SoFi's Exemplary Quarter

Well, that was a fun earnings. SoFi did everything right in 3Q23 in my opinion. Here were my earnings projections vs SoFi’s actual performance:

Members: Projection 565k new members Actual: 717k new members

Personal loan originations: $3.8B Actual: $3.88B

Student loan originations: $680M Actual: $919M

New deposits: $2.7B Actual: $2.9B

Lending revenue: $340M Actual: $342B

Financial Services Revenue: $115M Actual: $118M

Technology Platform Revenue: $92M Actual: $89.9M

Corporate Revenue: -$22M Actual: -19.9M

Total adjusted net revenue: $525M (WS estimate is $512M) Actual: $531M

Adjusted EBITDA: $85M Actual: $98M

EPS: -$0.04 (WS estimate is -$0.07) Actual: -$0.03

The only one they missed was tech platform revenue. On everything else they completely blew it out of the water. Especially members. Here are, in no particular order, things that I want to highlight:

Members

I thought 2Q23’s 584k members was awesome. They absolutely crushed those numbers in this quarter. I’d like to personally thank Taylor Swift and her tour. More importantly, this reaffirms that the flywheel is really starting to spin. I was excited after that 2Q23 print and that customer acquisition cost was coming (CAC) down. However, it takes more than one quarter of data to call this a trend and not just an outlier. After the 2Q23 earnings, I talked about SoFi’s moat and said this:

One quarter of lower CAC and high member adds is not definitive proof that they truly have turned a corner. However, the increase in brand awareness also provides data that supports this trend. If CAC can stay low as quarterly new members climb, it would be another piece of evidence that the moat is growing.

The trend not only continued, it improved. Members went up even faster and at an even lower CAC. I expect that they might pull back on marketing slightly in Q4 to absolutely guarantee profitability, but I think the days of less than 500k members per quarter and a CAC above $350/member are gone. These numbers are slightly off as I have not subtracted out the Tech Platform sales & marketing, so actual CAC is slightly lower than what is shown here.

Deposits

Deposit growth is one of the core drivers of revenue growth. I outlined all the reasons why in my recent articles about SoFi’s next growth vectors. SoFi continues to have strong and accelerating deposit growth. There is no other neobank showing this type of consistent growth. This chart is courtesy of Vadim Kotlarov.

Discover and LendingClub both saw an increase in deposits relative to 2Q23 growth, while Ally lost deposits in the quarter. None of them have come even close to seeing the deposit growth that they had in 4Q22. None of them except SoFi that is, who added 26% more deposits in 3Q23 as they did in 4Q22. SoFi is the outlier. Their value proposition as proven to be differentiated from the competition and it is resulting in exceptional results.

Loan Sales

Some of the strongest bear cases you see about SoFi often discuss their loans and accounting. Specifically they question whether the loans that SoFi holds at fair market value are really worth as much as SoFi says they’re worth. This was a big concern of mine coming into this quarter as well. LendingClub reported that they sold their loans at a 4% discount to fair values in 3Q23. I called this out on X as a warning to SoFi investors before the earnings as something to watch out for. Loan sales will become increasingly important as SoFi gets closer to hitting their capital ratios.

SoFi sold loans in 3Q23 at 105.1% of unpaid principal. Not only that, but the same buyer came back for $100M more in 4Q23, also at 105.1%. Not only that, but the same buyer also signed a $2B forward flow agreement, meaning that they agreed to buy $2B of loans at some point in the future at similar execution levels in addition to the loans already purchased. Not only that, but they are executing a $375M securitization of loans with BlackRock managed accounts and funds. Maybe selling loans won’t be quite as difficult as I thought it would be. Here is what Chris Lapointe said exactly about the sales.

In the third quarter, we sold portions of our personal loan and home loans portfolio. In terms of in-period sales execution levels, we sold personal loans at an execution level of 105.1% and will be sold home loans at a weighted average execution level of 100.2%.

In addition, last week, we executed a $100 million sale of personal loans at a 105.1% execution to the same partner who purchased personal loans in Q3 and we agreed to terms with that same partner for a $2 billion forward flow agreement at similar execution levels. We are also in the market, including in discussions with funds and accounts managed by BlackRock with respect to a $375 million securitization at favorable execution levels, and that is expected to close mid-November.

The fair market values for SoFi’s loans as accounted for in 3Q23 is 104.7% of unpaid principal. Actual sales in 3Q and 4Q were 105.1% of unpaid principal. Now, to be completely clear, the current sales ($15M in 3Q and $100M so far in 4Q) are small compared to the total amount of loans SoFi holds. Additionally, SoFi will have to start selling to maintain their current origination pace. I've called out that having to reprice their book of loans is a very real risk, and would cause a large miss in both revenue and profits. That’s still a risk, but the forward flow agreement at “similar execution levels” takes a lot of pressure off. Also, selling loans above the fair market value on their books is just stupendous, especially when competitors are really struggling to do the same.

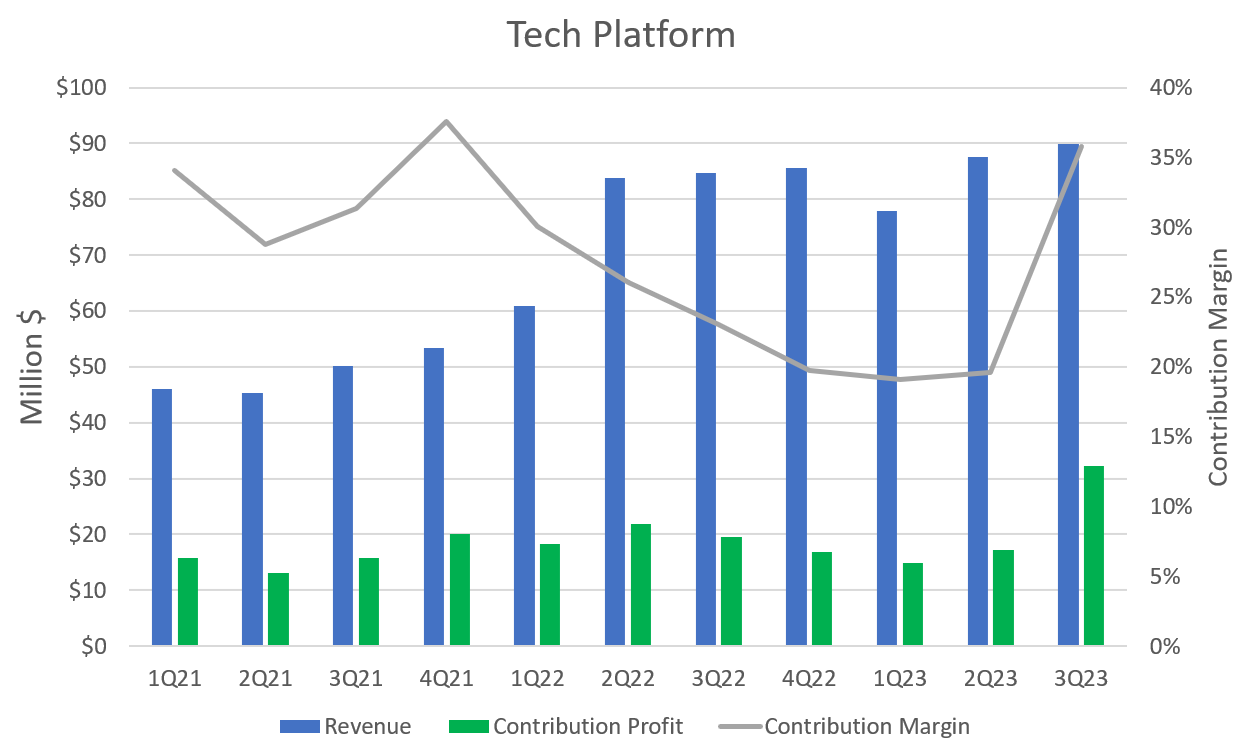

Tech Platform

Ok, so I really would have liked to see slightly more growth here, that’s really the only tiny thing I can nitpick about this earnings. The tech platform has not been performing at the level of lending or financial services. Hopefully as the macro picture settles out that will improve. However, something that absolutely exploded this quarter was the contribution margin in the tech platform segment. As a reminder, contribution margin is how much they make in the segment after subtracting all directly attributable costs to that segment. It had been trending down and hovering around 20%. It exploded back up to an almost all-time high.

I’ll forgive the slightly disappointing lack of revenue growth for pulling a rabbit out of the contribution margin hat. To be fair, this is a slight overperformance because, as was said in the earnings call, “in Q3, we benefited from lower compensation and benefits as a result of maxing out on payroll taxes for the year and a few other one-time items.” Now, it seems to me that if they already maxed out their payroll taxes for the year in Q3, we would see similar margin benefits in Q4. I don’t know what the other one-time items are, but if the taxes were the main one, expect another high contribution margin quarter in Q4.

Guidance

SoFi is guiding for a monster Q4. If you take the midpoint of their guidance, you’d have a quarter with revenue of $575M and an adjusted EBITDA of $140M, which equates to an EPS of 0.02-0.03. Wall Street expects $563M in revenue and -0.01 EPS. As a public company, SoFi has never missed on their own guidance. Their current guidance is already a significant double beat. Analyst estimates for the entirety of 2024 are that the company only makes 0.04 in EPS for the full year and $2.55B in revenue.

If they already earn an EPS of $0.02 in 4Q23 and then guide for growth in 2024, they’ll be way above analyst expectations for 2024 on earnings. As for revenue, assuming they hit $575M in revenue in 4Q23, they only have to grow revenue by $25M per quarter in 2024 to hit analyst estimates. Since 4Q21, their absolute revenue growth per quarter is $42M, $34M, $63M, $24M, $17M, $29M, and $42M. That means they’ve averaged $36M in revenue growth across the last two years. Even a drop off in revenue from what they’ve been doing for the past two years is enough to hit analyst estimates.

My expectation for the company is that they beat their own guidance, hit GAAP profitability, and their guidance for next year is a significant beat relative to analyst expectations. I don’t pretend to know what will happen to the stock, but if SoFi keeps executing the way they have been, at some point the market will be forced to rerate the company. I can be patient.

Subscriber update

Thank you to everyone who has become a paid subscriber. I am now at 70% of my Tier 2 goal. I plan on ramping my content output as paid subscribers increase. Here are the content tiers:

Tier 1 – About 2 articles/month on the Substack. This is the level I’m comfortable at for now with what I’m making.

Tier 2 – I’ll start a Youtube channel and do at least one video every other week.

Tier 3 – A minimum of 4 articles/month on the Substack

Tier 4 – Add a weekly Twitter Spaces where I can engage better with followers and answer questions people may have.

Disclosures: I have a long position in SOFI.

The information contained in this article is for informational purposes only. You should not construe any such information as legal, tax, investment, financial, or other advice. None of the information in this article constitutes a solicitation, recommendation, endorsement, or offer by the author, its affiliates or any related third party provider to buy or sell any securities or other financial instruments in any jurisdiction in which such solicitation, recommendation, endorsement, or offer would be unlawful under the securities laws of such jurisdiction.

Hey Chris, also this from Chris Lapointe, in context of hitting cap rates.

"And then third, the size of our loan book and the relatively short duration of personal loans, in

particular, the amortization on a quarterly basis is quite material now. Between our personal

loans business and the student loan refinancing business in quarter three, amortization or

paydowns was $2 billion or $8 billion on an annualized basis. "

I am assuming above means we are able to recycle $2B back, correct?

Thank you, great read as always!