Forget Third Gear: SoFi is Accelerating Ahead of its 2026 Guidance

In their Q4 2023 earnings, SoFi announced their very first GAAP profitable quarter. That was fully expected, but SoFi caught everyone off guard by giving medium-term EPS guidance of $0.55-$0.80 for 2026. In June 2024, I laid out a path for SoFi to go from “0 to 60 (cents of EPS)” to achieve that guidance. I then gave an update last December to check on their progress, as they’d done a fantastic job of “shifting into second gear”. With Q2 2025 now in the books, we are at the exact midpoint between when they gave the guidance and the end of 2026, making this a good time to reevaluate their progress. In that first article, I highlighted four targets for them to achieve their guidance:

Lending segment growth needs to be ~15% CAGR from 2023-2026 and it needs to maintain a contribution margin of low-to-mid 60s.

Tech platform segment growth needs to be ~25% and contribution margins need to be in the mid 30s.

Financial services segment growth needs to be ~50% and contribution margins need to be around 30%.

They need to stay disciplined with their other costs, allowing them to only increase by about 10% each year.

So let’s dive into the individual segments and see how things are progressing. The title may have given it away, but they are way ahead of schedule.

Lending

Growth

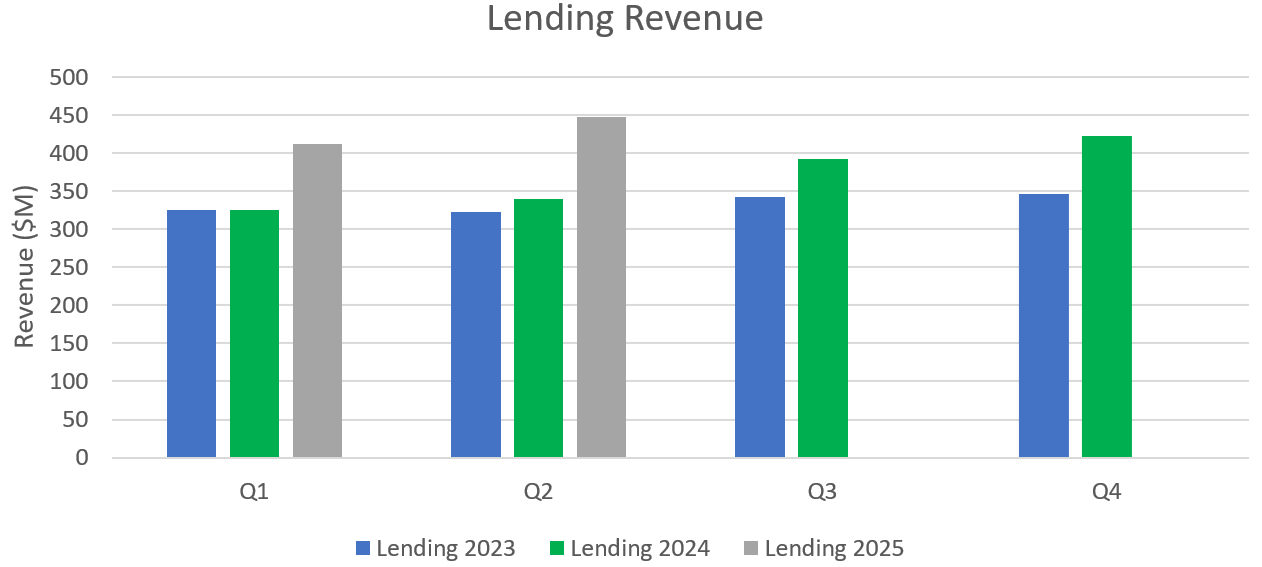

SoFi originally guided for lending to actually be down slightly in 2024 and then for growth to reaccelerate in 2025. Q1 and Q2 of 2024 were muted quarters, but as the macro picture cleared up in Q3 and Q4, SoFi leaned back earlier than expected into growth. As a result, instead of contracting by 5%-8%, lending revenue grew 10.6% in 2024. So they were already ahead of schedule last year to hit their mid-teens revenue CAGR.

The first half of 2025 has been absolutely stellar for lending growth. Growth was 27% in Q1 and then 32% in Q2. Those were both fairly easy comps from a year ago, but they are now so far ahead of their original guidance that even if lending were flat at Q2 levels in Q3 and Q4, they’d still come out $150M above what their original guidance implied they’d need to get to in 2025.

And we know they aren’t going to just stand still. The recent capital raise lowers their cost of capital, which should juice their net interest margin, resulting in more growth. Moreover, that also gives them extra flexibility to expand their balance sheet faster and push for further growth. My original article used the analogy of SoFi needing to go from 0 to 60. To extend that analogy, the lending segment is already in 5th gear. They can pretty much put it in cruise from here to achieve the original 15% CAGR target. They are far ahead of schedule in lending growth.

Contribution Margin

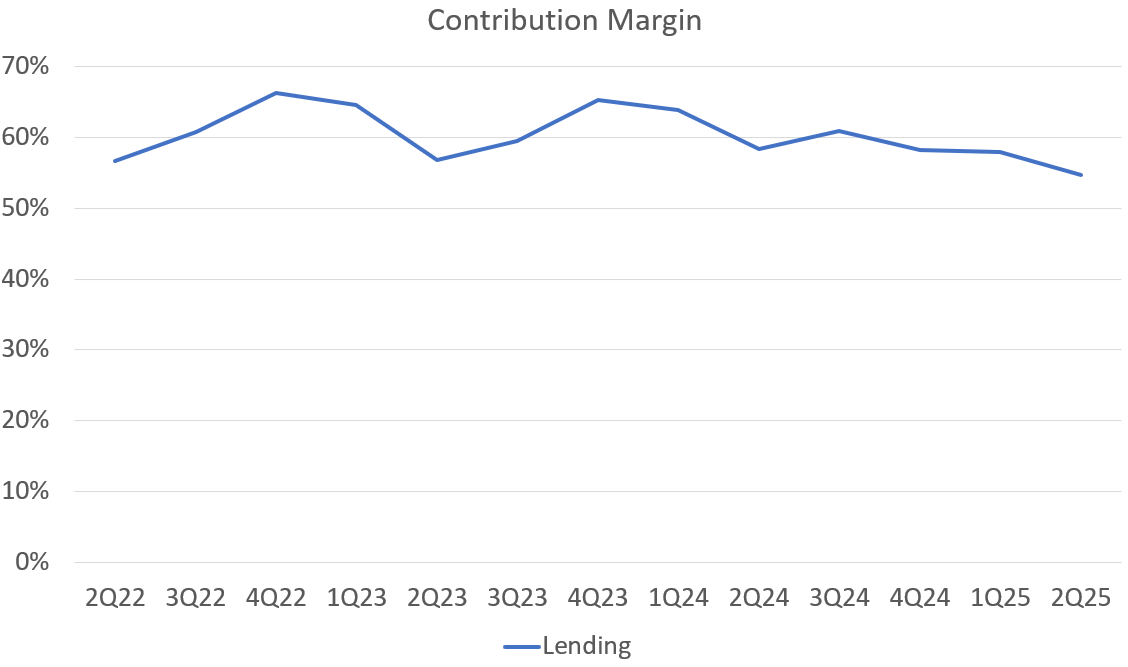

The contribution margin of that revenue is a bit of a different story. My original requirements called for a contribution margin in the low-to-mid 60. Here is what lending contribution margin has looked like for the last several years.

There is some seasonality here as contribution margin tends to bottom in Q2 and then rise in Q3 and Q4 before decreasing again in Q1 and then again in Q2. You’ll also notice that there is a definitive downward trend that started in the middle of last year and that margins have started to decline relative to where they were in 2022 and 2023. That would be slightly concerning if there were no mitigating circumstances here to explain it.

However, there is a very obvious mitigating circumstance and explanation for the decline. It’s the loan platform business. The LPB started in Q3 of 2024. Prior to that point, all revenues from the originations of loans ended up in the lending segment. So every marketing dollar spent generating leads for new originations was a directly attributable expense to the lending segment and led to revenue in the lending segment. That is no longer the case. Marketing dollars spent getting lending leads now contribute to both lending when they originate and hold the loans on their own balance sheet, AND financial services, since that’s where the LPB revenue gets recognized.

In other words, some of the directly attributable expenses that get assigned to lending are a worthwhile investment because they lead to great high-margin low-risk LPB revenue. However, the expenses get tallied up in the lending segment while the revenue gets attributed to financial services. That weighs on the contribution margin on lending while boosting the contribution margin in financial services. And that’s totally ok. It’s worth the trade off as we’ll see below. Furthermore, the extra growth highlighted above means that they are still getting more profit from the lending segment than their original guidance called for even with the lower contribution margin. Lending revenues and overall profits are still ahead of schedule, even if the contribution margin is lower than what I originally set as a goal.

Tech Platform

(Lack of) Growth

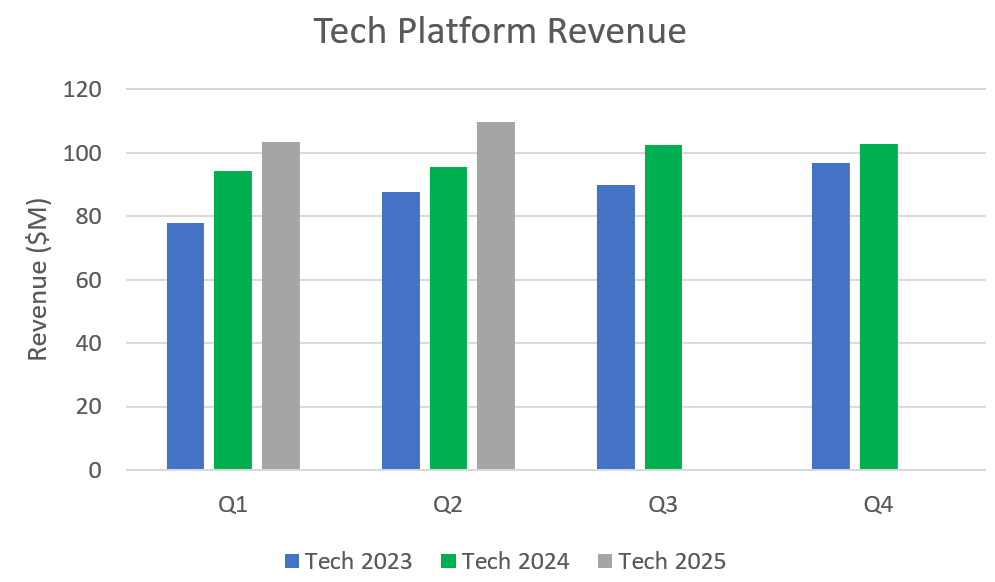

Galileo, SoFi’s Technology Platform, has underperformed their guidance. I spent a whole article doing a deep dive on how it has underperformed, what I’d like to see improved, mitigating circumstances, and what to expect from here. Original expectations were for around 25% CAGR for 2024-2026. Halfway to the finish line and the Tech Platform is underperforming. After putting up 21% growth in Q1 2024 off a very weak Q1 2023 comp, they haven’t even come close to 20% growth again since, much less the 25% growth they guided for. Q2 2025 was their best recent growth quarter, and it was barely 15%.

We found out just this week that Derek White, who had been Galileo CEO since June 2021, is moving on and the role is being filled by Bill Kennedy, who had been Galileo’s CFO since January 2022. Galileo is such a black box that it is hard for me, from the outside looking in, to know how valuable Derek White was, how much he’ll be missed, and how good of a fit Bill Kennedy is in that role. He does have some background as a VP of Salesforce’s Payments Product, but all his other recent past roles were in the CFO capacity. My gut tells me someone with more of a product and tech background would be a better fit for the CEO role, but that’s a complete outsider’s perspective.

Regardless, while there are green shoots about there being 10 new contracts that will be bringing in revenue at the beginning of 2026 that weren’t in place in January 2025, we still need more from Galileo. 20%+ revenue CAGR seems very unlikely right now and better execution will be necessary for this to fulfill the “AWS of Fintech” dream that management and investors had for the Tech Platform.

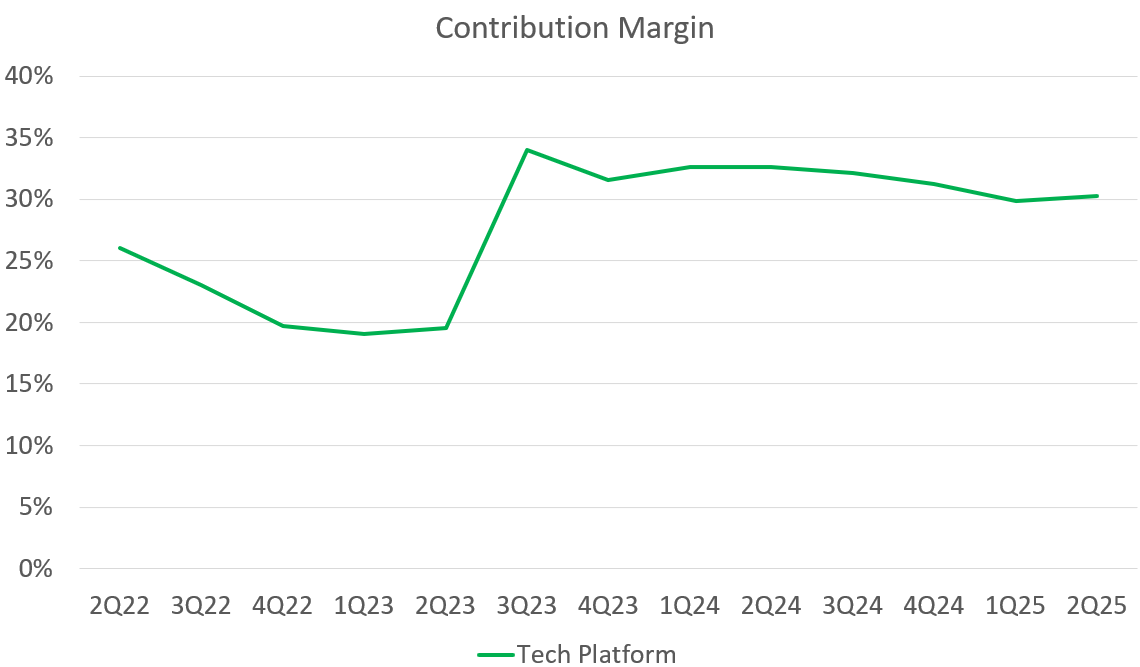

Contribution Margin

Galileo’s contribution margin has stayed right around 30%, so they are at least hitting their margin targets here. They are hiring quite a bit, and all those salaries will be part of this segment’s directly attributable expenses moving forward, so they need growth to accelerate if they want to maintain these margins. The jury has been out on this business for a while now, and 2026 needs to show some real improvement.

Fortunately, the overperformance of Lending and especially Financial Services actually more than makes up for the underperformance of the Tech Platform. This is the one black eye that SoFi has. If they could get back to a mid-20s CAGR in 2026 and 2027, watch out, because then the business would truly be firing on all cylinders. I do not expect that because their execution has been so lackluster now for several years. The rest of SoFi has been a fine-tuned machine, but Galileo needs improvement.

Financial Services

Growth

The previously discussed LPB caught absolutely everyone off guard. Myself and the other retail analysts had been concerned about how it would be possible for SoFi to achieve their very lofty financial services guidance. Wall Street was similarly blindsided by this business that came from nowhere to become SoFi’s primary growth driver.

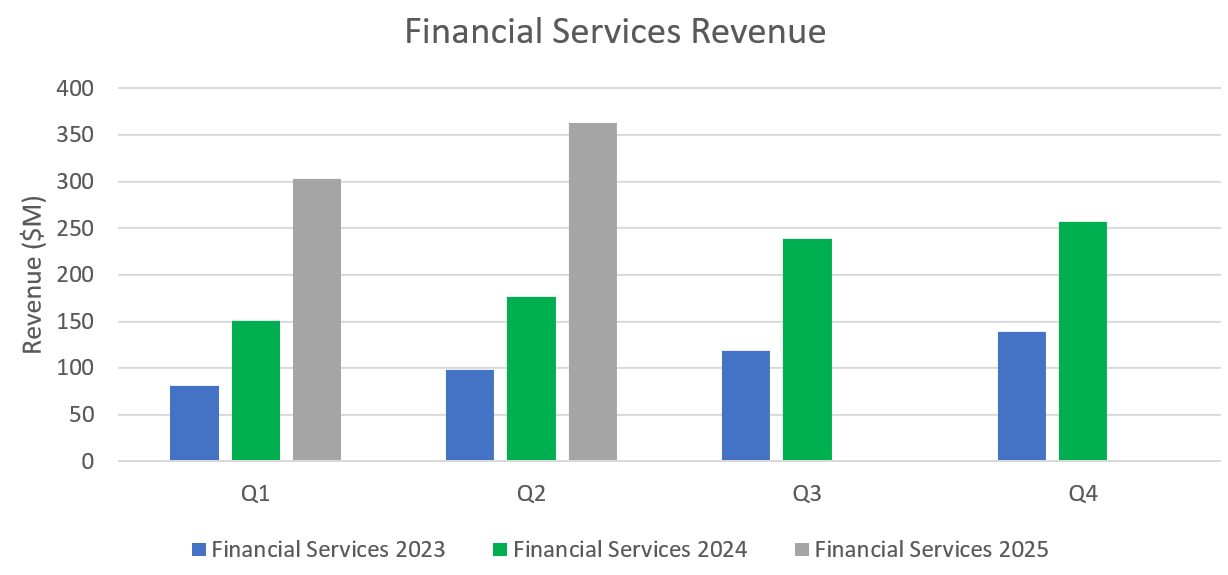

When SoFi originally set its guidance, 80% growth for this segment in 2024 and a 50% 3-year CAGR seemed like quite a stretch. Now that guidance seems significantly sandbagged. 2024 Financial Services revenue growth ended up at 88%. In Q1 and Q2 of this year, the segment put up 101% and 106% growth, respectively, compared to 2024. Q3 and Q4 comps are much harder since they include the LPB now, but even with absolutely no growth whatsoever from Q2 levels, they would still put up 69% growth in 2025. The LPB has truly been a gamechanger. They are so far ahead of that 50% CAGR guide that at this point it’s basically a foregone conclusion that they’ll absolutely torch those expectations.

And there is a lot more growth to be had here as well. They just started expanding the credit box for personal loans in the LPB last quarter. The wider that box gets, the more fee-based risk-free revenue they get from this line of business. Furthermore, I fully expect that they’ll begin to fold in both student loans and home loans into the LPB in the near future as well. At this point, I think a 70% 3-yr CAGR is a fairly reasonable assumption for the LPB. To put that in perspective, a 50% CAGR would have resulted in 2026 FS revenue of $1.47B. My own projections for 2026 FS revenue is now $2.10B. That’s $600M and 43% more than they originally guided for. And I think they could realistically do even better than that.

Contribution Margin

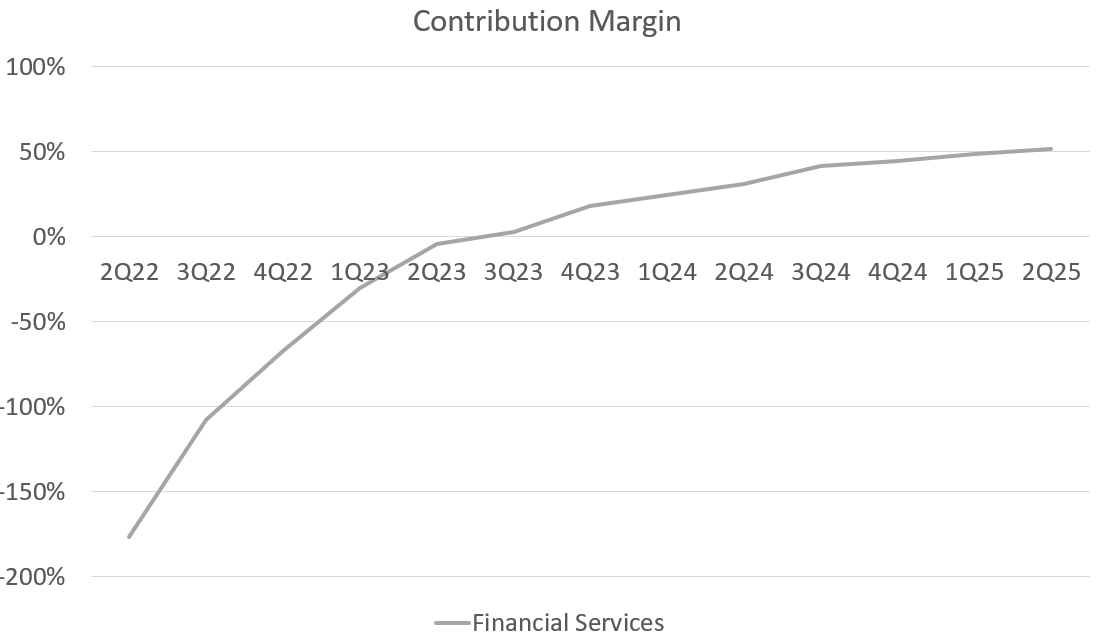

If you think that’s impressive, the contribution margin on this exponentially growing segment will knock your socks off. Remember that I originally said they’d be able to hit their EPS guidance if they could manage 30% contribution margin in the FS segment. At the time they provided their midterm guidance, they’d only had two quarters with positive contribution margin, so 30% seemed achievable but possibly difficult.

Again, everything changed with the advent of the LPB in Q3 2024. They put up a contribution margin for the segment of 42% that quarter and haven’t looked back since. In Q2, contribution margin hit 52%. Remember what I said about lending absorbing some of the costs for the LPB? This is where you see that benefit. When you couple the massive growth of financial services with the massive operating leverage they are displaying, you end up with profitability far ahead of what even the biggest SoFi bulls could have possibly foreseen even one year ago.

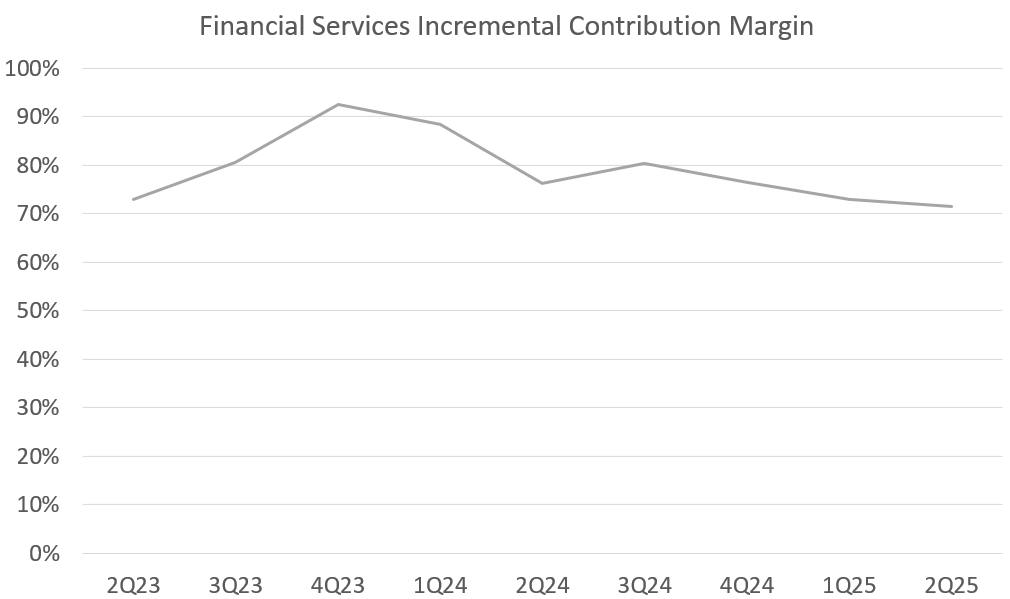

So where does this margin settle out long term? They are reinvesting into SoFi Invest and their credit card, but we can get an idea of where it might end up by looking at Y/Y incremental contribution margins over the last several years. That chart you can find below.

In 2023, when they were really pushing for profitability, incremental margins got as high as 92.4%. That means for each new dollar of financial services revenue growth, 92.4 cents went towards contribution profit. Financial services probably has the most operating leverage of any of their businesses. There are fairly set fixed costs, but the variable cost of each new dollar of revenue is extremely low.If necessary, and if they were only hyperfocused on profitability, they could probably drive 80%+ contribution margins if they wanted to. I don’t expect them to ever get that high because the higher ROI in the long-term is to reinvest a portion of that money to drive future growth. Even with their greater reinvestment into brokerage and credit cards, incremental margins still have yet to dip below 70%.

In the long term, it seems very reasonable to expect margins to settle above 60%, and possibly as high as 70%, meaning that there is still operating leverage in their fastest growing segment. The combination of the massive growth and contribution margin outperformance means that SoFi is WAY ahead of where their guidance and my models thought they’d be in contribution profit. When I first ran these numbers in June 2024, I had contribution profit for FY2025 and FY2026 at $332M and $471M to hit their guidance. My bearish scenario estimate for what they’ll actually hit now that we are halfway through 2025 is $711M in 2025 and $924M in 2026. My own projections for what I think will happen are actually $797M and $1,179M for this year and next year, respectively. In my June 2024 article, the bullish “if everything goes right” scenario for financial services was $415M and $634M for 2025 and 2026, respectively. They will beat my own most bullish estimates for 2026 already in 2025. This outperformance does not get enough ink.

Corporate

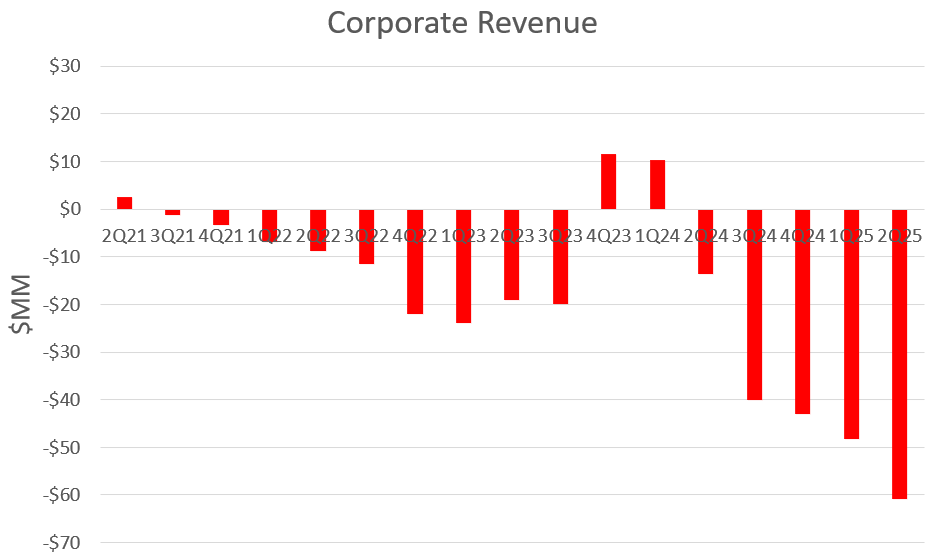

If there is one thing bad about SoFi that rarely gets talked about, it’s the corporate revenue line item. I used to dismiss this mostly as a throwaway line because it was small and fluctuated quite a bit from quarter to quarter. It isn’t small anymore. As deposits have become a larger and larger portion of their funding base, the fluctuations to corporate revenue have increased, and they’ve been mostly to the downside.

Corporate revenue fluctuated around +/- $20M per quarter for three straight years. However, starting in Q3 2024, it dropped to -$40M and it’s only gone down since then. Corporate revenue is made up of the revenue they pay on their corporate debt and reconciling the difference between lending and financial services net income with their Funds Transfer Pricing. For the last year, the reconciliation amount has become increasingly negative each quarter. There is no way to predict this, but the point is that some of the growth that I was so effusive about above with regards to lending and financial services can be attributed to the fact that this number is so negative.

My original projections from June 2024 assumed corporate revenue would be around -$40M per year. A value of -$60M/qtr adds a significant wrench into the projections that was not accounted for properly in the past. The extremely frustrating thing is that I have absolutely no idea how to project this value going forward. What changed from Q3 2023 to Q4 2023 when it went from -$20M to +12M? Why did it fall so far in the last year? Will this revert back to -$40M or by next year at this time will it be at -$80M or -$100M? I know this company about as well as any non-employee, yet I have no answers to those questions. I wish there were more clarity here and I wish that there were some way to predict it.

I hate operating in a vacuum of information. It’s especially frustrating when I’m trying to make multi-year projections. So I’m adding a fifth target to my original list, which is that corporate revenue needs to stay below $75M/qtr. I’m trying to be conservative, so for my bear, bull, and DDI projections outlined below, I’m assuming -$260M in corporate revenue for this year and then -$300M in corporate revenue (which is -$75M/qtr) for every subsequent year. If anybody reading this has more info on how to model the corporate revenue line, please reach out.

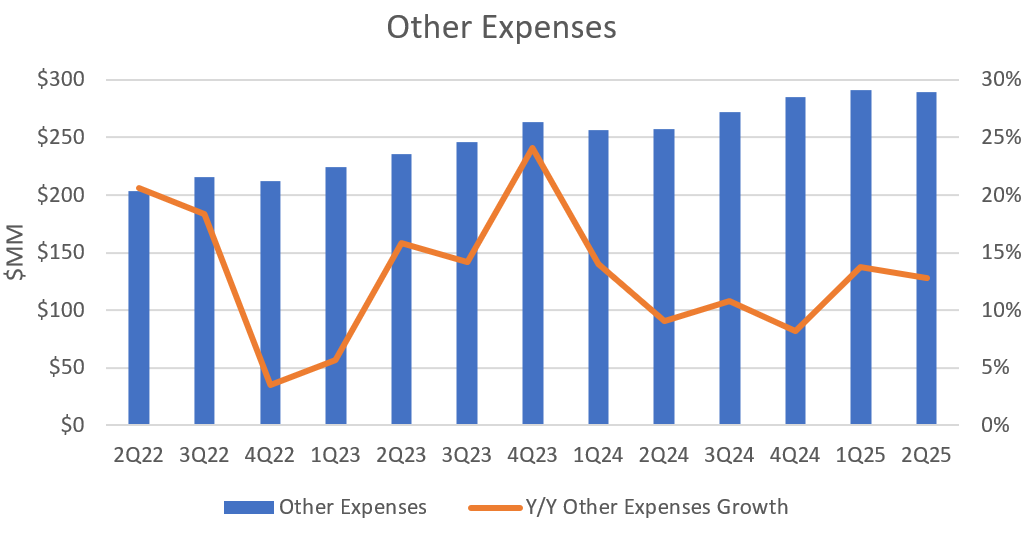

Other Expenses

Other expenses have ticked up slightly above the 10% YoY number that I originally set as a target. That’s actually okay though because revenue growth has also accelerated beyond what we expected. They will ramp reinvestment back into the business if they continue to overperform. Anthony Noto talked about this in the last earnings call.

I think it’s really critical that we invest for the future. We want to compound 25% revenue growth for decades, not just for a couple of years. So we don’t want to under invest in the business. In the quarter, if we start to outperform relative to expectations on the revenue line, we’re going to have a hard time spending that money back in the quarter. And so if you see us above the 30% incremental EBITDA margin in the quarter, it’s because we outperformed relative to what we thought and we couldn’t spend the money fast enough. But we are going to make sure that we keep putting $0.70 of every incremental revenue dollar back into the business

So if they are outperforming on growth in the rest of the business, it’s alright for their expenses to increase a bit. They still need to stay disciplined, but as long as the expense growth does not increase too fast relative to the outperformance in revenue, it’s not a problem.

In Q1 and Q2, other expenses grew by 13.7% and 12.7%, respectively. That’s well within the range afforded them. For my bullish scenarios, I actually had 15% Y/Y growth in other expenses and for my own DDI projections, I had 13%. The 10% number was what would be required if they hit their guidance. Since they are above and beyond that guidance, there is flexibility here.

Dilution

Not going to spend a lot of time here, but I do just want to say the updated scenarios account for the dilution from the recent capital raise and assume 4% annual dilution moving forward.

Scenarios

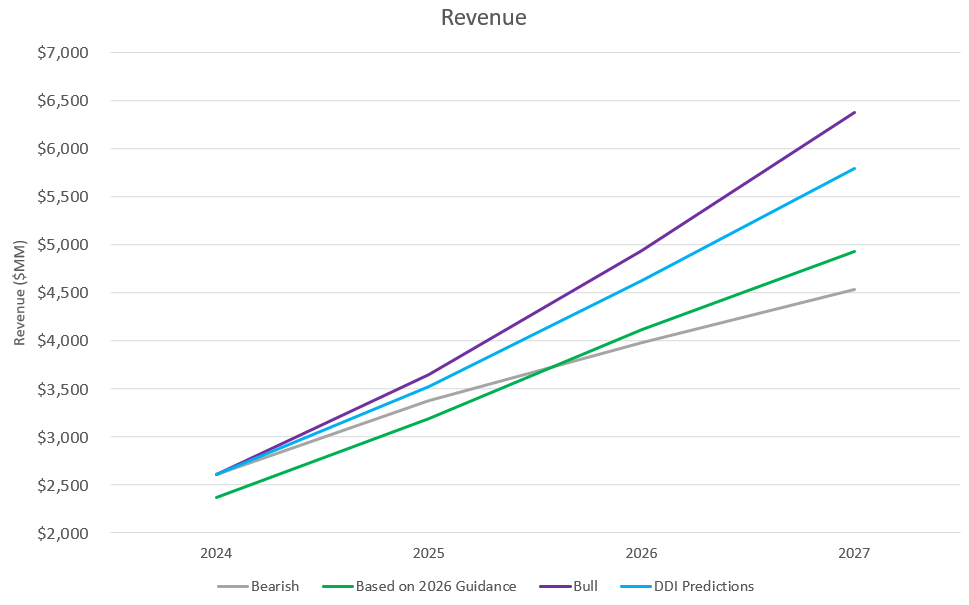

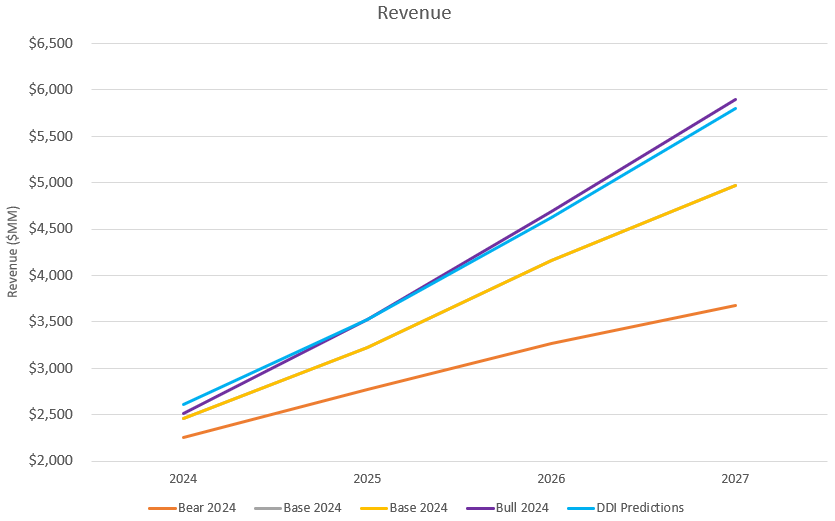

Below you will see the revenue and EPS outcomes for 2024 through 2027 for a bearish case, bullish case, my own projections (labeled DDI). I’ve also included the outcomes from what I originally calculated in June 2024 that they’d achieve based on the guidance they gave at Q4 2023 earnings (the green line), so you can see how ahead of schedule they are, which is also the reason I included 2024. I’m not sharing every growth and margin assumption (I’ll keep that to my paid subscribers), but you can probably get a reasonable approximation from the discussion above.

Revenue

Let’s start by looking at expectations for the top line.

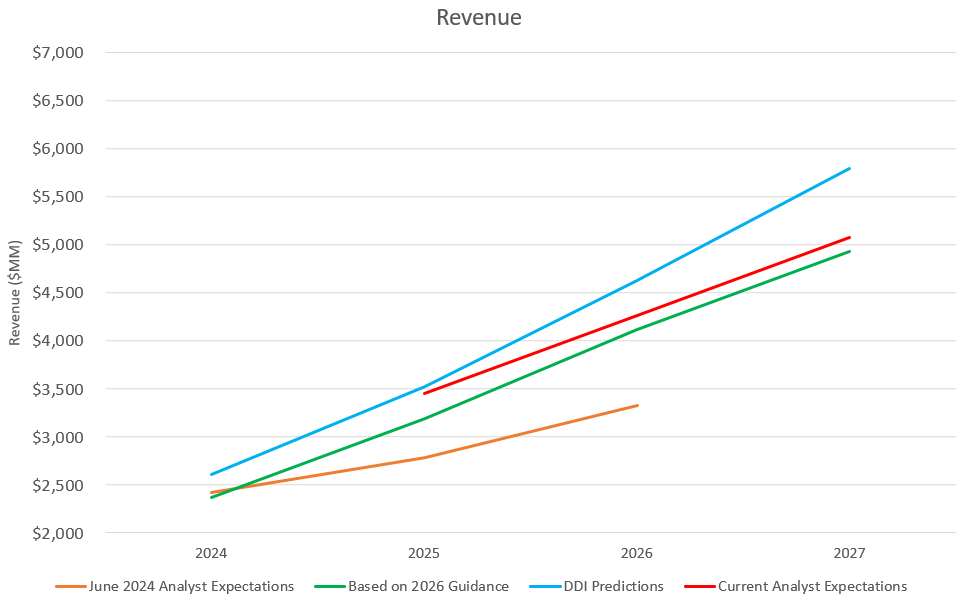

You can see that despite the Tech Platform underperformance relative to their medium-term guidance, the business as a whole outperformed by around $240M last year and is on pace for around a $340M beat in 2025. Even my bearish projections, which assume a major slowdown starting in Q3 2025, are not far from the original guidance. SoFi is significantly ahead of where they need to be to hit their guidance. To get an idea of how far off analysts have been, I’ve also included their estimates from June 2024 and current estimates in the graph below. My estimates (blue) and the guidance curve (green) are the same to so you can compare across the graph above and graph below.

Look at the massive difference between what analysts thought this year’s revenue would be just a little over a year ago and what they think it will be now. Their expectations back then were for $2.78B revenue in 2025. Their estimates now are $3.45B, and I expect $3.53B. Their estimates will end up being wrong by something like 25%. In June 2024, I wrote “I really have a hard time believing SoFi will not completely blow analyst top line expectations out of the water over the next several years given the analysis I just went through.” I was right.

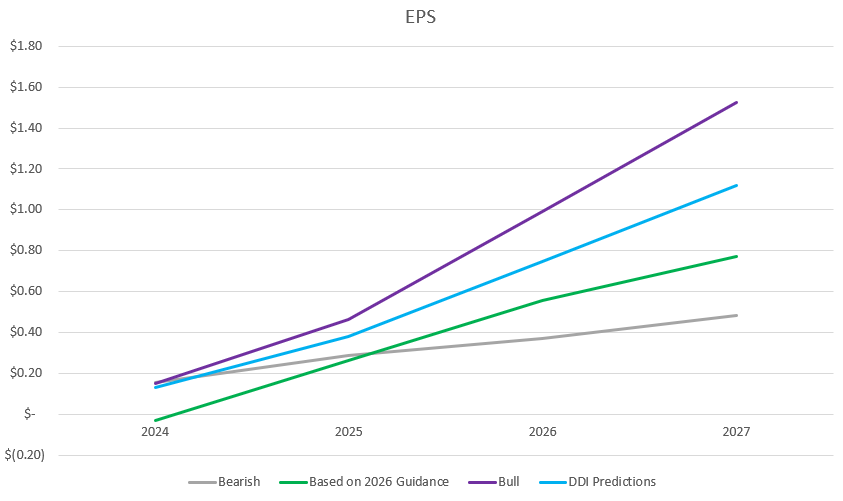

EPS

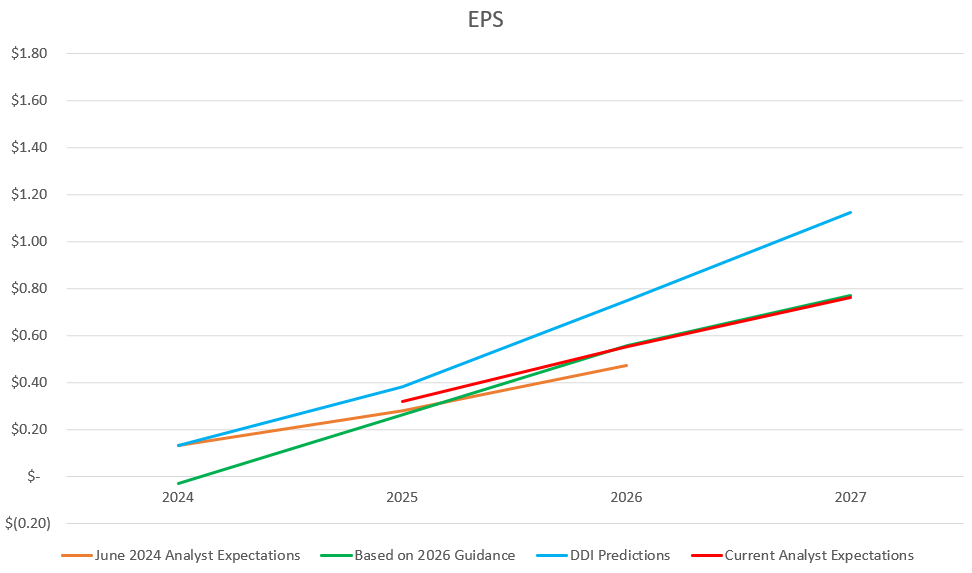

Same graphs but now for EPS.

My predictions have them coming in at $0.75 in EPS in 2026. I’m assuming a fairly high amount of reinvestment. The main differences between my own projections and the bullish projections are that the bullish predictions assume a return to real growth for the tech platform, whereas they remain pretty much at current levels in my own projections, and the financial services growth is maintained at around 5% greater levels in the bullish case. The bullish scenario also has higher contribution margins across the board, which really helps the bottom line. The contribution margins are probably a little too high for this level of growth, but it’s a bullish scenario. The main takeaway though, is that $0.55-$0.80 in EPS next year seems basically inevitable barring a massive recession. They are way ahead of where they need to be to hit their guidance.

My prediction gives them a 2026 EPS growth rate of 95% compared to 2025. If my predictions are accurate, and the stock is trading around $30 in January when they report Q4 earnings, it would be trading at a FWD PEG of 0.42. A FWD PEG of 1 is considered undervalued. Here are those EPS projections compared to analyst estimates from 2024 and current analyst estimates.

Analysts have finally caught up with the bottom of SoFi’s own 2026 guidance and are now predicting $0.55 EPS in 2026. It only took them 20 months of wrong predictions that were too low to get there. I suspect they will continue to play catch-up on both revenue and EPS.

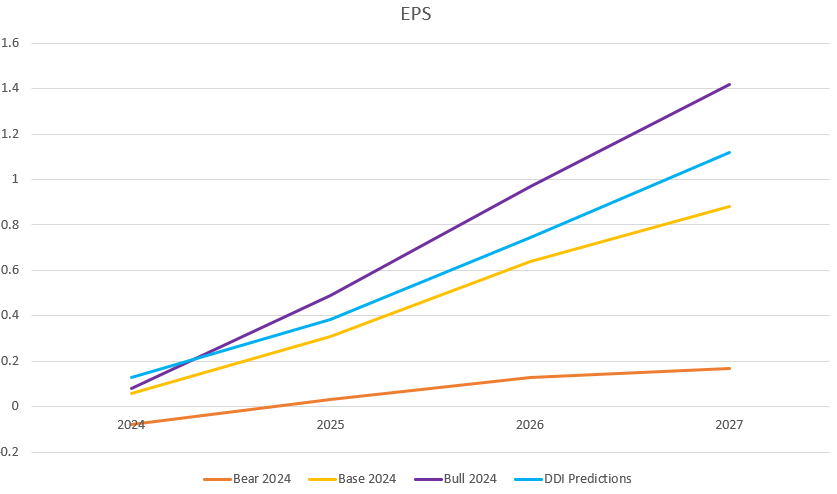

Reality vs 2024 Bullish scenario

It was interesting to check how SoFi is trending compared to the bearish, base, and bullish predictions I made in 2024. This is instructive to me because it helps me understand where I was right and where I was wrong and how I can improve my own predictions moving forward. It also shows how well SoFi has or has not executed relative to what I thought was possible a year-and-a-half ago. Here are those 2024 revenue scenarios compared with my current DDI prediction.

My current projections are almost EXACTLY aligned with what I thought would be the most bullish possible outcome in June 2024. I only did this comparison after having completed the rest of the article above, so I had no idea these were so close. This reiterates to me once again just how incredible SoFi’s execution has been. They made my revenue growth stretch goals a reality.

There are two reasons my current EPS predictions are lagging the 2024 bull predictions despite the fact that SoFi is hitting the bullish revenue predictions. The first is that I underestimated the amount of other expenses that would be needed to accomplish this growth. At the time I said that other expenses were “by far the most difficult one for me to project,” so I’m not surprised I got it wrong. The second is the recent share offering. I’m now projecting about 10% more shares outstanding than I had previously. Even with those adjustments, it’s still trending way above where anybody on Wall Street thought it would be at this point. Noto and team deserve a lot of credit for what they’ve accomplished.

SoFi could coast to their guidance, but they won’t

SoFi is way ahead of their own guidance for 2026. They could play it conservative at this point and hit the lower end of the guidance by resting on their laurels. Fortunately for investors, that isn’t how this team is built. SoFi has tailwinds for the first time since becoming a public company. They have balance sheet flexibility, a proven ability to exceed their own lofty expectations, and profits to reinvest into new verticals. Moreover, Crypto is coming back, rates are coming down, and they’re completing the transition to having everything on their own backend software. Things are lining up to be extremely exciting for the next 12-18 months. Rather than coast, I actually expect them to shift into an even higher gear.

Subscriber update

The DDI YouTube Channel is live. If you want to support my work, you can subscribe here on substack, or on X, or, YouTube.

Paid subscribers get three perks.

1) Access to a private X chat.

2) I buy stocks every week, and every week I send out my weekly DCA weighting list to subscribers

3) I send out a portfolio snapshot at the beginning of each month which shows my total allocation to each of my positions.

If you are a paid subscriber and not in the X chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

You can also use my referral links for SoFi if you want free money when you sign up for SoFi, or discounts on Tesla or finchat.io:

SoFi Money Link - Get an extra $25 when opening an account

SoFi Invest Link - Get an extra $25 when opening an account

Tesla Referral Link - Get a discount on a new Tesla

finchat.io Link - Get 15% off

Disclosures: I have long positions in SoFi

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Excellent and very detailed article. Thank you for your hard work and best wishes for the You Tube channel.

This is exceptional analysis - the segment-by-segment breakdown really clarifies how SoFi is tracking. The LPB truly has been transformational for the Financial Services margin profile. That 101%/106% growth with 52% contribution margins is remarkable. Your point about Galileo absorbing marketing costs that benefit LPB revenue is spot-on and explains the lending margin compression nicely. What concerns me most is the corporate revenue line going increasingly negative - from -$40M to -$60M/qtr. Without visibility into the FTP reconcilation methodology, it's really hard to model with confidence. If that trend continues to deteriorate, it could offset some of the FS overperformance. Galileo remains the weak link, and the leadership change mid-stream doesn't inspire confidense. But overall, the $0.75 EPS for 2026 seems very achievable barring a macro shock. Great work on tracking this so rigorously!