, I’ll send out my list to paid subscribers. It usually doesn’t change much from week to week, but often shifts quite a bit over several months. Paid subscribers will know what stocks I’m buying every week.

New Paid Subscriber Benefit #2: Monthly portfolio updates

Additionally, I will share my portfolio through Savvy Trader with my subscribers every month. It won’t show absolute numbers, but it does show percent allocation to each position (and you will see that I am absolutely putting my money where my mouth is with SoFi).

Hopefully that will also lead to more questions from paid subscribers so I can better interact with those of you who are out there.

I do also have a paid subscriber chat on X. If you are a paid subscriber and have not been invited to join, please reach out to me at datadinvesting@gmail.com or just send me a DM on X.

Disclosures: I have a long positions in SOFI, HIMS, DUOL, and PLTR.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

I have read this article a couple of times. Interesting. Some partial random observations that come at first glance:

- First of all, SOFI is basically a bank (yes, I am in that camp). A quick glance at its verticals tells me that Financial Services is where the growth is. YoY% is impressive, and it has the potential to keep growing if the economy cooperates.

- On Financial Services, fundamentals might be conducive to future growth if the economy remains in solid footing. Risks / vulnerabilities would be the same as any other consumer bank provider. In addition, the NPV of a credit card is way more attractive than that of a personal loan or student loan. SOFI also has an attractive brand name that can be leveraged to grow this division. On this topic, I would like to see that the company relies less on securitizations or loan selling, and focuses more on owning the entire revenue / risk stream. Capital One did this in the mid 2000s to great success when it moved from a monoline credit card company to a bank.

- Personal Services and Student Loans might also benefit from a solid economy / labor market, and a gradual reduction in interest rates (I agree that fast moves up or down are not healthy).

- For SOFI to be considered more than a bank in a proper way, Galileo has to grow faster. Current contribution and projected growth rates are just not enough in my opinion. Maybe if Galileo gets spinned off and operates as an independent company, value could be potentially unlocked, as . Several cases of companies where value gets created by spinning off divisions (e.g. Novartis / Sandoz as one that I personally benefited last year). And on this topic, banks in general have provided great returns to its shareholders in spite of the mini crisis in early 2023.

- In terms of risks, I would actually think that the economy and labor market trends are the biggest risk / opportunity, as is the case for other banks with strong consumer focus. I would expect SOFI's leadership to keep executing on its vision. That is a risk that they should be able to control. But how the economy performs could make the strategy to either be accelerated or scaled back.

Interesting article.I do not have to agree with every single point, but it is well done.

Keep it up.

Best - jh

Disclosure: No position. Current view of this company is neutral. I might trade it from time to time in both directions (recently with a long bias).

Thanks Chris, much appreciated