SoFi Q2 Earnings Review Part 2: That Is How You Control the Story

My two biggest questions going into earnings were:

1) Where will the narrative end up after earnings?

2) Where is the company going from here?

I said that both the narrative of the company and the trajectory of the stock was going to hinge on two things: credit performance and guidance. Let’s talk about what happened.

Credit Performance

I thought it was time for management to step up, be high energy, and control the narrative, Here is exactly what I said in my earnings preview about how they can address credit:

I think SoFi management need to address this in the prepared remarks and in the Q&A session and completely put to bed any narrative that the bears could stir up after the fact. They need to be absolutely crystal clear that loans will come in line with the 7%-8% life of loan losses guidance or they run the risk of the bears injecting their own story into any void that is created by a lack of communication. I think even more than in past quarters, they have to come out swinging in this quarter with their commentary and confidence in the business moving forward. They’ve killed it in terms of execution, and I think it’s time they start demanding the respect their results should justify.

I don’t know for sure if management reads what I write, but it sure seems like they got this same message from somewhere. They were so ready for this and they absolutely killed it in the earnings call. That was the best earnings call they’ve ever had. They addressed every credit concern that anyone could reasonably have. There is no void left for anyone to exploit. Let’s start with life of loan losses, then we’ll go to talk about net charge-offs, and we’ll finish up with delinquencies.

Life of loan losses

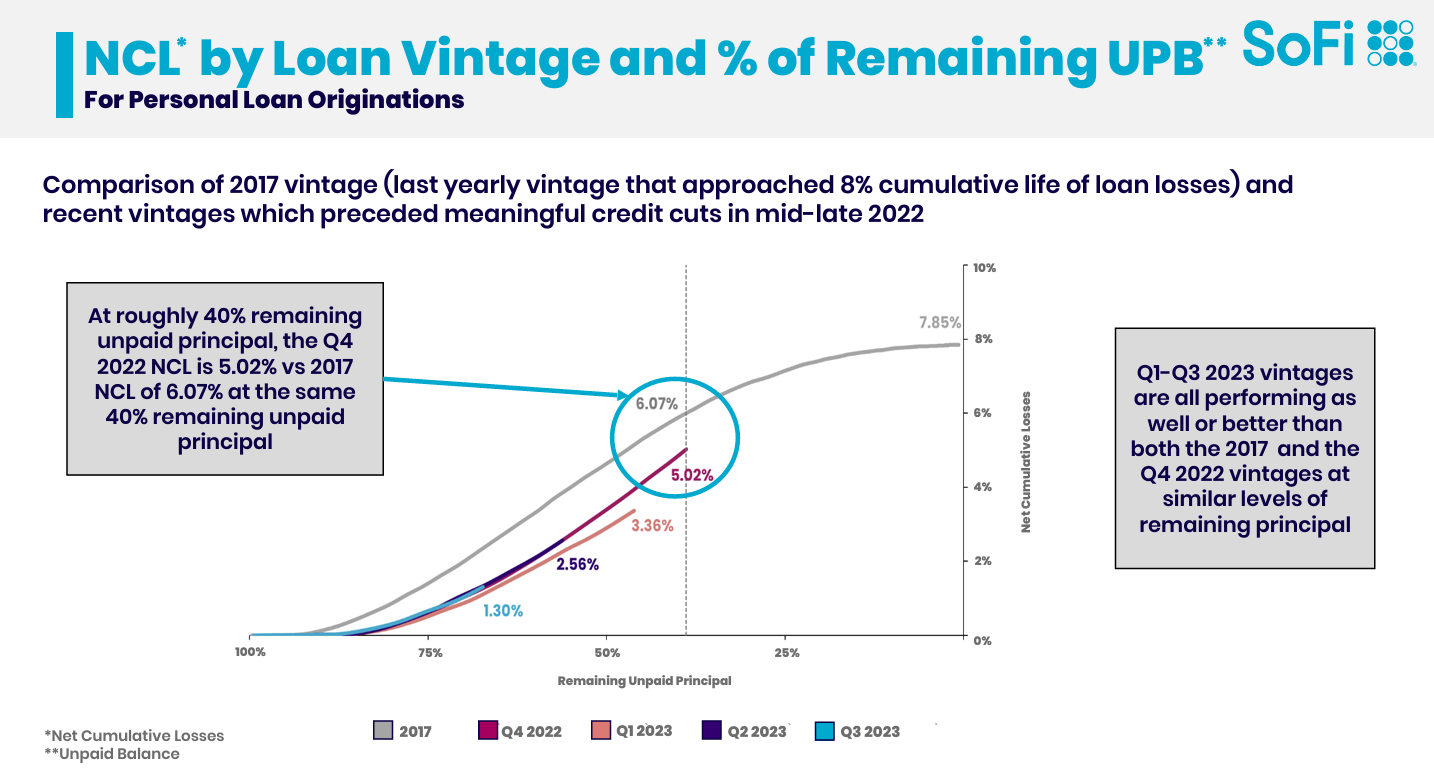

SoFi investors and especially the skeptics have long been asking for greater transparency on loan performance. Specifically, they wanted to see losses by vintage. SoFi provided a brand new slide in the deck that ought to go a long way in quieting bearish growls.

SoFi guides to 7-8% life of loan losses. The last time they got close to the tope of that range was in 2017, which is the gray line in the chart and came in at 7.85% losses. All of their recent vintages, and these include their larger origination cohorts (Q2 2023 and Q3 2023), are outperforming those 2017 loan losses. Losses would have to accelerate significantly from here to even approach the 2017 levels.

I have seen some analysis that argues that using remaining unpaid balance as the x-axis distorts the fact that these curves would look worse and the lines would not look as good if they used time as the x-axis instead. If you use time as a x-axis, the recent vintages would line up closer to the 2017 line. That is absolutely true. It’s also mostly irrelevant when it comes to whether they will hit their guidance.

Life of loan losses is, by definition, mostly concerned with the entire life of the loan. If the concern is how the loans will perform over their entire lifetime, it seems to me that unpaid balance is a better metric if there is a duration mismatch between the loans. SoFi’s loans are moving to shorter duration and prepayments are accelerating. That means that defaults will happen on a slightly accelerated timescale. Management has made this clear on several recent earnings calls.

It also means that the entire vintage will age out earlier. If you switched the x-axis to time, the recent vintages may follow the gray line more closely. However, the lines stop for the newer vintages would stop earlier. So on a time basis, the newer vintage lines will stop at a lower point than the gray line. That means that the newer vintages will still end up with lower life of loan losses than the 2017 vintage. Shorter term loans and more prepayment also results in the capital being redeployed and cycled at a faster rate. You can argue about the visualization. You can’t argue with the conclusion. Current loan vintages will come in within the guided range.

The take home message is simple. SoFi’s underwriting is more than good enough to achieve their guided life of loan losses.

Net Charge-Offs

SoFi skeptics were so ready to jump all over this one. In fact, there were some reports out even ahead of the earnings that predicted a massive spike in charged-off loans. What happened? SoFi showed outstanding execution and the bear case didn’t actually materialize. That should sound familiar if you read my article on how SoFi always handles every bear case. Let’s start with the raw data and then we’ll discuss the implications. SoFi’s net charge-offs (NCOs) for the quarter came in at an annualized rate of 3.82%. However, that number does not tell the whole story because SoFi once again sold late-stage delinquent loans in the quarter that otherwise would have increased NCOs. They’ve now done that in each of the last two quarters. So the real annualized NCO rate would have been higher if they hadn’t sold those loans. How much higher? SoFi filled that information void as CFO Chris Lapointe immediately clarified that even without that sale, their annualized NCO rate would have been approximately 5.4%. Here is the graph of the annualized NCO rate without late stage delinquent loan sales (which happened in both 1Q24 and 2Q24).

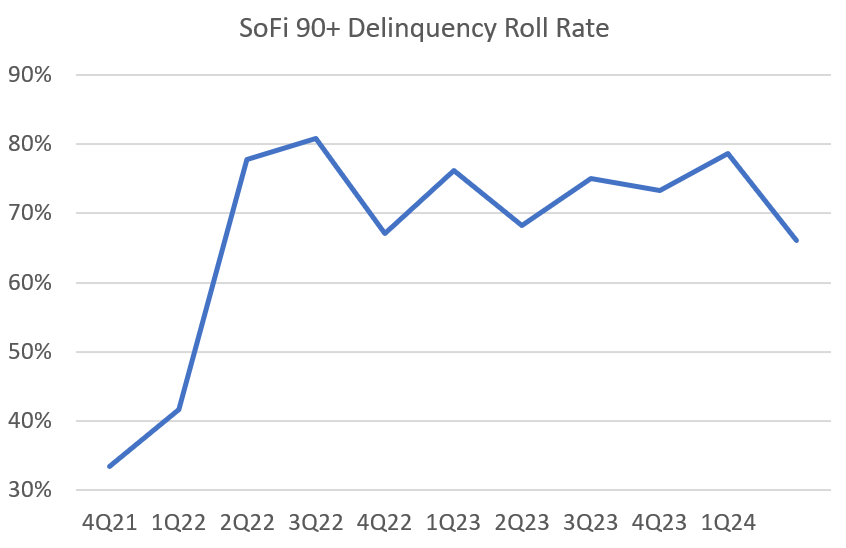

How good is that 5.4% number? Three weeks before earnings, KBW came out with a report that said to short SoFi going into earnings because they “believe it is fair to assume that NCOs will likely be in the 6.3-7.1% range in 2Q24.” They used delinquency roll rates to come up with that range. I could not recreate their numbers, but when I reran that exact same analysis for myself, I came up with a range of 5.7-6.7%. The fact that they came in at 5.4% is astounding. That was almost a full percentage point below the low range of KBW’s estimates and 0.3% lower than the bottom of my estimates. That corresponds to a roll rate of 66%, which is the best quarterly roll rate they’ve seen since 1Q22, when the values were artificially low because of Covid stimulus.

Honestly, a beat this big on their loan performance probably should have been enough to see a jump in the stock price all by itself. Everyone was expecting the worst and they came in way ahead of expectations.

Delinquencies

One of the main reasons that roll rate came in so low is because the 90+ day delinquency rate the calculation was based on was taken at the end of Q1, or the end of March. As it turns out, delinquencies peaked in March, so that roll rate was based on what would have been close to peak delinquencies. This highlights how extrapolating a number taken at just one single point in time can lead to false conclusions.

One of the concerns that people may have if they look at the annualized NCO graph above is that it still appears to be rising over time. Delinquencies are a leading indicator to charge-offs because loans go delinquent before they go into default. As we just covered, delinquencies peaked in March. That means if the macro stays resilient, this quarter may very well have marked peak loan losses. Here is the chart of delinquencies.

Again, this alone could easily have boosted the stock. One of the bigger recent concerns about SoFi’s business is that delinquencies and defaults were continuing to rise. This throws cold water on yet another bear thesis. One could argue that the only reason delinquencies came down is because they originated so many new loans in the quarter, so the percentage went down. That is also untrue. Not only did delinquencies come down as a percentage of the total loans, but it came down in absolute terms as well. In other words, even though SoFi has more loans now than they did in Q1, less of those loans in total are delinquent in Q2 than they were in Q1.

SoFi management did a spectacular job of putting together the information needed to dispel these fears, publicly displaying it for all to see in the earnings presentation, and then leaving no weak spots for bears to poke or prod. They didn’t have to disclose the 5.4% NCO number, but they did. They could have just reiterated their 7-8% life of loan guidance, but they put two different slides together to show why they are so confident. Then in the call they talked it through magnificently. The very first question was about credit quality and not only did Chris Lapointe respond very clearly, but reiterated that, “What's even more important than that, these trends are continuing throughout the first several weeks of Q3.” The door on this bear case is closed. Confirmation of anything but a hard landing should be the deadbolt sliding into place.

Guidance

Q3 guidance was excellent. However, they were still conservative on the full year guidance.

Q3 guidance beat analyst expectations by 26.5M at the midpoint for revenue, about $5M for adjusted EBITDA, and $0.01 EPS. With their propensity to always beat their guidance, they forced many analysts to increase their estimates across the board. The average analyst estimate for Q3 revenue jumped from ~$610M before they reported to $626M now.

However, the full year guide actually implies only $632M of revenue in Q4, which would mean it comes in lower than Q3. It’s about the same as analysts were looking for before earnings. Those estimates have increased slightly since earnings, so it is now below analyst expectations for Q4. Furthermore, the full year EPS guide of $0.09-$0.10 means that they are guiding for $0.02-$0.03 in Q4, which would also be a decrease from Q3.

What I really liked about the call is that they were so firm, confident, and deliberate on everything they said and everything they are doing. In fact, one of my favorite responses was about how they are intentionally not growing as much as possible. They are choosing to diversify by investing in businesses that drive less revenue overall, but more diversified and less risky revenue. Here was Anthony Noto’s full response to a question about their approach to lending moving forward.

As we go through the year, I think it's important just to understand, we're trying to manage the overall growth of the company. We have so many resources we want to allocate, and we're allocating it to drive that outcome of diversified, less risky, less capital-intensive businesses. If we wanted to grow personal loans more, we would have to allocate more capital to it. Why? We have to drive marketing that drives the top of the funnel that then drives conversion. Those loans don't just happen because we decided to actually underwrite more, we actually have to spend money to underwrite more. Right now we're choosing to spend that money in different areas that don't drive as much revenue.

Honestly, the fact that they are leaving revenue on the table and still delivering these kind of results makes me even more confident in the long-term future of the company and their ability to meet their long-term guidance.

Speaking of Long-Term Guidance…

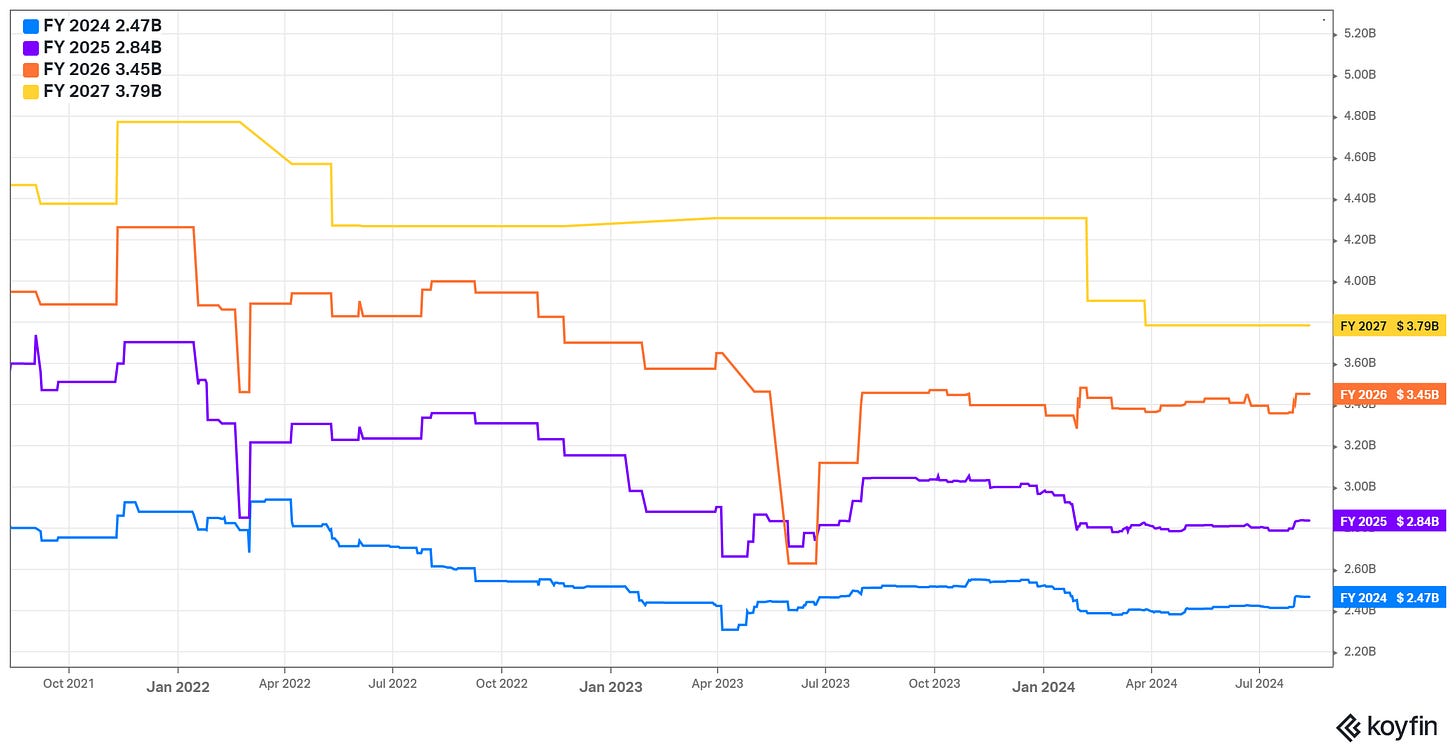

Ok, so I call myself a long-term investor. However, one of the things that I have overlooked is that long-term analyst estimates for SoFi’s revenue and EPS have been consistently revised downward. SoFi investors, including myself, love to highlight the fact that they’ve never missed their own guidance nor analyst estimates in a quarterly earnings. While that is true and very impressive, part of the reason that the stock’s performance has nevertheless been less than stellar is because long-dated estimates have consistently been dropping over time. Look at where the revenue estimates have been going for the last three years. The trend is down and the EPS trend (shown further below) is similar.

I think that trend is about to reverse. As I’ve covered before, the long-term 2026 guidance that management has given implies that while growth will be muted this year at under or around 20%, it will need to accelerate to around 30% for the business overall in 2025 and 2026. Analysts do not believe management will deliver that growth. The average analyst estimate for revenue growth is 15% in 2025 and 21% in 2026. Let me put up that same chart with analyst estimates are relative to what I predict 2025 and 2026 revenue will be based on management guidance.

EPS shows a similar trend. Long-term EPS estimates have been coming down. That means that while SoFi has been beating every quarter, their FWD earnings and revenues expectations were still coming down. That will not be the case anymore. From now on estimates will be climbing as long as they hit their long-term guidance. Here are those analyst EPS estimates along with my own estimates of what they need to hit their guidance.

You might notice that there was, in fact, a jump in future projections for revenue and EPS after the Q2 results. I believe that’s the beginning of a new trend.

Shots Fired

Management, and Anthony Noto in particular, were fired up. Here are two of my favorites from the call:

On scaling the lending business (my emphasis added):

So a lot of opportunities as it relates to the lending business, we're taking a pretty conservative view purposely. I, quite frankly, don't feel like we're getting paid for the results we're delivering, so I'm not sure why I would be overly aggressive at this point.

Awesome shot across the bow at the analysts and Wall Street who are listening to the call. I agree whole-heartedly that they are not being adequately rewarded for the results. The second one is a warning for Robinhood investors that echoes many of the things I’ve said about their Gold card offering. The Gold Card is an awesome product for consumers, and I am using it as my primary card for virtually everything myself, but I think it’s a big risk for the company (again, I added the emphasis):

But in credit card today, we're going to continue to move relatively slowly and not step on the gas too hard because this is a business you can lose a lot of money and you can lose it every day. It's unlike a loan where you give somebody a fixed amount. In Credit Card, you have lines that are quite big and they can be utilized in nefarious ways and drive really high losses. So we'll continue to make sure we approach this prudently, but we are stepping on the gas a little bit more than we have in the past.

I quite enjoyed a fired up Noto.

Closing Remarks

Let’s answer those two initial questions I put at the top of this article:

1) Where will the narrative end up after earnings?

Anthony Noto and Chris Lapointe set the narrative with their preparation and throughout the earnings call. Then Noto threw down the gauntlet with these closing remarks:

2) Where is the company going from here?

The company fundamentals have only gone up and to the right. They will continue to go up and to the right. As the company continues to deliver, starting now, analyst estimates will go up and to the right. And if there is justice in this world, the stock will follow up and to the right.

Subscriber update

Right now I am comfortable with taking the time to write about 2 articles every month. Once I get to 100 paid subscribers, I’ll start a YouTube channel and do at least one video every other week (I plan on also posting those on X).

Paid subscribers also get access to a private X chat. If you are a paid subscriber and not in the chat, please email me at datadinvesting@gmail.com and let me know and I’ll get you added. If you have any other ideas for things I can do to bring value to my paid subscribers, don’t hesitate to reach out.

Disclosures: I am long SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Thank you Chris, excellent analysis as usual. I found the discussion about the long-term guidance particularly helpful to keep their long-term progress in perspective and to understand the gaping chasm between SoFi delivery reality and analyst la-la-land assumptions!